The RBI team led by Governor Shaktikanta Das must be complimented for raising the repo rate by 40 basis points (bps) and the cash reserve ratio (CRR) by 50 bps with a view to tame inflation. High inflation is always an implicit tax on the poor and those who keep their savings in banks. The real value of their savings gets depreciated with every round of inflation as interest on deposits is often far below the inflation rate. So, controlling inflation is an important mandate of the RBI. The question that arises is: Will the increases in the repo rate and CRR control inflation, especially food inflation? The short answer is, “not yet”. Our assessment of the situation is that the RBI has been behind the curve by at least by 4-to 5 months, and its optimism in controlling inflation in the earlier meetings of the Monetary Policy Committee was somewhat misplaced. If the RBI has to make up for lost time, it will have to repeat this feat of raising repo rates and CRR by at least three more times in this fiscal year (FY23) to mop up excess liquidity in the system. Even then, it may be difficult to rein in food inflation, which is surging faster than the overall consumer price index (CPI).

The reason for this is simple. Food prices globally are scaling new peaks as per the FAO’s food price index. The disruptions caused by the pandemic and now the Russia-Ukraine war are contributing to this escalation in food prices. India cannot remain insulated from this phenomenon. While on the one hand, it has opened opportunities for Indian farm exports, on the other hand, it has posed challenges as import prices of edible oils and fertilisers surge.

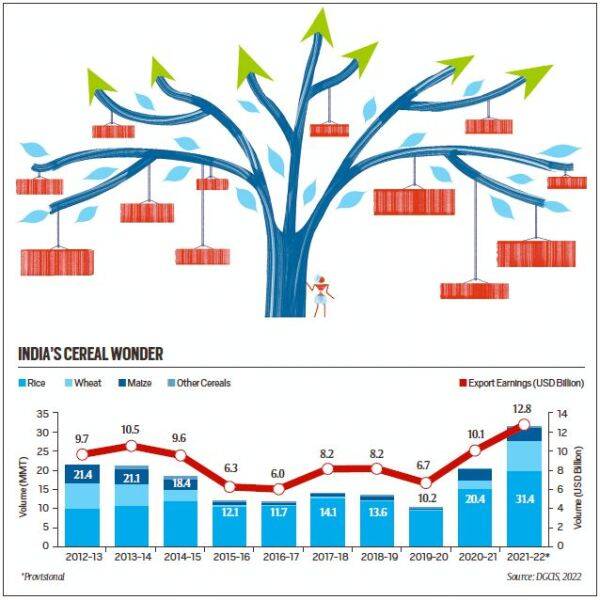

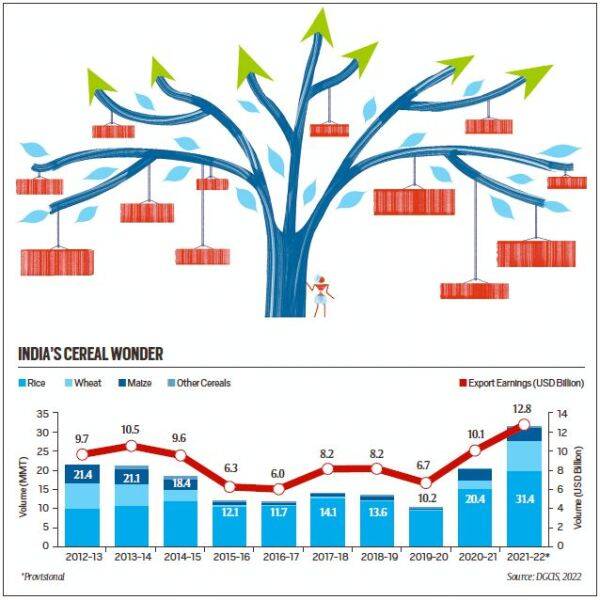

Let us focus here on cereals, which have the greatest weight in India’s food CPI. For the first time in the history of Indian agriculture, cereal exports have already crossed a record high of 31 million metric tonnes (MMT) at $13 billion (FY22), and the same cereal wonder may be repeated this fiscal (FY23). Among cereals, wheat exports have witnessed an unprecedented growth of more than 273 per cent, jumping nearly fourfold from $0.56 billion (or 2 MMT) in FY21 to $2.1 billion (or 7.8 MMT) in FY22 (see figure). Commerce and Industry Minister Piyush Goyal is upbeat on agri-farm exports, which overall have crossed $50 billion for the first time in FY22. On wheat, while the government has set a target of 10 MMT for exports in FY23, Goyal in a recent interview said that it may go even up to 15 MMT. This has raised fears amongst many about whether India can export 10 to 15 MMT in the face of the scaling down of the production estimate of the current crop from 111 MMT to 105 MMT due to the heatwave, and the massive drop in procurement in the ongoing season due to higher market rates compared to MSP. However, there is very little talk about rice exports, which have crossed 20 MMT in FY22 in a global market of 50 MMT. That’s a much bigger wonder than wheat. (See figure)

Some of the concerns on the wheat front are genuine, and we need to realise that climate change is already knocking on our doors. With every one degree Celsius rise in temperatures, wheat yields are likely to suffer by about 5 MMT, as per earlier IPCC reports. This calls for massive investments in agri-R&D to find heat-resistant varieties of wheat and also create models for “climate-smart” agriculture. We are way behind the curve on this. But we are way ahead of the curve in distributing free food to 800 million Indians, with a food subsidy bill that is likely to cross Rs 2.8 lakh crore this fiscal out of the Centre’s net tax revenue of about Rs 20 lakh crore in FY23. Can Goyal, who is rightly upbeat on agri-exports also rationalise the public distribution system and PMGKAY, as food minister, targeting only those below the poverty line for free or subsidised food and charging a reasonable price, say 90 per cent of MSP, from those who are above the poverty line. The bottom line is: He has to effectively target the massive food subsidy and save resources for the higher import bill on edible oils and fertilisers. Inflation in edible oils has been running amok — to double digits — for a long time, and there has been no relief for consumers on that front.

In the wake of likely lower production and procurement of wheat this year, Goyal has done well to substitute more rice in the PMGKAY, and may also do so in NFSA allocations. We would suggest giving an option to beneficiaries to receive cash in their Jan Dhan accounts (equivalent to MSP plus 20 per cent) in lieu of grains. This is permitted under NFSA and by doing so, he can save on the burgeoning food subsidy bill.

Goyal also needs to ward off any fear-mongering over wheat that can push him towards an export ban. That would be the worst thing he could do. It would be an anti-farmer move. The problem with our earlier policymaking has been that it is heavily biased towards protecting the consumers in the name of the poor by suppressing prices for farmers through choking markets — through imposing stock limits on traders, putting minimum export prices or outright bans on exports. He must avoid that route, and let agri-exports flourish. Indian farmers need access to global markets to augment their incomes, and the government must facilitate Indian farmers to develop more efficient export value chains by minimising marketing costs and investing in efficient logistics for exports.

Gulati is Infosys Chair Professor and Juneja is consultant at ICRIER

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘444470064056909’);

fbq(‘track’, ‘PageView’);

.

Premium

Premium Premium

Premium Premium

Premium Premium

Premium