LONDON, Oct 13 (Reuters) – A Russian region adjoining Ukraine said it was preparing to receive refugees from the Russian-held part of Ukraine’s Kherson province, after its Russian-appointed leader proposed on Thursday that residents leave to seek safety as Ukrainian forces advance.Most of the Kherson region was seized in the first days of Russia’s invasion as it sent in troops from adjoining Crimea. It is one of four partly occupied Ukrainian regions that Russia proclaimed as its own last month in a move overwhelmingly condemned on Wednesday by the U.N. General Assembly.However, since August it has been the scene of a major advance by Ukrainian forces.Register now for FREE unlimited access to Reuters.comIn a video statement on Telegram, Vladimir Saldo publicly asked for government help in moving civilians to safer regions of Russia.”Every day, the cities of Kherson region are subjected to missile attacks,” Saldo said.”As such, the leadership of Kherson administration has decided to provide Kherson families with the option to travel to other regions of the Russian Federation to rest and study,” he said, adding that people should “leave with their children”.He said the suggestion applied foremost to residents on the west bank of the Dnipro River – an area that includes the regional capital, Kherson. Local residents visit a street market during Ukraine-Russia conflict in the Russia-controlled city of Kherson, Ukraine July 26, 2022. REUTERS/Alexander Ermochenko”But at the same time, we suggested that all residents of the Kherson region, if there is such a desire, to protect themselves from the consequences of missile strikes, also go to other regions.”The TASS news agency quoted the governor of Russia’s Rostov region, Vasily Golubev, as saying that a first group of people from Kherson would arrive there on Friday.”The Rostov region will accept and accommodate everyone who wants to come to us from the Kherson region,” he said.Russian Deputy Prime Minister Marat Khusnullin said those leaving Kherson would be provided with free accommodation and necessities – and, if they decided to remain outside Kherson permanently, with housing.Russia’s incorporation of the four regions has been denounced by Kyiv and the West as an illegal annexation like that of Crimea, which Russia seized in 2014. At the U.N. General Assembly, 143 of 193 countries condemned it in Wednesday’s vote.Ukrainian authorities say hundreds of thousands of Kherson’s residents have fled, mostly to unoccupied parts of Ukraine, including half the pre-war population of the regional capital.Any major territorial losses in Kherson would restrict Russia’s access to the Crimean peninsula further south, whose return Kyiv has coveted since 2014.Register now for FREE unlimited access to Reuters.comReporting by Reuters; Editing by Kevin Liffey, Mark Trevelyan and Sandra MalerOur Standards: The Thomson Reuters Trust Principles. .

Local residents visit a street market during Ukraine-Russia conflict in the Russia-controlled city of Kherson, Ukraine July 26, 2022. REUTERS/Alexander Ermochenko”But at the same time, we suggested that all residents of the Kherson region, if there is such a desire, to protect themselves from the consequences of missile strikes, also go to other regions.”The TASS news agency quoted the governor of Russia’s Rostov region, Vasily Golubev, as saying that a first group of people from Kherson would arrive there on Friday.”The Rostov region will accept and accommodate everyone who wants to come to us from the Kherson region,” he said.Russian Deputy Prime Minister Marat Khusnullin said those leaving Kherson would be provided with free accommodation and necessities – and, if they decided to remain outside Kherson permanently, with housing.Russia’s incorporation of the four regions has been denounced by Kyiv and the West as an illegal annexation like that of Crimea, which Russia seized in 2014. At the U.N. General Assembly, 143 of 193 countries condemned it in Wednesday’s vote.Ukrainian authorities say hundreds of thousands of Kherson’s residents have fled, mostly to unoccupied parts of Ukraine, including half the pre-war population of the regional capital.Any major territorial losses in Kherson would restrict Russia’s access to the Crimean peninsula further south, whose return Kyiv has coveted since 2014.Register now for FREE unlimited access to Reuters.comReporting by Reuters; Editing by Kevin Liffey, Mark Trevelyan and Sandra MalerOur Standards: The Thomson Reuters Trust Principles. .

U.S. says Russia price cap should take risk premium out of oil market

Liberia-flagged Aframax tanker Suvorovsky Prospect discharges fuel oil from Russia at the Matanzas terminal, in Matanzas, Cuba, July 16, 2022. REUTERS/Alexandre Meneghini/File PhotoRegister now for FREE unlimited access to Reuters.comSINGAPORE/WASHINGTON, Sept 9 (Reuters) – The price cap that G7 countries want to impose on Russian oil to punish Moscow should be set at a fair market value minus any risk premium resulting from its invasion of Ukraine, a U.S. Treasury Department official told reporters on Friday.The price should be set above the marginal production cost of Russia’s oil and take into consideration historical prices, said Elizabeth Rosenberg, U.S. Treasury Assistant Secretary for Terrorist Financing and Financial Crimes.The G7 price cap plan agreed last week calls for participating countries to deny insurance, finance, brokering and other services to oil cargoes priced above a yet to be set price cap on crude and two oil products. read more Register now for FREE unlimited access to Reuters.comRosenberg said services providers would not have to police price cap compliance themselves but could rely on the attestations of buyers and sellers, leaving enforcement to participating jurisdictions.She said the G7 countries – Britain, Canada, France, Germany, Italy, Japan and the United States – would work together in coming weeks to determine the capped price and other key implementation details.”There are several key data points we are considering and how the prices should ultimately be set and that includes the marginal cost of production for Russian oil,” Rosenberg told a briefing call held for media in Asia.”The price cap price should be … in line or consistent with historical prices accepted by the Russian market.”That could imply a potential cap of around $60 a barrel, experts say, as Russian Urals crude, based off of benchmark Brent, sold for $50 to $70 a barrel in 2019.Russian government documents have identified a marginal crude production cost of $44 per barrel, although some Western officials believe it may be somewhat lower.A European official said G7 members had not begun formal discussions about the price cap, although officials had “notions” about what was possible.”The idea is that you still incentivize Russian oil producers to export by guaranteeing a price in line with their cost of production with a small incentive,” the official said.U.S. Treasury Secretary Janet Yellen and other Biden administration officials have been travelling to oil consuming countries to promote a mechanism that seeks to cut Russia’s oil export revenues, the lifeblood of its war machine, without reducing volumes of Russian shipments to global markets.Russian President Vladimir Putin has said Russia would halt shipments to countries that impose the price cap. read more Putin says Russia is conducting a “special military operation” in Ukraine to protect his country’s security against expansion of the Western military alliance NATO. read more Register now for FREE unlimited access to Reuters.comReporting by Florence Tan in Singapore, and David Lawder, Timothy Gardner and Andrea Shalal in Washington; Writing by Timothy Gardner and David Lawder; Editing by Christian Schmollinger and Tom HogueOur Standards: The Thomson Reuters Trust Principles. .

Insurance rates jump for Ukraine war-exposed business, sources say

Planes of Aeroflot and Rossiya Airlines are seen parked at Sheremetyevo International Airport, as the spread of the coronavirus disease (COVID-19) continues, outside Moscow, Russia April 8, 2020 REUTERS/Tatyana Makeyeva/File PhotoRegister now for FREE unlimited access to Reuters.comLONDON, May 30 (Reuters) – Insurance premiums are doubling or more for some aviation and marine business particularly exposed to the war in Ukraine, increasing costs for airline and shipping firms, industry sources say.Global commercial insurance premiums rose 11% on average in the first quarter, according to insurance broker Marsh, which said the war was putting upward pressure on rates.But the overall figure masks sharper moves in some sectors, and only covers the first five weeks following the invasion.Register now for FREE unlimited access to Reuters.comWar is typically excluded from mainstream insurance policies. Customers buy extra war cover on top.Garrett Hanrahan, global head of aviation at Marsh, said aviation war insurance was no longer available for Ukraine, Russia and Belarus as a result of the conflict.For the rest of the world, aviation war cover has doubled, as insurers try to recoup some of their losses, he said.”The hull war market is beginning to reflate itself through rate rises.”The conflict, which Russia calls a “special military operation”, could lead to insurance losses of $16 billion-$35 billion in so-called “specialty” insurance classes such as aviation, marine, trade credit, political risk and cyber, S&P Global said in a report. read more Aviation insurance claims alone could total $15 billion, S&P Global said, with hundreds of leased planes stranded in Russia as a result of western sanctions and Russian countermeasures.One aircraft lessor described recent rate increases on its insurance as “not a pretty sight”. read more Some aircraft lessors – a particularly exposed sector of the market because their planes are stuck in Russia – were now having to pay 10 times their original premium, one underwriter said, while another said insurers could “name their price” to lessors.In ship insurance, policyholders pay an additional “breach” premium when a ship enters particularly dangerous waters, locations which are updated by the Lloyd’s market.For the area around Russian and Ukrainian waters in the Black Sea and Sea of Avov, this has increased multiple times, three insurance sources said, to around 5% of the value of the ship, from 0.025% before the invasion, amounting to millions of dollars for a seven-day policy.Each time a ship goes into those waters, it has to pay that extra premium.Rates for ships going into other Russian waters have also risen by at least 50% after the Lloyd’s market classified all Russian ports as high risk, two of the sources said.Because of the dangers, some marine insurers have also stopped providing cover for the region. read more Register now for FREE unlimited access to Reuters.comReporting by Carolyn Cohn, Jonathan Saul and Noor Zainab Hussain, Editing by Angus MacSwanOur Standards: The Thomson Reuters Trust Principles. .

Column: Saudi’s record crude oil price for Asia shows Russia war impact: Russell

A view shows branded oil tanks at Saudi Aramco oil facility in Abqaiq, Saudi Arabia October 12, 2019. REUTERS/Maxim Shemetov/Register now for FREE unlimited access to Reuters.comLAUNCESTON, Australia, April 5 (Reuters) – The jump in Saudi Arabia’s crude oil prices for its Asian customers is a real world example of how the Russian invasion of Ukraine is starting to force a realignment of global oil markets.Saudi Aramco (2222.SE), the state-controlled producer, raised its official selling price (OSP) for its flagship Arab Light crude for Asian refiners to a record premium of $9.35 a barrel above the Oman/Dubai regional benchmark. read more An increase in the OSP had been anticipated, with a Reuters survey of seven refiners estimating the price would rise to a premium of between $10.70 and $11.90. read more Register now for FREE unlimited access to Reuters.comThis means the actual increase from April’s premium of $5.90 to May’s $9.35 was somewhat below market expectations, but still highlights that refiners in Asia are going to be paying considerably more for Middle East crudes.There are several factors at work driving the increase in Saudi OSPs, which tend to set the trend for price movements by other major Middle East exporters.Spot premiums for Middle East grades hit all-time highs in March, a sign that usually points to higher OSPs as it signals strong demand from refiners.However, these have slumped in recent trading sessions as physical traders mulled the impact of more crude being released from the strategic reserves of major importing nations, led by the U.S. commitment to supply 180 million barrels over a six-month period. read more Another factor driving the increase in the OSPs for May cargoes is the strong margins being enjoyed by Asian refiners, especially for middle distillates, such as diesel.Robust refinery profits are also usually a trigger for producers to raise crude prices, and currently a Singapore refinery processing Dubai crude is making a margin of about $18.45 a barrel, which is more than three times the 365-day moving average of $5.03.But behind all these factors is the dislocation of global crude markets caused by Russia’s Feb. 24 invasion of neighbouring Ukraine.While Russia’s crude oil and refined product exports have not been targeted by Western sanctions, buyers are starting to shun Russian cargoes and seek alternatives.Russia exported up to 5 million barrels per day (bpd) of crude and around 2 million bpd of products, mainly to Europe and Asia, prior to the conflict.IMPACT IMMINENT?Russia’s crude and product exports are yet to show any meaningful decline, with commodity analysts Kpler putting March crude exports at 4.56 million bpd, down only a touch from 4.60 million bpd in February.But the self-sanctioning of Russian crude is likely only to start being felt in April and May, as cargoes loaded in March would have been secured before the Feb. 24 invasion, which Moscow refers to as a special military operation.Asian importers such as Japan and South Korea may start to pull back from buying Russian crude, meaning they will be keen to source similar grades from the Middle East, thereby likely boosting demand for cargoes from Saudi Arabia and other exporters such as the United Arab Emirates and Kuwait.Conversely, China, the world’s biggest crude importer, and India, Asia’s second-biggest, may well try to buy more Russian cargoes, given both countries have refused to condemn Moscow’s attack on Ukraine.India in particular will be keen to secure heavily discounted Russian cargoes, with some reports of Urals crude being offered at discounts of $35 a barrel or more to global benchmark Brent.There are several key questions that remain to be answered, including how much more Russian crude can China and India actually buy, and arrange to transport, especially from the eastern ports that used to mainly ship to European refiners.The United States will not set any “red line” for India on its energy imports from Russia but does not want to see a “rapid acceleration” in purchases, a top U.S. official said last week during a visit to New Delhi. read more It is also still unclear just how much self-sanctioning will cut Europe’s and Asia’s imports of Russian crude.What is likely to happen is that Europe and the democracies in Asia, such as Japan and South Korea, effectively swap with China and India their Russian cargoes for Middle Eastern grades.Even so, this is unlikely to soak up all the Russian crude that will be available, meaning the market will still have to find additional barrels, and Middle East exporters will be likely to continue to keep OSPs at elevated levels.GRAPHIC-Saudi oil prices to Asia: https://tmsnrt.rs/36XkgP8Register now for FREE unlimited access to Reuters.comEditing by Himani SarkarOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Palm oil becomes costliest vegoil as Ukraine war halts sunoil supply

- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

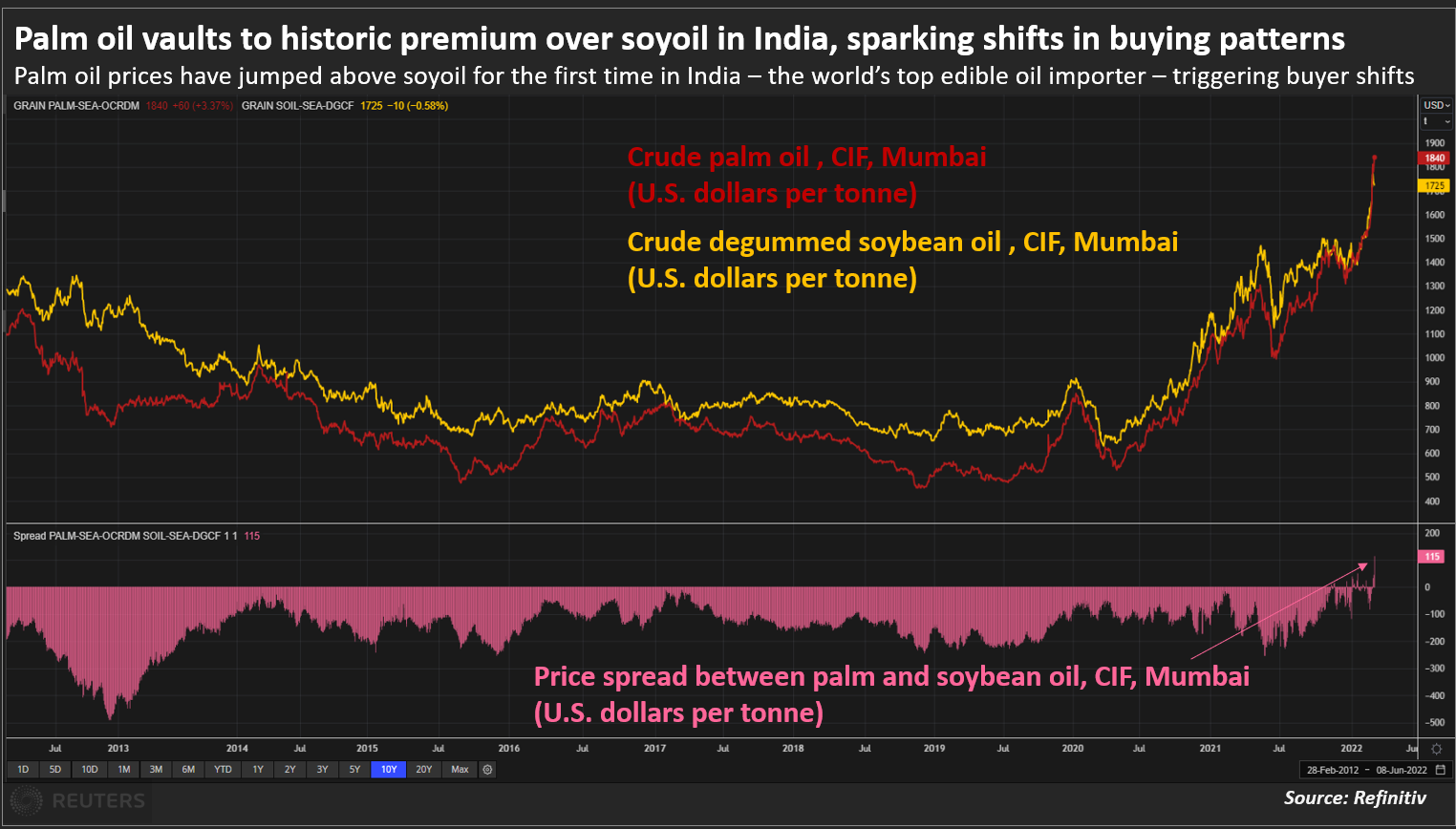

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .