A man walks past in front of a sign board of Mitsubishi UFJ Trust and Banking Corporation, the asset management unit of Japan’s Mitsubishi UFJ Financial Group Inc. (MUFG), in Tokyo, Japan July 31, 2017. REUTERS/Issei KatoRegister now for FREE unlimited access to Reuters.comSINGAPORE, July 20 (Reuters) – Mitsubishi Corp bought a cargo of Vietnamese crude for loading in September on behalf of Japanese utilities at a record premium for the grade, traders said on Wednesday.The purchase comes after Nippon Steel bought a liquefied natural gas (LNG) cargo at the highest price ever paid in Japan. The world’s No. 2 LNG importer is scrambling for power fuels as a global heatwave drives electricity demand this summer. read more “Japan has a power shortage, so it has to pay up. Other countries also have the same problem now, especially in Europe,” one of the traders said.Register now for FREE unlimited access to Reuters.comMitsubishi paid a premium of $21 a barrel to dated Brent for the 300,000-barrel cargo of Vietnamese Chim Sao crude, said two of the traders who regularly track the grade.That puts the cost of the cargo at about $127 a barrel based on current Brent prices, or $38.1 million.Mitsubishi does not comment on individual deals, a spokesperson said.Japan last imported Chim Sao crude in February and April, according to Refinitiv data.Register now for FREE unlimited access to Reuters.comReporting by Florence Tan, Additional reporting by Nobuhiro Kubo in Tokyo; Editing by Louise HeavensOur Standards: The Thomson Reuters Trust Principles. .

EDF shares suspended as France prepares nationalisation plan

View of the company logo of Electricite de France (EDF) on the facade of EDF’s headquarters in Paris, France, July 7, 2022. REUTERS/Johanna GeronRegister now for FREE unlimited access to Reuters.com

- French government aiming to fully nationalise EDF

- State already holds an 84% stake in the group

- Utility grappling with outages and tariff caps

PARIS, July 13 (Reuters) – Shares in debt-laden EDF (EDF.PA) were suspended on Wednesday as the French government prepares to detail its plans to fully nationalise Europe’s biggest nuclear power operator.France said last week it wanted to fully nationalise EDF, in which the state already holds an 84% stake, without explaining how it would do so. In a statement, the finance ministry said it would clarify its plans before the market opens on July 19 at the latest.Taking EDF back under full state control would give the government greater licence to restructure the group that runs the nation’s nuclear power plants, as it contends with a European energy crisis.Register now for FREE unlimited access to Reuters.comA finance ministry source said the suspension of EDF shares, which was requested by the company, was temporary and trading would resume once the government had made clear how it would fully nationalise the utility.EDF has been grappling with extraordinary outages at its nuclear fleet, delays and cost overruns in building new reactors, and power tariff caps imposed by the government to shield French consumers from soaring electricity prices.Two sources told Reuters this week that the government was poised to pay up to 10 billion euros to buy the 16% stake in the group it does not already own, after including the purchase of convertible bonds and a premium it is expected to offer to minority shareholders. read more That would translate into a buyout price of close to 13 euros per share, a 30% premium to current market prices but still a big loss for long-term shareholders, as the group was listed in 2005 at a price of 33 euros per share.”A 30% premium does not seem unreasonable given the market fluctuations of the share price – we are still talking about a 50% to 60% loss for shareholders,” said Antoine Fraysse-Soulier, head of market analysis at eToro in Paris.The sources said the state wanted to move quickly and would probably launch a voluntary offer on the market rather than push a nationalisation bill through parliament, with the aim of closing the operation in October-November.”The government may want to offer a sufficient premium to avoid legal challenges and resulting delays to the offer,” JPMorgan analysts said in a note.EDF did not give a reason for requesting the suspension of its shares, which have risen 30% since the nationalisation announcement, increasing the cost of buying out minorities. The finance ministry source said the move was “among routine tools to manage financial markets in this kind of situation”.”I would imagine it is to stop the price going up to a point that the French government ends up having to pay over the odds for the remaining shares in issue,” a London trader said.The shares closed at 10.2250 euros on Tuesday.In a sign of how badly reactor outages are affecting the company, which is expected to post a loss this year, EDF said power generation at its French nuclear reactors fell by 27.1% in June from a year earlier after the discovery of stress corrosion took several sites off line.EDF has said it expects an 18.5 billion euro hit to its earnings in 2022 from production losses, and further losses of 10.2 billion euros from the energy price cap.($1 = 0.9964 euros)Register now for FREE unlimited access to Reuters.comAdditional reporting by Joice Alves in London and Marc Angrand in Paris; Writing by Silvia Aloisi; Editing by Edmund Blair, Jan Harvey, Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles. .

Siemens Energy launches $4.3 billion bid for remaining Siemens Gamesa stake

A model of a wind turbine with the Siemens Gamesa logo is displayed outside the annual general shareholders meeting in Zamudio, Spain, June 20, 2017. REUTERS/Vincent WestRegister now for FREE unlimited access to Reuters.com

- Siemens Energy bids 18.05 euros/share for 33% stake

- Bid comes after operational problems at Siemens Gamesa

- Deal could yield cost synergies of up to 300 mln eur

FRANKFURT, May 21 (Reuters) – Siemens Energy (ENR1n.DE) on Saturday launched a 4.05 billion euro ($4.28 billion) bid for the remaining shares in struggling wind turbine unit Siemens Gamesa (SGREN.MC), hoping to remove a complex ownership structure that has weighed on its shares.Siemens Energy said the 18.05 euros per share bid constitutes a premium of 27.7% over the last unaffected closing share price of Spanish-listed Siemens Gamesa of 14.13 euros on May 17. It is a 7.8% premium to Friday’s closing price.Siemens Energy has faced mounting shareholder pressure to seek control of Siemens Gamesa (SGRE), in which it owns 67%, a stake it inherited as part of a spin-off from former parent Siemens (SIEGn.DE).Register now for FREE unlimited access to Reuters.comThat stake has given Siemens Energy little influence to deal with product delays and operational problems at Siemens Gamesa. The group has issued three profit warnings in less than a year.”It is critical that the deteriorating situation at SGRE is being stopped as soon as possible, and the value-creating repositioning starts quickly,” said Joe Kaeser, Siemens Energy’s supervisory board chairman.This year, sources told Reuters that Siemens Energy was exploring options to acquire the remaining stake in Siemens Gamesa and a deal could materialise by summer. read more Siemens Energy said it plans to finance up to 2.5 billion euros of the transaction with equity or equity-like instruments, adding a first step could be a capital increase without subscription rights.The remainder would be financed with debt as well as cash on hand, Siemens Energy said, adding it aimed to delist Siemens Gamesa. Spanish stock market regulations allow that once ownership of 75% is reached.Full integration of Siemens Gamesa will simplify Siemens Energy’s structure and provide a more coherent business model that caters to legacy energy assets like coal, transition technologies such as gas, and renewable power sources.”This transaction comes at a time of major changes affecting global energy,” Siemens Energy Chief Executive Christian Bruch said. “Our conviction is that the current geopolitical developments will not lead to a setback to the energy transition.”Siemens Energy said the deal would lead to cost synergies of up to 300 million euros annually within three years of the full integration, mainly due to more favourable supply chain management, combined administration and joint R&D.The deal should close in the second half and is expected to achieve revenue synergies of a mid triple-digit million amount by 2030, the group said.($1 = 0.9470 euros)Register now for FREE unlimited access to Reuters.comReporting by Christoph Steitz and Ludwig Burger; Editing by Nick Zieminski, Daniel Wallis and David GregorioOur Standards: The Thomson Reuters Trust Principles. .

Column: European smelter squeeze keeps zinc close to record highs

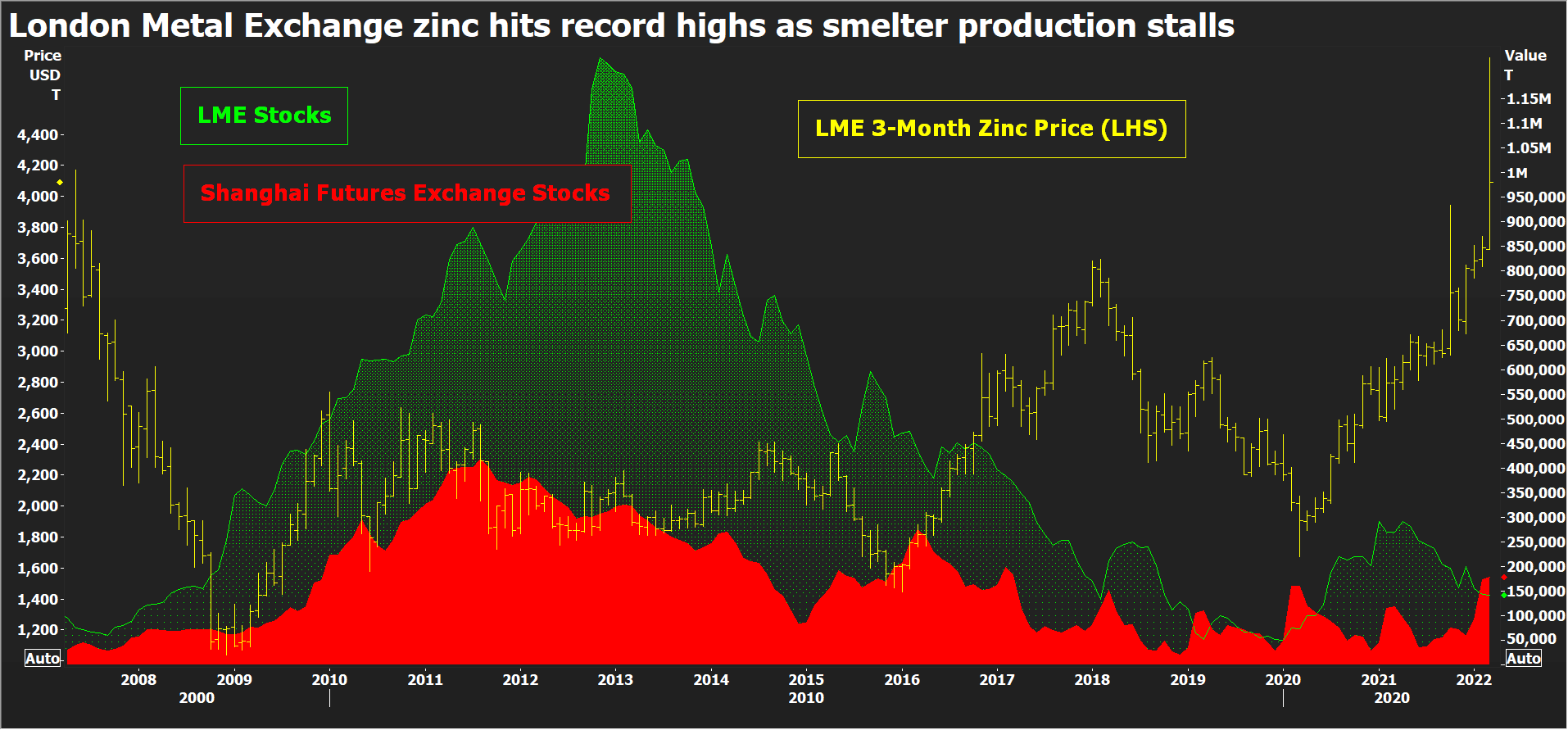

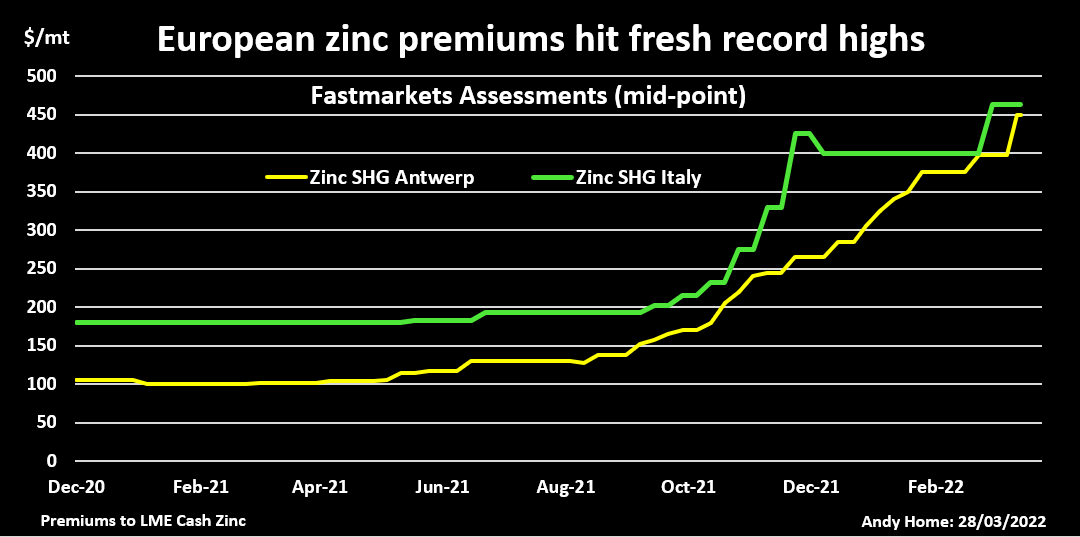

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Asia Fuel Oil VLSFO cash premiums gain, HSFO cash premiums hit multi-month highs

SINGAPORE, March 8 (Reuters) – Asia’s cash premiums for 0.5% very low-sulphur fuel oil (VLSFO) rose for a second consecutive session on Tuesday, while the prompt-month spread for the marine fuel grade remained in steep backwardation.Cash differentials for Asia’s 0.5% VLSFO , which have surged about 44% in the last month, were at a premium of $19.80 a tonne to Singapore quotes, compared with $19.67 per tonne a day earlier.The March/April VLSFO time spread traded at $32 a tonne on Tuesday, compared with $33.75 a tonne on Monday.Register now for FREE unlimited access to Reuters.comThe front-month VLSFO crack rose to $29.83 per barrel against Dubai crude during Asian trading hours, up from $29.61 per barrel in the previous session.Meanwhile, the 380-cst HSFO barge crack for April traded at a discount of $16.79 barrel to Brent on Tuesday, while cash premiums for 380-cst high sulphur fuel oil (HSFO) rose to a more than four-month high of $5.55 per tonne to Singapore quotes.Backed by firmer deals in the physical market, the cash differentials for 180-cst HSFO surged to a premium of $8.59 a tonne to Singapore quotes, a level not seen since October last year. They were at a premium of $6.39 per tonne a day earlier.ASIA REFINERS TO CRANK UP RUNS- Some Asian refineries plan to increase output in May to cash in on high prices for gasoil exports to Europe, even as the steepest crude prices in 14 years threaten profit margins, numerous trade sources said. read more – European diesel supplies have shrunk following the disruption of western sanctions imposed on Russia in response to its invasion of Ukraine, which it describes as a “special operation”.- Strong European demand has boosted Asian refiners’ profits for producing gasoil for exports to the West. However, the refiners are also paying record premiums for Middle East crude supplies after the disruption of sanctions left buyers with limited options.WINDOW TRADES- One 380-cst high-sulphur fuel oil (HSFO) deal, two 180-cst HSFO trades- One VLSFO trade was reportedOTHER NEWS- The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia’s invasion of Ukraine. read more – Oil prices rose on Tuesday, with Brent surging past $126 a barrel, as fears of formal sanctions against Russian oil and fuel exports spurred concerns about supply availability.ASSESSMENTSRegister now for FREE unlimited access to Reuters.comReporting by Koustav Samanta; Editing by Shinjini GanguliOur Standards: The Thomson Reuters Trust Principles. .