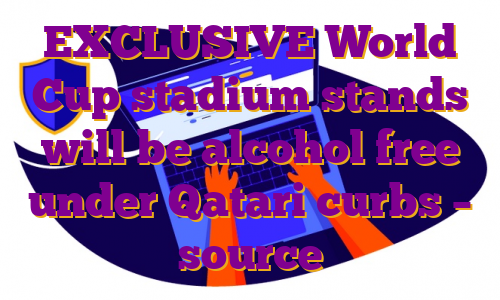

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Siemens Energy launches $4.3 billion bid for remaining Siemens Gamesa stake

A model of a wind turbine with the Siemens Gamesa logo is displayed outside the annual general shareholders meeting in Zamudio, Spain, June 20, 2017. REUTERS/Vincent WestRegister now for FREE unlimited access to Reuters.com

- Siemens Energy bids 18.05 euros/share for 33% stake

- Bid comes after operational problems at Siemens Gamesa

- Deal could yield cost synergies of up to 300 mln eur

FRANKFURT, May 21 (Reuters) – Siemens Energy (ENR1n.DE) on Saturday launched a 4.05 billion euro ($4.28 billion) bid for the remaining shares in struggling wind turbine unit Siemens Gamesa (SGREN.MC), hoping to remove a complex ownership structure that has weighed on its shares.Siemens Energy said the 18.05 euros per share bid constitutes a premium of 27.7% over the last unaffected closing share price of Spanish-listed Siemens Gamesa of 14.13 euros on May 17. It is a 7.8% premium to Friday’s closing price.Siemens Energy has faced mounting shareholder pressure to seek control of Siemens Gamesa (SGRE), in which it owns 67%, a stake it inherited as part of a spin-off from former parent Siemens (SIEGn.DE).Register now for FREE unlimited access to Reuters.comThat stake has given Siemens Energy little influence to deal with product delays and operational problems at Siemens Gamesa. The group has issued three profit warnings in less than a year.”It is critical that the deteriorating situation at SGRE is being stopped as soon as possible, and the value-creating repositioning starts quickly,” said Joe Kaeser, Siemens Energy’s supervisory board chairman.This year, sources told Reuters that Siemens Energy was exploring options to acquire the remaining stake in Siemens Gamesa and a deal could materialise by summer. read more Siemens Energy said it plans to finance up to 2.5 billion euros of the transaction with equity or equity-like instruments, adding a first step could be a capital increase without subscription rights.The remainder would be financed with debt as well as cash on hand, Siemens Energy said, adding it aimed to delist Siemens Gamesa. Spanish stock market regulations allow that once ownership of 75% is reached.Full integration of Siemens Gamesa will simplify Siemens Energy’s structure and provide a more coherent business model that caters to legacy energy assets like coal, transition technologies such as gas, and renewable power sources.”This transaction comes at a time of major changes affecting global energy,” Siemens Energy Chief Executive Christian Bruch said. “Our conviction is that the current geopolitical developments will not lead to a setback to the energy transition.”Siemens Energy said the deal would lead to cost synergies of up to 300 million euros annually within three years of the full integration, mainly due to more favourable supply chain management, combined administration and joint R&D.The deal should close in the second half and is expected to achieve revenue synergies of a mid triple-digit million amount by 2030, the group said.($1 = 0.9470 euros)Register now for FREE unlimited access to Reuters.comReporting by Christoph Steitz and Ludwig Burger; Editing by Nick Zieminski, Daniel Wallis and David GregorioOur Standards: The Thomson Reuters Trust Principles. .

Insurer LIC opens subscriptions for $2.7 bln IPO, India’s largest

MUMBAI, May 4 (Reuters) – State-owned Life Insurance Corp’s (LIC) $2.7 billion IPO, India’s largest, opened to subscriptions from retail and other investors on Wednesday following strong demand from anchor investors led by domestic mutual funds.The Indian government expects to raise the sum, just a third of its original target, from selling a 3.5% stake in the country’s top insurance company, giving it an initial value of $78.52 billion. read more The subscription, set to close on May 9, will offer a discount to employees and retail investors of 45 rupees per share. LIC policyholders will be offered a discount of 60 rupees per share.Register now for FREE unlimited access to Reuters.comThe price range for the issue has been set between 902 rupees and 949 rupees per share.After a reservation for employees and policyholders, the remaining shares will be allocated in a ratio of 50% to qualified institutional buyers, 35% to retail investors and 15% for non-institutional investors.The final IPO price will be determined after the subscription closes.LIC shares were trading in the “grey” market at a premium of 95 rupees, at around 1,044 rupees apiece.To drum up demand from retail investors, in addition to heavy advertising in local newspapers, some 1.2 million field agents were dispatched across India to woo many of LIC’s more than 250 million policyholders to buy the shares.Policyholders were also flooded with text messages earlier this year recommending they open an electronic stock holding account early so they can take part in the IPO. read more The 59.3 million shares set aside for anchor investors were subscribed at 949 rupees apiece. Norwegian wealth fund Norges Bank Investment Management and the government of Singapore joined the anchor book, along with several domestic mutual funds. read more The government had initially wanted to list LIC in the financial year that ended March 31 but chose to delay the sale after Russia’s invasion of Ukraine and the U.S. Federal Reserve’s interest rate tightening triggered a market rout.The 66-year-old company dominates India’s insurance sector, with more than 280 million policies. It was the fifth-biggest global insurer in terms of insurance premium collection in 2020, the latest year for which statistics are available.Register now for FREE unlimited access to Reuters.comReporting by Nupur Anand Editing by Jamie Freed and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

In it for the long haul: Qantas bets on non-stop Sydney-London flights with Airbus order

- Orders 12 Airbus ultra-long haul A350-1000 planes

- Commercial direct Sydney-London flight to start late in 2025

- 20-hour trip to be world’s longest non-stop flight

- Orders 20 A321XLRs and 20 A220s to renew domestic fleet

- Overall Airbus deal could be worth more than $4 bln – Barrenjoey

SYDNEY, May 2 (Reuters) – Qantas Airways (QAN.AX) will fly non-stop from Sydney to London after ordering a dozen special Airbus (AIR.PA) jets, charging higher fares in a multi-billion dollar bet that fliers will pay a premium to save four hours on the popular route.To be launched late in 2025, the flights will use A350-1000 planes, specially configured with extra premium seating and reduced overall capacity, to ferry up to 238 passengers in a 20-hour trip – the world’s longest direct commercial flight.Announcing plans for the service on Monday, the loss-making carrier said a strong recovery in the domestic market and signs of an improvement in international flying after the worst of the COVID-19 pandemic had given it the confidence to make a major investment on its future. Qantas forecasts a return to profit in the financial year starting this July.Register now for FREE unlimited access to Reuters.comThe order from the European aircraft maker also includes 40 narrowbody A321XLR and A220 jets to start the replacement of Qantas’ ageing domestic fleet, with deliveries spread over a decade. The airline did not disclose the value of the Airbus deal, but analysts at Barrenjoey estimated in a client note it would cost at least A$6 billion ($4.23 billion).”Since the start of the calendar year, we have seen huge increases in demand,” Qantas Chief Executive Alan Joyce told reporters at Sydney Airport, where an Airbus A350-1000 test plane flown from France emblazoned with the Qantas logo and “Our Spirit flies further” was parked in a hangar as a backdrop for the announcement.Qantas shares surged as much as 5.5% on Monday to the highest level since November after it also said debt levels had fallen to pre-COVID levels faster than the market’s expectations.The A350-1000 order was the culmination of a challenge called “Project Sunrise” set for Airbus and its rival Boeing Co (BA.N) in 2017 to create aircraft capable of the record-breaking flights.Airbus was selected as the preferred supplier in late 2019, but Qantas delayed placing an order for two years due to financial challenges during the COVID pandemic.Airbus Chief Commercial Officer Christian Scherer said the aircraft to be used on the Sydney-London flights would offer more fuel storage than A350-1000s currently in operation with other airlines.The Qantas planes will carry passengers across four classes and will have around 100 fewer seats than rivals British Airways (ICAG.L) and Cathay Pacific Airways Ltd (0293.HK) use on their A350-1000s. The Australian carrier will dedicate more than 40% of the jets’ cabins to premium seating.CEO Joyce said demand for non-stop flights had grown since the pandemic, when complex travel rules were put in place. Rising fuel costs could be recovered through higher fares, he said, as the airline had done previously on its non-stop Perth-London flights.In a market update, Qantas said while it expects an underlying operating loss for the financial year ending June 30, 2022, the second half would benefit from improved domestic and international demand, with free cash flow seen rising further in the current quarter.Barrenjoey analysts forecast Qantas could achieve a 20% revenue premium on the ultra-long haul flights, which Joyce said will also go to New York from late 2025 and possible future destinations like Paris, Chicago and Rio de Janeiro.Qantas estimated Project Sunrise would have an internal rate of return of around 15%.($1 = 1.4180 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Jamie Freed; Additional reporting by Sameer Manekar in Bengaluru; Editing by Diane Craft, Sam Holmes and Kenneth MaxwellOur Standards: The Thomson Reuters Trust Principles. .

Twitter set to accept Musk’s $43 billion offer

Elon Musk’s twitter account is seen through the Twitter logo in this illustration taken, April 25, 2022. REUTERS/Dado Ruvic/Illustration Register now for FREE unlimited access to Reuters.comNEW YORK, April 25 (Reuters) – Twitter Inc (TWTR.N) is poised to agree a sale to Elon Musk for around $43 billion in cash, the price the CEO of Tesla has called his “best and final” offer for the social media company, people familiar with the matter said.Twitter may announce the $54.20-per-share deal later on Monday once its board has met to recommend the transaction to Twitter shareholders, the sources said, adding it was still possible the deal could collapse at the last minute.Musk, the world’s richest person according to Forbes, is negotiating to buy Twitter in a personal capacity and Tesla (TSLA.O) is not involved in the deal.Register now for FREE unlimited access to Reuters.comTwitter has not been able to secure so far a ‘go-shop’ provision under its agreement with Musk that would allow it to solicit other bids once the deal is signed, the sources said. Still, Twitter would be allowed to accept an offer from another party by paying Musk a break-up fee, the sources added.The sources requested anonymity because the matter is confidential. Twitter and Musk did not immediately respond to requests for comment.Twitter shares were up 4.5% in pre-market trading in New York at $51.15.Musk, a prolific Twitter user, has said it needs to be taken private to grow and become a genuine platform for free speech.The 50-year-old entrepreneur, who is also CEO of rocket developer SpaceX, has said he wants to combat trolls on Twitter and proposed changes to the Twitter Blue premium subscription service, including slashing its price and banning advertising.The billionaire, a vocal advocate of cryptocurrencies, has also suggested adding dogecoin as a payment option on Twitter.He has said Twitter’s current leadership team is incapable of getting the company’s stock to his offer price on its own, but stopped short of saying it needs to be replaced.”The company will neither thrive nor serve this societal imperative in its current form,” Musk said in his offer letter last week.Up to the point Musk disclosed a stake in Twitter in April, the company’s shares had fallen about 10% since Parag Agrawal took over as CEO from founder Jack Dorsey in late November.The deal, if it happens, would come just four days after Musk unveiled a financing package to back the acquisition.This led Twitter’s board to take his offer more seriously and many shareholders to ask the company not to let the opportunity for a deal slip away, Reuters reported on Sunday. Before Musk revealed the financing package, Twitter’s board was expected to reject the bid, sources had said. read more The sale would represent an admission by Twitter that Agrawal is not making enough traction in making the company more profitable, despite being on track to meet ambitious financial goals the company set for 2023. Twitter’s shares were trading higher than Musk’s offer price as recently as November.Musk unveiled his intention to buy Twitter on April 14 and take it private via a financing package comprised of equity and debt. Wall Street’s biggest lenders, except those advising Twitter, have all committed to provide debt financing.Musk’s negotiating tactics – making one offer and sticking with it – resembles how another billionaire, Warren Buffett, negotiates acquisitions. Musk did not provide any financing details when he first disclosed his offer for Twitter, making the market skeptical about its prospects.Register now for FREE unlimited access to Reuters.comReporting by Greg Roumeliotis in New York, additional reporting by Krystal Hu;

Editing by Mark PotterOur Standards: The Thomson Reuters Trust Principles. .