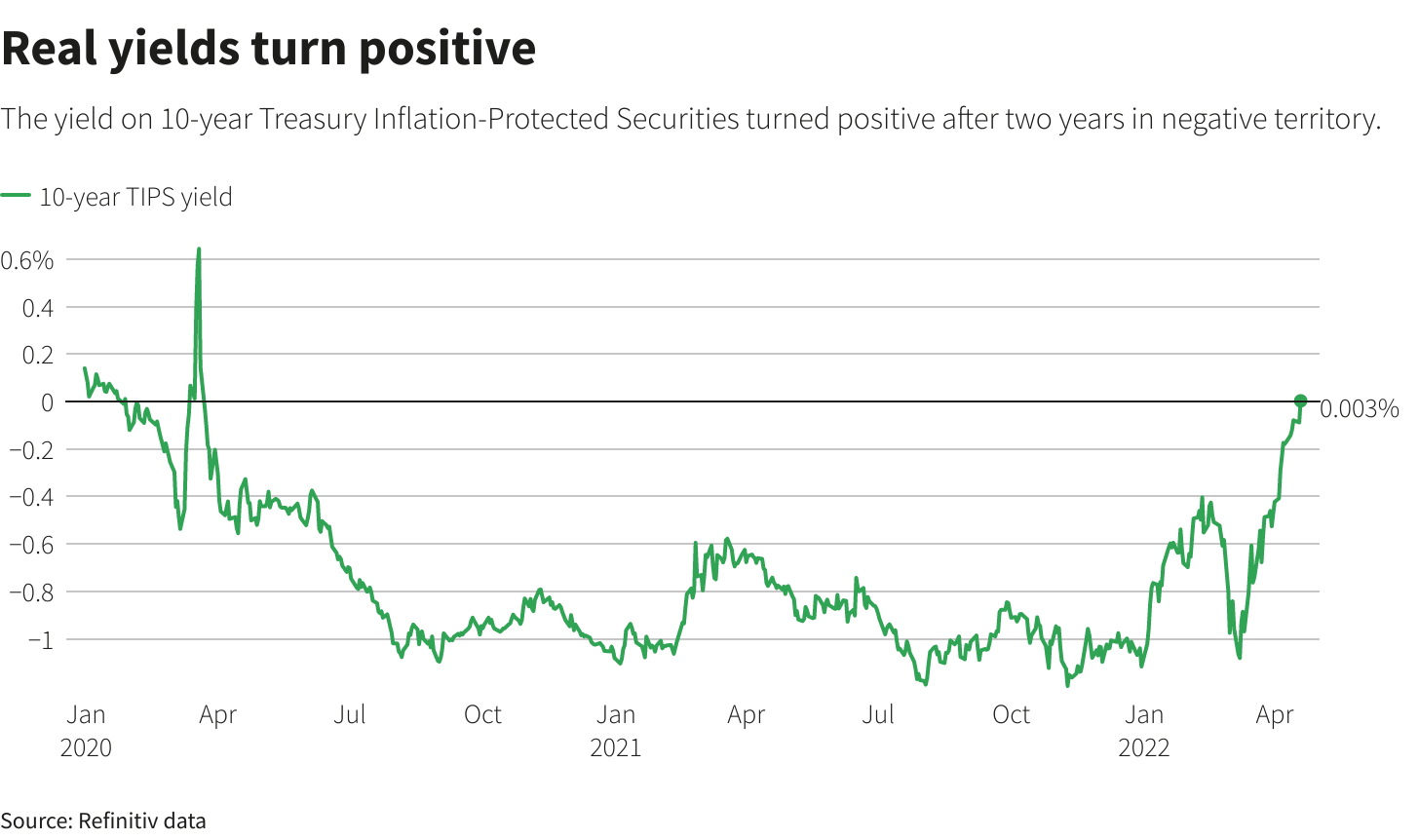

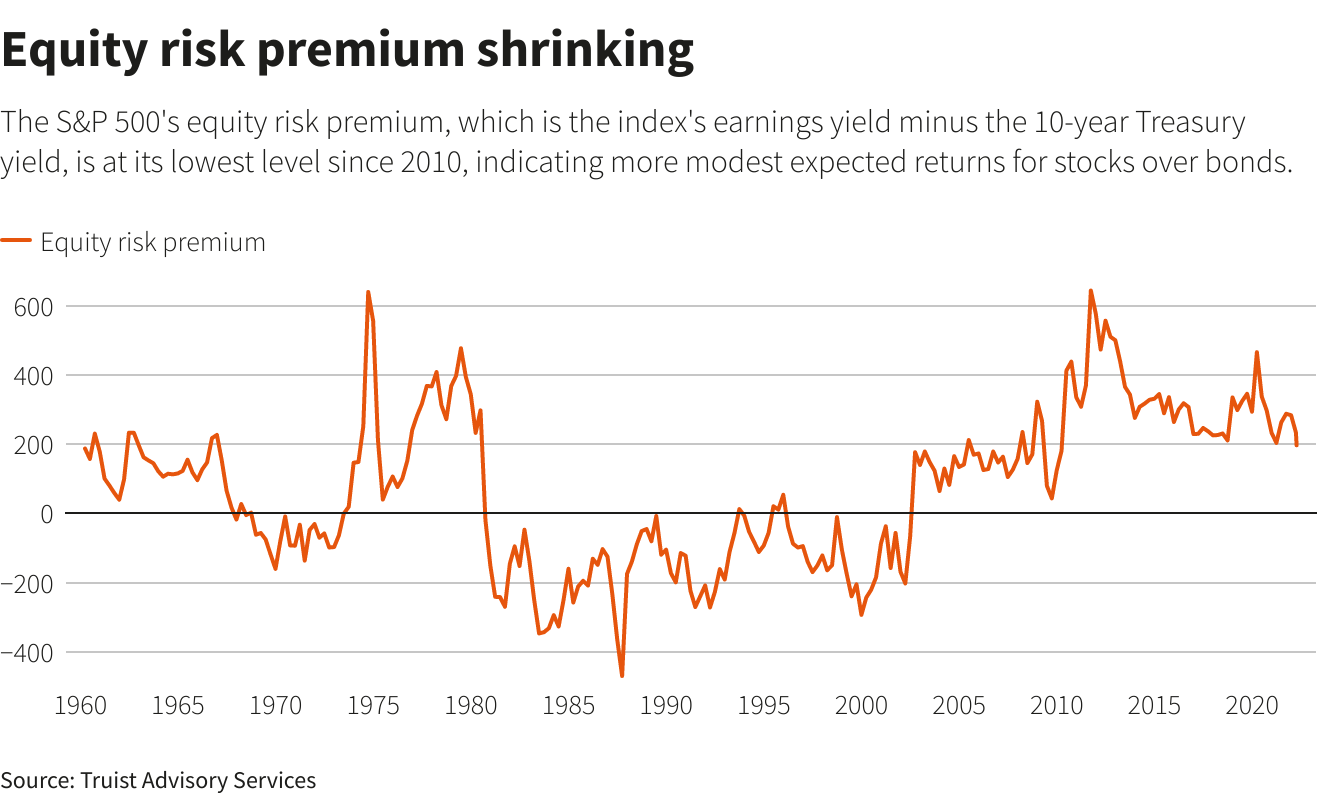

A street sign for Wall Street is seen in the financial district in New York, U.S., November 8, 2021. REUTERS/Brendan McDermid/File Photo/File PhotoRegister now for FREE unlimited access to Reuters.comNEW YORK, April 20 (Reuters) – A hawkish turn by the Federal Reserve is eroding a key support for U.S. stocks, as real yields climb into positive territory for the first time in two years.Yields on the 10-year Treasury Inflation-Protected Securities (TIPS) – also known as real yields because they subtract projected inflation from the nominal yield on Treasury securities – had been in negative territory since March 2020, when the Federal Reserve slashed interest rates to near zero. That changed on Tuesday, when real yields ticked above zero. Negative real yields have meant that an investor would have lost money on an annualized basis when buying a 10-year Treasury note, adjusted for inflation. That dynamic has helped divert money from U.S. government bonds and into a broad spectrum of comparatively riskier assets, including stocks, helping the S&P 500 (.SPX) more than double from its post-pandemic low.Register now for FREE unlimited access to Reuters.comAnticipation of tighter monetary policy, however, is pushing yields higher and may dent the luster of stocks in comparison to Treasuries, which are viewed as much less risky since they are backed by the U.S. government. Reuters GraphicsOn Tuesday, stocks shrugged off the rise in yields, with the S&P 500 ending up 1.6% on the day. Still, the S&P 500 is down 6.4% this year, while the yield on the 10-year TIPS has climbed more than 100 basis points.”Real 10-year yields are the risk-free alternative to owning stocks,” said Barry Bannister, chief equity strategist at Stifel. “As real yield rises, at the margin it makes stocks less attractive.”One key factor influenced by yields is the equity risk premium, which measures how much investors expect to be compensated for owning stocks over government bonds.Rising yields have helped result in the measure standing at its lowest level since 2010, Truist Advisory Services said in a note last week.

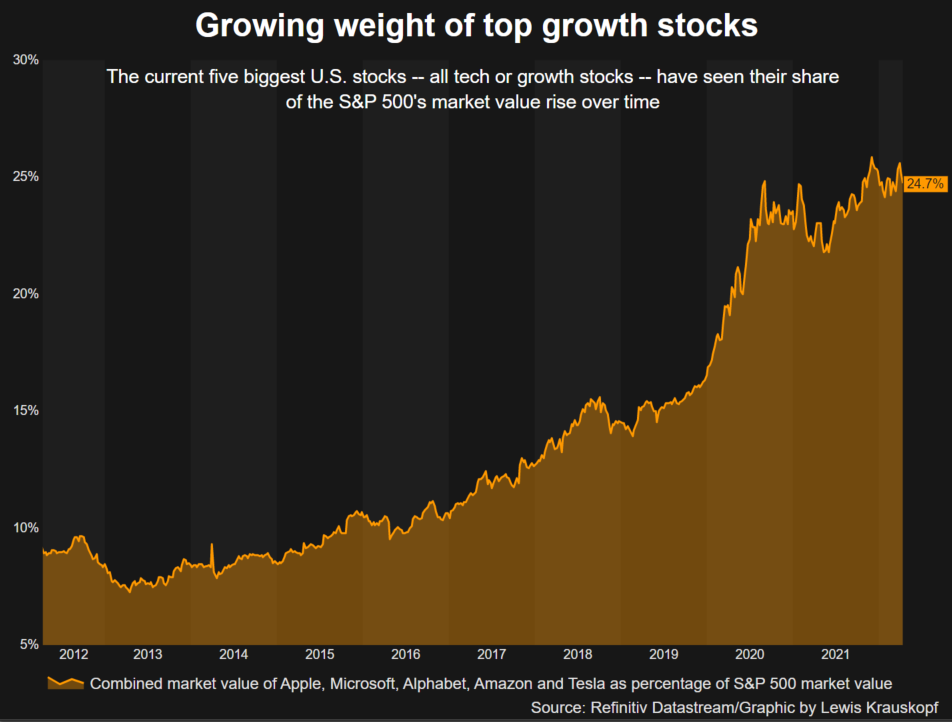

Reuters GraphicsOn Tuesday, stocks shrugged off the rise in yields, with the S&P 500 ending up 1.6% on the day. Still, the S&P 500 is down 6.4% this year, while the yield on the 10-year TIPS has climbed more than 100 basis points.”Real 10-year yields are the risk-free alternative to owning stocks,” said Barry Bannister, chief equity strategist at Stifel. “As real yield rises, at the margin it makes stocks less attractive.”One key factor influenced by yields is the equity risk premium, which measures how much investors expect to be compensated for owning stocks over government bonds.Rising yields have helped result in the measure standing at its lowest level since 2010, Truist Advisory Services said in a note last week. Reuters GraphicsHEADWIND TO GROWTH SHARESHigher yields in particular dull the allure of companies in technology and other high-growth sectors, with those companies’ cash flows often more weighted in the future and diminished when discounted at higher rates.That may be bad news for the broader market. The heavy presence of tech and other growth stocks in the S&P 500 means the index’s overall expected dividends are weighted in the future at close to their highest level ever, according to BofA Global Research. Five massive, high-growth stocks, for example, now make up 22% of the weight of the S&P 500.At the same time, growth shares in recent years have been highly linked to the movement of real yields.Since 2018, a ratio comparing the performance of the Russell 1000 growth index (.RLG) to its counterpart for value stocks (.RLV) – whose cash flows are more near-term – has had a negative 96% correlation with 10-year real rates, meaning they tend to move in opposite directions from growth stocks, according to Ohsung Kwon, a U.S. equity strategist at BofA Global Research.Rising yields are “a bigger headwind to equities than (they have) been in history,” he said.

Reuters GraphicsHEADWIND TO GROWTH SHARESHigher yields in particular dull the allure of companies in technology and other high-growth sectors, with those companies’ cash flows often more weighted in the future and diminished when discounted at higher rates.That may be bad news for the broader market. The heavy presence of tech and other growth stocks in the S&P 500 means the index’s overall expected dividends are weighted in the future at close to their highest level ever, according to BofA Global Research. Five massive, high-growth stocks, for example, now make up 22% of the weight of the S&P 500.At the same time, growth shares in recent years have been highly linked to the movement of real yields.Since 2018, a ratio comparing the performance of the Russell 1000 growth index (.RLG) to its counterpart for value stocks (.RLV) – whose cash flows are more near-term – has had a negative 96% correlation with 10-year real rates, meaning they tend to move in opposite directions from growth stocks, according to Ohsung Kwon, a U.S. equity strategist at BofA Global Research.Rising yields are “a bigger headwind to equities than (they have) been in history,” he said. Top five stocks market cap as percentage of S&P 500Bannister estimates the S&P 500 could retest its lows of the year, which included a drop in March of 13% from the index’s record high, should the yield on the 10-year TIPS rise to 0.75% and the earnings outlook – a key component of the risk premium – remain unchanged.Lofty valuations also make stocks vulnerable if yields continue rising. Though the tumble in stocks has moderated valuations this year, the S&P 500 still trades at about 19 times forward earnings estimates, compared with a long-term average of 15.5, according to Refinitiv Datastream.“Valuations aren’t great on stocks right now. That means that capital may look at other alternatives to stocks as they become more competitive,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.Still, some investors believe stocks can survive just fine with rising real yields, for now. Real yields were mostly in positive territory over the past decade and ranged as high as 1.17% while the S&P 500 has climbed over 200%.JPMorgan strategists earlier this month estimated that equities could cope with 200 basis points of real yield increases. They advised clients maintain a large equity versus bond overweight.”If bond yield rises continue, they could eventually become a problem for equities,” the bank’s strategists said. “But we believe current real bond yields at around zero are not high enough to materially challenge equities.”Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf in New York

Top five stocks market cap as percentage of S&P 500Bannister estimates the S&P 500 could retest its lows of the year, which included a drop in March of 13% from the index’s record high, should the yield on the 10-year TIPS rise to 0.75% and the earnings outlook – a key component of the risk premium – remain unchanged.Lofty valuations also make stocks vulnerable if yields continue rising. Though the tumble in stocks has moderated valuations this year, the S&P 500 still trades at about 19 times forward earnings estimates, compared with a long-term average of 15.5, according to Refinitiv Datastream.“Valuations aren’t great on stocks right now. That means that capital may look at other alternatives to stocks as they become more competitive,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.Still, some investors believe stocks can survive just fine with rising real yields, for now. Real yields were mostly in positive territory over the past decade and ranged as high as 1.17% while the S&P 500 has climbed over 200%.JPMorgan strategists earlier this month estimated that equities could cope with 200 basis points of real yield increases. They advised clients maintain a large equity versus bond overweight.”If bond yield rises continue, they could eventually become a problem for equities,” the bank’s strategists said. “But we believe current real bond yields at around zero are not high enough to materially challenge equities.”Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf in New York

Editing by Ira Iosebashvili and Matthew LewisOur Standards: The Thomson Reuters Trust Principles. .

Ramsay Health Care gets $14.8 bln bid from KKR-led consortium; shares soar

Trading information for KKR & Co is displayed on a screen on the floor of the New York Stock Exchange (NYSE) in New York, U.S., August 23, 2018. REUTERS/Brendan McDermidRegister now for FREE unlimited access to Reuters.com

- Ramsay receives A$88 cash per share proposal

- Proposal at a 37% premium to Ramsay’s last close

- Ramsay stock up 29.8% in early trade

April 20 (Reuters) – Ramsay Health Care Ltd (RHC.AX), Australia’s largest private hospital operator, said on Wednesday it received a A$20.05 billion ($14.80 billion) indicative takeover offer from a consortium led by private equity giant KKR & Co (KKR.N).The non-binding proposal of A$88 cash per share represents a premium of nearly 37% to Ramsay’s Tuesday closing price of A$64.39. The offer sent the hospital operator’s shares up as much as 29.8% to A$83.55 in early trade, their biggest-ever intraday jump.Ramsay said in a statement it would provide the KKR-led consortium with due diligence on a non-exclusive basis and talks were at a preliminary stage.Register now for FREE unlimited access to Reuters.comThe hospital operator said it had reviewed the proposal with its advisers and asked for further information from the consortium in relation to its funding and structure of the deal.KKR did not immediately respond to a Reuters request for comment.If successful, the takeover would be the biggest in Australia this year and nearly double deal activity, which at a total value of $17.4 billion, suffered a 41.2% decline in the first quarter compared with a year earlier, according to Refinitiv data.The proposal comes as record-low interest rates prompt private equity firms, superannuation and pension funds with ample liquidity to invest in healthcare and infrastructure assets.The deal would also rank as the second biggest private-equity backed in deal in Australia, following a consortium’s A$31.6 billion ($23.35 billion) enterprise value deal for Sydney airport last year. read more The pandemic hit healthcare operators including Ramsay, with the shutdown of non-urgent surgeries, staffing shortages due to isolation regulations, and upward wage pressure weighing on earnings and hurting stocks, making the sector relatively affordable for a buyout, compared to a few years ago.Last year, Australian biopharmaceutical giant CSL Ltd (CSL.AX) said it would buy Swiss drugmaker Vifor Pharma AG (VIFN.S) for $11.7 billion. read more Ramsay operates hospitals and clinics across 10 countries in three continents, with a network of more than 530 locations, according to its website.It has 72 private hospitals and day surgery units in Australia, while it operates clinics and primary care units in about 350 locations across six countries in Europe.KKR currently owns French healthcare group Elsan.Earlier this year, Ramsay and Malaysia’s Sime Darby Holdings received a $1.35 billion buyout offer from IHH Healthcare Bhd (IHHH.KL) for their Asia joint venture. Ramsay said it was still pursuing this transaction. The hospital operator has hired UBS AG’s Australia Branch and Herbert Smith Freehills as financial and legal advisers, respectively, for the KKR-led consortium’s proposal.($1 = 1.3535 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Harish Sridharan in Bengaluru; additional reporting by Byron Kaye in Sydney; Editing by Sriraj Kalluvila, Aditya Soni and Krishna Chandra Eluri and Rashmi AichOur Standards: The Thomson Reuters Trust Principles. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

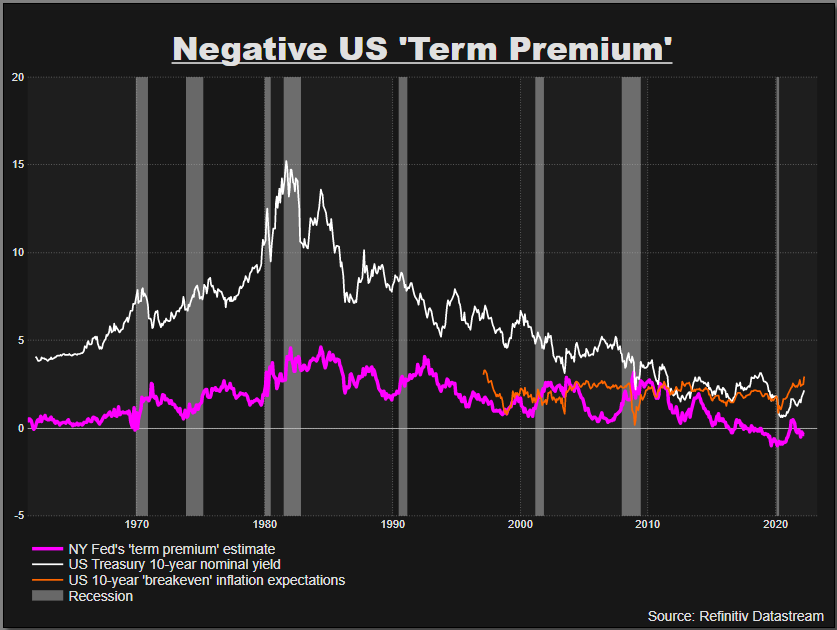

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

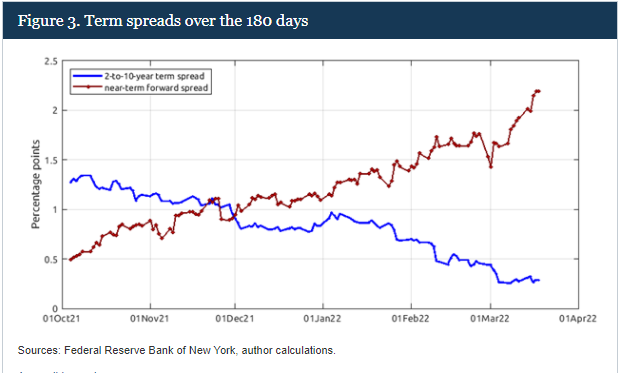

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

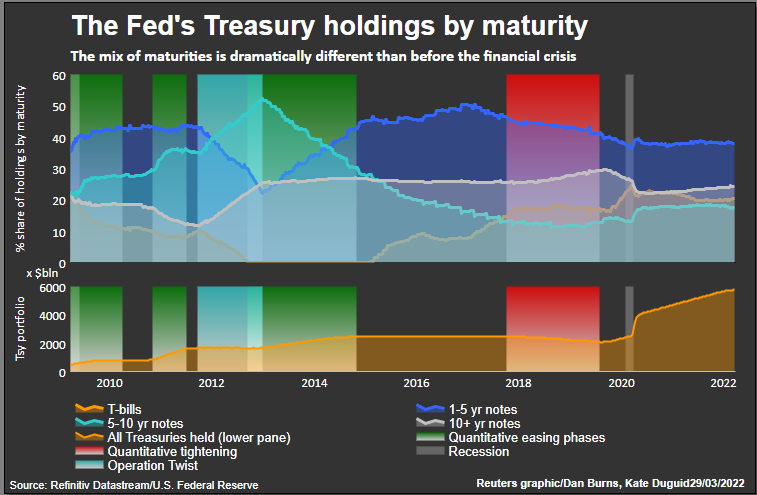

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Tight supplies lift Mideast, Russian crude grades to multi-year highs

- Cash Dubai’s premium breaches $4/bbl for first time – Platts

- ESPO premiums jump to $7/bbl, highest since Dec 2019

- Sokol premiums rise to highest since Dec 2019

SINGAPORE, Feb 16 (Reuters) – Middle East benchmark Dubai crude soared to a record this week while spot premiums for April-loading Russian oil jumped to their highest in more than two years in Asia, trade sources said on Wednesday as prices returned to pre-pandemic levels.The global supply-demand balance has tightened as the Organization of the Petroleum Exporting Countries and its allies are lagging behind commitments to increase output by 400,000 barrels per day each month. read more Demand, meantime, is robust as refiners globally are cranking up operations to reap higher margins on gasoline and diesel.Register now for FREE unlimited access to Reuters.comRegisterThe Russia-Ukraine crisis has also boosted Brent prices, pushing the benchmark’s premium to Dubai to its highest since 2013 this week.There was no immediate sign of the price spread weakening after Russia pulled back some of its forces from the border on Tuesday.The wide spread between the benchmarks is boosting Asia’s demand for Middle East and Russian grades priced off Dubai, leading spot premiums to hit multi-year highs this month.Cash Dubai hit a record high at Tuesday’s market close, breaching $4 a barrel premium over futures for the first time, oil pricing agency S&P Global Platts reported.The April cash Dubai versus same-month Dubai futures was assessed at a premium of $4.08 a barrel, Platts data showed.For Russian grades, spot premiums for ESPO Blend crude exported from the Far East port of Kozmino soared to their highest in more than two years after producer Surgutneftegaz sold three cargoes via a tender, trade sources said.The cargoes for late March to early April loading were sold at premiums of $7-$7.10 a barrel above Dubai quotes, they said, about $2 higher than last month.ESPO crude premiums were last seen at these levels in December 2019, Refinitiv data showed.Trading houses Mitsui and Petraco bought the cargoes, the sources said.Similarly, spot premiums for Russian Sokol crude loading in April jumped to their highest since January 2020 after India’s ONGC Videsh sold a cargo via a tender, they added.The cargo for April 19-25 loading was sold to Glencore at a premium of $7.80-$7.90 a barrel to Dubai quotes, the sources said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Florence Tan in Singapore and Olga Yagova in Moscow; Editing by Tom Hogue, Shailesh Kuber & Simon Cameron-MooreOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Where now after 2% yield? Bond investors take stock

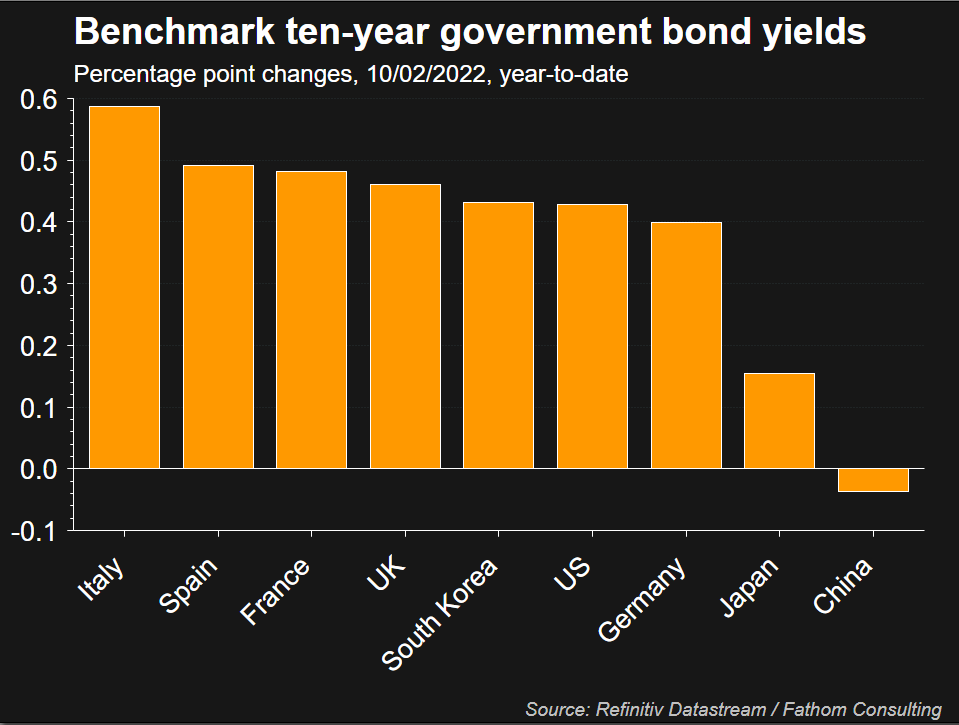

The Federal Reserve building is seen in Washington, U.S., January 26, 2022. REUTERS/Joshua Roberts/File PhotoRegister now for FREE unlimited access to Reuters.comRegisterNEW YORK, Feb 10 (Reuters) – U.S. Treasury yields have shot higher this year, rising faster than many forecast. Investors are now assessing if anticipation of a more hawkish Fed will continue to push levels up, with the potential to upset riskier assets.Expectations that the U.S. Federal Reserve may increase rates more aggressively than anticipated to counter rising inflation have pushed up yields while flattening the U.S. Treasury yield curve. That matters as bond yields impact global asset prices as well as consumer loans and mortgages. The shape of the U.S. Treasury yield curve can also help predict how the economy will fare.On Thursday, yields on 10-year notes hit 2% after higher-than-anticipated inflation data. Federal funds rate futures showed an increased chance of a half percentage-point tightening at next month’s meeting after the data, while strategists said the data increased the chances of swifter moves to reduce the Fed’s balance sheet. The central bank’s nearly $9 trillion portfolio doubled in size during the pandemic. read more Register now for FREE unlimited access to Reuters.comRegister“The market is starting to price in a much more aggressive path of rate hikes … clearly there is a sense of urgency again”, said Subadra Rajappa, head of U.S. rates strategy at Societe Generale.Yields, which move inversely to prices, are up from 1.79% at the beginning of February. The last time they breached 2% was August 2019.”I would say the chances of yields continuing to go higher are pretty high,” said Gargi Chaudhuri, Head of iShares Investment Strategy, Americas, at BlackRock, speaking ahead of the data.FOREIGN COMPETITIONCompetition in other markets for yield may be sapping demand for Treasuries and helping push yields higher, Chaudhuri said.A second rate hike by the Bank of England last week, and expectations of faster policy tightening by the European Central Bank (ECB), added to U.S. bonds’ weakness, with borrowing costs in Europe – as well as Japanese government bond yields – having jumped to multi-year highs in recent days. read more “Investors have these other markets to gravitate towards that they didn’t in the past, and that will require investors that are focusing on U.S. markets to seek a higher term premium and therefore will impact yields higher,” Chaudhuri said.Japan’s benchmark 10-year government bond yield is around its highest level since January 2016 at 0.220% while Germany’s 10-year government bond yield , at 0.255%, is at its highest since January 2019. read more  FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .