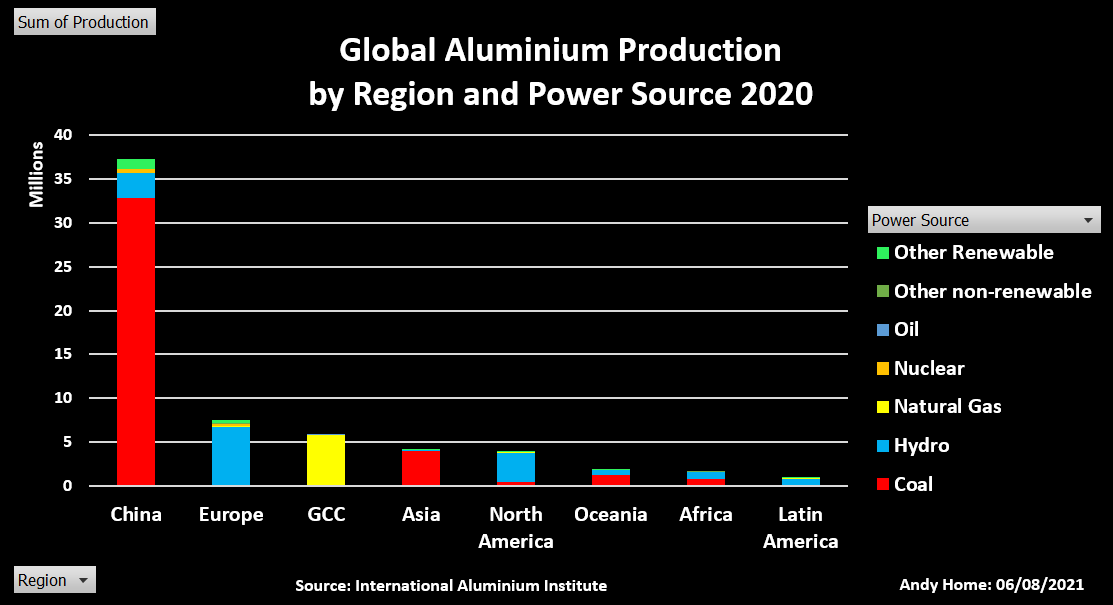

LONDON, May 26 (Reuters) – These are turbulent times for the global aluminium market.Aluminium has for years been characterised by chronic oversupply thanks to China’s relentless build-out of primary smelting capacity.Now, however, buyers in Europe and the United States are paying up record high premiums to get hold of physical metal.Register now for FREE unlimited access to Reuters.comRegisterThe Chinese aluminium juggernaut has run out of momentum and smelters in Europe are powering down as a rolling energy crunch takes a rising toll on the region’s producers. read more London Metal Exchange (LME) stocks are disappearing to fill gaps in the supply chain. Even after its recent tumble LME three-month metal at a current $2,860 per tonne is trading at levels last seen in the great bull market of 2008.None of which, it seems, is going to slow down the drive towards green low-carbon aluminium with some of the world’s largest buyers this week committing to purchase a minimum 10% of near-zero carbon metal by 2030.GREEN ALLIANCEThe newly-formed aluminium branch of the First Movers Coalition comprises automotive companies Ford (F.N) and Volvo Group (VOLVb.ST), packaging company Ball Corp , aluminium products manufacturer Novelis (NVLXC.UL) and trade house Trafigura.The Coalition, led by the World Economic Forum and the U.S. government, is aimed at tackling carbon emissions in heavily emitting sectors such as steel, shipping and aviation. And now aluminium.The light metal is a key enabler of the green energy transition. It is a material of choice for electric vehicle (EV) battery casings and solar panels as well as offering light-weighting across multiple transport applications.However, producing aluminium is an energy-intensive process, the global sector accounting for around 2% of greenhouse gas emissions, including over one billion tonnes per year of carbon dioxide.The paradox is encapsulated in an EV battery. Aluminium accounts for only 1-2% of the cost but 17% of the carbon impact, according to Torbjörn Sternsjö, senior advisor at Swedish products group Granges, speaking at CRU’s London aluminium conference.This is a problem given ever more automakers are themselves committing to carbon-neutrality – as early as 2035 in the case of Porsche. Global aluminium production by power source 2020FROM LOW CARBON…Coal is still the globally dominant source of power for smelting aluminium, reflecting the market dominance of China, which last year accounted for around 58% of world primary output.Within China there has been a rush to swap coal-fired capacity for new plants in hydro-rich Yunnan province but spaces are fast running out and most of the country’s smelters continue to run on captive coal plants or draw energy from coal-based grids.Changing the source of power from fossil fuel to renewables is the fastest way of lowering primary aluminium’s carbon footprint.Outside of China, the rush to go green has been led by those producers with large captive hydro generation capacity.The LMEpassport for ESG accreditation now lists several aluminium producers, including Russia’s Rusal, U.S. operator Century Aluminum (CENX.O), Indonesian producer Asahan Aluminium and smelters in France (Dunkerque) and the United Kingdom (Lochaber).All have disclosed carbon equivalent footprints of 0-4 tonnes per tonne of aluminium, referencing research house CRU’s Emissions Analysis Tool.No-one yet can make it to zero on a commercial basis.The new green aluminium coalition accepts that its 10% purchase commitments for near-zero metal will be dependent on “advanced technologies not yet commercially available”….TO NO CARBONThe collective race to get to zero or near-zero aluminium is already underway, led by ELYSIS, a joint venture between Alcoa and Rio Tinto.It requires the replacement of the carbon anode in the electrolytic smelting process. The anode accounts for 1.9 tonnes of carbon per tonne of aluminium, the largest remaining carbon problem for a renewables-powered smelter, according to Tim Murray, chief executive of Cardinal Virtues Consulting, also presenting at the CRU conference.The anode being trialled in the ELYSIS process results in zero direct emissions, a much longer anode life and 15% lower costs, Alcoa chief operations officer John Slaven told delegates.If the smelter is fed with “green” alumina, the carbon impact falls below 1 tonne per tonne of metal, freight accounting for most of the residue.A processing path to near-zero primary aluminium is starting to take tangible shape.NO GREEN SANCTIONSThere has been concern that aluminium’s race to go green would be abruptly halted by Russia’s invasion of Ukraine and the possible sanctioning of Rusal metal.Rusal is already a major supplier of low-carbon aluminium from its hydro-powered smelters in Siberia and is itself working on inert anode technology.Fortunately for carbon-conscious buyers, the company was already put through the U.S. sanctions process in 2018, resulting in owner Oleg Deripaska (still sanctioned) giving up control of the company.That shields Rusal this time around. So too do memories of the sanctions supply-chain disruption which stretched from Guinean bauxite mines to European automakers.Rusal’s significance as a supplier, particularly to Europe, will only increase as buyers look for low-carbon metal.NO GREEN PREMIUM…YETThe First Movers Coalition is intended to create a decarbonisation tipping-point for individual sectors centred on future purchase commitments.The incentive for suppliers will be a premium for their low-carbon aluminium, according to Trafigura chief executive Jeremy Weir.Such a green premium remains conspicuous by its absence at the primary metal stage of aluminium’s process chain.And it might not appear for long at all, Colin Hamilton, commodities analyst at BMO Capital Markets, told the CRU conference.Rather, a green premium would simply be a “stepping-stone to low-carbon becoming the prime market and anything else sub-prime.”We may not have to wait much longer to find out because the drive to zero-carbon aluminium has just accelerated.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comRegisterEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Global aluminium production by power source 2020FROM LOW CARBON…Coal is still the globally dominant source of power for smelting aluminium, reflecting the market dominance of China, which last year accounted for around 58% of world primary output.Within China there has been a rush to swap coal-fired capacity for new plants in hydro-rich Yunnan province but spaces are fast running out and most of the country’s smelters continue to run on captive coal plants or draw energy from coal-based grids.Changing the source of power from fossil fuel to renewables is the fastest way of lowering primary aluminium’s carbon footprint.Outside of China, the rush to go green has been led by those producers with large captive hydro generation capacity.The LMEpassport for ESG accreditation now lists several aluminium producers, including Russia’s Rusal, U.S. operator Century Aluminum (CENX.O), Indonesian producer Asahan Aluminium and smelters in France (Dunkerque) and the United Kingdom (Lochaber).All have disclosed carbon equivalent footprints of 0-4 tonnes per tonne of aluminium, referencing research house CRU’s Emissions Analysis Tool.No-one yet can make it to zero on a commercial basis.The new green aluminium coalition accepts that its 10% purchase commitments for near-zero metal will be dependent on “advanced technologies not yet commercially available”….TO NO CARBONThe collective race to get to zero or near-zero aluminium is already underway, led by ELYSIS, a joint venture between Alcoa and Rio Tinto.It requires the replacement of the carbon anode in the electrolytic smelting process. The anode accounts for 1.9 tonnes of carbon per tonne of aluminium, the largest remaining carbon problem for a renewables-powered smelter, according to Tim Murray, chief executive of Cardinal Virtues Consulting, also presenting at the CRU conference.The anode being trialled in the ELYSIS process results in zero direct emissions, a much longer anode life and 15% lower costs, Alcoa chief operations officer John Slaven told delegates.If the smelter is fed with “green” alumina, the carbon impact falls below 1 tonne per tonne of metal, freight accounting for most of the residue.A processing path to near-zero primary aluminium is starting to take tangible shape.NO GREEN SANCTIONSThere has been concern that aluminium’s race to go green would be abruptly halted by Russia’s invasion of Ukraine and the possible sanctioning of Rusal metal.Rusal is already a major supplier of low-carbon aluminium from its hydro-powered smelters in Siberia and is itself working on inert anode technology.Fortunately for carbon-conscious buyers, the company was already put through the U.S. sanctions process in 2018, resulting in owner Oleg Deripaska (still sanctioned) giving up control of the company.That shields Rusal this time around. So too do memories of the sanctions supply-chain disruption which stretched from Guinean bauxite mines to European automakers.Rusal’s significance as a supplier, particularly to Europe, will only increase as buyers look for low-carbon metal.NO GREEN PREMIUM…YETThe First Movers Coalition is intended to create a decarbonisation tipping-point for individual sectors centred on future purchase commitments.The incentive for suppliers will be a premium for their low-carbon aluminium, according to Trafigura chief executive Jeremy Weir.Such a green premium remains conspicuous by its absence at the primary metal stage of aluminium’s process chain.And it might not appear for long at all, Colin Hamilton, commodities analyst at BMO Capital Markets, told the CRU conference.Rather, a green premium would simply be a “stepping-stone to low-carbon becoming the prime market and anything else sub-prime.”We may not have to wait much longer to find out because the drive to zero-carbon aluminium has just accelerated.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comRegisterEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

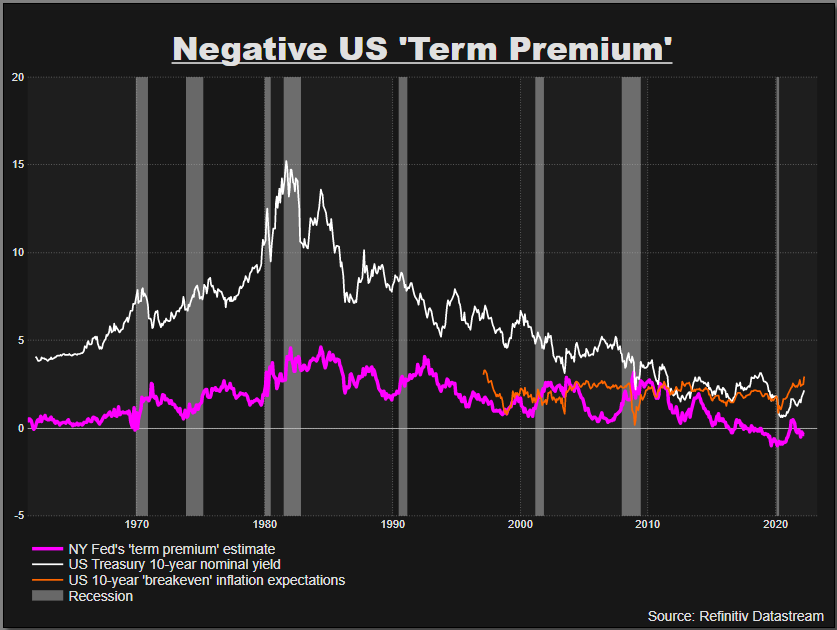

US ‘term premium’ stays negative

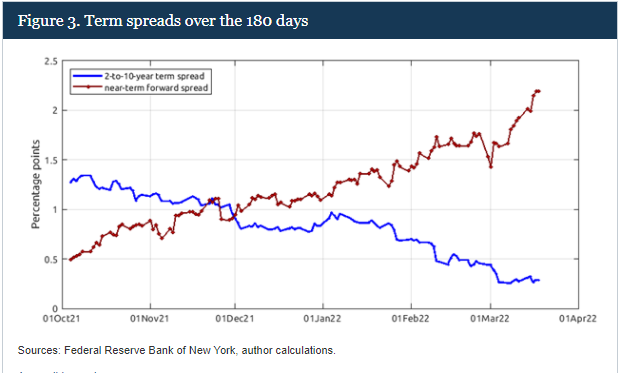

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

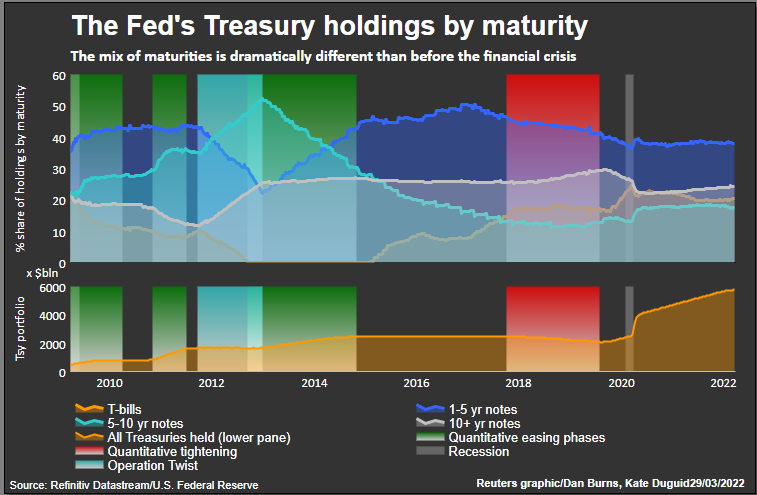

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.com

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.com