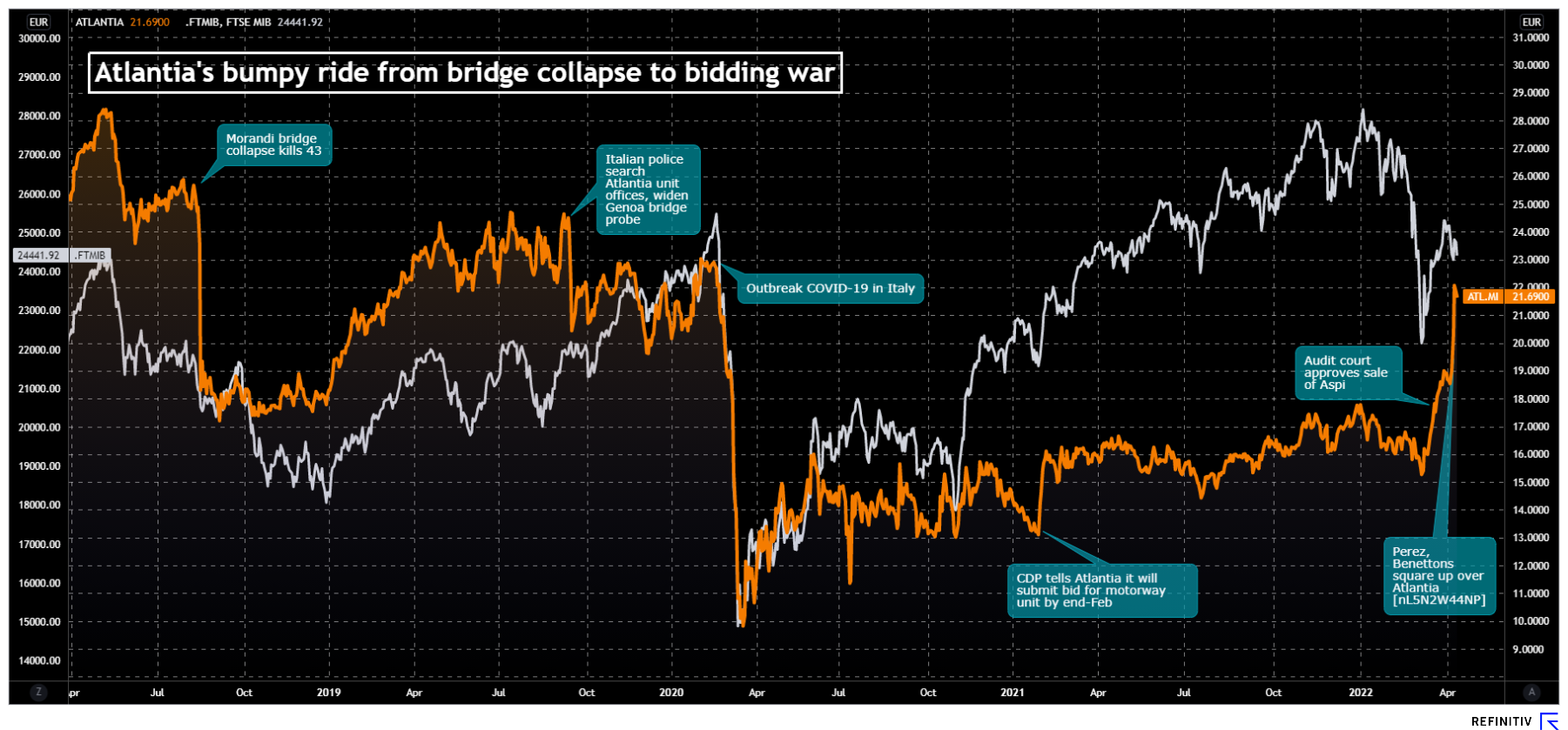

The logo of infrastructure group Atlantia in Rome, Italy October 5, 2020. REUTERS/Guglielmo MangiapaneRegister now for FREE unlimited access to Reuters.comMILAN, April 12 (Reuters) – The Benetton family and U.S. investment fund Blackstone are working on a premium of around 30% over Atlantia’s (ATL.MI) average stock price in the last six months, as they ready a bid that could land as early as Wednesday, three sources said.The two partners are considering an offer between 22 and 23 euros per share, one of the sources said, but cautioned no final decision had been taken.While a significant premium on the six month average share price, that would be a more modest increase over the current price of about 21.7 euros, and would value the whole of Atlantia – in which the Benetton family already owns a 33% stake – at about 18.1-19.0 billion euros ($19.7-$20.7 billion).Register now for FREE unlimited access to Reuters.comShares in the Italian infrastructure group have gained nearly 20% since April 6 when speculation first emerged about an approach involving Global Infrastructure Partners (GIP), Brookfield and Florentino Perez, head of Spain’s ACS (ACS.MC).The stock hit a two-year high of 22.5 euros on Monday as investors waited for a move that could take the group private.”The offer could land very soon, even early Wednesday morning,” one of the sources said.Blackstone and Benetton holding company Edizione declined to comment. Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Editing by Mark Potter and Chizu NomiyamaOur Standards: The Thomson Reuters Trust Principles. .

HP seeks to ride hybrid work boom with $1.7 billion Poly buyout

March 28 (Reuters) – HP Inc (HPQ.N) said on Monday it would buy audio and video devices maker Poly (POLY.N) for $1.7 billion in cash as it looks to capitalise on the hybrid work led boom in demand for electronic products.Shares in HP, which expects the deal will position it for long-term growth, fell 1.4% in premarket trade.The company has offered $40 for each share of Poly, formerly known as Plantronics, which represents a premium of about 53% to the stock’s last closing price. Including debt, the deal is valued at $3.3 billion.Register now for FREE unlimited access to Reuters.com“The rise of the hybrid office creates a once-in-a-generation opportunity to redefine the way work gets done,” HP Chief Executive Officer Enrique Lores said.With the global healthcare crisis boosting the need for hybrid work, the market has seen several acquisitions, including business software maker Salesforce.com’s (CRM.N) $27.7-billion purchase of workplace messaging app Slack Technologies Inc last year. read more Poly, whose shares rose 49% in premarket trade, said it would be required to pay a fee of $66 million if the deal is terminated.The transaction is expected to close by the end of 2022.Register now for FREE unlimited access to Reuters.comReporting by Tiyashi Datta in Bengaluru; Editing by Aditya Soni and Vinay DwivediOur Standards: The Thomson Reuters Trust Principles. .

Treasury Wine shares surge as ex-China growth begins to pay off

Bottles of Penfolds Grange wine and other varieties, made by Australian wine maker Penfolds and owned by Australia’s Treasury Wine Estates, sit on shelves for sale at a winery located in the Hunter Valley, north of Sydney, Australia, February 14, 2018. REUTERS/David GrayRegister now for FREE unlimited access to Reuters.comRegisterFeb 16 (Reuters) – Treasury Wine Estates (TWE.AX) said on Wednesday its operating earnings outside mainland China jumped 28%, underpinned by growth in its luxury and premium brands, sending shares of the world’s largest standalone winemaker nearly 12% higher.Treasury has had to re-direct supply to the United States, Europe and domestically after a diplomatic row between Canberra and Beijing effectively closed the lucrative Chinese market to Australian wine.The company said it recorded strong growth in its Americas and premium brands businesses, both of which reported a 19% rise in their earnings before interest, tax, SGARA and material items (EBITS).Register now for FREE unlimited access to Reuters.comRegister“Penfolds growth was particularly strong in Asian markets outside of Mainland China … increasing distribution in Asia, domestic markets, Europe and the United States was a key execution highlight,” the company said in a statement.Reported EBITS, excluding Australian COO wine sold in mainland China, rose to A$262.4 million ($187.7 million), narrowly missing market expectations of A$265 million while its total net profit slid 7.5% to A$109.1 million.The company said trading conditions for the remainder of fiscal 2022 were expected to remain broadly in line with the first half across its key markets and channels.”Despite FY22 potentially shaping up to be slightly softer than expectations, we see Treasury doing a commendable job building demand for its products in new markets,” Citi analysts said in a note.Treasury shares jumped as much as 11.8% to A$11.78 in early trading, while the broader market (.AXJO) rose 0.4%.The company said it plans to increase prices across select portfolio brands to partly mitigate the impact of elevated supply chain costs and logistics. The Melbourne-based firm retained its interim dividend of 15 Australian cents per share.($1 = 1.3986 Australian dollars)Register now for FREE unlimited access to Reuters.comRegisterReporting by Tejaswi Marthi and Savyata Mishra in Bengaluru; Editing by Aditya Soni and Sherry Jacob-PhillipsOur Standards: The Thomson Reuters Trust Principles. .

Finnair to stay independent and stick to Asia strategy, says CEO

A Finnair Airbus A320-200 aircraft prepares to take off from Manchester Airport in Manchester, Britain September 4, 2018. REUTERS/Phil NobleRegister now for FREE unlimited access to Reuters.comRegisterHELSINKI, Feb 11 (Reuters) – Finnair will remain a stand-alone airline and stick to its Asia-focused strategy while adding new routes to the United States, Chief Executive Topi Manner said on Friday.Finland’s national carrier, which has bet heavily on providing connections to Asia, expects the business environment to return close to normal in the second half of this year following pandemic disruptions, he told Reuters.”We are optimistic about summer,” Manner said, adding the airline expected countries like Japan and South Korea to lift travel restrictions towards summer in the northern hemisphere.Register now for FREE unlimited access to Reuters.comRegisterThe recovery of Asian traffic from the slump caused by widespread border restrictions is particularly important for the Finnair, which seeks to benefit from providing connections to Asia from Europe thanks to the location of its Helsinki hub.”We believe Asia will open up eventually. In the meantime, we are partially pivoting to North America,” Manner said in an interview.He was speaking after the airline announced a 200-million-euro ($228 million) investment in renewing the cabins of its long-haul fleet, including a new premium economy service and redesigned business cabin.Manner said the new cabin class was being added to address increasing demand in premium leisure travel, while also introducing a new business class seat called “the air lounge,” a nest-like shell that does not recline but modifies to allow for vertical sleeping.”We as a carrier of course need to differentiate and we have chosen to differentiate with quality,” he said.Finnair operates Airbus A330 and A350 planes on long-haul routes.Unlike many airlines, Finnair has not yet joined a wave of orders for the latest generation of narrowbody jets like the A320neo, which burn 15% less fuel.Finnair’s fleet of 35 Airbus A320-family jets includes some planes as old as 21 years but others produced as recently as 2018, according to its website.Asked whether Finnair planned to renew its medium-haul fleet, Manner said it could do so in three or four years but stressed the importance of sustainable aviation fuel as the airline targets net zero emissions by 2045.($1 = 0.8770 euros)Register now for FREE unlimited access to Reuters.comRegisterReporting by Anne Kauranen Editing by Tim Hepher and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

Stellantis شاسی بلند Alfa Romeo Tonale الکتریکی شده را عرضه می کند

آرم آلفا رومئو در نمایشگاه خودروی لس آنجلس، کالیفرنیا، ایالات متحده، 20 نوامبر 2019 به تصویر کشیده شده است. رویترز/لوسی نیکلسون/فایل عکس اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنیدثبت نام کنید[01] ]برای رقابت با مدلهایی از جمله BMW X1، مرسدس GLA

MILAN ، 8 فوریه (رویترز) – Stellantis (STLA.MI) روز سه شنبه از خودروی کاربردی اسپرت کامپکت جدید خود (SUV) آلفارومئو تونله رونمایی کرد زیرا قصد دارد در بازار پرمیوم گسترش یابد و خودروهای برقی و متصل به هم را به محدوده خود اضافه کند. مدل جدید نامگذاری شده برگرفته از یک گذرگاه آلپاین در شمال ایتالیا، در بخش پرطرفدارترین خودروهای پریمیوم اروپا مانند BMW X1، مرسدس GLA و فولکس واگن (VOWG_p.DE) Audi Q3 رقابت خواهد کرد. چهارمین خودروساز بزرگ جهان قصد دارد هزینه کند. بیش از 30 میلیارد یورو (34.2 میلیارد دلار) تا سال 2025 تا ال خط تولید خودروهای خود را تقویت کرده و محتوای نرم افزاری خود را برای رسیدن به رقبا از جمله تسلا (TSLA.O) تقویت کند. بیشتر بخوانید اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید ثبت نام Tonale شامل ویژگی های دستیار صوتی الکسا آمازون داخلی است. مالکان میتوانند خودروی خود را بهعنوان محل تحویل انتخاب کنند و به پیکها این امکان را میدهد که قفل درها را با خیال راحت باز کنند و بستهای را در داخل وسیله نقلیه بگذارند.» رئیس این برند، ژان، گامی در جهت تبدیل شدن گروه ما به یک شرکت فناوری است. فیلیپ ایمپاراتو طی یک ارائه اینترنتی گفت. Tonale جدید که در کارخانه Pomigliano ایتالیا در نزدیکی ناپل ساخته می شود، اولین خودروی الکتریکی آلفا رومئو است و در ابتدا در مدل های هیبریدی ملایم و همچنین موتورهای دیزلی ارائه می شود. یک نسخه پلاگین هیبریدی، با برد تمام الکتریکی تا 80 کیلومتر، اواخر امسال وارد بازار خواهد شد. ایمپاراتو جزئیاتی درباره زمان عرضه نسخه تمام الکتریکی ارائه نکرده است. انتظار میرود قیمتهای فروش قبل از باز شدن سفارشها در ماه آوریل اعلام شود. برخی از تحلیلگران میگویند که برند آلفارومئو میتواند بخشی از استراتژی Stellantis در چین، بزرگترین بازار خودروی جهان باشد، جایی که از اکثر رقبا عقب مانده است. ایمپاراتو وعده یک محصول جدید را داده است. عرضه مدل برای آلفارومئو هر سال تا سال 2026، با شروع Tonale در سال 2022. این باید شامل یک SUV با اندازه کوچکتر باشد که انتظار می رود در لهستان ساخته شود. ادامه مطلب او گفت که از سال 2027 تمام خودروهای جدید آلفارومئو تماماً الکتریکی خواهند بود. استلانتیس سال گذشته از طریق ادغام فیات کرایسلر و سازنده پژو PSA شکل گرفت و خانه 14 برند از جمله پرفروش ترین جیپ، دی اس و لانچیا است. در بخش ممتاز و مازراتی در پایان لوکس. آلفارومئو توناله جدید مبتنی بر معماری سابق فیات کرایسلر است، در حالی که انتظار میرود اولین مدلهای Stellantis که بر روی پلتفرم مشترک جدید ساخته شدهاند، از سال آینده تولید شوند.

(1 دلار = 0.8767 یورو) اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید ثبت نام گزارش توسط Giulio Piovaccari

ویرایش توسط کیت ویر استانداردهای ما: اصول اعتماد تامسون رویترز. .