A man uses the SnapChat app on an Apple iPad Mini.studioEAST | Getty ImagesSnap announced Wednesday it’s rolling out a $3.99/month subscription plan for Snapchat that unlocks exclusive and pre-release features. It’s called Snapchat+.The announcement comes after Snapchat gave a disappointing sales outlook for the current quarter when it reported first-quarter results in April. Snap CFO Derek Andersen said at the time that macroeconomic conditions like supply chain disruptions, labor shortages and inflation are impacting advertising, Snap’s main source of revenue.Snapchat+ could help the company diversify its revenue sources, though Snapchat’s senior vice president of products Jacob Andreou told The Verge that the company doesn’t expect the plan to become a “material new revenue source.”Shares of Snapchat were down about 1% at 11 a.m. ET on Wednesday morning.The Plus plan includes pre-release, experimental and exclusive features such as pining your close friend as a BFF (best friend forever) and customizing the app’s icon. It is intended for the “most passionate members” of Snapchat users, the company said.Other social media platforms have also rolled out subscription services recently. Twitter in 2021 announced the Blue subscription that offers ad-free access to other websites for $2.99 a month. Chat app Telegram introduced Telegram Premium in June.Snapchat+ launches Wednesday in the United States, Canada, the United Kingdom, France, Germany, Australia, New Zealand, Saudi Arabia and the United Arab Emirates. .

Why You Probably Shouldn’t Pay for Telegram Premium

Photo: Diego Thomazini (Shutterstock)No free service remains free forever. For some apps, such as Instagram, advertising pays the price of your admission—and you’ll likely see more ads the longer the service has been around. Others eventually try to get their users to pay a subscription fee. Telegram, the popular messaging app that competes with WhatsApp, has taken the latter route.

Telegram Premium is a paid subscription targeted at Telegram’s most dedicated users. It adds features such as increased limits for file sizes and groups, dedicated stickers, and verification badges for paid members. However, none of those features will make a difference to people who use Telegram as a messaging app, rather than something more like a Discord server. Telegram is trying to target a small section of its user base to fund its server and developer costs, and most people are better off not paying for the service. Here’s why.The best features of Telegram Premium (and why you don’t need them)

Telegram has a very generous free tier that lets you chat, upload files up to 2GB, and create groups of up to 500 people. Telegram Premium lets you upload files as large as 4GB, create groups of up to 1,000 members, and connect six different phone numbers to your account. Those added features are nice to have, but it’s clear the free tier is good enough for almost everyone.

A paid subscription also doubles a few other limits that will only be helpful for those who practically live inside Telegram. For example, the premium tier bumps up the number of chat folders to 20 (from 10), lets you store 200 chats per folder (up from 100), save up to 400 gifs to your account (as opposed to 200), and lets you reserve 20 public links (up from 10).A legitimately great feature for paid Telegram enthusiasts is the removal of download speed limits within the app. You could theoretically use this as an opportunity to stop using WeTransfer or another cloud storage service in favor of Telegram. The big draw for many will be the ability to better manage your chats. Telegram Premium’s chat management features let you hide chats from people who aren’t in your contact lists and automatically archive chats from people who spam you. (That said, Telegram’s free tier allows you to automatically delete chats, too.)Telegram Premium will also allow you to transcribe incoming voice messages quickly, but only certain languages are supported.Otherwise, you get a profile badge to brag to others that you’re giving Telegram money, unique emoji reactions, animated profile pictures, and premium stickers. Still, if one premium user adds a unique emoji reaction to a message, those on the free tier can tap it to “use” the reaction too, and the free version of the app already includes a ton of stickers.

How much does Telegram Premium cost and should you get it?Telegram Premium costs $5 per month, and you can subscribe from the app on all platforms. Based on the feature set that Telegram is offering at the moment, though, most people shouldn’t consider it.You will be able to continue using Telegram for free, and the ads in Telegram are so few that most of its users won’t be seeing them anyway. In short, the free tier is good enough for almost everyone.If you’re a dedicated Telegram user who hosts large groups and uses the app to send files all the time, then the paid subscription offers a good value. If nothing else, its chat management features alone are worth the asking price—the ability to automatically archive and hide chats is great if you are a heavy use. But at its current price, Telegram Premium is only worth it for a small subset of its user base. If you aren’t sure if that’s you, it probably isn’t.

.

Former interim CBI director discovers that sarkari privilege does not translate to social media influence

There are jobs at the higher echelons of government service that come with perks most working people can only dream of: Free healthcare, a pension for life, job security, etc. But perhaps the greatest privilege, the one that seems the hardest to shake off, is a socially-sanctioned sense of entitlement. For the officer, in his Ambassador (or its imported equivalent), people and traffic part like the Red Sea for Moses, queues disappear, train tickets are magically booked, thanks to the “lal batti” and all it stands for. Unfortunately, as former interim director, CBI, M Nageswara Rao recently discovered, not all privilege lasts forever.

Rao has now moved the Delhi High Court twice in as many months demanding that Twitter restore the “blue tick” — given to verified accounts — that his handle once enjoyed. On Tuesday, while dismissing his second writ petition, the court ordered that he pay a fine of Rs 10,000. Clearly, the petitioner did not understand rejection. Or, even more significantly, that a blue tick — like the lal batti — is a privilege that can be temporary. It is certainly not a matter over which a high court need exercise its original jurisdiction.

But perhaps the retired IPS officer should not be judged too harshly. After all, unthinking entitlement — in essence, confusing rights for privileges, discretion for discrimination — may just be the inevitable outcome of years in power. Unlike regular working folk, who struggle with job precarity and no pensions, an All-India Service officer is rarely told that he does not deserve institutional recognition and backing, that he is just one among the millions with a voice on the internet. Most people, the voiceless, find on places like Twitter — for better and often worse — a chance to be heard. For the babu, being a part of that cacophony itself appears to be traumatic.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘444470064056909’);

fbq(‘track’, ‘PageView’);

.

The Murky World Of Social Media Stock Tips

By December 2021, the channel garnered quite a following—of nearly 52,000 subscribers. It recommended stocks to buy and sell, particularly small cap scrips. But there was one problem. The administrators weren’t research analysts. One of them, Himanshu Patel, did a masters in tourism management and had previously worked in a hotel.

Patel, along with other administrators, was using their trading accounts to first buy the shares of certain companies and then recommend it to their subscribers. Next, they sold the shares for a neat profit, India’s market regulator found during an investigation. In an interim order passed on 12 January, the Securities and Exchange Board of India (Sebi) alleged unlawful gains worth ₹2.84 crore. It also advised investors to stay away from such tipsters.

Bullrun2017 was running a classic ‘pump-and-dump’ scheme or one where a stock is manipulated through exaggerated recommendations. Nothing new about this except for the fact that in this case, social media was widely used in talking up penny stocks.

With Sebi cracking the whip, many other Telegram channels dedicated to recommending penny stocks were alarmed. Some of them shifted to other platforms such as Twitter. On 14 January, the admin of one such Telegram channel told its 1,585 subscribers: “Due to Sebi guidelines, I will (be) more active on Twitter …. I will update all stocks, suggestions on Twitter”.

Yet another channel which assures “great returns” with close to 2 lakh subscribers said: “Mandatory disclaimer as required by Sebi. This channel is only for educational purposes. Consult with your financial advisor before investment”.

Interestingly, there is no Sebi guideline that says stock tips and trade suggestions can be given for educational purposes. In any case, most of these channels have little educational material or any discussion on the fundamentals of stocks they recommend.

The rot goes deeper. There are instances where influencers who have considerable following on Instagram, Twitter and Facebook are approached by companies to send out social media posts recommending and endorsing their shares.

All this at a time when more and more Indians are investing in equities. According to data published by the regulator, an average of 26 lakh new demat accounts were opened every month in the year ending March 2022, as against a monthly average of 4 lakh in 2019-20. As of November 2021, the total number of investor accounts stood at 7.7 crore. The new-to-stock markets are easy prey for tipsters peddling in penny stocks.

Mint deep dived into this rabbit hole. The hole runs deep. Here, the lines between what is legal and illegal, ethical and unethical get fairly blurry.

Shades of grey

‘Buy-sell’ and ‘stock tips’ are among the most commonly searched terms on every possible social media site. If we type ‘stock tips’ on Twitter, more than a thousand handles show up.

“Social media is full of instances of how certain stocks are sold on behalf of the investment relations teams of the said companies. The stocks are hard sold through webinars, YouTube, WhatsApp, non-stop tweeting and Telegram channels,” Shyam Sekhar, chief ideator and founder of iThought, a Sebi-registered investment advisory firm, said. “These are all virtual marketing tools used to create a sense of FOMO (fear of missing out) among investors. There are many instances where investors have been caught in this trap. They end up investing at peak valuation of manipulated stocks and end up losing as much as 25%-30% of the money invested,” he added.

Mint investigated 12 stock market focused telegram channels to get a sense of how they operate.

“Invest ₹50,000 and get assured returns of ₹1.5 lakh in six months,” pinned messages in many of these groups often state.

Sebi, in the past, has frowned upon many advisors who have promised “assured returns” because this is illegal.

Another standard disclaimer in stock market channels and WhatsApp groups: “We are not Sebi registered investment advisors”. Surprisingly, this hasn’t dented their subscriber base. The admins of many Telegram channels continue to be revered for they have been able to make money in last year’s extended bull run.

“In a bull run, it is easy to make money. The real test of these mushrooming social media stock channels would be in the bear market. These telegram channels are, more often than not, front running stocks at the detriment of their subscribers. These disclaimers are traps to induce investors and avoid being caught in regulatory crosshairs,” Alok Jain, founder of Weekend Investing, another Sebi registered advisory firm, said.

One Telegram channel has over 15,000 subscribers and is run by an individual whose credentials on LinkedIn show that his real expertise lies in ‘search engine optimization’. He worked with a leading stock exchange as a junior level social media manager. On his channel, he recommends small cap stocks.

Yet another channel is run by an individual in Bihar whose experience, before 2017, was solely marketing for retail chains. Before he began giving “super HNI calls” (tips that high networth individuals use), he was the CEO of a departmental store. Currently, his firm is dolling out stock calls to 31,000 subscribers for free. He also has a premium model—for ₹10,000, he would advise “buying the next multi bagger stock”. Stocks that generate returns several times their costs are called multi baggers. These stocks are mostly undervalued but have strong fundamentals.

“Stock recommendations are always followed by emojis of a rocket taking off or fire. These are highly suggestive emojis that indicate a stock is ready for a take-off,” said a senior market analyst who didn’t want to be identified.

Typically, many of these stock calls are always accompanied by an increase in trading volumes.

Here are two examples. Both the stocks were recommended in at least two-three Telegram channels.

Inventure Growth and Securities, a financial services company, was recommended in January this year and the volume of shares traded increased by 3.5 times as compared to the previous month. However, in February, the volume reduced nearly by half.

Lasa Supergenerics, an active pharmaceutical ingredient (API) products company, was recommended in December 2021 and in January this year. The trading volume in December increased almost three times; in January, the volume tripled from the previous month. The volume subsequently reduced almost by half in February.

Mint reached out to both Inventure Growth and Lasa Supergenerics for clarifications. Both did not respond.

Sebi regulations are clear—any investment advice against a fee needs the advisor or the advisory firm to be registered with the regulator. However, some channels have found a way around it. They recommend stocks against a nominal fee towards a social cause. “No one can verify what that social cause is, and whether the money is being used for the said social purpose,” said the market analyst quoted above.

The fin-influencers

Along with hordes of investors during the pandemic, came a new breed of financial experts. They offer advise on personal finance through the social media. Many of these experts have amassed a massive following on YouTube, Twitter and Instagram. They are popularly known as ‘fin-influencers’ or ‘money-influencers’. At times, these influencers are approached by companies to subtly push their upcoming public offerings or even give their stock prices a boost. The influencers include chartered accountants.

“I know of a well-known chartered accountant who quotes nearly ₹8-10 lakh for recommending stocks,” a market expert who didn’t want to be identified said.

A recent example of a scrip being pushed by influencers is allegedly that of Salasar Techno Engineering Ltd, an infrastructure construction services company. At least three financial experts who have a large following on Twitter raised concerns.

“Please be careful of Salasar….many influencers are being approached to push this in return for ₹25-30K,” Alok Jain of Weekend Investing tweeted on 7 March to his 1.88 lakh followers.

Shravan Venkataraman, a proprietary trader with over 17,000 followers on Twitter, claimed that a digital marketing agency contacted him for a promotional tweet on behalf of the company. “I usually promote any good tool or software, or anything useful for the followers. But this took me by surprise,” he said.

Aditya Kondawar, chief investment officer at JST Investments, a financial services company, said he has been approached quite a few times to recommend the scrip of Salasar.

Mint reached out to Salasar for clarifications multiple times—through the company’s website, and to Shashank Agarwal, the company’s joint managing director, through LinkedIn. The company didn’t respond, neither did Agarwal.

What is the regulator doing?

The markets regulator, since December last year, has conducted search and seizure operations against Telegram channel operators. Sebi has also issued multiple press releases to alert investors against misleading stock tips on social media platforms.

Barring cautionary advisories, Sebi’s crackdown has hinged on whether the admins of social media channels, or individuals giving out stock tips, have made gains. This, perhaps, gives us a sense of the nature of the beast.

“It is difficult, not just because of the scale of social media, but also because it is often difficult to distinguish between honest or wrong opinion from dishonest manipulation,” said Sandeep Parekh, managing partner, FinSec Law Advisors, a law firm.

“One should not impinge on the freedom of speech for honest but inaccurate opinion. Anyone holding shares may have a view on how his portfolio of companies are likely to do. The forecast may or may not turn out to be true. But that doesn’t automatically mean that the person is dishonest,” he added.

Going ahead, Sebi wants to establish a data lake initiative to improve surveillance. A data lake stores and processes large amounts of structured and unstructured data. This would help the regulator monitor and analyse social media posts to detect potential market manipulations.

During an event, former Sebi chief Ajay Tyagi, said: “Sebi has already planned (a) data lake project to augment analytical capability with advanced analytical tools, such as artificial intelligence and machine learning, deep learning, big data analytics, pattern recognition, structured and unstructured data processing, text mining and natural language processing, and so on”.

Madhabi Puri Buch, the current chairperson of Sebi, earlier spearheaded the regulator’s Advisory Committee for Leveraging Regulatory Technology Solutions (ALeRTS).

Sebi has now formed a special team to carry out frequent search and seizure operations. Since posts on WhatsApp and Telegram channels are encrypted and data is not shared by the big tech companies with Indian regulators, scanning the mobile phones and laptops of suspected market manipulators is crucial. Sebi’s search and seizure team is working closely with consultants to develop a machine learning platform that would help scan social media posts for relevant information.

Stock exchanges, on their part, use web crawler tools to “listen” into social media chatter and posts.

“Exchanges are typically looking for terms such as ‘assured returns’, ‘money will be doubled/ tripled’. Social media posts and conversations with such terms get flagged internally for further action,” said an exchange official who didn’t want to be named.

Meanwhile, the exchanges are proactively cautioning investors to be aware.

On ‘fin-influencers’, much like the rest of the world, Sebi hasn’t firmed up its approach just yet. The only outlier is the Australian Securities and Investments Commission. The Australian regulator, earlier this month, said that paid advertisements—such as sponsored posts or traditional commercials—may constitute a violation of the law. The Australian law specifies that only licenced financial advisers are permitted to recommend financial products.

The Indian regulator has a long road ahead. And it would be interesting to watch how it regulates malpractices without impinging on free speech, a right under the Constitution.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Topics

.

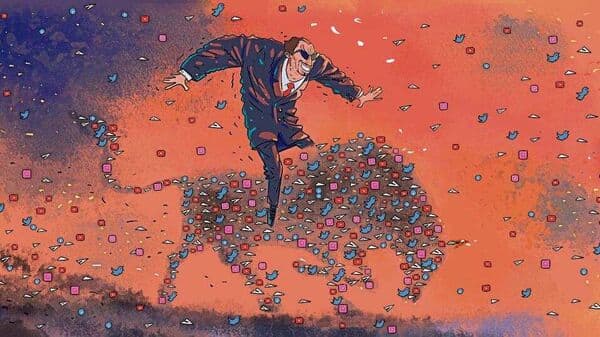

Should Brands Be Worried About Elon Musk’s Proposal For An Ad-free Twitter?

Elon Musk has declined a role on the board of Twitter, opening the door for the billionaire to take ownership of more of the social platform. He then went on to publicly share his musings for an advertising-free Twitter. But how much influence can he wield in shaping a new direction for the platform? Twitter’s CEO Parag Agarwal announced today (Monday, April 11) that Elon Musk had declined the opportunity to join its board, mere days after stating the opposite. The move to invite Musk to the board was widely seen as an attempt from Twitter to prevent the billionaire from buying up more than 15% of the company.

Now, however, that option appears to be back on the table, raising questions about the extent to which Musk’s plans for the company will be implemented regardless of Twitter’s pre-existing strategies.Responses to the news included skepticism about the extent to which this is a plan to boost the stock of Twitter through Musk’s performative tweeting. He has previously employed this tactic with the cryptocurrency dogecoin and even with Twitter itself. Of course this will prompt speculation that Musk is going for a full takeover, thus driving up share prices and making Musk’s stake more valuable. SEC investigation incoming. https://t.co/ARMhUnJyPB— Ian Betteridge (@ianbetteridge) April 11, 2022 Others – including Musk himself, according to his likes – seem to suggest that the Twitter board’s attempts to curb the attention-seeking billionaire’s proclivities ran counter to his stated aims for the company. Musk’s initial interest in Twitter came to a head last month when he began tweeting that the social media platform needed to change for nebulous ‘free speech’-related reasons.Social media consultant and industry analyst Matt Navarra says: “Right now, it’s incredibly hard to predict how much influence Elon Musk has – or will have – in the short and longer term. He has declined to join the board, which leads many to suspect he is keeping his options open in regards to increasing the size of his shareholding in the future. This will be concerning for Twitter and anyone who sees Elon’s moves as a threat, rather than an opportunity.“Twitter has launched a significant number of privacy and safety controls for users in recent years. The platform has also built out more comprehensive content moderation policies to tackle growing concerns about the spread of misinformation and online harassment. Elon says he’s a free speech absolutist. It’s only a matter of time before this clash of ideologies and visions for the platform becomes problematic and boils over. “Until there’s a clearer picture of exactly how much sway Elon’s multi-billion-dollar investment gives him, those nervous about his role in the company will remain anxious. And that’s probably part of the fun for Elon Musk and exactly what he wants.”Advertising in his sights Musk’s hinted-at changes to Twitter functionality would appear to fly in the face of much of what the social platform has sought to accomplish over the past few years, both commercially and culturally. It has been praised for its quick response to disinformation around the war in Ukraine, for instance, and its labelling of automated and state-affiliated accounts falls in line with that of platforms including YouTube and Facebook. Advertisers have welcomed the changes aimed at making the platform a brand-safe space. So it is unclear the extent to which Musk’s interest in curbing moderation on Twitter in the name of free speech would impact Twitter’s commercial interests. In its latest results, it shared that its total ad engagements decreased 12% year-on-year, but its cost per engagement (CPE) increased 39%. The net loss for the full year amounted to $221m, which the company ascribes to higher-than-average costs and the lingering impacts of Covid upon spending. Despite that, ad sales rose 22% overall in the fourth quarter. Musk has instead tabled a focus on ad-free subscriptions, stating: “Price should probably be ~$2/month, but paid 12 months up front & account doesn’t get checkmark for 60 days (watch for credit card chargebacks) & suspended with no refund if used for scam/spam.“And no ads. The power of corporations to dictate policy is greatly enhanced if Twitter depends on advertising money to survive.” Anthony Macro, head of display, video and social at Croud, says: “If Twitter introduced an ad-free subscription model, the impact on advertising cost would be primarily on inventory availability, impacting cost-per-engagement via increased CPMs. It’s hard to see how this wouldn’t drive advertisers away from the platform, but the hope would be that this loss in advertising revenue would be made up (and exceeded) by a smart pricing model with features that encouraged a good percentage of their active users to convert. “Despite Musk’s increased stake in Twitter, it remains a private company and is therefore within its rights to impose certain limits on its platform. Previous Twitter CEOs have obviously seen the importance of this – as have their counterparts at Meta, Snap and TikTok. While this can be perceived as an attack on ‘free speech’, it is primarily a business decision and if efforts were put in place to roll back moderation it could have a negative impact on both active users’ and advertisers’ willingness to be present on the platform, and thus the value of Musk’s shares.“Average monetizable DAU (mDAU) reached 217M, up 13% y/y, driven by product improvements, as well as global conversation around current events. $TWTR pic.twitter.com/O77d6ZgOWj— Twitter Investor Relations (@TwitterIR) February 10, 2022 While it cramps a lot of Twitter’s partnerships and investments in improving the value of its ads, it does line up with some of the social platform’s focus on direct payments. In addition to experimenting with allowing users to tip or donate to other users directly, its 2021 acquisition of newsletter platform Revue was in service of developing new revenue sources for Twitter users. Navarra elaborates: “A paid ad-free option for social media platforms like Facebook and Twitter has been proposed many times in the past. However, adding such an option brings a new set of problems. “For example, the users who are most likely to pay an ad-free premium are often the most affluent and tend to generate the greatest amount of revenue for social networks. They are the high-spending user group advertisers want to reach the most. Also, to offer such an option, it’s likely Twitter would need to invest significant amounts of its resources to reconfigure its tech stack in order to switch off ads and data collection for a limited group of users paying to remove ads from their feeds.“Unless Twitter can figure out a revenue model less dependent on advertising income, an ad-free premium option could become highly disruptive. This is a challenge pretty much all social networks have wrestled with in recent years. And, as yet, not one of them has found a solution to.“Musk’s strategy of throwing spanners into the works makes it hard to predict how the whole situation will shake out. The reality, however, is that moving fast and breaking things seems to be anathema to Twitter’s slow, incremental progress towards sustainability over the past few years. .