This week’s Current Climate, which every Saturday brings you the latest news about the business of sustainability. Sign up to get it in your inbox every week.

Forbes

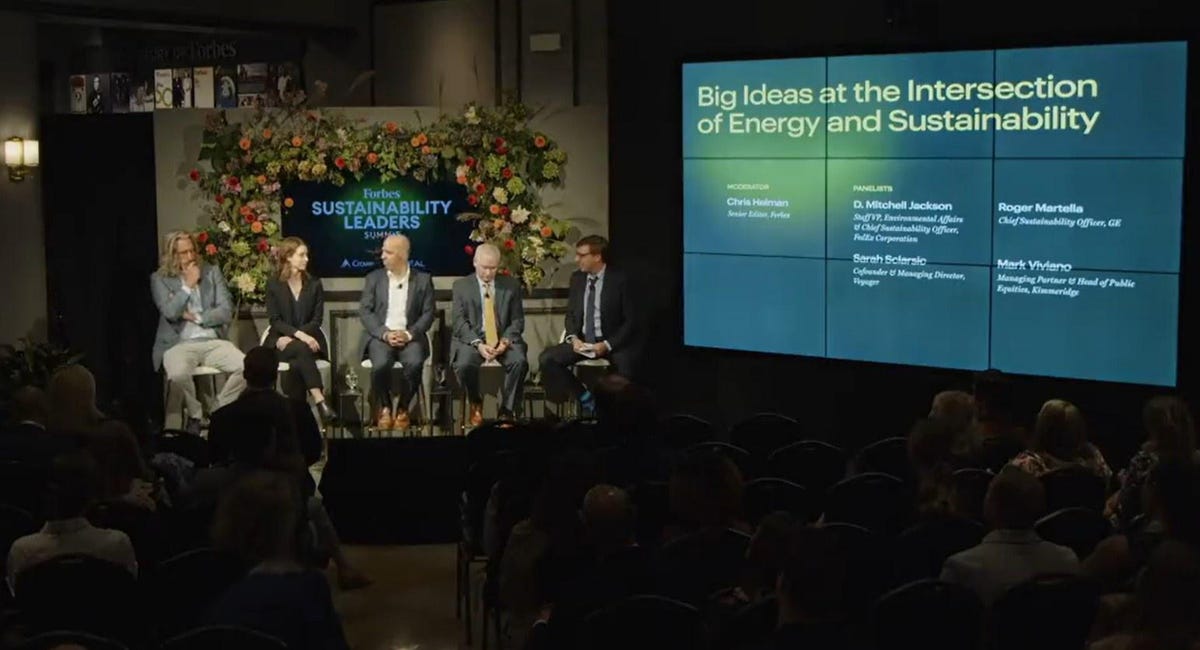

This past week we held the inaugural Forbes Sustainability Leaders Summit, where we brought in leaders from multiple industries to talk about solving pressing environmental issues while still ensuring a healthy, vibrant economy. I led a panel featuring Todd Brady, who has been a leader at Intel in driving down its energy use and carbon footprint (Intel, he told the crowd, uses 100% renewable energy in the United States); Gaurab Chakrabarti, the CEO of Solugen, a startup that’s making industrial chemicals like hydrogen peroxide without the messy, energy-intensive processes that utilize oil; and Maddie Hall, whose company Living Carbon is bioengineering trees to both store more carbon dioxide and to grow trees in blighted areas where normal trees can’t grow.

The whole summit was energizing. But what really hit home for me was this simple idea: there’s really no conflict between environment and economy. Intel’s moves towards energy conservation have been good for the company’s bottom line. Solugen is selling its products cost-competitively, without any marketing premium for being green. And Living Carbon’s trees? They produce wood that’s more durable than what’s on the market. You can be green and make green at the same time–all it takes is some clever science and engineering.

The Big ReadJUSTIN SULLIVAN/GETTY IMAGES

California’s Water Emergency: Satisfying The Thirst Of Almonds While The Wells Of The People That Harvest Them Run Dry

Broiling heat in the middle of the worst drought in 1,200 years has strained the state’s underground water supply, pitting the Central Valley’s $20 billion agriculture industry against many of its own workers.

Read more here.

Discoveries And Innovations

Researchers have figured out a way to build lithium-ion batteries without using cobalt, which makes them both safer and less prone to market volatility.

California was able to weather a historic heat wave without rolling blackouts because it has gone all-in on clean energy technology like wind, solar, battery storage, and demand response.

NASA scientists developed a way to weigh land masses using two satellites in space, which allowed them to document Greenland’s staggering weight loss from melted ice.

Sustainability Deals Of The Week

Fusion Development: The Department of Energy announced a new $50 million program to support companies, universities and other organizations in developing commercial fusion power technologies.

Aluminum Bottles: Ball Corporation announced that it has partnered with Boomerang Water to provide aluminum bottled water for resorts, cruise ships and other locations; the bottles can be more easily filled and recycled than their plastic counterparts.

On The Horizon

Sustainable technology can find its inspiration everywhere – even older technologies. Here’s a conversation about where future green tech might be going.

What Else We’re Reading This Week

For years, Chile exploited its environment to grow. Now it’s trying to save it. (Popular Science)

Extreme Heat Saps Billions in Worker Productivity (Scientific American)

The Tonga Volcano Shook the World. It May Also Affect the Climate. (New York Times)

Green Transportation UpdateGetty Images

The ongoing transition away from fossil fuels to electricity for our cars and trucks is good for carbon emissions but will likely trigger shortages of key metals used in electric vehicle batteries requiring hundreds of new mines. This is according to industry experts who expect demand for EV batteries to spike to tens of millions of units annually in the years ahead.

The Big Transportation StoryTony Ponds

Black Founders Of EV-Charging Startups Have More Than Profits On Their Minds

Sheryl E. Ponds, whose company designs and builds electric vehicle charging stations, has had success landing business from customers seeking home installations as adoption of the new green technology grows. But for Ponds, who is Black, it’s hard to ignore the fact that those customers tend to be suburban, affluent and white. She values their business, but wants to make sure the infrastructure she develops also reaches urban and Black communities. So last year she started pitching her service to managers of apartment properties in areas where demographics tend to be more diverse — even though sales have been tougher to come by.

Read more here.

More Green Transportation News

Class 8 Hydrogen Truck Competition Disrupted By A Canada-United Kingdom Partnership

Charging EVs At Home Overnight May Not Be The Cheapest Option For Much Longer

Live Longer, Look Sexier And 43 Other Reasons To Ride A Bicycle This World Car Free Day

Battery-Swapping Unlikely To Ruffle Fragile U.S., European Chargers

By The Numbers: How Much Electric Car Battery Range Is Enough?

Amazon Will Power Trucks With ‘Electrofuel’ Diesel To Curb Carbon Emissions

For More Sustainability Coverage, Click Here.

.

Jack Dorsey stepped down as chief executive of Twitter, the social media site he co-founded in 2006.

Jack Dorsey stepped down as chief executive of Twitter, the social media site he co-founded in 2006.