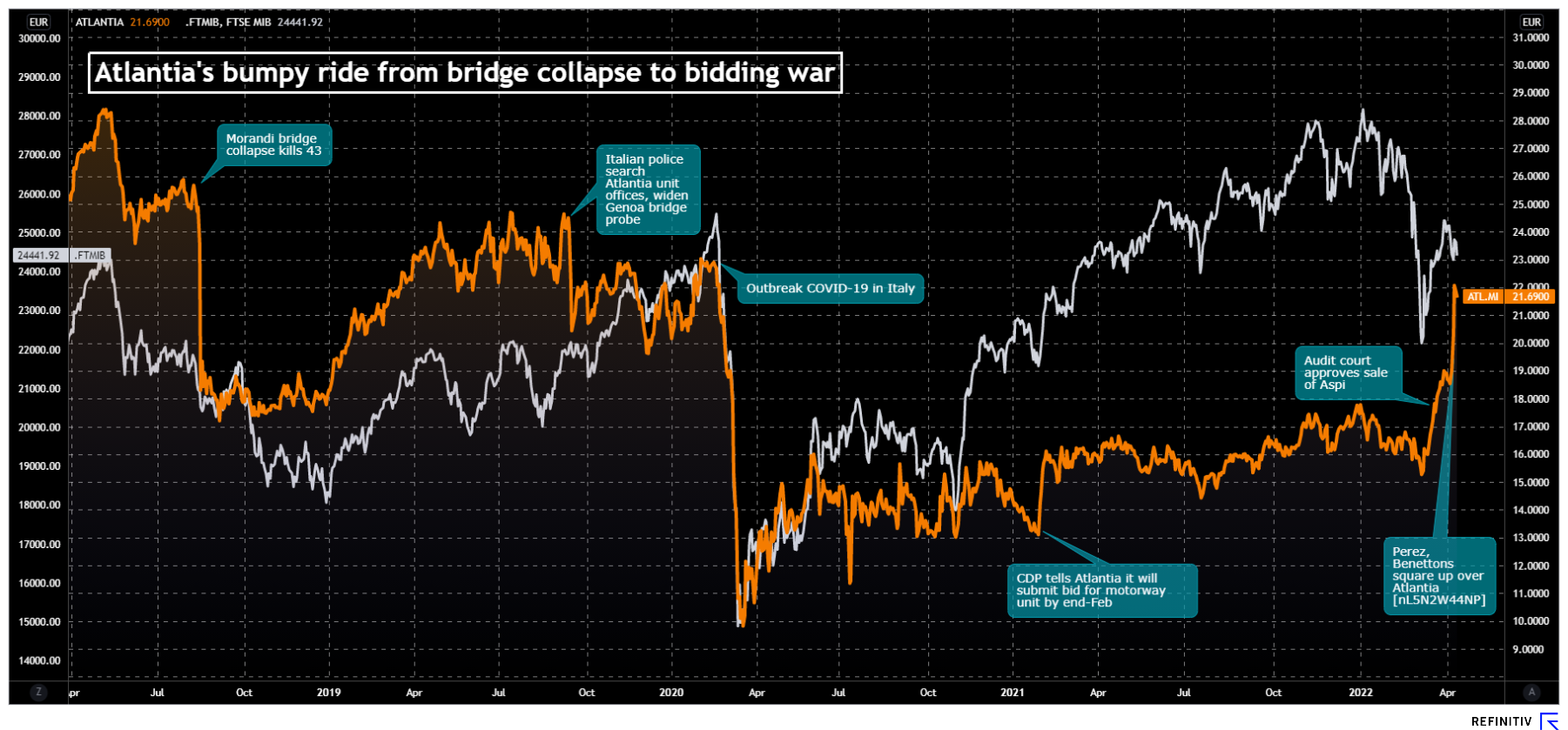

The logo of infrastructure group Atlantia in Rome, Italy October 5, 2020. REUTERS/Guglielmo MangiapaneRegister now for FREE unlimited access to Reuters.comMILAN, April 12 (Reuters) – The Benetton family and U.S. investment fund Blackstone are working on a premium of around 30% over Atlantia’s (ATL.MI) average stock price in the last six months, as they ready a bid that could land as early as Wednesday, three sources said.The two partners are considering an offer between 22 and 23 euros per share, one of the sources said, but cautioned no final decision had been taken.While a significant premium on the six month average share price, that would be a more modest increase over the current price of about 21.7 euros, and would value the whole of Atlantia – in which the Benetton family already owns a 33% stake – at about 18.1-19.0 billion euros ($19.7-$20.7 billion).Register now for FREE unlimited access to Reuters.comShares in the Italian infrastructure group have gained nearly 20% since April 6 when speculation first emerged about an approach involving Global Infrastructure Partners (GIP), Brookfield and Florentino Perez, head of Spain’s ACS (ACS.MC).The stock hit a two-year high of 22.5 euros on Monday as investors waited for a move that could take the group private.”The offer could land very soon, even early Wednesday morning,” one of the sources said.Blackstone and Benetton holding company Edizione declined to comment. Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Editing by Mark Potter and Chizu NomiyamaOur Standards: The Thomson Reuters Trust Principles. .

Insurance costs of shipping through Black Sea soar

The Arkas Line’s Conti Basel container ship is docked in the Black sea port of Odessa, Ukraine, November 4, 2016. REUTERS/Valentyn OgirenkoRegister now for FREE unlimited access to Reuters.comRegisterLONDON, Feb 25 (Reuters) – Insurers have raised the cost of providing cover for merchant ships through the Black Sea, adding to soaring rates to transport goods through the region for vessels still willing to sail after Russia’s invasion of Ukraine.Ship owners pay annual war-risk insurance cover as well as an additional “breach” premium when entering high-risk areas. These separate premiums are calculated according to the value of the ship, or hull, for a seven-day period.Ship insurers have quoted the additional premium rate for seven days at anywhere between 1% to 2% and up to 5% of insurance costs, from an estimated 0.025% on Monday before Russia’s invasion began, according to indicative rates from marine insurance sources.Register now for FREE unlimited access to Reuters.comRegisterThis would mean additional costs of hundreds of thousands of dollars for a ship voyage depending on the destination.”Given the Russian offensive from land, sea and air, it would not be surprising if some insurers will be reluctant (to provide cover),” one insurance source said.A Moldovan-flagged chemical tanker was hit by a missile on Friday near Ukraine’s port of Odessa, seriously wounding two crew.On Thursday, a Turkish-owned ship was hit by a bomb off Odessa with no casualties and the ship sailed safely into Romanian waters.Ukraine has appealed to Turkey to block Russian warships from passing through the Dardanelles and Bosphorus straits which lead to the Black Sea, after Moscow on Thursday launched a full-blown assault on Ukraine. read more Russian forces landed at Ukraine’s Black and Azov Sea ports as part of the invasion.Ukraine’s military has suspended commercial shipping at its ports although some Russian Black Sea ports remain open, including Novorossiisk, traders said on Friday.”Due to the sea invasion potential and Crimea’s location in the Black Sea, freight destined for surrounding countries will likely see re-routings and longer transit to meet its final destination,” added Glenn Koepke with supply-chain tracking platform FourKites.Mark Nugent, with shipbroker Braemar ACM, citing satellite tracking data, said a number of dry bulk vessels in the Black Sea had reversed course and were sailing towards the Bosphorus to exit the region.Freight rates have jumped after shipping companies including the world’s top container lines MSC and Maersk and many oil tanker owners suspended sailings through the region.Average earnings for smaller aframax tankers trading in the Black Sea jumped to over $100,000 a day on Thursday from $8,000 a day on Monday, shipping sources said.Earlier this month, London’s marine insurance market added the Ukrainian and Russian waters around the Black Sea and Sea of Azov to its list of areas deemed high risk, which prompted some shipping companies to hold back on sending vessels into the area. read more Register now for FREE unlimited access to Reuters.comRegisterAdditional reporting by Michael Hogan in Hamburg and Carolyn Cohn in London; Editing by Nick MacfieOur Standards: The Thomson Reuters Trust Principles. .

Finnair to stay independent and stick to Asia strategy, says CEO

A Finnair Airbus A320-200 aircraft prepares to take off from Manchester Airport in Manchester, Britain September 4, 2018. REUTERS/Phil NobleRegister now for FREE unlimited access to Reuters.comRegisterHELSINKI, Feb 11 (Reuters) – Finnair will remain a stand-alone airline and stick to its Asia-focused strategy while adding new routes to the United States, Chief Executive Topi Manner said on Friday.Finland’s national carrier, which has bet heavily on providing connections to Asia, expects the business environment to return close to normal in the second half of this year following pandemic disruptions, he told Reuters.”We are optimistic about summer,” Manner said, adding the airline expected countries like Japan and South Korea to lift travel restrictions towards summer in the northern hemisphere.Register now for FREE unlimited access to Reuters.comRegisterThe recovery of Asian traffic from the slump caused by widespread border restrictions is particularly important for the Finnair, which seeks to benefit from providing connections to Asia from Europe thanks to the location of its Helsinki hub.”We believe Asia will open up eventually. In the meantime, we are partially pivoting to North America,” Manner said in an interview.He was speaking after the airline announced a 200-million-euro ($228 million) investment in renewing the cabins of its long-haul fleet, including a new premium economy service and redesigned business cabin.Manner said the new cabin class was being added to address increasing demand in premium leisure travel, while also introducing a new business class seat called “the air lounge,” a nest-like shell that does not recline but modifies to allow for vertical sleeping.”We as a carrier of course need to differentiate and we have chosen to differentiate with quality,” he said.Finnair operates Airbus A330 and A350 planes on long-haul routes.Unlike many airlines, Finnair has not yet joined a wave of orders for the latest generation of narrowbody jets like the A320neo, which burn 15% less fuel.Finnair’s fleet of 35 Airbus A320-family jets includes some planes as old as 21 years but others produced as recently as 2018, according to its website.Asked whether Finnair planned to renew its medium-haul fleet, Manner said it could do so in three or four years but stressed the importance of sustainable aviation fuel as the airline targets net zero emissions by 2045.($1 = 0.8770 euros)Register now for FREE unlimited access to Reuters.comRegisterReporting by Anne Kauranen Editing by Tim Hepher and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .