Prathanchorruangsak | Istock | Getty ImagesWhether you’re a current employee or changing jobs, you may need to choose between pre-tax and Roth 401(k) contributions, and it may be trickier than you expect.Here’s the difference: Pre-tax 401(k) deposits reduce your adjusted gross income, and the money grows tax-deferred, meaning you’ll pay levies on withdrawals. By contrast, Roth 401(k) contributions don’t provide an upfront write-off, but earnings are tax-free.However, there may be other tax trade-offs, so you’ll need to weigh the pros and cons before diverting funds, financial experts say.More from Personal Finance:

White House tries to figure out which student debt to forgive

There’s an ‘un-retirement’ trend amid this hot job market

How to beat back rising prices with Memorial Day dealsRoughly 86% of 401(k) plans offered a Roth account in 2020, up from 75% in 2019, according to the Plan Sponsor Council of America.”In general, the goal is to take deductions at a higher tax rate and distributions at a lower one,” said certified financial planner Ken Waltzer, co-founder and managing partner of KCS Wealth Advisory in Los Angeles. If you plan on more income or higher taxes in retirement, tax-free withdrawals from Roth contributions may make sense, and tax-deferred contributions may be better if you expect lower earnings and levies.But that’s not always a winning strategy, according to Michelle Gessner, a Houston-based CFP and founder of Gessner Wealth Strategies.”Investors are quick to discard the idea of making Roth contributions if they are in a high tax bracket because they want the deduction that comes with a regular 401(k) contribution,” she said.However, the upfront write-off may not be worth it if you worry about the consequences of taxable required minimum distributions, she said. Social Security and Medicare costsWhen someone withdraws tax-deferred money from a 401(k), it boosts their income, which may trigger levies on Social Security and hike Medicare premiums. The formulas for Social Security taxes, Medicare Part B and Medicare Part D use so-called modified adjusted gross income, or MAGI.If half of your Social Security payments plus MAGI is more than $34,000 ($44,000 for a joint return), up to 85% of those benefits may be taxable.However, the bigger issue for retirees above certain income levels may be the surcharge for Medicare Part B, known as the Income Related Monthly Adjustment Amount, or IRMAA. While the base amount for Medicare Part B premiums is $170.10 for 2022, payments go up once income exceeds $91,000 ($182,000 for joint filers). The calculation uses MAGI from two years prior. Roth withdrawals, however, won’t show up on tax returns, said Gessner, meaning retirees don’t have to worry about these distributions causing Medicare premium increases.Diversify taxesSince no one can predict future tax rates, you may also consider creating a mix of pre-tax and after-tax funds from a diversification standpoint, experts say.”It is great when clients have both Roth and traditional retirement savings,” said Catherine Valega, a CFP and wealth consultant at Green Bee Advisory in Winchester, Massachusetts.If you have both pre-tax and after-tax funds, it may provide more options to craft an efficient retirement income plan, she said. .

I started tech budgeting and you should do it too

Before going to bed one-night last month, I got a text message: “You have spent Rs 459 via debit card at Amazon.” I read the message and slept. Later, in the morning, when I woke up I read the message again and wondered why Rs 459 was charged to my debit card. I then checked the Amazon app and realised I forgot to turn off auto-renewal. Rs 459 is not a huge sum but it pinched me a lot when the money was deducted from my account for a service I no longer use. That day I realised I need to seriously understand my monthly expenses better, especially the amount spent on services and apps. I am not trying to be a personal finance expert but I want to share my experience and a few tips you can apply to better manage your tech budget.

Understand where your money is going

Whether you are a student or a working professional, start paying attention to the basic fundamental components of financial literacy. Nobody will tell you what is more important: a coffee at a cafe or paying the EMI of your smartphone before the due date? The point is to understand the benefits of financial literacy so that you know where your money is going. Every penny matters. Until a few months back, I was randomly purchasing vintage gadgets on OLX and because of that, I messed up my finances. I still buy vintage gadgets but now I look at my bank balance and review my spending before buying anything new.

Disney Hotstar Plus offers three tiers and each plan costs more than the other. (Image credit: Disney)

Disney Hotstar Plus offers three tiers and each plan costs more than the other. (Image credit: Disney)

Allocating monthly budget for streaming services

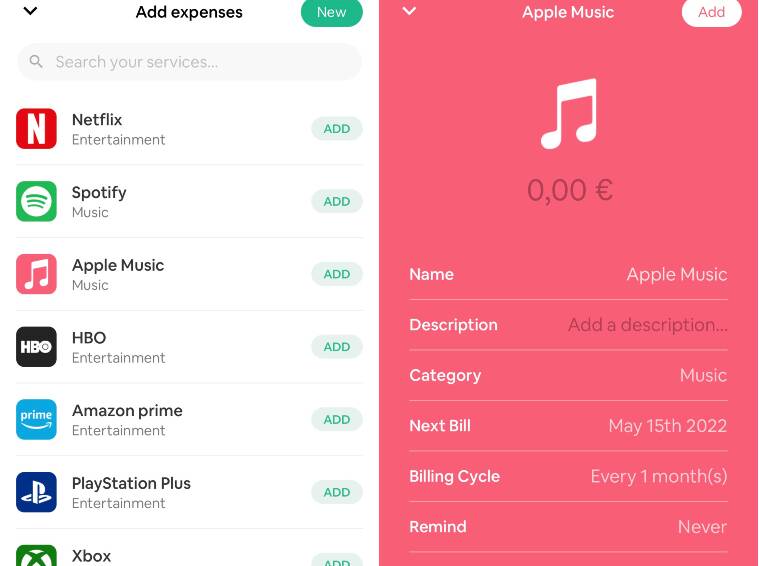

About a month back, I logged into my savings account and started calculating the money I spent on subscriptions. To put it simply, it was a shock, especially the fact that there were so many monthly subscriptions I had forgotten about. It is easy to subscribe to subscription services, but hard to keep using them or to keep a tab of what you are spending on these.

First, let me tell you how many subscription services I have subscribed to:

Apple Music

Netflix

Amazon Prime

PlayStation Plus

Google Doc

Alt Balaji

Zee5

Xbox Game Pass

Disney Hotstar Plus

Apple TV Plus

Here’s what I did to cut down on my expenses on streaming and subscription services.

Identify the services you can cancel

Sit down on the weekend and figure out which services to keep and which ones to cancel. For example, if you have signed up for Netflix and lately have not been watching any shows that appeal to you, simply cancel the subscription. It may save you Rs 499 a month. Instead, save the money for another important financial goal, such as travelling or paying EMI for the laptop you just bought. The good thing about these services is that you can go back anytime and resume whenever there is a show coming that is interesting enough.

It is easy to subscribe to subscription services, but hard to keep using them or to keep a tab of what you are spending on these. (Image credit: Netflix website)

It is easy to subscribe to subscription services, but hard to keep using them or to keep a tab of what you are spending on these. (Image credit: Netflix website)

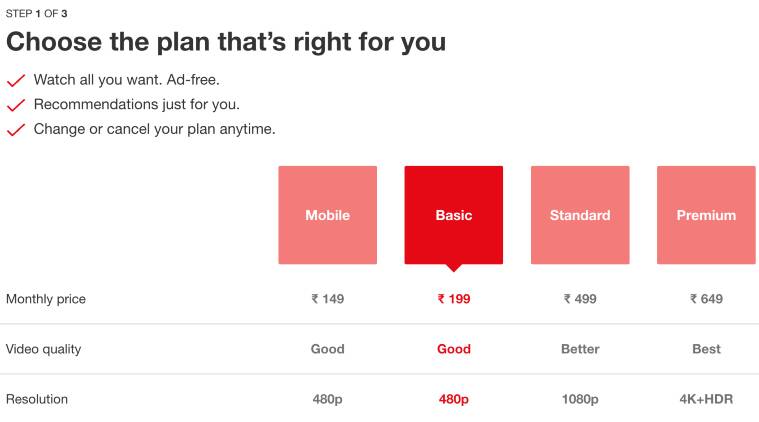

Choose the basic subscription tier

I know people whose only mode of entertainment is access to Netflix or Amazon Prime since they don’t have cable at home. I will tell them to choose the basic, non-premium subscription tier and save some cash. Netflix, for example, costs Rs 149 for a mobile-only plan. Opting for that plan makes a lot of financial sense if your viewing is limited to mobile. Before subscribing to any service, ask yourself if you really need the super-premium subscription plan. Like, Disney Hotstar Plus offers three tiers and each plan costs more than the other. Its Rs 1,499 annual plan is pointless if you don’t have a 4K TV at home but four people can log in using the same account and enjoy content ad-free.

Apple One bundle brings together Apple’s premium services offerings, such as Apple Music and Apple Arcade, at a discount. (Image credit: Apple)

Apple One bundle brings together Apple’s premium services offerings, such as Apple Music and Apple Arcade, at a discount. (Image credit: Apple)

Look for a bundled plan

Instead of subscribing to individual services, opt for a bundle that brings a lot of services under one umbrella. I don’t know if you have heard about Apple One, it’s a services bundle that brings together Apple’s premium services offerings, such as Apple Music and Apple Arcade, at a discount. I recently subscribed to the Apple One Individual Plan, where I got access to Apple Music, Apple TV Plus, Apple Arcade, and 50GB of iCloud Storage, all for Rs 195 a month. Previously, I was paying individually for Apple Music and Apple Arcade, and both services cost more than Rs 200 a month. Another reason to choose the Apple One bundle is Severance on Apple TV Plus, a show I am currently hooked to.

Hot tip: Make sure you are aware of the mobile data plans that come with free access to popular streaming services. Reliance Jio, Airtel and Vi (previously Vodafone) have prepaid and postpaid plans with a free subscription to streaming services.

Dedicate a monthly budget

This is probably the biggest lesson I learned about money in the past decade. Not only does budgeting help you reach your financial goals if you stick to it, but documenting every expense incurred in a month is a smarter move in the long run. Here’s how to do it.

A fixed sum for streaming services: Commit a budget that you need to spend on streaming and subscription services. A simple way to divide it is by using the 50/20/30 rule of budgeting. Essentially, you are breaking your income into three parts: 50% of your income goes to basic needs (house rent, groceries, etc), 20% goes to savings (and debt repayment), and 30% is to spend on personal use (eating out, streaming services, etc). If it works, a monthly budget will give a lot of flexibility. In my case, I have figured out which services I want to use and based on that I am dedicating a monthly budget. For me, the biggest challenge is to get into the habit of knowing how much I have to spend each month.

Track where your money goes: Write it down on paper, maintain a spreadsheet or use budgeting apps, and note down every expense you have for a month. The ability to make better financial decisions is what you need to learn and that too quickly.

Try using budgeting apps to track all your streaming services and apps on the go. (Image credit: Billbot/screenshot)

Try using budgeting apps to track all your streaming services and apps on the go. (Image credit: Billbot/screenshot)

Categorize your expenses by type: I might be paying a little more on PlayStation Plus but I don’t have to pay bank or credit card companies for a new iPhone 13 in the form of monthly instalments. I have the liberty to cancel the subscription to PlayStation Plus any day, but you don’t have the option to skip the monthly instalment and pay it later.

Leave room for flexibility in your budget: I have seen people who allocate a monthly budget with great enthusiasm but are unable to stick to a budget when their income is not stable. This is the hard reality. Budgeting can be a lot difficult when your income is not stable or spending is consistent. You know you are planning a trip to Dharamshala, so your tech budgeting needs to be done accordingly. Can I cut back on a premium subscription to Spotify for three months and dedicate that money to renting a bike instead? Understand that your income or spending varies on a monthly basis. You don’t have to cut back on everything; it’s all about priorities in life.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘444470064056909’);

fbq(‘track’, ‘PageView’);

.

Why Do Different Stocks Have Different Price-to-sales Multiples?

In an environment of rising inflation and interest rates, most new-age stocks are struggling. In recent times, backed by expectations of a bright future, these stocks were being priced aggressively, especially when seen on traditional valuation metrics. Most of these companies are loss-making even at the operating level. Not surprisingly, price-to-sales (P/S) is the most commonly used valuation metric to evaluate them.

The P/S multiple shrinkage has been conspicuous but new-age companies are still enjoying a meaningful premium. For example, today, Zomato is trading at P/S of about 22.6x versus 34x in September 2021. To provide some context, Mindtree and ABB (comparable market capitalization) have P/S of 5.1x and 6.8x. Stocks with high P/S multiples are found mostly in sectors like technology and allied sectors, clean energy, new-age retail, etc.

So, what are the fundamental drivers of P/S? Further, why are stock with high P/S ratio falling more than other stocks? Here are some key factors that drive differentiation on P/S multiples amongst stocks.

Growth– As per the bedrock of corporate valuation, DCF, or discounted cash flow methodology, the higher a company’s revenue growth, the higher the value of its future cashflows. In turn, this implies a higher P/S multiple. Many new-age companies like Paytm, Nykaa, Zomato, etc. fall in the high growth category.

Long and predictable runway– A company whose revenues can be forecasted with reasonable confidence far into the future understandably attracts healthy valuations. Tata Steel has registered a revenue compound annual growth rate (CAGR) of 16%, versus 10% for TCS, in the last five years but is still getting a paltry P/S of 0.6x vs 6.6x for TCS. This, to an extent, can be explained by the cyclicality and hence the lower predictability of Tata Steel’s revenues.

Quality of revenues and growth – This can be gauged from the following.

Competitive advantages: A company must have an edge somewhere in order to consistently offer its products and services at a price at which it makes healthy return ratios. This edge can be in the form of a strong and difficult-to-replicate distribution channel, cost advantage, or brand strength.

Network effect: This effect kicks in beautifully as a network of consumers grows. These products or services do not require much incremental cost once research, development, and initial marketing costs have been incurred. Network effect ensures that competing products/services, even though more superior, are not able to mount a challenge. Microsoft’s operating system in the 1980s and Facebook in the 2010s are famous examples. None of the two firms were original innovators nor were they providing the best-in-class user experience. However, nudged by the network effect even critics, dissatisfied users, and fans of competitive services were increasingly channelled into using Microsoft’s operating systems and Facebook’s social media platform.

Stickiness of customers: Revenue with quasi-annuity characteristics does attract better P/S multiples. If customers for some reason — technical, logistics, cost — do not switch to competition easily, the intrinsic value of the company can be high even with a relatively flattish growth.

On the other hand, high customer churn bumps up the cost of revenues (since subscriber acquisition cost has to be incurred again), thus hurting the company’s intrinsic value.

Entry barriers: If others can start the same business and offer the same products and services at the same price point as the incumbent, then that firm will witness a dent in its growth, profitability, and return ratios. That’s why entry barriers play an important role in the evaluation of a company.

Asset turnover: A company that is efficient at generating revenues out of its assets, commands high P/S. This is a measure of the company’s capital intensity and is one of the fundamental reasons why Bharti Airtel is getting a P/S multiple of 3.8x while HUL enjoys a P/S of 9.7x. Bharti Airtel has an asset turnover ratio of 0.3x versus HUL’s 1.2x.

EBITDA Margin: This factor, apart from asset turnover, is a basic indicator of a company’s return ratios. EBITDA margin indicates the part of the revenue that goes into free cashflows, the building blocks of a company’s intrinsic value.

As can be seen, typically high P/S companies get a large chunk of their intrinsic value from cashflows predicted far out into the future. Now, the cost of capital at which these cashflows are discounted are mounting with rising policy interest rates. As a result, these companies are witnessing a sharper erosion in their intrinsic values versus companies with lower P/S in general.

Vipul Prasad, founder & CEO at Magadh Capital LLP.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

.

Find And Cancel Unwanted Subscriptions

Select’s editorial team works independently to review financial products and write articles we think our readers will find useful. We earn a commission from affiliate partners on many offers, but not all offers on Select are from affiliate partners.Netflix, Amazon Prime, Spotify, Instacart Express, HBO Max, Apple Music, iCloud, cable, etc. — the list of subscriptions people have can go on and on. It’s often easy to forget about the many subscriptions you signed up for and, over time, ones that you may have slowly stopped using. Unfortunately just because they aren’t being used doesn’t mean you aren’t still paying for the service.Parsing through your bank accounts to find those unused subscriptions and cancel them can be very time consuming and draining. TrueBill, however, seeks to remove some of that hassle. It’s an app and an online platform that syncs to your accounts to find subscriptions you’ve been paying for. In addition to that, the app also offers a bill negotiation service so you can lower the costs of things you have to pay for each month.Below, Select breaks down what you need to know about the TrueBill app, including each of its features, how to get started and a few other important details you should know about if you’re interested in trying the service.Subscribe to the Select Newsletter!Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.TrueBill reviewTruebillOn Truebill’s secure site

- CostFree, with option to upgrade to Truebill Premium Service for fee of $3 to $12 per month; bill negotiation costs between 30% to 60% of the 12-month savings achieved as a result of the negotiation

- Standout featuresEasily cancel unwanted subscriptions, track your spending and credit score, automate savings and get help lowering bills

- Categorizes your expensesYes, Truebill instantly identifies your top spending categories

- Links to accountsYes, bank and credit cards

- AvailabilityOffered in both the App Store (for iOS) and on Google Play (for Android), as well as online

- Security featuresTruebill accesses users’ transaction data via an encrypted token, uses Plaid API so user credentials are never stored, provides bank-level 256-bit encryption and hosts servers on secure Amazon Web Services (AWS), which is used by the Department of Defense, NASA and the Financial Industry Regulatory Authority (FINRA)

Pros

- Negotiates cell phone and cable bills, plus helps you get refunds for some bank fees

- Free version available

- Syncs to your bank accounts and credit cards

- Instantly finds and tracks your subscriptions

- Website says 80% of people save money by using Truebill to find and cancel unwanted subscriptions

- Provides breakdown of user spending and notifies of upcoming charges and low balance alerts

- Helps users create a budget

- Users can see their Experian VantageScore 3.0 credit score and get access to their credit report

- Provides an interest-free pay advance up to $100 directly to qualifying users’ checking accounts

- Users can set goals, save money with autopilot Smart Savings feature

- Concierge service available to identify bills to be lowered and, for a fee, Truebill will negotiate on users’ behalf for the best rates (non-refundable negotiation fee is anywhere from 30% to 60% of the 12-month savings achieved as a result of the negotiation)

- Truebill Premium Service features include free access to Smart Savings feature, unlimited budgeting categories, custom spend categories, real-time account balance updates, premium chat, subscription cancellation concierge, “Truebill Offers” and educational material

- Coming soon: Users can track their net worth

- High Trustscore rating of 4.3/5 stars (from 392 reviews)

Cons

- Costs between $3 and $12 per month to upgrade to Truebill Premium Service

- Non-refundable negotiation fee anywhere from 30% to 60% of the 12-month savings achieved as a result of Truebill’s bill negotiation on users’ behalf

- Less than 10 Better Business Bureau reviews

- Does not negotiate internet, landline phones, cable/phone/internet bundles, alarm and security systems, satellite radio/TV or electric bills

Features and how they workOne of the main features TrueBill offers is the ability to find and cancel subscriptions you no longer use. To do this, TrueBill links to your bank accounts and analyzes your transactions for subscriptions. Once it finds subscriptions, you can choose which ones you want to keep and which ones you want to cancel.Another service TrueBill provides is bill negotiation. To use this feature, you’ll need to take a photo of your bill — like your phone bill or or cable bill — and upload it to the app or website. TrueBill’s team will then look for ways you can receive additional discounts on your bill.And for those instances where you wind up getting charged an overdraft fee for accidentally overspending or a maintenance fee for falling below your bank’s required minimum balance, TrueBill will request a refund for you. Keep in mind that it isn’t guaranteed that the refund will be granted but it’s always worth a shot — especially when you don’t have to go through the hassle to do it yourself.The app can also help you track your spending and save money on autopilot. To use these services, you’ll need to make sure your bank accounts are connected to the app. It’ll categorize your transactions, which can make it easier for you to see where your spending is highest (and lowest). From there, you can decide how much money you want to budget for each of your spending categories, and the app will alert you if you’re nearing your spending limit in any of the categories.As for the savings feature, you’ll need to create a savings goal in the app and from there, TrueBill will use your spending habits to determine how much money to save and when to save it. This way, you’ll still avoid accidental overdrafts. And if you begin using the savings feature but decide you want a more hands-on approach to stashing your cash, you can always pause this feature. You can also edit your goal or withdraw your money at any time and your savings are FDIC-insured. However, you may want to consider moving your funds into high-yield savings account, like the Marcus by Goldman Sachs High Yield Online Savings, where you’ll earn interest on your money.How to get startedThere are many features you can use through TrueBill but the first step before you can explore any of them is to create an account. You can do this by downloading the TrueBill app and inputting your name, email address and a password of your choosing.FeesThe TrueBill app is free to download, but you’ll have to pay for a premium membership to use some of its features. The app actually lets users decide for themselves how much they want to pay for the premium subscription — the amount can be anywhere from $3 – $12 a month with the option to be billed annually if you choose to pay $3 a month or $4 a month.With the premium version, you’ll have access to the ability to sync your bank accounts to the app, subscription cancellation, auto savings, customizable savings categories and unlimited budgets, to name a few.The bill negotiation feature is free to use if the TrueBill team isn’t able to successfully negotiate lower prices for you. If they are able to get you some savings on your bill, though, they’ll charge a percentage of what you can expect to save from your first year. However, you can choose how what percentage they charge (anywhere from 30% to 60%) while you submit your negotiation request.There are other subscription trackers out there that offer similar services, but different fees, compared to TrueBill, like AskTrim.com and PocketGuard. Their offerings and fee structure could potentially fit your needs better.Bottom lineIf you think you have a number of subscriptions or bills that are sucking up your money each month, TrueBill may offer an affordable way to lower some of those costs. It’s not exactly surprising that such an app charges for premium features but what stands out about TrueBill is the user’s ability to choose how much they pay for premium membership and how much of a cut the app receives for successfully negotiating down bills. This can make it feel more affordable to more users.However, if you feel comfortable calling up your banks and other service providers for your bills and negotiating lower payments on your own, then it might not make sense for you to potentially pay for TrueBill to do it for you.Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party. .

3 Marriott Credit Cards Offering Free Nights, up to 100,000 Points

Select’s editorial team works independently to review financial products and write articles we think our readers will find useful. We earn a commission from affiliate partners on many offers, but not all offers on Select are from affiliate partners.Subscribe to the Select Newsletter!Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.Marriott’s new credit card welcome bonusesHotel co-branded rewards cards provide an easy way for any type of traveler to earn points to use for free stays. Whether you’re a road warrior for work or you only plan to stay somewhere twice a year, the welcome bonuses from these three cards can help save you hundreds, or even thousands, of dollars in hotel costs. And with Marriott Bonvoy’s robust portfolio of more than 7,000 hotels spanning 30 brands across 131 countries, you’ll be hard-pressed to find somewhere without a location to cash in your hotel rewards.Here’s a look at the welcome bonuses and unique benefits of each Marriott Bonvoy credit card:Marriott Bonvoy Boundless® Credit CardThe Marriott Bonvoy Boundless® Credit Card is now offering the opportunity to earn three free nights after spending $3,000 within the first three months of card membership. Note that the three free nights represent a value of 150,000 Marriott Bonvoy points, with each night being redeemable for a stay of up to 50,000 points per night.Cardholders will also be able to earn the following by spending with the card:

- Up to 17X points per dollar at participating Marriott Bonvoy properties—that’s 6X points per dollar for using your card, 10X points per dollar for bring a member of Marriott Bonvoy® and 1X points per dollar for your included Silver Elite Status

- 3X points per dollar on the first $6,000 you spend each year in combined purchases on dining and at grocery stores and gas stations

- 2X points per dollar on other purchases, travel-related or otherwise

Cardmembers will also earn one elite night credit for every $5,000 spent, as well as a free night certificate, worth up to 35,000 points, each year following your account anniversary. You’ll also score automatic Silver Elite status with Marriott Bonvoy and be eligible to receive 15 Elite Night Credits each calendar year.This card is a great fit for someone who travels a few times per year and doesn’t want to pay a hefty annual fee. There is a $95 annual fee, while other benefits include trip delay insurance, baggage delay insurance, lost luggage and trip delay reimbursement, purchase protection, complimentary Visa Concierge service, no foreign transaction fees and access to complimentary premium Wi-Fi at participating Marriott Bonvoy properties. Points also won’t expire if you keep your account active by making purchases every 24 months.Marriott Bonvoy Boundless® Credit Card

- RewardsEarn 3X Bonvoy points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining; 1 Elite Night Credit towards Elite Status for every $5,000 spent; up to 17X total points for every $1 spent at hotels participating in Marriott Bonvoy®, and 2X points for every $1 spent on all other purchases

- Welcome bonusEarn 3 Free Nights (each night valued up to 50,000 points) after qualifying purchases

- Annual fee

- Intro APR

- Regular APR16.24% to 23.24% variable on purchases and balance transfers

- Balance transfer feeEither $5 or 5% of the amount of each transfer, whichever is greater

- Foreign transaction fee

- Credit needed

Marriott Bonvoy Brilliant® American Express® CardThe Marriott Bonvoy Brilliant® American Express® Card is a step up from the Boundless card in terms of benefits and features. After being approved, you’ll have the opportunity to earn 100,000 Marriott Bonvoy points and one Free Night Award, redeemable up to 85,000 points, after spending $5,000 in eligible purchases within the first three months of account opening.Cardholders will also be able to earn:

- 6X points per dollar at participating Marriott Bonvoy properties

- 3X points per dollar on dining, takeout and delivery at U.S. restaurants, as well as in-flight meals booked directly with the airline

- 2X points per dollar for all other purchases

The card is loaded with travel benefits, including the following perks:

- Automatic Gold Elite status and premium Wi-Fi access

- A $300 Marriott Bonvoy statement credit each year of membership

- 1 Free Night Award each year following your card renewal month, redeemable for a stay of up to 50,000 points

- A $100 Marriott Bonvoy property credit to use toward qualifying charges when you book a stay of at least two night at participating St. Regis or Ritz-Carlton properties

- 15 Elite Night Credits to use toward achieving your next level of elite status

- Priority Pass Select membership, allowing access to more than 1,200 lounges in over 130 countries

- A statement credit to use for TSA PreCheck or Global Entry enrollment

- *Baggage, trip cancellation and interruption insurance; trip delay insurance; rental car loss and damage insurance; and access to the Premium Global Assist Hotline.

While this card does have a $450 annual fee (see rates and fees), if you fully take advantage of its many benefits and earn the welcome bonus responsibly, the perks can definitely outweigh the price.Marriott Bonvoy Brilliant™ American Express® CardOn the American Express secure site

- Rewards6X Marriott Bonvoy points for each dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3X points at U.S. restaurants and on flights booked directly with airlines, 2X points on all other eligible purchases

- Welcome bonusEarn 100,000 Marriott Bonvoy bonus points and 1 Free Night Award after you use your new card to make $5,000 in purchases within the first 3 months.

- Annual Fee

- Intro APR

- Regular APR

- Balance transfer fee

- Foreign transaction fee

- Credit needed

Marriott Bonvoy Bold® Credit CardWhile the Marriott Bonvoy Bold® Credit Card is the lowest-tier card on our list, it can still be valuable for those who don’t travel as frequently. The card is currently offering a welcome bonus of 30,000 Marriott Bonus points after you spend $1,000 within the first three months of account opening.Cardholders will be able to earn the following:

- Up to 14X points per dollar at participating Marriott Bonvoy hotels — that’s 3X points for using your card, 10X points for being a member of Marriott Bonvoy and 1X points per dollar for your included Silver Elite Status

- 2X points per dollar on travel-related purchases

- 1X point per dollar spent everywhere else

This card also gives you 15 Elite Night Credits per year, which will qualify you for Silver Elite Status. It also comes with many of the same travel and protection benefits as the Marriott Bonvoy Boundless card, such as travel insurance, baggage delay insurance, trip delay and lost luggage reimbursement and no foreign transaction fees — all without an annual fee.Marriott Bonvoy Bold® Credit Card

- RewardsEarn up to 14X total points for every $1 spent at over 7,000 participating Marriott Bonvoy® hotels, 2X points on other travel purchases (from airfare to taxis and trains) and 1X point on all other purchases

- Welcome bonusEarn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening

- Annual fee

- Intro APR

- Regular APR16.24% to 23.24% variable on purchases and balance transfers

- Balance transfer feeEither $5 or 5% of the amount of each transfer, whichever is greater

- Foreign transaction fee

- Credit needed

How to maximize Marriott Bonvoy pointsAs you start to rack up Marriott Bonvoy points, it’s important to keep a few things in mind to ensure you’re getting the biggest bang for your buck.Stretch the value of each Marriott Bonvoy pointDo your best to redeem your points for the highest cost per point available. Generally, Marriott Bonvoy points are worth roughly 0.8 cents per point, according to several travel rewards websites, so as you’re searching for hotels, keep the following formula in mind:(The cost of the hotel stay including taxes and fees) / (the number of points) = the cost per point.If you can get this value to 0.8 cents per point or above, it’s considered to be a worthwhile redemption.For example, in May 2022 you can use around 97,000 to 115,000 Marriott points per night to stay at the The Ritz-Carlton Maldives, Fari Islands, a luxurious resort in the Maldives with overwater villas. However, cash prices during this same timeframe are anywhere from $1,700 to $4,000 per night. This would give you well over 1 cent per point in value and would make for a fantastic redemption.Redeem five nights for the price of fourKeep in mind that as you redeem your rewards, you can get one night free if you pay for a stay of at least five nights completely with Marriott Bonvoy points. For example, if a stay at your desired Marriott hotel goes for 20,000 points per night, a five-night stay will only end up costing you 80,000 points, giving you a 20% boost in the value of your points.Put those points to useRemember that all points and miles earned through airline, hotel and travel brands are susceptible to devaluation. This happens when the brand itself requires more points for the same booking, which results in your points suddenly becoming less valuable, and often without any notice. To fight back against this, it’s best to try and use your hard-earned points and miles regularly. Whether you’re taking a trip for yourself or booking a hotel room for a friend, it’s not wise to hold onto a large sum of points for a long period of time since their value could drop at any given time.Bottom lineThese three updated Marriott Bonvoy credit card welcome bonuses are among the most valuable available right now. Before you apply, it may be advantageous to check your credit score, as all of the cards mentioned above require at least a good credit score in order for you to be approved.Should you decide to apply, be sure you have a plan that lets you earn the welcome bonus responsibly. It’s never advised to make more purchases on a credit card just to earn a welcome bonus. If you need help earning one, consider talking to friends or family about making some purchases on their behalf and then getting reimbursed.Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.For rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, click here.*Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/ benefitsguide for more details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by thirdparty service providers. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party. .