Register now for FREE unlimited access to Reuters.comBEIJING, Sept 13 (Reuters) – Zhou Changchang likes to spend his spare time cruising along the streets of China’s capital with his cycling club friends, on his Tiffany Blue bicycle made by the British company Brompton.The 42-year-old teacher is part of a growing army of cycling enthusiasts in China, who are splashing out on premium bicycles made by the likes of Brompton, Giant and Specialized, fuelling a market that consultancy Research & Markets estimates could be worth $16.5 billion by 2026.Social media and e-commerce platforms say there has been a surge of interest in cycling over the past year and sales of bicycles and gear are booming.Register now for FREE unlimited access to Reuters.comTypically, Chinese cyclists will pay more than 13,000 yuan ($1,870) for an inner-city, high-end foldable bike made by the likes of Brompton. High-performance road bikes, made for longer journeys, start at around 10,000 yuan ($1,450) and can go many times higher.Last month, media reported that a bicycle made by luxury brand Hermes sold for 165,000 yuan ($24,500).”The majority of riding hobbyists are willing to splurge,” e-commerce platform JD.com said last month.It said road bike sales on its platform had more than doubled from June to August compared with the same time last year, while riding apparel sales had jumped 160%.China has had a long love affair with bicycles and was once known as the “kingdom of bicycles”.For decades, bikes made by the likes of the Flying Pigeon company filled the streets.Cycling fell out of fashion when a growing middle class turned to cars but bike manufacturers saw a revival in 2014 as bike-sharing companies like Mobike and Ofo sprang up to flood cities with their fleets, offering rides as cheap as 1 yuan.Zhou, like many cyclists, said he got into biking to get fit. COVID-19 and its lockdowns also created a urge for the open road.”I really longed for the outdoors and fresh air,” said Shanghai office worker Lily Lu who went out and ordered a Brompton bike for 13,600 yuan ($1,965) the day after she was released from a three-month lockdown.As the craze gathers pace, manufacturers are struggling to meet demand. Lu said she had to wait two months to get her bicycle. Brompton did not respond to a request for comment.China’s Pardus, which makes racing bikes that can cost more than 30,000 yuan ($4,335), said sales doubled from last year and its factory was operating around the clock.”Everything is out of stock,” said Pardus branding director Li Weihai.

($1=6.96 yuan)Register now for FREE unlimited access to Reuters.comReporting by Sophie Yu, Brenda Goh; Editing by Robert BirselOur Standards: The Thomson Reuters Trust Principles. .

Juicy Couture owner scoops up UK’s Ted Baker for about $254 mln

The Ted Baker logo is seen at their store at the Woodbury Common Premium Outlets in Central Valley, New York, U.S., February 15, 2022. REUTERS/Andrew Kelly/File PhotoRegister now for FREE unlimited access to Reuters.com

- Offer price of 110 pence per Ted Baker share

- Offer backed by Ted Baker board

Aug 16 (Reuters) – Juicy Couture and Forever 21 owner Authentic Brands (ABG) (AUTH.N) has agreed to buy Ted Baker (TED.L) in a deal worth roughly 211 million pounds ($254 million), ending months of speculation over the fate of the British fashion group.Pandemic-related losses forced Ted Baker to put itself up for sale in April and the company picked a preferred suitor the following month. However, the bidder – reported to have been ABG – in June decided not to make an offer, forcing Ted Baker to consider other options. read more Ted Baker has now reached an agreement with U.S.-based ABG, whose brands also include Reebok, consisting of 110 pence cash for each Ted Baker share, and which represents a premium of about 18.2% to Monday’s closing price.Register now for FREE unlimited access to Reuters.comThe companies said the deal would not be revised unless a rival suitor emerges.”ABG believes there are significant growth opportunities for the Ted Baker brand in North America given (its) … strong consumer recognition in this market,” the New York-listed company said in a statement on Tuesday.Known for its suits, shirts and dresses with quirky details, Ted Baker is in the midst of a turnaround plan and is looking to benefit from a rebound in demand for office and leisure wear.In May it posted a smaller annual loss of 38.4 million pounds and said sales in the first quarter of the current year had risen 20% year-on-year. read more Ted Baker had also rejected several bids from private-equity group Sycamore before launching its sale process, and Tuesday’s move is the latest in a flurry of deals for British companies, made more affordable to overseas buyers by the weakness of the pound.Ted Baker’s shares were up about 17% at 108p in early trading, just shy of the offer price and still well short of their peak in 2015 when they were trading at 2,972p apiece.($1 = 0.8299 pounds)Register now for FREE unlimited access to Reuters.comReporting by Pushkala Aripaka in Bengaluru; Editing by Sherry Jacob-Phillips and David HolmesOur Standards: The Thomson Reuters Trust Principles. .

Column: Collapsing metal inventories clash with plunging prices

LONDON, July 13 (Reuters) – London Metal Exchange (LME) stocks are rapidly dwindling.LME warehouses held just 696,109 tonnes of registered metal at the end of June, the lowest amount this century.Inventory halved over the first six months of the year and June’s tally was down by 1.67 million tonnes year-on-year.Register now for FREE unlimited access to Reuters.comThe downtrend has further to run.Nearly 306,000 tonnes of metal were awaiting physical load-out at the end of last month. Available tonnage of all metals was just 390,280.LME shadow stocks, metal stored off-market with the option of exchange delivery, rebuilt modestly in April and May but the year-to-date increase has been a negligible 4,600 tonnes.Shrinking exchange stocks should be a bullish price signal. Right now, however, macro is trumping micro as Western recession fears pummel the industrial metals complex. The LME Index (.LMEX), which tracks the performance of the exchange’s six main base metals, has slumped by 31% from its April peak.The scale of the disconnect between price and stocks is striking. The resulting mismatch of current scarcity and expected future surplus is likely to be resolved by sporadic flare-ups in LME time-spreads.LME registered and “shadow” stocksSTOCKED OUTThis is currently happening in the LME zinc market. The cash premium over three-month metalAvailable live stocks shrunk to a depleted 14,975 tonnes at one stage in June and are still a meagre 22,475 tonnes.The rest of the headline zinc inventory of 82,200 tonnes is scheduled to depart.It also happened to sister metal lead last year, when the cash premium spiked to over $200 per tonne in August as LME on-warrant stocks fell to less than 40,000 tonnes.Time-spread tightness has been a recurring feature of the LME lead contract ever since and the cash premium is once again edging wider, ending Tuesday valued at $33 per tonne.That’s because lead stocks haven’t rebuilt in any meaningful way, currently totalling 39,250 tonnes with available tonnage at 34,850.The LME tin market has been living with depleted stocks since the start of 2021 and backwardation appears to be now hard-wired into short-dated spreads.PHYSICAL TIGHTNESSLow LME stocks of all three metals reflect extreme physical supply-chain tightness.All three have seen significant supply disruption over the last year with tin smelters hit by coronarivus lockdowns, zinc smelters in Europe powering down due to high energy prices and the Stolberg lead plant in Germany out of action since July 2021 due to flooding. read more Physical premiums for all three metals have hit record highs in Europe and the United States and remain close to those levels even as outright prices have dropped like a stone.The LME has acted as market of last resort for physical buyers and stocks will only rebuild once the supply-chain pressures pass.Chinese exports are helping rebalance both lead and zinc markets but the process is a slow one as freight and logistics bottlenecks brake arbitrage flows.

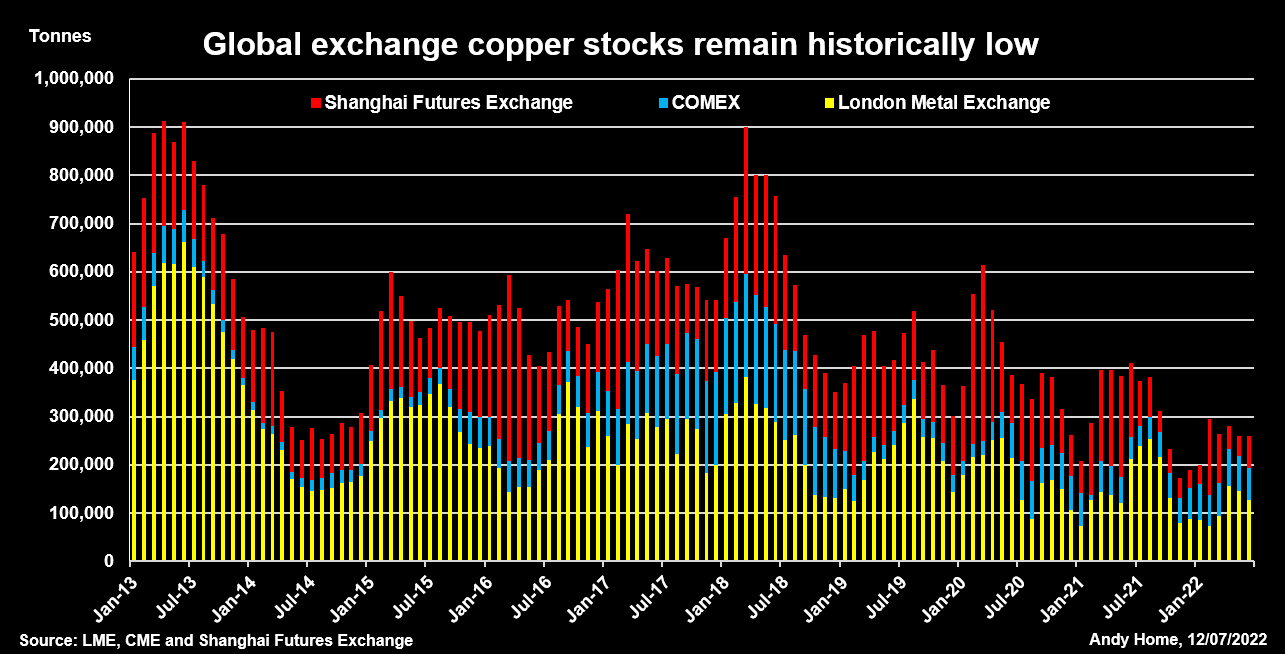

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.LME registered and shadow aluminium stocksOFF-MARKET BUILD?Weaker Chinese demand doesn’t appear to have made any impact on ShFE copper inventory, which remains low at 69,000 tonnes, down from 129,500 tonnes a year ago.However, the headline stocks may be deceiving.The Chinese market has been rocked by another multi-pledging stocks scandal reminiscent of the Qingdao fraud of 2014.That seems to have triggered movement of both aluminium and zinc into safe-haven storage and may be deterring copper exchange deliveries.It’s quite possible that such rotation between visible and non-visible storage is accentuating the LME stocks downtrend as well.Registered aluminium stocks, for example, collapsed by 64% over the first half of the year. Live tonnage stands at just 156,300 tonnes.Yet there is no sign of tension in aluminium time-spreads, the cash-to-three-months period trading in mild contango.The market seems to be assuming that there is no shortage of aluminium despite the headline stocks figure ticking lower every day.But if metal is available, it is evidently sitting in the statistical darkness.One small clue as to its existence was a 92,000-tonne build in LME shadow aluminium stocks over the course of April and May.Such metal is primed for LME warranting if price and spreads move into the right alignment and the recent rise suggests that some metal at least is being enticed back to the paper market from the physical market.REGIONAL IMBALANCEJust about all of the shadow aluminium stocks build has occurred in Asia, which accounted for 87% of the 289,978 tonnes in this category at the end of May.LME warehouse locations in Europe held just 21,642 tonnes and U.S. ones 14,608 tonnes.The same regional skew is clear to see across all the LME base metals and is as equally true of registered stocks as it is of shadow inventory.It is a symptom of the supply and freight issues that have roiled the metals markets since the onset of COVID-19 two years ago.It is also a warning that metals supply chains are still far from functioning efficiently, even as prices bow to the weight of macro selling.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Oil jumps after Saudi Arabia hikes crude prices

A drilling rig operates in the Permian Basin oil and natural gas production area in Lea County, New Mexico, U.S., February 10, 2019. REUTERS/Nick Oxford/File PhotoRegister now for FREE unlimited access to Reuters.comMELBOURNE, June 6 (Reuters) – Oil prices rose more than $2 in early trade on Monday after Saudi Arabia raised prices sharply for its crude sales in July, an indicator of how tight supply is even after OPEC+ agreed to accelerate its output increases over the next two months.Brent crude futures were up $1.80, or 1.5%, at $121.52 a barrel at 2319 GMT after touching an intraday high of $121.95, extending a 1.8% gain from Friday.U.S. West Texas Intermediate (WTI) crude futures were up $1.63, or 1.4%, at $120.50 a barrel after hitting a three-month high of $120.99. The contract gained 1.7% on Friday.Register now for FREE unlimited access to Reuters.comSaudi Arabia raised the official selling price (OSP) for its flagship Arab light crude to Asia to a $6.50 premium versus the average of the Oman and Dubai benchmarks, up from a premium of $4.40 in June, state oil produce Aramco (2222.SE) said on Sunday.The move came despite a decision last week by the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, to increase output in July and August by 648,000 barrels per day, or 50% more than previously planned.”Mere days after opening the spigots a bit wider, Saudi Arabia wasted little time hiking its official selling price for Asia, its primary market…seeing knock-on effects at the futures open across the oil market spectrum,” SPI Asset Management managing partner Stephen Innes said in a note.Saudi Arabia also increased the Arab Light OSP to northwest Europe to $4.30 above ICE Brent for July, up from a premium of $2.10 in June. However, it held the premium steady for barrels going to the United States at $5.65 above the Argus Sour Crude Index (ASCI).The OPEC+ move to bring forward output hikes is widely seen as unlikely to meet demand as several member countries, including Russia, are unable to boost output, while demand is soaring in the United States amid peak driving season and China is easing COVID lockdowns.”While that increase is sorely needed, it falls short of demand growth expectations, especially with the EU’s partial ban on Russian oil imports also factored in,” Commonwealth Bank analyst Vivek Dhar said in a note.Register now for FREE unlimited access to Reuters.comReporting by Sonali Paul in Melbourne; Editing by Sam HolmesOur Standards: The Thomson Reuters Trust Principles. .