BENGALURU, Sept 29 (Reuters) – Reliance Industries Ltd’s (RELI.NS) retail unit launched its first in-house premium fashion and lifestyle store on Thursday, as the billionaire Mukesh Ambani-led company continues to grab a bigger slice of India’s luxury market.The new store chain called Azorte, the first of which was launched in Bengaluru, will compete with the likes of Mango and Industria de Diseno Textil SA-owned Zara (ITX.MC), and cater to millenials and Gen Z.”The mid-premium fashion segment is one of fastest growing consumer segments as millennials and the Gen Z are increasingly demanding the latest of international and contemporary Indian fashion,” Akhilesh Prasad, chief executive of the fashion and lifestyle arm of Reliance Retail, said.Register now for FREE unlimited access to Reuters.comThe launch is a part of the Ambani company’s aggressive strides in the retail industry, forging partnerships with domestic and global brands. read more The company plans to build a portfolio of 50 to 60 grocery, household and personal care brands within the year and is in advanced talks to get the rights for LVMH-owned French beauty brand Sephora in India.Reliance’s luxury and lifestyle foray has been led by Ambani’s daughter Isha.Register now for FREE unlimited access to Reuters.comReporting by Nandan Mandayam and Nivedita Bhattacharjee in BengaluruOur Standards: The Thomson Reuters Trust Principles. .

Premium bicycles win new fans among China’s city folk

Register now for FREE unlimited access to Reuters.comBEIJING, Sept 13 (Reuters) – Zhou Changchang likes to spend his spare time cruising along the streets of China’s capital with his cycling club friends, on his Tiffany Blue bicycle made by the British company Brompton.The 42-year-old teacher is part of a growing army of cycling enthusiasts in China, who are splashing out on premium bicycles made by the likes of Brompton, Giant and Specialized, fuelling a market that consultancy Research & Markets estimates could be worth $16.5 billion by 2026.Social media and e-commerce platforms say there has been a surge of interest in cycling over the past year and sales of bicycles and gear are booming.Register now for FREE unlimited access to Reuters.comTypically, Chinese cyclists will pay more than 13,000 yuan ($1,870) for an inner-city, high-end foldable bike made by the likes of Brompton. High-performance road bikes, made for longer journeys, start at around 10,000 yuan ($1,450) and can go many times higher.Last month, media reported that a bicycle made by luxury brand Hermes sold for 165,000 yuan ($24,500).”The majority of riding hobbyists are willing to splurge,” e-commerce platform JD.com said last month.It said road bike sales on its platform had more than doubled from June to August compared with the same time last year, while riding apparel sales had jumped 160%.China has had a long love affair with bicycles and was once known as the “kingdom of bicycles”.For decades, bikes made by the likes of the Flying Pigeon company filled the streets.Cycling fell out of fashion when a growing middle class turned to cars but bike manufacturers saw a revival in 2014 as bike-sharing companies like Mobike and Ofo sprang up to flood cities with their fleets, offering rides as cheap as 1 yuan.Zhou, like many cyclists, said he got into biking to get fit. COVID-19 and its lockdowns also created a urge for the open road.”I really longed for the outdoors and fresh air,” said Shanghai office worker Lily Lu who went out and ordered a Brompton bike for 13,600 yuan ($1,965) the day after she was released from a three-month lockdown.As the craze gathers pace, manufacturers are struggling to meet demand. Lu said she had to wait two months to get her bicycle. Brompton did not respond to a request for comment.China’s Pardus, which makes racing bikes that can cost more than 30,000 yuan ($4,335), said sales doubled from last year and its factory was operating around the clock.”Everything is out of stock,” said Pardus branding director Li Weihai.

($1=6.96 yuan)Register now for FREE unlimited access to Reuters.comReporting by Sophie Yu, Brenda Goh; Editing by Robert BirselOur Standards: The Thomson Reuters Trust Principles. .

Juicy Couture owner scoops up UK’s Ted Baker for about $254 mln

The Ted Baker logo is seen at their store at the Woodbury Common Premium Outlets in Central Valley, New York, U.S., February 15, 2022. REUTERS/Andrew Kelly/File PhotoRegister now for FREE unlimited access to Reuters.com

- Offer price of 110 pence per Ted Baker share

- Offer backed by Ted Baker board

Aug 16 (Reuters) – Juicy Couture and Forever 21 owner Authentic Brands (ABG) (AUTH.N) has agreed to buy Ted Baker (TED.L) in a deal worth roughly 211 million pounds ($254 million), ending months of speculation over the fate of the British fashion group.Pandemic-related losses forced Ted Baker to put itself up for sale in April and the company picked a preferred suitor the following month. However, the bidder – reported to have been ABG – in June decided not to make an offer, forcing Ted Baker to consider other options. read more Ted Baker has now reached an agreement with U.S.-based ABG, whose brands also include Reebok, consisting of 110 pence cash for each Ted Baker share, and which represents a premium of about 18.2% to Monday’s closing price.Register now for FREE unlimited access to Reuters.comThe companies said the deal would not be revised unless a rival suitor emerges.”ABG believes there are significant growth opportunities for the Ted Baker brand in North America given (its) … strong consumer recognition in this market,” the New York-listed company said in a statement on Tuesday.Known for its suits, shirts and dresses with quirky details, Ted Baker is in the midst of a turnaround plan and is looking to benefit from a rebound in demand for office and leisure wear.In May it posted a smaller annual loss of 38.4 million pounds and said sales in the first quarter of the current year had risen 20% year-on-year. read more Ted Baker had also rejected several bids from private-equity group Sycamore before launching its sale process, and Tuesday’s move is the latest in a flurry of deals for British companies, made more affordable to overseas buyers by the weakness of the pound.Ted Baker’s shares were up about 17% at 108p in early trading, just shy of the offer price and still well short of their peak in 2015 when they were trading at 2,972p apiece.($1 = 0.8299 pounds)Register now for FREE unlimited access to Reuters.comReporting by Pushkala Aripaka in Bengaluru; Editing by Sherry Jacob-Phillips and David HolmesOur Standards: The Thomson Reuters Trust Principles. .

Column: Collapsing metal inventories clash with plunging prices

LONDON, July 13 (Reuters) – London Metal Exchange (LME) stocks are rapidly dwindling.LME warehouses held just 696,109 tonnes of registered metal at the end of June, the lowest amount this century.Inventory halved over the first six months of the year and June’s tally was down by 1.67 million tonnes year-on-year.Register now for FREE unlimited access to Reuters.comThe downtrend has further to run.Nearly 306,000 tonnes of metal were awaiting physical load-out at the end of last month. Available tonnage of all metals was just 390,280.LME shadow stocks, metal stored off-market with the option of exchange delivery, rebuilt modestly in April and May but the year-to-date increase has been a negligible 4,600 tonnes.Shrinking exchange stocks should be a bullish price signal. Right now, however, macro is trumping micro as Western recession fears pummel the industrial metals complex. The LME Index (.LMEX), which tracks the performance of the exchange’s six main base metals, has slumped by 31% from its April peak.The scale of the disconnect between price and stocks is striking. The resulting mismatch of current scarcity and expected future surplus is likely to be resolved by sporadic flare-ups in LME time-spreads.LME registered and “shadow” stocksSTOCKED OUTThis is currently happening in the LME zinc market. The cash premium over three-month metalAvailable live stocks shrunk to a depleted 14,975 tonnes at one stage in June and are still a meagre 22,475 tonnes.The rest of the headline zinc inventory of 82,200 tonnes is scheduled to depart.It also happened to sister metal lead last year, when the cash premium spiked to over $200 per tonne in August as LME on-warrant stocks fell to less than 40,000 tonnes.Time-spread tightness has been a recurring feature of the LME lead contract ever since and the cash premium is once again edging wider, ending Tuesday valued at $33 per tonne.That’s because lead stocks haven’t rebuilt in any meaningful way, currently totalling 39,250 tonnes with available tonnage at 34,850.The LME tin market has been living with depleted stocks since the start of 2021 and backwardation appears to be now hard-wired into short-dated spreads.PHYSICAL TIGHTNESSLow LME stocks of all three metals reflect extreme physical supply-chain tightness.All three have seen significant supply disruption over the last year with tin smelters hit by coronarivus lockdowns, zinc smelters in Europe powering down due to high energy prices and the Stolberg lead plant in Germany out of action since July 2021 due to flooding. read more Physical premiums for all three metals have hit record highs in Europe and the United States and remain close to those levels even as outright prices have dropped like a stone.The LME has acted as market of last resort for physical buyers and stocks will only rebuild once the supply-chain pressures pass.Chinese exports are helping rebalance both lead and zinc markets but the process is a slow one as freight and logistics bottlenecks brake arbitrage flows.

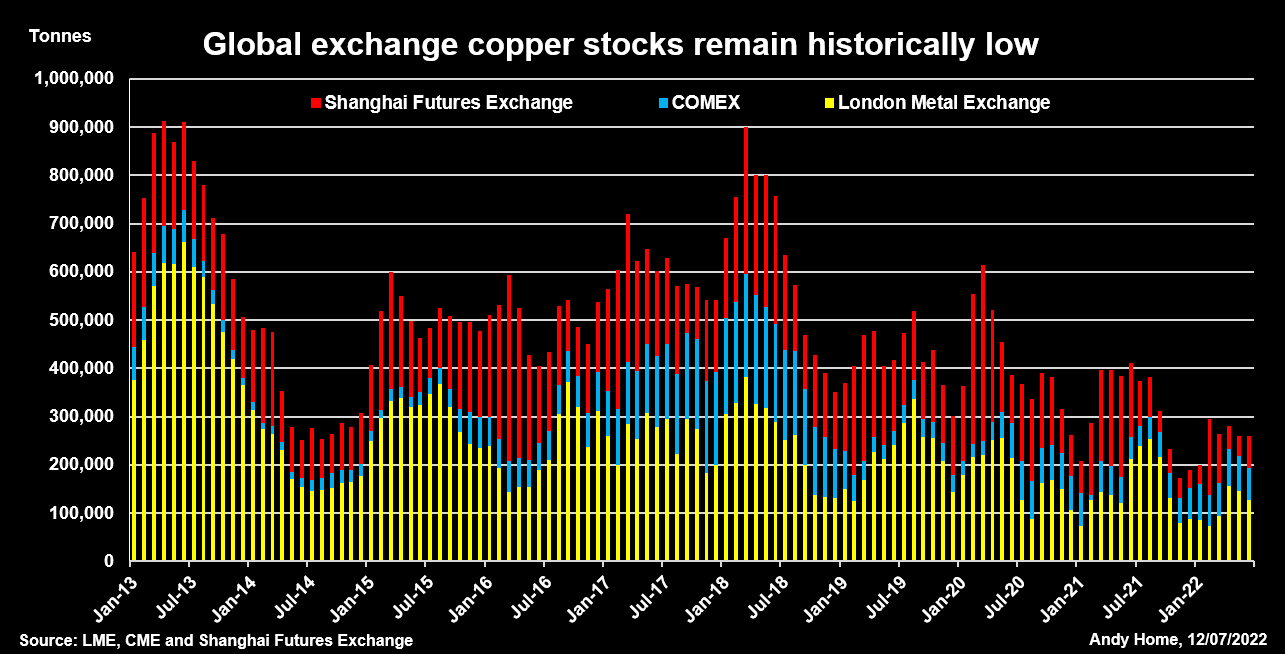

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.LME registered and shadow aluminium stocksOFF-MARKET BUILD?Weaker Chinese demand doesn’t appear to have made any impact on ShFE copper inventory, which remains low at 69,000 tonnes, down from 129,500 tonnes a year ago.However, the headline stocks may be deceiving.The Chinese market has been rocked by another multi-pledging stocks scandal reminiscent of the Qingdao fraud of 2014.That seems to have triggered movement of both aluminium and zinc into safe-haven storage and may be deterring copper exchange deliveries.It’s quite possible that such rotation between visible and non-visible storage is accentuating the LME stocks downtrend as well.Registered aluminium stocks, for example, collapsed by 64% over the first half of the year. Live tonnage stands at just 156,300 tonnes.Yet there is no sign of tension in aluminium time-spreads, the cash-to-three-months period trading in mild contango.The market seems to be assuming that there is no shortage of aluminium despite the headline stocks figure ticking lower every day.But if metal is available, it is evidently sitting in the statistical darkness.One small clue as to its existence was a 92,000-tonne build in LME shadow aluminium stocks over the course of April and May.Such metal is primed for LME warranting if price and spreads move into the right alignment and the recent rise suggests that some metal at least is being enticed back to the paper market from the physical market.REGIONAL IMBALANCEJust about all of the shadow aluminium stocks build has occurred in Asia, which accounted for 87% of the 289,978 tonnes in this category at the end of May.LME warehouse locations in Europe held just 21,642 tonnes and U.S. ones 14,608 tonnes.The same regional skew is clear to see across all the LME base metals and is as equally true of registered stocks as it is of shadow inventory.It is a symptom of the supply and freight issues that have roiled the metals markets since the onset of COVID-19 two years ago.It is also a warning that metals supply chains are still far from functioning efficiently, even as prices bow to the weight of macro selling.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

EDF shares suspended as France prepares nationalisation plan

View of the company logo of Electricite de France (EDF) on the facade of EDF’s headquarters in Paris, France, July 7, 2022. REUTERS/Johanna GeronRegister now for FREE unlimited access to Reuters.com

- French government aiming to fully nationalise EDF

- State already holds an 84% stake in the group

- Utility grappling with outages and tariff caps

PARIS, July 13 (Reuters) – Shares in debt-laden EDF (EDF.PA) were suspended on Wednesday as the French government prepares to detail its plans to fully nationalise Europe’s biggest nuclear power operator.France said last week it wanted to fully nationalise EDF, in which the state already holds an 84% stake, without explaining how it would do so. In a statement, the finance ministry said it would clarify its plans before the market opens on July 19 at the latest.Taking EDF back under full state control would give the government greater licence to restructure the group that runs the nation’s nuclear power plants, as it contends with a European energy crisis.Register now for FREE unlimited access to Reuters.comA finance ministry source said the suspension of EDF shares, which was requested by the company, was temporary and trading would resume once the government had made clear how it would fully nationalise the utility.EDF has been grappling with extraordinary outages at its nuclear fleet, delays and cost overruns in building new reactors, and power tariff caps imposed by the government to shield French consumers from soaring electricity prices.Two sources told Reuters this week that the government was poised to pay up to 10 billion euros to buy the 16% stake in the group it does not already own, after including the purchase of convertible bonds and a premium it is expected to offer to minority shareholders. read more That would translate into a buyout price of close to 13 euros per share, a 30% premium to current market prices but still a big loss for long-term shareholders, as the group was listed in 2005 at a price of 33 euros per share.”A 30% premium does not seem unreasonable given the market fluctuations of the share price – we are still talking about a 50% to 60% loss for shareholders,” said Antoine Fraysse-Soulier, head of market analysis at eToro in Paris.The sources said the state wanted to move quickly and would probably launch a voluntary offer on the market rather than push a nationalisation bill through parliament, with the aim of closing the operation in October-November.”The government may want to offer a sufficient premium to avoid legal challenges and resulting delays to the offer,” JPMorgan analysts said in a note.EDF did not give a reason for requesting the suspension of its shares, which have risen 30% since the nationalisation announcement, increasing the cost of buying out minorities. The finance ministry source said the move was “among routine tools to manage financial markets in this kind of situation”.”I would imagine it is to stop the price going up to a point that the French government ends up having to pay over the odds for the remaining shares in issue,” a London trader said.The shares closed at 10.2250 euros on Tuesday.In a sign of how badly reactor outages are affecting the company, which is expected to post a loss this year, EDF said power generation at its French nuclear reactors fell by 27.1% in June from a year earlier after the discovery of stress corrosion took several sites off line.EDF has said it expects an 18.5 billion euro hit to its earnings in 2022 from production losses, and further losses of 10.2 billion euros from the energy price cap.($1 = 0.9964 euros)Register now for FREE unlimited access to Reuters.comAdditional reporting by Joice Alves in London and Marc Angrand in Paris; Writing by Silvia Aloisi; Editing by Edmund Blair, Jan Harvey, Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles. .