While many of the ‘first wave’ products in this nascent field are likely to be hybrid products combining cell-cultured chicken or beef and textured plant-based proteins to provide texture and lower costs, BlueNalu intends to launch with whole muscle Bluefin Tuna Toro, a high-value product that typically commands a premium price.The firm – which has a 38,000sq ft pilot facility and innovation center – is currently in a back and forth with the FDA as it goes through a pre-market consultation process.This could take up to 18 months, at which point it plans to test market products in the foodservice arena and secure commitments that will help secure financing for a 140,000sq ft facility featuring multiple 100,000-liter bioreactors that can produce up to six million pounds of premium seafood products annually, the firm told FoodNavigator-USA.“We anticipate that we will select the site location for this facility in 2024, break ground in 2025 and that the facility will be operational in 2027. Once this facility is complete and optimized, we plan to replicate this around the globe so we have regional production centers.”Tech breakthroughsThe firm – which is working with partner Nutreco on bringing down the cost of animal-free growth media – says two key factors have been key to its latest cost projections: achieving single cell suspension (which mean it can grow large numbers of muscle cells without microcarriers in suspension); and ‘lipid-loading’ technology (prompting muscle cells to store a customized level of fat so BlueNalu doesn’t have to grow muscle and fat cells separately), CTO Dr Lauran Madden told us.No scaffolding or secondary bioreactors are needed, and the harvested cells are put through a cold extrusion process to create whole-muscle type products with the same amino acid and fatty acid profiles of regular bluefin tuna.Single cell suspension with non GMO cell lines: ‘It’s like if I put like a single marble in a vortex versus a beach ball’So how does it work?In the single cell suspension process, explained Madden, “We have all non GMO cell lines that we’ve been able to transition from the adherence state to the single cell suspension state.”BlueNalu’s myoblast cells (undifferentiated cells capable of giving rise to muscle cells) are ‘transitioned’ from an adherent state (where they need to be attached to something to grow and divide) to a non-adherent state such that they can proliferate in a large bioreactor and float around in single cell suspension without needing microcarriers (to attach to), which add expense, reduce cell densities, and then may become part the final product formulation.As the cells are in single cell suspension, rather than free-floating aggregates of cells, they are less vulnerable to shear forces that can damage cells in larger bioreactors (where the contents need to be agitated to ensure the nutrients get to all the cells), she added.“As you scale up you can be forced to have higher agitation and higher shear to get the proper mass transfer of nutrients [to the cells throughout the entire reactor].“It’s like if I put like a single marble in a vortex versus a beach ball or 10 marbles held together by bubble gum, they’re going to experience different types of shear, so you’re going to have shear impacts that can break apart the aggregates, you’re going to have diffusion limitations, because diffusion can only go so far into an aggregate, and so you begin having these inherent limitations of mass transfer, shear effects that really limit some of the scalability.”Lipid-loading: ‘We’re able to transition the muscle cells to store fats’As for the lipid-loading, she explained: “So Bluefin Tuna Toro has a combination of muscle and fat, typically 20 to 40% fat, which provides a lot of that flavor and mouthfeel and texture. Rather than having multiple cell types, a separate muscle cell type, a separate fat cell type [grown in different bioreactors and combined at the end], we’re actually able to transition the muscle cells to store fats, which is not typical of muscle, but creates the same nutritional profile as you would get in a fat loaded fat cell.”To achieve that, she said, “We have patent-pending technology, but essentially, we’re able to control the process to really be able to understand how much fat is going to be in the cell, and to also control the composition of fat to target the correct nutritional profile, which also gives you that proper flavor profile.”Nutritional equivalency – beyond macrosShe added: “We are using muscle cells, and when they turn on the gene expression and protein expression, we’re able to get the same protein that you have in fish meat to achieve nutritional equivalency at a molecular level [so not just the same macros – grams of fat, protein etc, but matching amino acid profiles, fatty acid profiles etc]. “So far, we have developed hundreds of cell lines for eight different finfish species, and we have initiated projects to expand into other premium seafood categories.”  External rendering of BlueNalu’s first large-scale facility with capability to produce up to six million pounds of premium seafood products annually. Image credit: BlueNaluTechno-economic analysisTo validate its commercialization pathway at its large-scale facility, BlueNalu commissioned a techno-economic analysis (TEA) performed in collaboration with a global engineering, procurement, and construction (EPC) firm and experts in bioprocess modeling, said co-founder, president and CEO Lou Cooperhouse.“This technology means we don’t have to blend; we’re developing a whole muscle high-value product that has the same nutritional and functional characteristics as conventional Bluefin tuna.”BlueNalu’s value proposition has attracted a number of strategic partners including multinational companies in Asia (Food & Life Companies, Mitsubishi Corporation, Pulmuone Corporation, Sumitomo Corporation, and Thai Union); Europe (Nomad Foods and Nutreco); and the U.S. (Griffith Foods and Rich Products), he added.Some construction could be debt-financedAsked about funding, he said: “We’ve raised $84.6m to date, and frankly what gets us very excited is our hope that we could get commitments on sales of a fair amount of the volume as we do market testing over the next few years. The goal is to get into the US but also other markets where per capita consumption of seafood is high and where our strategic partners can facilitate that and also where there’s regulatory approval.“So we feel not just that we can ideally sell a fair amount of the volume in advance of even construction occurring, but that this will also be very easily debt financed, because it is something that we’ll be able to demonstrate a very high level of demand for the time we put that shovel in the ground.”“Our projected 75% gross margin within the first year of production of our large-scale facility is unheard of in the food industry. This sets a very strong growth trajectory for the company, as we introduce additional products and establish new facilities around the globe.” Amir Feder, CFO, BlueNaluInterested in the future of meat?Check out our upcoming digital summit, Futureproofing the Food System (Nov 15-17), which will dedicated one of its six bite-sized sessions to The Future of Meat. REGISTER HERE (it’s free)!

External rendering of BlueNalu’s first large-scale facility with capability to produce up to six million pounds of premium seafood products annually. Image credit: BlueNaluTechno-economic analysisTo validate its commercialization pathway at its large-scale facility, BlueNalu commissioned a techno-economic analysis (TEA) performed in collaboration with a global engineering, procurement, and construction (EPC) firm and experts in bioprocess modeling, said co-founder, president and CEO Lou Cooperhouse.“This technology means we don’t have to blend; we’re developing a whole muscle high-value product that has the same nutritional and functional characteristics as conventional Bluefin tuna.”BlueNalu’s value proposition has attracted a number of strategic partners including multinational companies in Asia (Food & Life Companies, Mitsubishi Corporation, Pulmuone Corporation, Sumitomo Corporation, and Thai Union); Europe (Nomad Foods and Nutreco); and the U.S. (Griffith Foods and Rich Products), he added.Some construction could be debt-financedAsked about funding, he said: “We’ve raised $84.6m to date, and frankly what gets us very excited is our hope that we could get commitments on sales of a fair amount of the volume as we do market testing over the next few years. The goal is to get into the US but also other markets where per capita consumption of seafood is high and where our strategic partners can facilitate that and also where there’s regulatory approval.“So we feel not just that we can ideally sell a fair amount of the volume in advance of even construction occurring, but that this will also be very easily debt financed, because it is something that we’ll be able to demonstrate a very high level of demand for the time we put that shovel in the ground.”“Our projected 75% gross margin within the first year of production of our large-scale facility is unheard of in the food industry. This sets a very strong growth trajectory for the company, as we introduce additional products and establish new facilities around the globe.” Amir Feder, CFO, BlueNaluInterested in the future of meat?Check out our upcoming digital summit, Futureproofing the Food System (Nov 15-17), which will dedicated one of its six bite-sized sessions to The Future of Meat. REGISTER HERE (it’s free)! FIRESIDE CHAT: Cell-cultured (a.k.a. ‘cultivated’) meat: Foodtech fantasy or the future of meat?Dr Elliot Swartz, lead scientist, cultivated meat, The Good Food Institute and Elaine Watson, senior editor, FoodNavigator-USAGrowing meat from cells in bioreactors instead of living breathing animals should logically be more efficient, as resources are spent on growing only the cells that make up the meat product rather than keeping an animal alive. So is cultivated meat a no brainer, or does the technology face ‘intractable’ problems at food scale?PANEL: Meat 2.0: With weakening sales in the alt-meat segment prompting some serious soul-searching, what does the future hold for meat alternatives, how do the available options stack up, what will distinguish the winners from the losers in the category, and how do consumers feel about the next generation of meat?

FIRESIDE CHAT: Cell-cultured (a.k.a. ‘cultivated’) meat: Foodtech fantasy or the future of meat?Dr Elliot Swartz, lead scientist, cultivated meat, The Good Food Institute and Elaine Watson, senior editor, FoodNavigator-USAGrowing meat from cells in bioreactors instead of living breathing animals should logically be more efficient, as resources are spent on growing only the cells that make up the meat product rather than keeping an animal alive. So is cultivated meat a no brainer, or does the technology face ‘intractable’ problems at food scale?PANEL: Meat 2.0: With weakening sales in the alt-meat segment prompting some serious soul-searching, what does the future hold for meat alternatives, how do the available options stack up, what will distinguish the winners from the losers in the category, and how do consumers feel about the next generation of meat?

- Ethan Brown, co-founder and CEO, Beyond Meat

- Dr Lisa Dyson, founder and CEO, Air Protein

- Dr Tyler Huggins, co-founder, Meati Foods

- Abena Foli, head of regulatory affairs, Orbillion Bio

- MODERATOR: Elaine Watson, senior editor, FoodNavigator-USA

REGISTER HERE (it’s free)! .

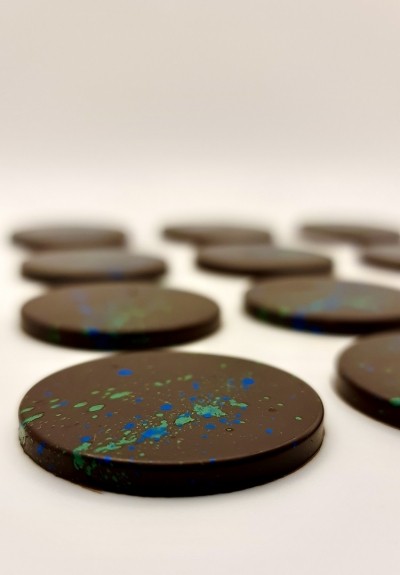

Carob is one of the key ingredients in WNWN’s product. GettyImages/kolesnikovsergHowever, carob is chocolatey, stressed the CTO, and the combination of carob and fermented barley makes for a ‘deliciously chocolatey profile’. WNWN’s carob is grown in Spain and Italy and is certified organic. “Production of carob is very sustainable and not mired by the sorts of deforestation problems that cacao is,” said Dr Drain.Without cacao, there is no cocoa butter. Instead WNWN is sourcing shea fat from Ghana.“All the ingredients we are sourcing and sustainable, organic, and high-quality,” said Pak. “We’ve gone to several lengths to ensure our supply is so. We’re looking to create long-lasting relationships with local farmers.”Nutritional and flavour profile for humans…and doggos!The start-up’s first product is a dairy-free premium dark chocolate alternative. Its nutritional profile is ‘very similar’ to conventional chocolate – albeit containing slightly less sugar.While the product’s full flavonoid and antioxidant profiles are not yet fully understood by WNWN, it plans to investigate its potential health benefits.One obvious upside of WNWN’s product, compared to chocolate, will be appreciated by consumers’ four-legged friends, suggested Dr Drain. Dogs cannot eat conventional chocolate due to its theobromine content, which they are unable to metabolise effectively.WNWN’s alt choc does not contain theobromine. “Your doggo can eat our chocolate,” said the CTO. “We’ve tested it on some dogs…and they absolutely go wild for it.”

Carob is one of the key ingredients in WNWN’s product. GettyImages/kolesnikovsergHowever, carob is chocolatey, stressed the CTO, and the combination of carob and fermented barley makes for a ‘deliciously chocolatey profile’. WNWN’s carob is grown in Spain and Italy and is certified organic. “Production of carob is very sustainable and not mired by the sorts of deforestation problems that cacao is,” said Dr Drain.Without cacao, there is no cocoa butter. Instead WNWN is sourcing shea fat from Ghana.“All the ingredients we are sourcing and sustainable, organic, and high-quality,” said Pak. “We’ve gone to several lengths to ensure our supply is so. We’re looking to create long-lasting relationships with local farmers.”Nutritional and flavour profile for humans…and doggos!The start-up’s first product is a dairy-free premium dark chocolate alternative. Its nutritional profile is ‘very similar’ to conventional chocolate – albeit containing slightly less sugar.While the product’s full flavonoid and antioxidant profiles are not yet fully understood by WNWN, it plans to investigate its potential health benefits.One obvious upside of WNWN’s product, compared to chocolate, will be appreciated by consumers’ four-legged friends, suggested Dr Drain. Dogs cannot eat conventional chocolate due to its theobromine content, which they are unable to metabolise effectively.WNWN’s alt choc does not contain theobromine. “Your doggo can eat our chocolate,” said the CTO. “We’ve tested it on some dogs…and they absolutely go wild for it.” WNWN’s premium dark chocolate product is made from two ‘hero ingredients’: barley and carob. Image source: WNWNSo does WNWN’s alt choc product taste like chocolate? “We’re trying to replicate the experience of chocolate,” the CTO explained.In terms of flavour, the start-up has achieved the archetypal bitterness associated with dark chocolate, as well as its ‘fruity acidity’. “We have red berries, prunes, notes of butterscotch in the long finish and a maltiness coming through from the barley.”“It’s a flavour profile that is very similar to that of premium dark chocolate: lots of acidity and brightness, complexity, and bitterness.”WNWN is working on an alternative to milk chocolate which is more ‘neutral’ in flavour, making for a ‘creamy’ experience with less acidity.The experience of chocolate, however, does not lie in flavour alone. The start-up wants the melt, snap, and baking properties of chocolate, and for the most part, it has been successful. If there was one element it hasn’t quite perfected just yet, it’s the ‘snapability’, Dr Drain revealed, “but we’re almost there”.First chocolate, next coffee and vanilla?WNWN is launching its first product next week direct-to-consumer. Initially targeting the 18–45-year-old eco-conscious consumer, the company expects the target market with grow as it develops more products, including a ‘mass market range’.

WNWN’s premium dark chocolate product is made from two ‘hero ingredients’: barley and carob. Image source: WNWNSo does WNWN’s alt choc product taste like chocolate? “We’re trying to replicate the experience of chocolate,” the CTO explained.In terms of flavour, the start-up has achieved the archetypal bitterness associated with dark chocolate, as well as its ‘fruity acidity’. “We have red berries, prunes, notes of butterscotch in the long finish and a maltiness coming through from the barley.”“It’s a flavour profile that is very similar to that of premium dark chocolate: lots of acidity and brightness, complexity, and bitterness.”WNWN is working on an alternative to milk chocolate which is more ‘neutral’ in flavour, making for a ‘creamy’ experience with less acidity.The experience of chocolate, however, does not lie in flavour alone. The start-up wants the melt, snap, and baking properties of chocolate, and for the most part, it has been successful. If there was one element it hasn’t quite perfected just yet, it’s the ‘snapability’, Dr Drain revealed, “but we’re almost there”.First chocolate, next coffee and vanilla?WNWN is launching its first product next week direct-to-consumer. Initially targeting the 18–45-year-old eco-conscious consumer, the company expects the target market with grow as it develops more products, including a ‘mass market range’. The start-up’s limited-release choc this are launching next week. Image source: WNWN“Pretty much anyone who likes the taste of chocolate should like our product,” said Pak.A box of WNWN’s limited-release choc thins will retail for around £10, ‘on par’ with the price range of premium chocolate. In the future, its mass market range with sit within the mass market price bracket of around £3-4, we were told.The B2C sales model is just the ‘first step’, however. Currently, it means WNWN can take a bigger role in educating shoppers and creating ‘fun products’. Once consumer demand is established, the business plans to expand into B2B ingredient sales.“We can supply our product in both chocolate mass and cocoa powder form, so that is the ultimate aim. Impact only comes with scale.” And WNWN doesn’t plan on stopping there. It is an ingredients company more than anything, the CEO suggested, and chocolate is only one product with problematic supply chains.“Chocolate is our first project, and then we’ll be moving into other products, such as coffee and vanilla.” .

The start-up’s limited-release choc this are launching next week. Image source: WNWN“Pretty much anyone who likes the taste of chocolate should like our product,” said Pak.A box of WNWN’s limited-release choc thins will retail for around £10, ‘on par’ with the price range of premium chocolate. In the future, its mass market range with sit within the mass market price bracket of around £3-4, we were told.The B2C sales model is just the ‘first step’, however. Currently, it means WNWN can take a bigger role in educating shoppers and creating ‘fun products’. Once consumer demand is established, the business plans to expand into B2B ingredient sales.“We can supply our product in both chocolate mass and cocoa powder form, so that is the ultimate aim. Impact only comes with scale.” And WNWN doesn’t plan on stopping there. It is an ingredients company more than anything, the CEO suggested, and chocolate is only one product with problematic supply chains.“Chocolate is our first project, and then we’ll be moving into other products, such as coffee and vanilla.” .