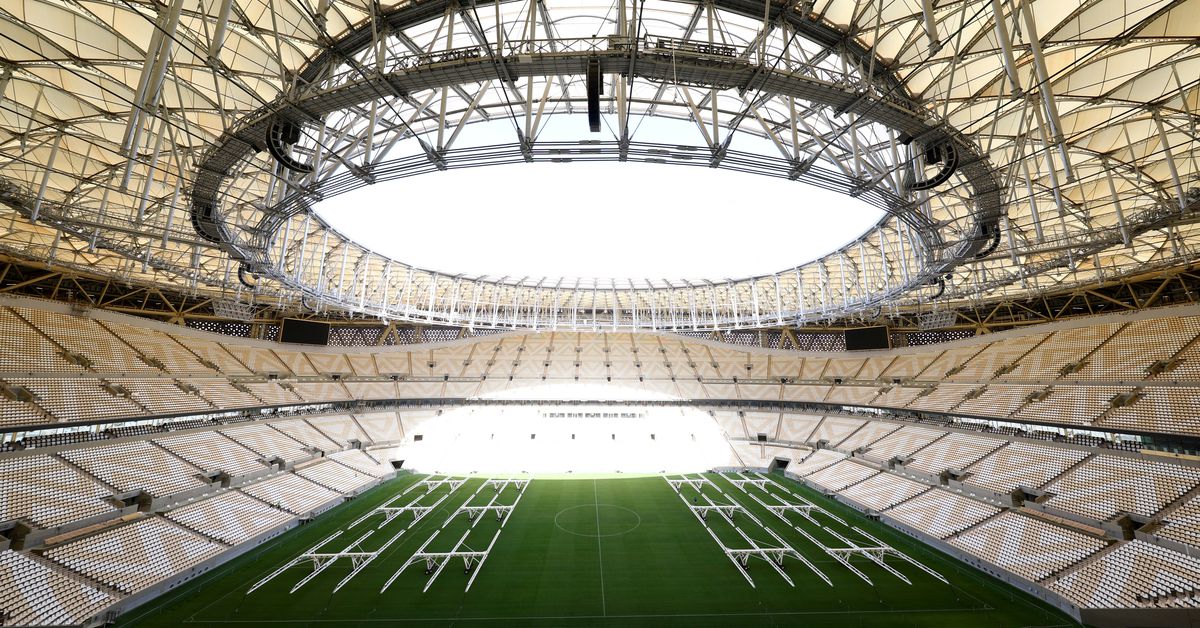

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Oil jumps after Saudi Arabia hikes crude prices

A drilling rig operates in the Permian Basin oil and natural gas production area in Lea County, New Mexico, U.S., February 10, 2019. REUTERS/Nick Oxford/File PhotoRegister now for FREE unlimited access to Reuters.comMELBOURNE, June 6 (Reuters) – Oil prices rose more than $2 in early trade on Monday after Saudi Arabia raised prices sharply for its crude sales in July, an indicator of how tight supply is even after OPEC+ agreed to accelerate its output increases over the next two months.Brent crude futures were up $1.80, or 1.5%, at $121.52 a barrel at 2319 GMT after touching an intraday high of $121.95, extending a 1.8% gain from Friday.U.S. West Texas Intermediate (WTI) crude futures were up $1.63, or 1.4%, at $120.50 a barrel after hitting a three-month high of $120.99. The contract gained 1.7% on Friday.Register now for FREE unlimited access to Reuters.comSaudi Arabia raised the official selling price (OSP) for its flagship Arab light crude to Asia to a $6.50 premium versus the average of the Oman and Dubai benchmarks, up from a premium of $4.40 in June, state oil produce Aramco (2222.SE) said on Sunday.The move came despite a decision last week by the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, to increase output in July and August by 648,000 barrels per day, or 50% more than previously planned.”Mere days after opening the spigots a bit wider, Saudi Arabia wasted little time hiking its official selling price for Asia, its primary market…seeing knock-on effects at the futures open across the oil market spectrum,” SPI Asset Management managing partner Stephen Innes said in a note.Saudi Arabia also increased the Arab Light OSP to northwest Europe to $4.30 above ICE Brent for July, up from a premium of $2.10 in June. However, it held the premium steady for barrels going to the United States at $5.65 above the Argus Sour Crude Index (ASCI).The OPEC+ move to bring forward output hikes is widely seen as unlikely to meet demand as several member countries, including Russia, are unable to boost output, while demand is soaring in the United States amid peak driving season and China is easing COVID lockdowns.”While that increase is sorely needed, it falls short of demand growth expectations, especially with the EU’s partial ban on Russian oil imports also factored in,” Commonwealth Bank analyst Vivek Dhar said in a note.Register now for FREE unlimited access to Reuters.comReporting by Sonali Paul in Melbourne; Editing by Sam HolmesOur Standards: The Thomson Reuters Trust Principles. .

Shift to premium spirits helps Remy weather China lockdowns

- 2021/22 current operating profit up 39.9% vs forecast 38.6%

- Expects another year of strong growth in 2022/23

- Still eyes double-digit organic sales growth in Q1 – CEO

PARIS, June 2 (Reuters) – France’s Remy Cointreau (RCOP.PA) on Thursday predicted a strong start to its new financial year, as broad demand for its premium spirits helps to offset inflationary pressures and the impact of COVID lockdowns in China.The maker of Remy Martin cognac and Cointreau liquor made the upbeat comments after reporting higher-than-expected operating profit growth for its financial year ended March 31.”On the strength of our progress against our strategic goals, new consumption trends and our robust pricing power, we are starting the year 2022-23 with confidence,” Chief Executive Officer Eric Vallat said in a statement.Register now for FREE unlimited access to Reuters.comThe pandemic has helped Remy’s long-term drive towards higher-priced spirits to boost profit margins, accelerating a shift towards premium drinks, at-home consumption, cocktails and e-commerce.Vallat told journalists that for the new fiscal year, Remy expected “solid profitable growth” as price increases and cost control would help mitigate inflationary pressures.In the short term, Vallat said: “I can confirm we are expecting double-digit organic sales growth in the first quarter despite the lockdown in China and high comparables.”With China accounting for 15-20% of group sales, growth would be led by demand from other regions, notably the United States.Strong demand for its premium cognac in China and the United States, along with tight cost management, lifted the company’s 2021/22 organic operating profit by 39.9% to 334.4 million euros ($356.3 million), beating the 38.6% forecast by analysts.Reflecting its confidence, Remy said it would pay shareholders an ordinary dividend of 1.85 euros per share in cash and an exceptional dividend of 1 euro.”Remy guides to another year of strong growth and margin improvement, led by its strong pricing power, which suggests upside to consensus organic EBIT of +10%,” Credit Suisse analysts said in a note.Remy Cointreau shares jumped more than 3% in early trade, before handing back some gains.The company reiterated its 2030 goals for a gross margin of 72% and an operating margin of 33%. That compares with the 68.6% and 25.5% achieved respectively in 2021/22.($1 = 0.9385 euros)Register now for FREE unlimited access to Reuters.comReporting by Dominique Vidalon Editing by Sherry Jacob-Phillips and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

Insurance rates jump for Ukraine war-exposed business, sources say

Planes of Aeroflot and Rossiya Airlines are seen parked at Sheremetyevo International Airport, as the spread of the coronavirus disease (COVID-19) continues, outside Moscow, Russia April 8, 2020 REUTERS/Tatyana Makeyeva/File PhotoRegister now for FREE unlimited access to Reuters.comLONDON, May 30 (Reuters) – Insurance premiums are doubling or more for some aviation and marine business particularly exposed to the war in Ukraine, increasing costs for airline and shipping firms, industry sources say.Global commercial insurance premiums rose 11% on average in the first quarter, according to insurance broker Marsh, which said the war was putting upward pressure on rates.But the overall figure masks sharper moves in some sectors, and only covers the first five weeks following the invasion.Register now for FREE unlimited access to Reuters.comWar is typically excluded from mainstream insurance policies. Customers buy extra war cover on top.Garrett Hanrahan, global head of aviation at Marsh, said aviation war insurance was no longer available for Ukraine, Russia and Belarus as a result of the conflict.For the rest of the world, aviation war cover has doubled, as insurers try to recoup some of their losses, he said.”The hull war market is beginning to reflate itself through rate rises.”The conflict, which Russia calls a “special military operation”, could lead to insurance losses of $16 billion-$35 billion in so-called “specialty” insurance classes such as aviation, marine, trade credit, political risk and cyber, S&P Global said in a report. read more Aviation insurance claims alone could total $15 billion, S&P Global said, with hundreds of leased planes stranded in Russia as a result of western sanctions and Russian countermeasures.One aircraft lessor described recent rate increases on its insurance as “not a pretty sight”. read more Some aircraft lessors – a particularly exposed sector of the market because their planes are stuck in Russia – were now having to pay 10 times their original premium, one underwriter said, while another said insurers could “name their price” to lessors.In ship insurance, policyholders pay an additional “breach” premium when a ship enters particularly dangerous waters, locations which are updated by the Lloyd’s market.For the area around Russian and Ukrainian waters in the Black Sea and Sea of Avov, this has increased multiple times, three insurance sources said, to around 5% of the value of the ship, from 0.025% before the invasion, amounting to millions of dollars for a seven-day policy.Each time a ship goes into those waters, it has to pay that extra premium.Rates for ships going into other Russian waters have also risen by at least 50% after the Lloyd’s market classified all Russian ports as high risk, two of the sources said.Because of the dangers, some marine insurers have also stopped providing cover for the region. read more Register now for FREE unlimited access to Reuters.comReporting by Carolyn Cohn, Jonathan Saul and Noor Zainab Hussain, Editing by Angus MacSwanOur Standards: The Thomson Reuters Trust Principles. .

Siemens Energy sees ‘need for action’ in $4.3 bln turbine unit takeover plan

MADRID, May 23 (Reuters) – Siemens Energy (ENR1n.DE) does not yet see signs of a recovery at wind turbine maker Siemens Gamesa (SGREN.MC), its chief executive said on Monday after launching a 4.05 billion euro ($4.29 billion) bid for minority holdings in the unit.Siemens Energy announced the bid on Saturday after pressure from shareholders to raise its stake in Siemens Gamesa from the 67% it inherited after a spin off from Siemens (SIEGn.DE). Siemens Gamesa said it would review the offer. read more Siemens Gamesa shares rose more than 6% at the Madrid market open to trade at about 17.7 euros by 0705 GMT, just below the 18.05 euro per share offer price. Siemens Energy shares rose 2.7% in Frankfurt.Register now for FREE unlimited access to Reuters.comSiemens Gamesa, whose shares had fallen 20% since the start of the year until the offer was made, had issued three profit warnings in less than a year, dogged by product delays and operational problems.”There are not yet clear signs of a near-term recovery in the current setup,” Siemens Energy Chief Executive Christian Bruch said, adding that Siemens Gamesa’s financial performance was “really creating the need for action.”The bid price represented a premium of 27.7% over the Spanish-listed stock’s last unaffected closing price on May 17, and a 7.8% premium to Friday’s closing price.Asked about the onshore turbine business which has caused particular headaches, Bruch told analysts on a conference call: “There is no reason why you cannot be successful in onshore business if you fix your operational issues.”European turbine makers have racked up losses in a fiercely competitive market as metals and logistics prices surged due to COVID-19, import duties and Russia’s invasion of Ukraine. read more “I don’t believe that the supply chain environment will get easier,” Bruch said, increasing the need to “push for operational excellence everywhere as fast as possible”.He said pooling suppliers would “leverage the double-digit billion procurement volume we have as a total group as best we can.”Working to produce hydrogen from wind power, a technology seen as a promising way to reduce planet-warming carbon emissions from industry, could also be more effective under the new setup, he said.($1 = 0.9431 euros)Register now for FREE unlimited access to Reuters.comReporting by Isla Binnie; Editing by Christian Schmollinger and Edmund BlairOur Standards: The Thomson Reuters Trust Principles. .