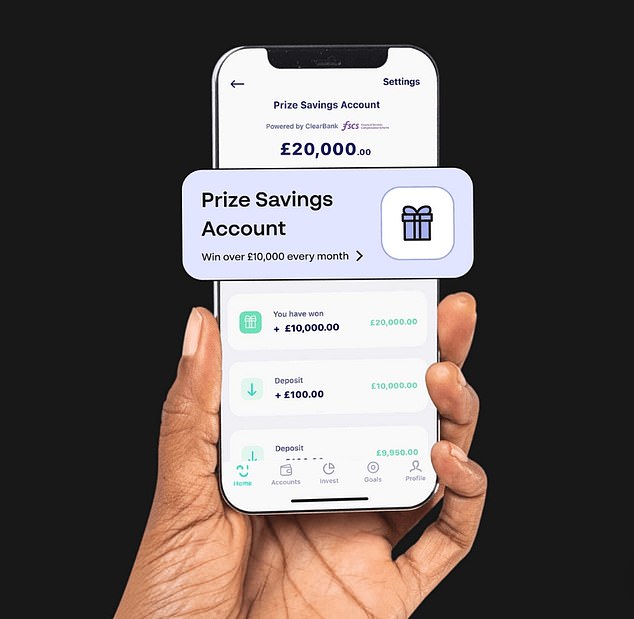

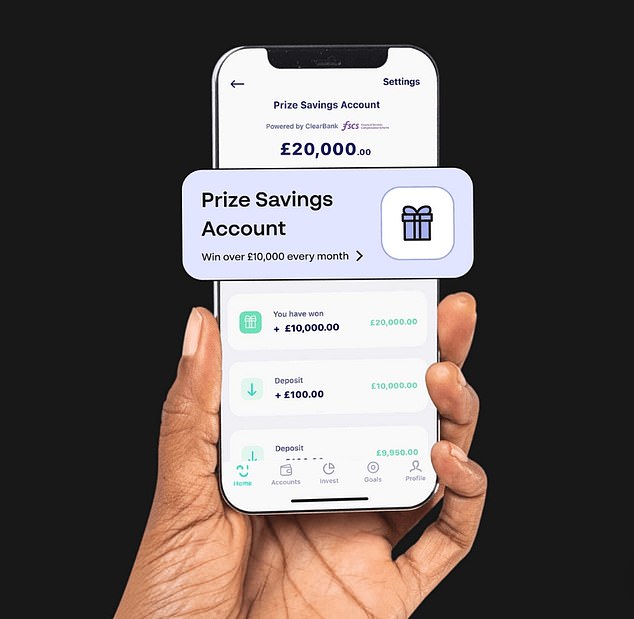

An app-based savings provider is offering its customers the chance to win monthly prizes in a similar vein to NS&I Premium Bonds.The Prize Savings Account, launched by savings and investing app, Chip, is an easy-access account giving savers the chance to win one prize of £10,000 as well as 250 smaller prizes of £10, each month.Savers will be entered into the monthly draw if they have at least £100 in their account at the end of each month.The minimum deposit into the account is £1 and the maximum amount is £85,000, with every £10 deposited counting as one entry per month.

Lottery style savings: Each month Chip randomly selects winners from all eligible entries.This means the more savers deposit, the more entries they have, up to a maximum of 8,500 entries per customer.Savers can also withdraw anytime with funds arriving in seconds, according to Chip – although in some cases it can take up to two hours.Chip is hoping its improved user experience and rapid withdrawal speed will appeal to Premium Bond holders who may be fed up with recent issues when accessing their cash.Last week, we reported how hundreds of savers were unable to access their savings accounts with NS&I due to its new online login system, three weeks after the issue was first reported.Simon Rabin, founder and chief executive of Chip pitched the new product as a genuine alternative to NS&I’s Premium Bonds.’It’s time for a more premium… Premium Bond,’ said Rabin, ‘we saw an opportunity to create a prize savings account with an amazing user experience.’NS&I Premium Bonds are a savings account you can put money into (and take out when you want), where the interest paid is decided by a monthly prize draw.’However, withdrawals sometimes take up to six days, and in December 2021 NS&I received 4,187 customer complaints that month.’What’s more, in late 2021 there was a whopping £74,452,325 in unclaimed prizes. We think when it comes to customer experience, there’s a lot of room for improvement – we think our new “Prize Savings Account” is just what you need.’Similar to Premium Bonds, Chip’s offering is a non-interest-bearing savings account provided by its partner bank, ClearBank.Any savings held in the account are protected by the Financial Services Compensation Scheme up to £85,000 per person.What is Chip?Chip is an automatic savings and investment app designed with the intention of helping its customers to save without having to think about it.Its app is available on iOS and Android and is used by over 500,000 people. In total it has more than £1billion in customer savings.Chip uses artificial intelligence technology linked to their bank account via open banking to calculate how much they can afford to save based on their spending habits.

Lottery style savings: Each month Chip randomly selects winners from all eligible entries.This means the more savers deposit, the more entries they have, up to a maximum of 8,500 entries per customer.Savers can also withdraw anytime with funds arriving in seconds, according to Chip – although in some cases it can take up to two hours.Chip is hoping its improved user experience and rapid withdrawal speed will appeal to Premium Bond holders who may be fed up with recent issues when accessing their cash.Last week, we reported how hundreds of savers were unable to access their savings accounts with NS&I due to its new online login system, three weeks after the issue was first reported.Simon Rabin, founder and chief executive of Chip pitched the new product as a genuine alternative to NS&I’s Premium Bonds.’It’s time for a more premium… Premium Bond,’ said Rabin, ‘we saw an opportunity to create a prize savings account with an amazing user experience.’NS&I Premium Bonds are a savings account you can put money into (and take out when you want), where the interest paid is decided by a monthly prize draw.’However, withdrawals sometimes take up to six days, and in December 2021 NS&I received 4,187 customer complaints that month.’What’s more, in late 2021 there was a whopping £74,452,325 in unclaimed prizes. We think when it comes to customer experience, there’s a lot of room for improvement – we think our new “Prize Savings Account” is just what you need.’Similar to Premium Bonds, Chip’s offering is a non-interest-bearing savings account provided by its partner bank, ClearBank.Any savings held in the account are protected by the Financial Services Compensation Scheme up to £85,000 per person.What is Chip?Chip is an automatic savings and investment app designed with the intention of helping its customers to save without having to think about it.Its app is available on iOS and Android and is used by over 500,000 people. In total it has more than £1billion in customer savings.Chip uses artificial intelligence technology linked to their bank account via open banking to calculate how much they can afford to save based on their spending habits.

Jackpot: Chip is offering one big grand prize each month worth £10,000. It then transfers that money from their current account to their Chip account – automatically whilst not interfering with a person’s normal day-to-day spending habits.Savers can also choose to set up a recurring payment, just like a direct debit that can be taken either weekly, fortnightly or monthly.The new account also allows savers to use both the auto-saves feature and the recurring payments to automatically deposit into the Prize Savings Account.Customers can increase or decrease the amount Chip puts aside by tweaking their saving level on the app, which determines how fast or slow they want to save.Chip can apparently adapt to a person overspending or earning irregular income and can adjust the savings amounts accordingly.It offers a host of features – it analyses your spending habits, helps set savings goals, and can automatically set a regular amount to save every time you get paid by your employer.How does its prize giving account compare?Chip may view disgruntled Premium Bond holders as its primary target. However, this will be no easy task given the amount of trust people have in the 65-year old savings product. NS&I’s draw has been running since 1956 and there are roughly 21million Premium Bond holders holding more than 118billion eligible £1 bonds between them.Chip is unable to offer the big money prizes that NS&I is, which will likely remove the magic for many.

Jackpot: Chip is offering one big grand prize each month worth £10,000. It then transfers that money from their current account to their Chip account – automatically whilst not interfering with a person’s normal day-to-day spending habits.Savers can also choose to set up a recurring payment, just like a direct debit that can be taken either weekly, fortnightly or monthly.The new account also allows savers to use both the auto-saves feature and the recurring payments to automatically deposit into the Prize Savings Account.Customers can increase or decrease the amount Chip puts aside by tweaking their saving level on the app, which determines how fast or slow they want to save.Chip can apparently adapt to a person overspending or earning irregular income and can adjust the savings amounts accordingly.It offers a host of features – it analyses your spending habits, helps set savings goals, and can automatically set a regular amount to save every time you get paid by your employer.How does its prize giving account compare?Chip may view disgruntled Premium Bond holders as its primary target. However, this will be no easy task given the amount of trust people have in the 65-year old savings product. NS&I’s draw has been running since 1956 and there are roughly 21million Premium Bond holders holding more than 118billion eligible £1 bonds between them.Chip is unable to offer the big money prizes that NS&I is, which will likely remove the magic for many.

Premium Bonds have been a popular product for UK savers for more than 65 years.Although the majority of prizes are worth £25, Premium Bond holders are always in with a distant chance of winning one of the two £1million monthly jackpot prizes. There are also ten £100,000 prizes and 19 prizes worth £50,000.In May, NS&I increased the Premium Bond underlying prize fund rate from 1 per cent to 1.4 per cent boosting the chances of its 21million savers bagging a monthly prize.It means the odds of each £1 Premium Bond number winning a prize has now changed from 34,500 to 1 to 24,500 to 1. Chip is unable to give the odds of winning just yet as its only in the first month of the account being live, although it says in future, it hopes to share this once it collects more data. However, needless to say, the more savers deposit the more entries the will have in the prize draw each month.One other factors for savers to consider is the fact that Premium Bond prizes are tax free whilst Chip’s prizes could incur tax depending on whether they exceed a person’s annual tax free allowance. Ultimately, there is no guarantee of winning anything with these prize draws. Savers looking for guaranteed returns whilst retaining access to their cash may do better to consider an interest bearing easy-access savings deal.The best easy-access savings account currently pays 2.1 per cent. On a £20,000 deposit that would mean £420 in interest over the course of a year.What other savings draws are worth considering?Halifax Savers Prize Draw Halifax current account customers can register through online banking or by visiting a local branch for its savings draw.Each month over 1,600 savings customers in the Halifax draw are randomly selected to win money – three of the prizes being worth £100,000.However, there is one barrier to overcome as they’ll need to hold £5,000 or more in savings for a whole month to be entered into the following month’s prize draw.The £5,000 can be made up of multiple pots across any Halifax savings account including cash Isas, although children’s accounts are excluded.Nationwide’s Member Prize DrawNationwide members benefit from a monthly prize draw split into 8,008 prizes, with one worth £100,000, two worth £25,000, five worth £10,000 and the rest all worth £100.Unlike, with Halifax, Nationwide members are automatically opted in, so as long as you hold a mortgage, savings account or current account with Nationwide, there is nothing to do.Nationwide currently has around 14million members eligible for the Prize Draw.Yorkshire Building Society Make Me a Saver accountThis regular savings account pays 1.65 per cent interest and instant access to savings without penalty whilst offering 10 £1,500 prizes each month.To be entered into one of the prize draws, customers need to deposit money into the account and increase the balance by at least £50 each month.The account also allows for unlimited instant withdrawals without loss of interest.A total of eleven prize draws will take place once each month between March 2022 and January 2023 with the account maturing on 31 January 2023.It’s worth noting that the account limit savers to a maximum deposit of £150 per month, meaning a total of £1,800 can be saved over 12 months.Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence. .

Premium Bonds have been a popular product for UK savers for more than 65 years.Although the majority of prizes are worth £25, Premium Bond holders are always in with a distant chance of winning one of the two £1million monthly jackpot prizes. There are also ten £100,000 prizes and 19 prizes worth £50,000.In May, NS&I increased the Premium Bond underlying prize fund rate from 1 per cent to 1.4 per cent boosting the chances of its 21million savers bagging a monthly prize.It means the odds of each £1 Premium Bond number winning a prize has now changed from 34,500 to 1 to 24,500 to 1. Chip is unable to give the odds of winning just yet as its only in the first month of the account being live, although it says in future, it hopes to share this once it collects more data. However, needless to say, the more savers deposit the more entries the will have in the prize draw each month.One other factors for savers to consider is the fact that Premium Bond prizes are tax free whilst Chip’s prizes could incur tax depending on whether they exceed a person’s annual tax free allowance. Ultimately, there is no guarantee of winning anything with these prize draws. Savers looking for guaranteed returns whilst retaining access to their cash may do better to consider an interest bearing easy-access savings deal.The best easy-access savings account currently pays 2.1 per cent. On a £20,000 deposit that would mean £420 in interest over the course of a year.What other savings draws are worth considering?Halifax Savers Prize Draw Halifax current account customers can register through online banking or by visiting a local branch for its savings draw.Each month over 1,600 savings customers in the Halifax draw are randomly selected to win money – three of the prizes being worth £100,000.However, there is one barrier to overcome as they’ll need to hold £5,000 or more in savings for a whole month to be entered into the following month’s prize draw.The £5,000 can be made up of multiple pots across any Halifax savings account including cash Isas, although children’s accounts are excluded.Nationwide’s Member Prize DrawNationwide members benefit from a monthly prize draw split into 8,008 prizes, with one worth £100,000, two worth £25,000, five worth £10,000 and the rest all worth £100.Unlike, with Halifax, Nationwide members are automatically opted in, so as long as you hold a mortgage, savings account or current account with Nationwide, there is nothing to do.Nationwide currently has around 14million members eligible for the Prize Draw.Yorkshire Building Society Make Me a Saver accountThis regular savings account pays 1.65 per cent interest and instant access to savings without penalty whilst offering 10 £1,500 prizes each month.To be entered into one of the prize draws, customers need to deposit money into the account and increase the balance by at least £50 each month.The account also allows for unlimited instant withdrawals without loss of interest.A total of eleven prize draws will take place once each month between March 2022 and January 2023 with the account maturing on 31 January 2023.It’s worth noting that the account limit savers to a maximum deposit of £150 per month, meaning a total of £1,800 can be saved over 12 months.Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence. .

The End of the EU’s Free Lunch by Hans-Werner Sinn

For many years, the European Central Bank was able to print money to purchase member states’ government debt without having to worry about causing high inflation. But now that stagflationary conditions have set in, the ECB finds itself on the horns of a dilemma.

MUNICH – Until recently, the European Central Bank could simply throw money at the eurozone’s problems. But that is no longer possible in the face of inflation, so it has now developed a new “anti-fragmentation” mechanism – the Transmission Protection Instrument (TPI) – to protect highly indebted member states in the event that their borrowing costs (sovereign-bond yields) rise much higher than those of less indebted member states. Should the need arise, the ECB will swap out low-debt member states’ bonds for those of high-debt member states in its portfolio, thereby reducing the interest-rate differential between them.

And who will decide whether there is indeed a need for such action? The ECB will – all by itself.

The TPI is problematic for many reasons, not least because interest-rate spreads are an integral part of a properly functioning capital market and federation. It is worth bearing in mind that while yield spreads refer to the nominal interest rates agreed on paper, these interest rates are not paid at all in the event of bankruptcy.

To make effective, mathematically expected interest rates the same for all countries, an efficient capital market assigns rates according to the level of country risk. If a country becomes excessively indebted, its risk of bankruptcy increases, investors demand a premium in the form of higher interest rates, and the higher rates cause the government to reduce its borrowing. The market thus automatically prevents excessive debt.

By contrast, intervening to reduce interest-rate differentials is tantamount to subsidizing highly indebted countries’ borrowing at the expense of less indebted countries, which must bear higher nominal and effective interest burdens as a result. Opposition from these countries’ taxpayers – and objections from their constitutional courts – are to be expected.

The Eurosystem is entering dangerous waters. Gone are the days when the ECB could deploy asset-purchase programs to provide freshly printed money to member states without creating withdrawal effects anywhere else. Now, if the ECB prints new money for the purpose of government financing, it will be expropriating the eurozone’s money holders through inflation; and if it applies its anti-fragmentation instrument, it will be redistributing budgetary resources between member states – a plainly political act.

Subscribe to Project Syndicate

Subscribe to Project Syndicate

Enjoy unlimited access to the ideas and opinions of the world’s leading thinkers, including long reads, book reviews, topical collections, short-form analysis and predictions, and exclusive interviews; every new issue of the PS Quarterly magazine (print and digital); the complete PS archive; and more. Subscribe now to PS Premium.

Subscribe

Through the succession of euro crises that followed Lehman Brothers’ collapse in 2008, financing public spending with the printing press has been the main driver of monetary expansion. Since the summer of 2008, no less than 83% – €5.3 trillion ($5.43 trillion) – of the total overhang of central bank money (relative to GDP, and over the level that had proved sufficient) came from the purchase of government securities.

For a while, these purchases allowed governments to take on more and more debt (in defiance of all the Eurosystem’s debt ceilings) without irritating investors. While that debt stimulated aggregate demand and kept unemployment in check, inflationary secondary effects from the expansion of banks’ credit supply failed to materialize, because the newly circulating money was being hoarded by banks and private individuals.

But conditions have changed. The COVID-19 pandemic has led to stagflation. Lockdowns and quarantine measures have curtailed production and caused supply problems everywhere – and these issues are far from being overcome, especially in China. Meanwhile, Russia’s war in Ukraine and other factors have created opportunistic supply shortages in the fossil-fuel sector. The result has been massive inflation, far dwarfing the effects of the 1970s oil crises.

In a stagflationary environment, government financing with the printing press no longer works, because it merely fuels inflation and social turmoil, especially among middle-class voters who justifiably fear for their savings. Under these conditions, over-indebted states and financial systems’ creditworthiness can be secured only through international fiscal aid programs financed with taxes – not debt. And yet, higher taxation also is certain to face staunch resistance among voters. The TPI can be thought of as one such program, because it leads to redistribution effects between state budgets.

The ECB is thus left with a dilemma. If it wants to continue helping hard-pressed governments by buying their bonds, it can get them the resources they need via predatory inflation at the expense of money holders, or it can get some governments the resources they need at the expense of other governments.

Either way, the free lunch offered by inflation-free money printing is over. In a context of stagflation, a Keynesian demand policy to stimulate economic activity will merely fuel inflation, for which the ECB will rightly be blamed if it keeps buying government bonds. But using the TPI would amount to redistribution between member states, leading to storms of protest and severe legal consequences.

The only other option is to do nothing, which would send capital markets into turmoil. The ECB may be facing its biggest test yet.

.

Premium Bonds rate rise: Should you throw your savings in?

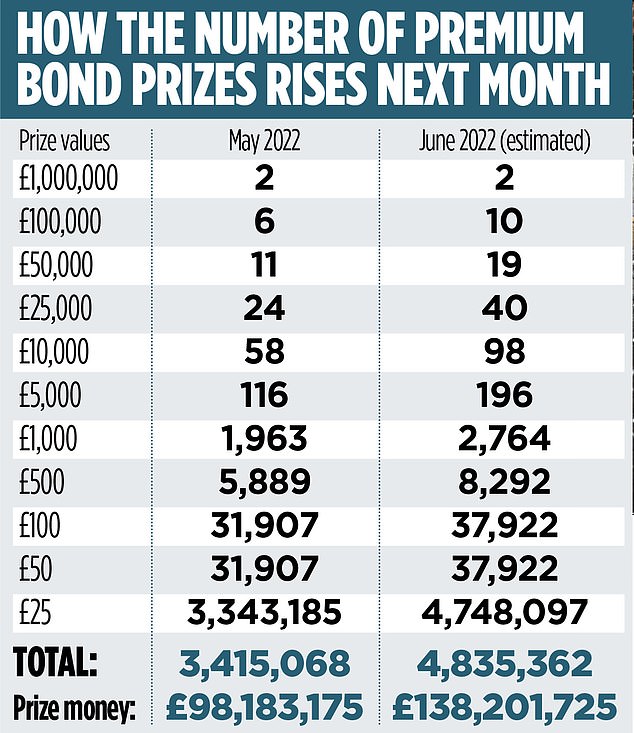

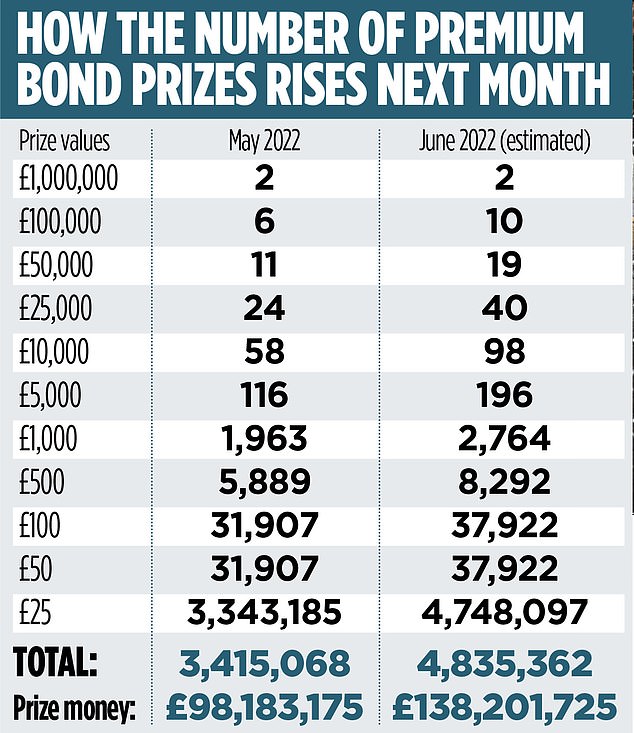

National Savings & Investments is finally increasing the number of Premium Bond prizes it pays out every month, boosting its 21million savers’ chances of winning. From next month, NS&I will pay out an additional 1.4million prizes, cutting the monthly odds against winning for every £1 in Premium Bonds from 34,500 to one to 24,500 to one. At a time when most high street banks are still paying a measly 0.1 per cent – and some just 0.01 per cent – on easy-access savings accounts, many savers will ask whether they are better off taking their chances on Premium Bonds instead. After all, on the face of it, the stated Premium Bond payout rate of 1.4 per cent sounds competitive. We take a look at the pros and cons of Premium Bonds right now.

What Premium Bond prize will change the most? There will still be two £1million prizes every month. However, the number of £100,000 prizes will rise from six to ten, and £50,000 prizes from 11 to 19. The number of £25 prizes will rise from 3.3million to 4.7million a month. Why is this happening now? Interest rates on the best savings accounts have been edging up thanks to four increases to the Bank of England base rate since December last year. NS&I has not budged on Premium Bond rates since it cut them to the equivalent of 1 per cent in December 2020. But it has been under increasing pressure to do so to reflect the base rate rises. NS&I likes to keep its rates roughly in the middle of the pack. It doesn’t want to be accused of offering the stingiest rates, but also doesn’t want to pay so much that it claws business away from other, commercial players. As well as respecting the interests of banks, it has a stated aim of doing the right thing by Premium Bond holders and the taxpayer, as NS&I is Government-backed. That requires a Goldilocks approach to rates – not too high, not too low. Now that other savings providers are starting to raise rates, NS&I has space to do the same. Have Premium Bonds become a good deal? The payout rate, at 1.4 per cent, sounds competitive. However, this does not mean that all holders will receive a 1.4 per cent annual return. Most will receive nothing in any one month: that is the pay-off for having big prizes. For every one person who wins big, tens of thousands more win nothing. Of course, the flip side to this is that a few lucky people do win one of the big prizes. Some people may be ready to relinquish a guaranteed interest payment from a savings provider in favour of even a very small chance of winning big. However, now the interest available on the best savings accounts is creeping up, Premium Bonds are looking like more of a gamble. The best easy-access savings account – offered by Chase Bank – now pays as much as 1.5 per cent. If you had £50,000 in savings – which is the maximum you can put into Premium Bonds – that’s a not insubstantial £750 a year of interest. If you’re happy to put your money away for a year, you can get a rate of 2.33 per cent with Al Rayan Bank – £1,165 on a £50,000 balance. With inflation at 9per cent, no savings account comes close to protecting the value of cash. So it’s perhaps even more vital to glean whatever protection is available, rather than resign yourself to none at all, in hope of a big prize. As Sarah Coles, a personal finance analyst at broker Hargreaves Lansdown, points out: ‘Even after the changes, there will still only be two million-pound prizes, so the odds of winning a million haven’t improved – in fact as more people buy more bonds, unless the number of million-pound prizes increases, the odds will get worse.’ Savings platforms can boost rates Savings platforms help savers keep track of their accounts more easily in one place and move money to better rates.Some of the most popular are, Raisin, Hargreaves Lansdown Active Savings, and AJ Bell’s Cash Savings Hub.They don’t offer all the deals on the market, but allow you to manage multiple accounts in one place and come within a whisker of table-topping accounts.In fact, sometimes rate boosters in the form of sign-up bonuses can lift interest rates to make them better than elsewhere. There is also offer Financial Services Compensation Scheme protection. Find out more about savings platforms and see the best rates in our regularly updated round-up.> Savings platforms: Top rates on offer and how to sign up

What Premium Bond prize will change the most? There will still be two £1million prizes every month. However, the number of £100,000 prizes will rise from six to ten, and £50,000 prizes from 11 to 19. The number of £25 prizes will rise from 3.3million to 4.7million a month. Why is this happening now? Interest rates on the best savings accounts have been edging up thanks to four increases to the Bank of England base rate since December last year. NS&I has not budged on Premium Bond rates since it cut them to the equivalent of 1 per cent in December 2020. But it has been under increasing pressure to do so to reflect the base rate rises. NS&I likes to keep its rates roughly in the middle of the pack. It doesn’t want to be accused of offering the stingiest rates, but also doesn’t want to pay so much that it claws business away from other, commercial players. As well as respecting the interests of banks, it has a stated aim of doing the right thing by Premium Bond holders and the taxpayer, as NS&I is Government-backed. That requires a Goldilocks approach to rates – not too high, not too low. Now that other savings providers are starting to raise rates, NS&I has space to do the same. Have Premium Bonds become a good deal? The payout rate, at 1.4 per cent, sounds competitive. However, this does not mean that all holders will receive a 1.4 per cent annual return. Most will receive nothing in any one month: that is the pay-off for having big prizes. For every one person who wins big, tens of thousands more win nothing. Of course, the flip side to this is that a few lucky people do win one of the big prizes. Some people may be ready to relinquish a guaranteed interest payment from a savings provider in favour of even a very small chance of winning big. However, now the interest available on the best savings accounts is creeping up, Premium Bonds are looking like more of a gamble. The best easy-access savings account – offered by Chase Bank – now pays as much as 1.5 per cent. If you had £50,000 in savings – which is the maximum you can put into Premium Bonds – that’s a not insubstantial £750 a year of interest. If you’re happy to put your money away for a year, you can get a rate of 2.33 per cent with Al Rayan Bank – £1,165 on a £50,000 balance. With inflation at 9per cent, no savings account comes close to protecting the value of cash. So it’s perhaps even more vital to glean whatever protection is available, rather than resign yourself to none at all, in hope of a big prize. As Sarah Coles, a personal finance analyst at broker Hargreaves Lansdown, points out: ‘Even after the changes, there will still only be two million-pound prizes, so the odds of winning a million haven’t improved – in fact as more people buy more bonds, unless the number of million-pound prizes increases, the odds will get worse.’ Savings platforms can boost rates Savings platforms help savers keep track of their accounts more easily in one place and move money to better rates.Some of the most popular are, Raisin, Hargreaves Lansdown Active Savings, and AJ Bell’s Cash Savings Hub.They don’t offer all the deals on the market, but allow you to manage multiple accounts in one place and come within a whisker of table-topping accounts.In fact, sometimes rate boosters in the form of sign-up bonuses can lift interest rates to make them better than elsewhere. There is also offer Financial Services Compensation Scheme protection. Find out more about savings platforms and see the best rates in our regularly updated round-up.> Savings platforms: Top rates on offer and how to sign up

Boost: From next month, NS&I will pay out an additional 1.4million prizesIs their tax-free status worth using? It is true there is no tax to pay on any Premium Bond winnings. But most people don’t pay tax on their savings interest anyway. First, everyone has a £20,000 tax-free Individual Savings Account (Isa) allowance to use every year. Second, savers also have a personal savings allowance, which means that all basic-rate taxpayers can earn up to £1,000 interest a year without paying any tax. With savings rates so low, you would have to have a very large balance to reach anywhere near this limit. Higher-rate taxpayers have only a £500 personal savings allowance, while additional-rate taxpayers have none. For these people, the possibility of tax-free saving becomes more relevant. Laura Suter, head of personal finance at wealth manager AJ Bell, says: ‘Anyone who is in the highest-rate tax bracket gets no savings allowance, and so will pay 45 per cent tax on any of their savings income, which means the Premium Bond tax-free nature becomes far more attractive. ‘That’s also true for higher-rate taxpayers who have a lot of money sitting in cash, as they will breach their allowance and pay 40 per cent tax on their savings income.’ However, if you are a high earner with a large amount held in cash, you may want to consider investing anyway.And what about full Treasury protection? All NS&I deposits are backed by the Treasury, which means that as long as the Government is solvent, your savings are safe. However, the maximum Premium Bonds holdings you can have is £50,000, and balances on savings accounts with most providers are covered by the Financial Services Compensation Scheme, which protects the first £85,000 of savings per provider. Are there any other major perks?Premium Bonds are an easy way of saving for children as they can be bought for under-16s and looked after by their parent or guardian. Anyone can buy Premium Bonds for a child, so friends and family members are able to buy them as a gift. The minimum amount that you can buy is £25. Has NS&I sorted customer service? In late 2020, NS&I had a customer service meltdown. As The Mail on Sunday reported at the time, customers were facing delays lasting weeks to withdraw cash, and routinely waiting as long as an hour to get through on the phone to call centre staff. The problems arose when NS&I took in a record £14.5billion of deposits in three months alone from income-starved savers. NS&I was offering one of the best rates at the time, so its popularity soared. However, NS&I is confident the problems are now resolved. Volumes are unlikely to hit the levels seen in 2020 as the increase in Premium Bond prizes is not as attractive as the top-rate deals back then, so NS&I has a better chance of coping this time round. THIS IS MONEY’S FIVE OF THE BEST SAVINGS DEALS Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence. .

Boost: From next month, NS&I will pay out an additional 1.4million prizesIs their tax-free status worth using? It is true there is no tax to pay on any Premium Bond winnings. But most people don’t pay tax on their savings interest anyway. First, everyone has a £20,000 tax-free Individual Savings Account (Isa) allowance to use every year. Second, savers also have a personal savings allowance, which means that all basic-rate taxpayers can earn up to £1,000 interest a year without paying any tax. With savings rates so low, you would have to have a very large balance to reach anywhere near this limit. Higher-rate taxpayers have only a £500 personal savings allowance, while additional-rate taxpayers have none. For these people, the possibility of tax-free saving becomes more relevant. Laura Suter, head of personal finance at wealth manager AJ Bell, says: ‘Anyone who is in the highest-rate tax bracket gets no savings allowance, and so will pay 45 per cent tax on any of their savings income, which means the Premium Bond tax-free nature becomes far more attractive. ‘That’s also true for higher-rate taxpayers who have a lot of money sitting in cash, as they will breach their allowance and pay 40 per cent tax on their savings income.’ However, if you are a high earner with a large amount held in cash, you may want to consider investing anyway.And what about full Treasury protection? All NS&I deposits are backed by the Treasury, which means that as long as the Government is solvent, your savings are safe. However, the maximum Premium Bonds holdings you can have is £50,000, and balances on savings accounts with most providers are covered by the Financial Services Compensation Scheme, which protects the first £85,000 of savings per provider. Are there any other major perks?Premium Bonds are an easy way of saving for children as they can be bought for under-16s and looked after by their parent or guardian. Anyone can buy Premium Bonds for a child, so friends and family members are able to buy them as a gift. The minimum amount that you can buy is £25. Has NS&I sorted customer service? In late 2020, NS&I had a customer service meltdown. As The Mail on Sunday reported at the time, customers were facing delays lasting weeks to withdraw cash, and routinely waiting as long as an hour to get through on the phone to call centre staff. The problems arose when NS&I took in a record £14.5billion of deposits in three months alone from income-starved savers. NS&I was offering one of the best rates at the time, so its popularity soared. However, NS&I is confident the problems are now resolved. Volumes are unlikely to hit the levels seen in 2020 as the increase in Premium Bond prizes is not as attractive as the top-rate deals back then, so NS&I has a better chance of coping this time round. THIS IS MONEY’S FIVE OF THE BEST SAVINGS DEALS Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence. .