What is a Credit Score

A credit score, also known as the CIBIL score is a three-digit number ranging from 300 to 900, with 900 being the highest. It determines a borrower’s general creditworthiness, as well as their ability to repay a loan. The credit score of a borrower is based on a variety of factors, including their existing debt, the period of their credit history, repayment patterns, and the number of credit inquiries, among others. It is a simple process to check your credit score and get the report since everything can be done online. Equifax, TransUnion (formerly known as CIBIL), Experian, and CRIF Highmark are the credit bureaus that assess your credit history and create a report based on your financial habits. This report contains information such as your credit score, personal information, transaction information, debts, and so on. Regular monitoring of your credit score will help you understand your creditworthiness. If you have a high credit score, you will be eligible for various benefits, such as better interest rates and longer tenures on loans, and higher credit card limits. You maycheck your CIBIL score by PAN card anytime by visiting any of the credit bureau’s home pages. How to Check Credit Score Online Using PAN Card Here’s a step-by-step guide to follow to check CIBIL score by PAN card.

- Visit CIBIL’s official website.

- Log in to the page by entering your information.

- After logging in, you will see a ‘Get CIBIL Score’ option on your right top. Click on it.

- Fill up your personal information and establish a password. Log in with that password to the CIBIL website.

- As your ID type, choose ‘Income Tax ID (PAN).’

- Next, enter your PAN number.

- Then click on the ‘Verify Your Identity’ option. As part of the verification procedure, you must answer a few questions.

- After that, log in to your account using the OTP you got by SMS and email.

- Fill out the form carefully and submit it.

- Your CIBIL score will be displayed on the screen.

- You may also examine your credit summary, score history, and other information by subscribing to monthly, semi-annual, or annual premium plans.

Importance of PAN Card to Check Credit Score A PAN card is required to check credit score for the reasons stated below:

- All of your bank accounts and financial data are linked to your PAN card.

- The sole purposes for which your PAN card number will be utilised are to check your credit history and confirm your identification.

- PAN card is a ubiquitous document that may be used to identify a person by utilising the unique PAN card number.

- Your PAN card number is specific to you, which makes it easier for bureaus to find and then access your credit-related data.

- Your PAN card and Aadhaar card must be linked to your financial accounts as per the law and regulations. In order to identify people who have loans from several banks, financial institutions can identify them by verifying the CIBIL score with a PAN card.

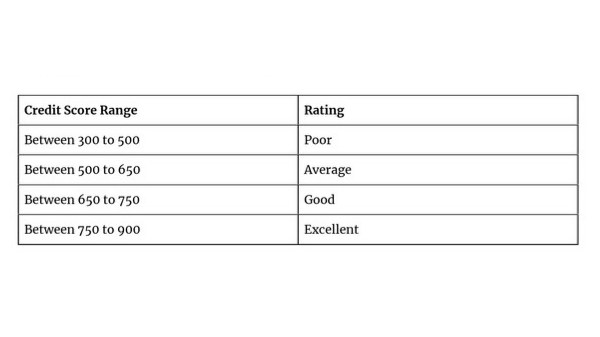

What is a Good Credit Score When you apply for a loan, your CIBIL report is used by lenders to assess your capacity to repay a loan based on your past credit behaviour. Low CIBIL scores can lead to a rejected loan application by financial institutions, but good CIBIL ratings might result in rapid loan approvals for borrowers. A score of 750 or above is suitable for loans with low-interest rates, while a score of 650 or higher (may vary across lenders) is often considered good credit. Here are some more details about credit scores.  View Full ImageDetails about credit scores. Concluding Comments The significance of CIBIL score has increased over the past few years. Even if you do not currently need a loan, it is always essential to keep your CIBIL score in good standing. This is done so that if you ever need a loan, having a high CIBIL score will make it easier for you to get one. Before processing a loan request, financial organisations now carefully review a borrower’s credit history. A good CIBIL score has several benefits, one of which is that it makes it simpler to get any kind of loan at a low-interest rate. So, you should oftencheck your credit score and try to maintain a good score. FAQs on How to Check CIBIL Score by Pan Card Hassle-Free How is the credit score measured? A credit score is calculated and issued using the information and facts included in your credit report. Many indicators are considered, including payment history (35%), amount owing (30%), length of history (15%), new credit (10%), and categories of credit utilised (10%). Is having a PAN card mandatory to check credit score? No. You can check the credit score without using a PAN card by providing information such as your name, ID proof, date of birth, and mobile number. What impact will the PAN modification have on my CIBIL Score? If you have misplaced your PAN card or it has been stolen, you can apply for a replacement of your PAN card. Your PAN number will remain unchanged, hence it has no effect on your CIBIL score. If you have two PAN cards, you must give up one of them. How can I improve my CIBIL score? You can raise your CIBIL score by paying off outstanding debts, settling bills in a timely manner, maintaining a good credit history, and so on. Disclaimer: This article is a paid publication and does not have journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content(s) of the article/advertisement and/or view(s) expressed herein. Hindustan Times shall not in any manner, be responsible and/or liable in any manner whatsoever for all that is stated in the article and/or also with regard to the view(s), opinion(s), announcement(s), declaration(s), affirmation(s) etc., stated/featured in the same.

View Full ImageDetails about credit scores. Concluding Comments The significance of CIBIL score has increased over the past few years. Even if you do not currently need a loan, it is always essential to keep your CIBIL score in good standing. This is done so that if you ever need a loan, having a high CIBIL score will make it easier for you to get one. Before processing a loan request, financial organisations now carefully review a borrower’s credit history. A good CIBIL score has several benefits, one of which is that it makes it simpler to get any kind of loan at a low-interest rate. So, you should oftencheck your credit score and try to maintain a good score. FAQs on How to Check CIBIL Score by Pan Card Hassle-Free How is the credit score measured? A credit score is calculated and issued using the information and facts included in your credit report. Many indicators are considered, including payment history (35%), amount owing (30%), length of history (15%), new credit (10%), and categories of credit utilised (10%). Is having a PAN card mandatory to check credit score? No. You can check the credit score without using a PAN card by providing information such as your name, ID proof, date of birth, and mobile number. What impact will the PAN modification have on my CIBIL Score? If you have misplaced your PAN card or it has been stolen, you can apply for a replacement of your PAN card. Your PAN number will remain unchanged, hence it has no effect on your CIBIL score. If you have two PAN cards, you must give up one of them. How can I improve my CIBIL score? You can raise your CIBIL score by paying off outstanding debts, settling bills in a timely manner, maintaining a good credit history, and so on. Disclaimer: This article is a paid publication and does not have journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content(s) of the article/advertisement and/or view(s) expressed herein. Hindustan Times shall not in any manner, be responsible and/or liable in any manner whatsoever for all that is stated in the article and/or also with regard to the view(s), opinion(s), announcement(s), declaration(s), affirmation(s) etc., stated/featured in the same.

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

More

Less

.