Storm clouds can be seen behind chimneys at the Bayswater coal-powered thermal power station located near the central New South Wales town of Muswellbrook, Australia, March 14, 2017. Picture taken Mach 14, 2017. REUTERS/David Gray Register now for FREE unlimited access to Reuters.comRegisterMELBOURNE, Feb 23 (Reuters Breakingviews) – Brookfield Asset Management (BAMa.TO) and Grok Ventures’ A$5 billion ($3.6 billion) offer for AGL Energy read more has reignited Australia’s dirty climate wars. The asset manager and the investment fund of Atlassian (TEAM.O) co-founder Mike Cannon-Brookes want to plough up to A$20 billion into the coal-heavy power company to speed its shift to solar and wind. That ought to be a welcome development for a struggling target read more and for a federal government finally paying lip service read more to net-zero greenhouse-gas emissions. Instead, they’re returning to tired old anti-renewables tropes.The bidders face some deserved hurdles as it is. Success would mean Brookfield part-owning not just Australia’s largest power producer and retailer, but also, thanks to a recent A$10 billion club deal for AusNet, significant parts of the country’s transmission grid. That raises potential but probably not insurmountable competition concerns.To seal a deal, wannabe buyers also need to up their 4.8% premium. Some shareholders may agree that AGL’s plan to demerge its two divisions will destroy value, but Brookfield and Grok have to work off where the shares trade, not where they think they should. AGL Chief Executive Graeme Hunt is overplaying his hand implying he needs at least a 30% premium to start talks. But there’s probably some middle ground.Register now for FREE unlimited access to Reuters.comRegisterTrouble is, Hunt is raising the more serious spectre of Brookfield-Grok disrupting the energy market. That seems disingenuous while pitching for a higher offer, but he’s following the government’s lead: On the back of the bid, Prime Minister Scott Morrison warned early coal plant closures mean “electricity prices go up”. Treasurer Josh Frydenberg asserted it was an “indisputable fact” proved by the 2017 closure of Hazelwood power station.That specific comparison is wielded out of context: French owner Engie only gave six months’ notice before switching Hazelwood off, with no plans to replace production. And rising gas prices and big coal suppliers gaming the system also played a big role in price hikes, according to Australia’s own competition commission and researchers at the University of Melbourne.Brookfield and Grok are giving at least eight years’ notice and will only mothball coal once enough renewables are up and running. Of course, a parliamentary election due by May is fuelling tried and tested populist politics. The buyers could do without the toxic smokescreen.Follow @AntonyMCurrie on TwitterCONTEXT NEWS- AGL Energy Chief Executive Graeme Hunt on Feb. 22 said the A$5 billion ($3.6 billion) offer from Brookfield Asset Management and Grok Ventures offered very poor value for shareholders. He told The Australian newspaper that investors “typically, for a change of control…are looking for premium 30-40 plus per cent over whatever the appropriate share trading range is for the company”.- Hunt also called into question the consortium’s ability to replace AGL’s coal-fired power stations with adequate renewable energy sources by 2030. On the same day federal Treasurer Josh Frydenberg said it was an “indisputable fact” that energy prices will go up if coal-fired power stations close early, referring to the shutdown of the Hazelwood plant in Victoria in 2017.- Any takeover offer which leaves a foreign company owning 10% or more in an Australian company deemed part of critical infrastructure like energy, financial services, food and grocery, and water and sewage is subject to approval by the Foreign Investment Review Board, which submits its recommendations to the country’s Treasurer.- AGL’s bid represents a 4.8% premium to the stock’s closing price on Feb. 18. The prospective buyers made their approach on Feb. 19. The company’s board said on Feb. 21 that it had rejected the offer.Register now for FREE unlimited access to Reuters.comRegisterEditing by Jeffrey Goldfarb and Katrina HamlinOur Standards: The Thomson Reuters Trust Principles. .

Finnair to stay independent and stick to Asia strategy, says CEO

A Finnair Airbus A320-200 aircraft prepares to take off from Manchester Airport in Manchester, Britain September 4, 2018. REUTERS/Phil NobleRegister now for FREE unlimited access to Reuters.comRegisterHELSINKI, Feb 11 (Reuters) – Finnair will remain a stand-alone airline and stick to its Asia-focused strategy while adding new routes to the United States, Chief Executive Topi Manner said on Friday.Finland’s national carrier, which has bet heavily on providing connections to Asia, expects the business environment to return close to normal in the second half of this year following pandemic disruptions, he told Reuters.”We are optimistic about summer,” Manner said, adding the airline expected countries like Japan and South Korea to lift travel restrictions towards summer in the northern hemisphere.Register now for FREE unlimited access to Reuters.comRegisterThe recovery of Asian traffic from the slump caused by widespread border restrictions is particularly important for the Finnair, which seeks to benefit from providing connections to Asia from Europe thanks to the location of its Helsinki hub.”We believe Asia will open up eventually. In the meantime, we are partially pivoting to North America,” Manner said in an interview.He was speaking after the airline announced a 200-million-euro ($228 million) investment in renewing the cabins of its long-haul fleet, including a new premium economy service and redesigned business cabin.Manner said the new cabin class was being added to address increasing demand in premium leisure travel, while also introducing a new business class seat called “the air lounge,” a nest-like shell that does not recline but modifies to allow for vertical sleeping.”We as a carrier of course need to differentiate and we have chosen to differentiate with quality,” he said.Finnair operates Airbus A330 and A350 planes on long-haul routes.Unlike many airlines, Finnair has not yet joined a wave of orders for the latest generation of narrowbody jets like the A320neo, which burn 15% less fuel.Finnair’s fleet of 35 Airbus A320-family jets includes some planes as old as 21 years but others produced as recently as 2018, according to its website.Asked whether Finnair planned to renew its medium-haul fleet, Manner said it could do so in three or four years but stressed the importance of sustainable aviation fuel as the airline targets net zero emissions by 2045.($1 = 0.8770 euros)Register now for FREE unlimited access to Reuters.comRegisterReporting by Anne Kauranen Editing by Tim Hepher and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

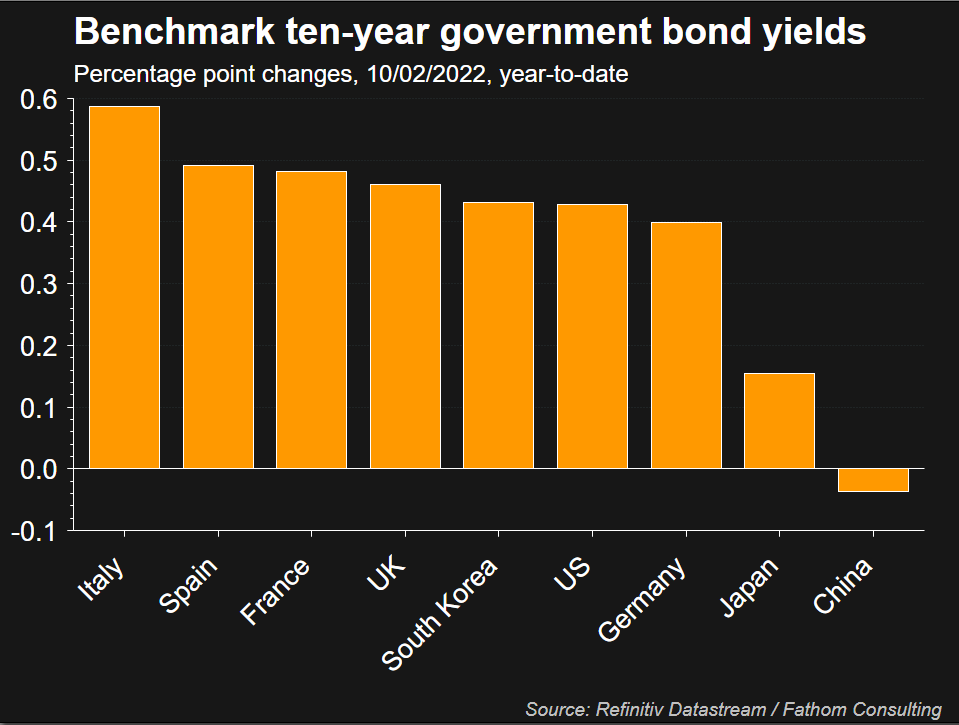

Analysis: Where now after 2% yield? Bond investors take stock

The Federal Reserve building is seen in Washington, U.S., January 26, 2022. REUTERS/Joshua Roberts/File PhotoRegister now for FREE unlimited access to Reuters.comRegisterNEW YORK, Feb 10 (Reuters) – U.S. Treasury yields have shot higher this year, rising faster than many forecast. Investors are now assessing if anticipation of a more hawkish Fed will continue to push levels up, with the potential to upset riskier assets.Expectations that the U.S. Federal Reserve may increase rates more aggressively than anticipated to counter rising inflation have pushed up yields while flattening the U.S. Treasury yield curve. That matters as bond yields impact global asset prices as well as consumer loans and mortgages. The shape of the U.S. Treasury yield curve can also help predict how the economy will fare.On Thursday, yields on 10-year notes hit 2% after higher-than-anticipated inflation data. Federal funds rate futures showed an increased chance of a half percentage-point tightening at next month’s meeting after the data, while strategists said the data increased the chances of swifter moves to reduce the Fed’s balance sheet. The central bank’s nearly $9 trillion portfolio doubled in size during the pandemic. read more Register now for FREE unlimited access to Reuters.comRegister“The market is starting to price in a much more aggressive path of rate hikes … clearly there is a sense of urgency again”, said Subadra Rajappa, head of U.S. rates strategy at Societe Generale.Yields, which move inversely to prices, are up from 1.79% at the beginning of February. The last time they breached 2% was August 2019.”I would say the chances of yields continuing to go higher are pretty high,” said Gargi Chaudhuri, Head of iShares Investment Strategy, Americas, at BlackRock, speaking ahead of the data.FOREIGN COMPETITIONCompetition in other markets for yield may be sapping demand for Treasuries and helping push yields higher, Chaudhuri said.A second rate hike by the Bank of England last week, and expectations of faster policy tightening by the European Central Bank (ECB), added to U.S. bonds’ weakness, with borrowing costs in Europe – as well as Japanese government bond yields – having jumped to multi-year highs in recent days. read more “Investors have these other markets to gravitate towards that they didn’t in the past, and that will require investors that are focusing on U.S. markets to seek a higher term premium and therefore will impact yields higher,” Chaudhuri said.Japan’s benchmark 10-year government bond yield is around its highest level since January 2016 at 0.220% while Germany’s 10-year government bond yield , at 0.255%, is at its highest since January 2019. read more  FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

کنیاک های گران قیمت در Remy Cointreau روحیه می بخشند

آرم Remy Cointreau SA در دفتر مرکزی آنها در پاریس، فرانسه، 21 ژانویه 2019 به تصویر کشیده شده است. رویترز/Benoit Tessier هم اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنیدثبت نام کنید[196539001]4% فروش. مشابه برای شبیه در مقابل تخمین 14.9%

پاریس، 25 ژانویه (رویترز) – Remy Cointreau (RCOP.PA) مطمئن است که تقاضا برای کنیاک ممتاز خود در چین، ایالات متحده و اروپا باعث رشد سود در سال جاری خواهد شد، زیرا گروه مشروبات الکلی فرانسوی پیش بینی های فروش سه ماهه سوم را شکست داد. سازنده کنیاک رمی مارتین و مشروب Cointreau اندکی کاهش یافت. با این حال، در مورد چشم اندازهای جشنهای سال نوی چینی در ماه آینده به دلیل محدودیتهای کووید، محتاطتر است و سهام آن با افزایش 1.6 درصدی تا ظهر روز به روز رسید. ماه پیش خواهد بود لوکا ماروتا، رئیس امور مالی، به تحلیلگران گفت: یک سال جدید چینی 2022 جامد، اگرچه بهترین سال برای صنعت نیست. اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید. او اضافه کرد که سهم بازار چین را به دست بیاورد. این بیماری همه گیر به حرکت رمی به سمت مشروبات الکلی با قیمت بالاتر کمک کرده است تا حاشیه سود را در درازمدت افزایش دهد و به سمت نوشیدنی های ممتاز، مصرف در خانه، کوکتل ها و تجارت الکترونیک سرعت بخشد. فروش گروهی برای این سه مورد ماههای منتهی به 31 دسامبر به 440.5 میلیون یورو (498.1 میلیون دلار) رسید که رشدی ارگانیک 21 درصدی را نشان میدهد که بر اجماع 18 تحلیلگر شرکت برای افزایش 15.1 درصدی پیشی گرفته است. فروش در بخش کنیاک رمی مارتین که 90 درصد است. سود گروه، 19.4 درصد افزایش یافت و به 332.7 میلیون یورو رسید، همچنین بالاتر از برآوردهای 14.9 درصدی تحلیلگران. این شرکت گفت که عملکرد سه ماهه سوم منعکس کننده رشد فروش دو رقمی در چین است که توسط کنیاک کلوب و فروش تجارت الکترونیک قوی در طول سال. خرید آنلاین روز مجردها nza. تقاضای کنیاک در ایالات متحده نیز قوی باقی مانده است، با مارک های گران قیمت مانند کنیاک لوئیس سیزدهم که بیش از 2000 دلار در هر بطری به فروش می رسد، Remy Martin XO و 1738 Accor Royal عملکرد بهتری داشتند. برای تمام سال 2021/2022، رمی حفظ کرد. پیشبینی رشد ارگانیک «بسیار قوی» در سود عملیاتی جاری و رشد فروش ارگانیک قوی، و مجدداً تأکید کرد که به توانایی خود در عملکرد بهتر از بازار مشروبات الکلی ممتاز اطمینان دارد. 38٪ و رشد فروش 26.5٪ "در سطح مناسب" بود. گروه تکرار کرد که به دلیل هزینه های بازاریابی و ارتباطات بیشتر و مقایسه سخت تر در نیمه دوم، سود کل سال صرفاً توسط رشد نیمه اول خواهد بود. سال مالی شرکت فرانسوی از 1 آوریل شروع می شود و در 31 مارس به پایان می رسد. (1 دلار = 0.8843 یورو) اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید ثبت نام گزارش توسط Dominique Vidalon

ویرایش توسط جین مریمن و مارک پاتر استانداردهای ما: اصول اعتماد تامسون رویترز. .