MUMBAI, Sept 30 (Reuters) – The Indian rupee is expected to open higher against the U.S. dollar on Friday, after the country reported a lower-than-expected current account deficit for the June quarter.The dollar index pulling back further from multi-year highs will likely be an additional boost for the rupee, traders said.The rupee is likely to open around 81.65-81.70 per dollar, up from 81.86 in the previous session.Register now for FREE unlimited access to Reuters.comIndia posted a CAD of $23.9 billion in the April-June period, wider than $13.4 billion in the preceding quarter but lower than $30.5 billion that economists were expecting.In terms of percentage of the GDP, the CAD widened to 2.8%, the highest in four years. A Reuters poll of 18 economists were expecting CAD of 3.6% of the GDP.”A slightly larger services surplus, and remittances, ensured the deficit did not widen dramatically,” said Rahul Bajoria, chief India economist at Barclays Bank.Bajoria expects the CAD to remain elevated in the coming quarters, thanks to the revival in domestic demand and the ongoing impact of elevated commodity prices.Traders await the Reserve Bank of India’s policy decision at 1000 IST (0430 GMT). The surging Treasury yields and the resultant pressure on the rupee is likely to prompt the RBI reason to deliver a 50-basis-point rate hike. read more “In the context how quickly the rupee has fallen over the last few days, we think it is almost certain the RBI will deliver a 50 basis point hike and a hawkish commentary,” a trader at a Mumbai-based bank said.FTSE Russel said India will be retained on its watch list for a potential upgrade to Market Accessibility Level ‘1’ and for consideration for inclusion in the FTSE Emerging Markets Government Bond Index (EMGBI).”FTSE Russell outcome reduces the likelihood that India would be added to GBI-EM, as it suggests that there have not been sufficient progress on overcoming operational hurdles,” DBS said in a note.The dollar index dropped about 1% on Thursday to near 112, pulling back away from the two-decade high of 114.78. A rally in the British pound to above 1.10 to the dollar pulled down the gauge.KEY INDICATORS: ** One-month non-deliverable rupee forward at 81.82; onshore one-month forward premium at 26 paise** USD/INR NSE October futures closed at 82.0175 on Thursday** USD/INR forward premium for end October is 24 paise** Dollar index at 112.12** Brent crude futures down 0.3% at $88.2 per barrel** Ten-year U.S. note yield at 3.79%** SGX Nifty nearest-month futures down 0.6% at 16,715** As per NSDL data, foreign investors sold a net $255.9 million worth of Indian shares on Sept. 28** NSDL data shows foreign investors sold a net $45.8 million worth of Indian bonds on Sept. 28Register now for FREE unlimited access to Reuters.comReporting by Nimesh Vora; Editing by Rashmi AichOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Brazil risk premium soars after Congress breaks spending cap

BRASILIA, July 22 (Reuters) – Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures. read more “The problem is the change in the spending cap,” said an Economy Ministry official, who requested anonymity to discuss the situation openly. “It weakens the reading that the fiscal situation will be under control in the coming years.”Register now for FREE unlimited access to Reuters.comEven with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil’s yield curve remains under pressure as investors brace for the worst. read more Both major presidential candidates on the ballot in October – leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro – have signaled they plan to extend this year’s boost in social spending into next year.”It’s a fiscal bomb,” said Sergio Goldenstein, chief strategist at Renascença DTVM. “Risk premiums look high, but there is little room for a relevant drop.”The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil’s five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.Concerns about Brazil’s credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.”All the credit spreads in the world are opening, our bonds are not immune to that,” said Ronaldo Patah, chief strategist at UBS Consenso.In fact, Brazil’s strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.Brazil’s central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.”I am struck by this process of (yield curve) flattening that we are seeing at a very high level”, said the chief economist at Ativa Investimentos Etore Sanchez.Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending.”The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected”, said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.Register now for FREE unlimited access to Reuters.comReporting by Marcela Ayres and Jose de Castro

Editing by Brad HaynesOur Standards: The Thomson Reuters Trust Principles. .

Wall St Week Ahead Recession fears loom over U.S. value stocks

A screen displays trading informations for stocks on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., June 27, 2022. REUTERS/Brendan McDermidRegister now for FREE unlimited access to Reuters.comNEW YORK, July 15 (Reuters) – Fears of a potential economic slowdown are clouding the outlook for value stocks, which have outperformed broader indexes this year in the face of surging inflation and rising interest rates.Value stocks – commonly defined as those trading at a discount on metrics such as book value or price-to-earnings – have typically underperformed their growth counterparts over the past decade, when the S&P 500’s (.SPX) gains were driven by tech-focused giants such as Amazon.com Inc (AMZN.O) and Apple Inc (AAPL.O).That dynamic shifted this year, as the Federal Reserve kicked off its first interest rate-hike cycle since 2018, disproportionately hurting growth stocks, which are more sensitive to higher interest rates. The Russell 1000 value index (.RLV) is down around 13% year-to-date, while the Russell 1000 growth index (.RLG) has fallen about 26%.Register now for FREE unlimited access to Reuters.comThis month, however, fears that the Fed’s monetary policy tightening could bring on a U.S. recession have shifted the momentum away from value stocks, which tend to be more sensitive to the economy. The Russell value index is up 0.7% in July, compared with a 3.4% gain for its growth-stock counterpart.”If you think we are in a recession or are going into a recession, that does not necessarily … work to the advantage of value stocks,” said Chuck Carlson, chief executive at Horizon Investment Services.The nascent shift to growth stocks is one example of how investors are adjusting portfolios in the face of a potential U.S. economic downturn. BofA Global Research on Thursday cut its year-end target price for the S&P 500 to 3,600 from 4,500 previously and became the latest Wall Street bank to forecast a coming recession. read more The index closed at 3,863.16 on Friday and is down 18.95% this year.Corporate earnings arriving in force next week will give investors a better idea of how soaring inflation has affected companies’ bottom lines, with results from Goldman Sachs , Johnson & Johnson (JNJ.N) and Tesla among those on deck.For much of the year, value stocks benefited from broader market trends. Energy shares, which comprise around 7% of the Russell 1000 value index, soared over the first half of 2022, jumping along with oil prices as supply constraints for crude were exacerbated by Russia’s invasion of Ukraine.But energy shares along with crude prices and other commodities have tumbled in recent weeks on concerns that a recession would sap demand.A recession also stands to weigh on bank stocks, with a slowing economy hurting loan growth and increasing credit losses. Financial shares represent nearly 19% of the value index. read more An earnings beat from Citigroup, however, buoyed bank shares on Friday, with the S&P 500 banks index (.SPXBK)gaining 5.76%.At the same time, tech and other growth companies also tend to have businesses that are less cyclical and more likely able to weather a broad economic slowdown.”People pay a premium for growth stocks when growth is scarce,” said Burns McKinney, portfolio manager at NFJ Investment Group.JPMorgan analysts earlier this week wrote they believe growth stocks have a “tactical opportunity” to make up lost ground, citing cheaper valuations after this year’s sharp sell-off as one of the reasons.Value stock proponents cite many reasons for the investing style to continue its run.Growth stocks are still more expensive than value shares on a historical basis, with the Russell 1000 growth index trading at a 65% premium to its value counterpart, compared to a 35% premium over the past 20 years, according to Refinitiv Datastream.Meanwhile, earnings per share for value companies are expected to rise 15.6% this year, more than twice the rate of growth companies, Credit Suisse estimates.Data from UBS Global Wealth Management on Thursday showed value stocks tend to outperform growth stocks when inflation is running above 3% – around a third of the 9.1% annual growth U.S. consumer prices registered in June. read more Josh Kutin, head of asset allocation, North America at Columbia Threadneedle, believes a possible U.S. recession in the next year would be a mild one, leaving economically sensitive value stocks primed to outperform if growth picks up.”If I had to pick one, I’d still pick value over growth,” he said. “But that conviction has come down since the start of the year,” Kutin said.Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf, additional reporting by David Randall and Ira Iosebashvili; Editing by Ira Iosebashvili and Richard ChangOur Standards: The Thomson Reuters Trust Principles. .

Column: Collapsing metal inventories clash with plunging prices

LONDON, July 13 (Reuters) – London Metal Exchange (LME) stocks are rapidly dwindling.LME warehouses held just 696,109 tonnes of registered metal at the end of June, the lowest amount this century.Inventory halved over the first six months of the year and June’s tally was down by 1.67 million tonnes year-on-year.Register now for FREE unlimited access to Reuters.comThe downtrend has further to run.Nearly 306,000 tonnes of metal were awaiting physical load-out at the end of last month. Available tonnage of all metals was just 390,280.LME shadow stocks, metal stored off-market with the option of exchange delivery, rebuilt modestly in April and May but the year-to-date increase has been a negligible 4,600 tonnes.Shrinking exchange stocks should be a bullish price signal. Right now, however, macro is trumping micro as Western recession fears pummel the industrial metals complex. The LME Index (.LMEX), which tracks the performance of the exchange’s six main base metals, has slumped by 31% from its April peak.The scale of the disconnect between price and stocks is striking. The resulting mismatch of current scarcity and expected future surplus is likely to be resolved by sporadic flare-ups in LME time-spreads.LME registered and “shadow” stocksSTOCKED OUTThis is currently happening in the LME zinc market. The cash premium over three-month metalAvailable live stocks shrunk to a depleted 14,975 tonnes at one stage in June and are still a meagre 22,475 tonnes.The rest of the headline zinc inventory of 82,200 tonnes is scheduled to depart.It also happened to sister metal lead last year, when the cash premium spiked to over $200 per tonne in August as LME on-warrant stocks fell to less than 40,000 tonnes.Time-spread tightness has been a recurring feature of the LME lead contract ever since and the cash premium is once again edging wider, ending Tuesday valued at $33 per tonne.That’s because lead stocks haven’t rebuilt in any meaningful way, currently totalling 39,250 tonnes with available tonnage at 34,850.The LME tin market has been living with depleted stocks since the start of 2021 and backwardation appears to be now hard-wired into short-dated spreads.PHYSICAL TIGHTNESSLow LME stocks of all three metals reflect extreme physical supply-chain tightness.All three have seen significant supply disruption over the last year with tin smelters hit by coronarivus lockdowns, zinc smelters in Europe powering down due to high energy prices and the Stolberg lead plant in Germany out of action since July 2021 due to flooding. read more Physical premiums for all three metals have hit record highs in Europe and the United States and remain close to those levels even as outright prices have dropped like a stone.The LME has acted as market of last resort for physical buyers and stocks will only rebuild once the supply-chain pressures pass.Chinese exports are helping rebalance both lead and zinc markets but the process is a slow one as freight and logistics bottlenecks brake arbitrage flows.

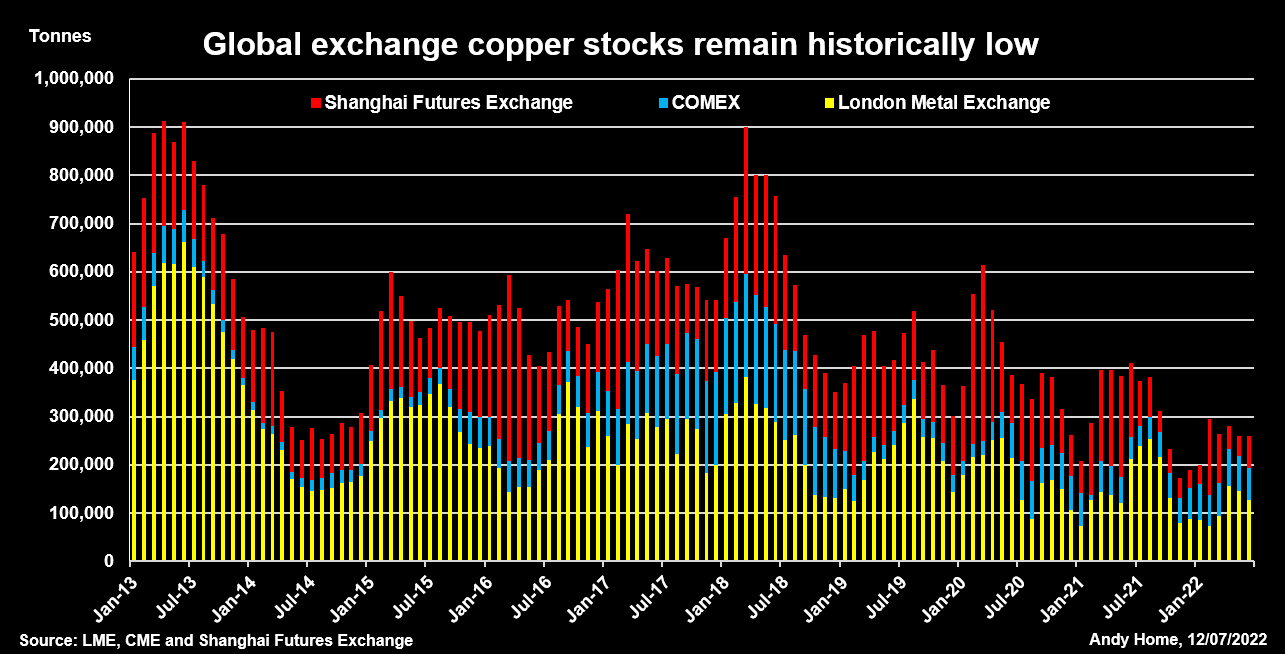

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.LME registered and shadow aluminium stocksOFF-MARKET BUILD?Weaker Chinese demand doesn’t appear to have made any impact on ShFE copper inventory, which remains low at 69,000 tonnes, down from 129,500 tonnes a year ago.However, the headline stocks may be deceiving.The Chinese market has been rocked by another multi-pledging stocks scandal reminiscent of the Qingdao fraud of 2014.That seems to have triggered movement of both aluminium and zinc into safe-haven storage and may be deterring copper exchange deliveries.It’s quite possible that such rotation between visible and non-visible storage is accentuating the LME stocks downtrend as well.Registered aluminium stocks, for example, collapsed by 64% over the first half of the year. Live tonnage stands at just 156,300 tonnes.Yet there is no sign of tension in aluminium time-spreads, the cash-to-three-months period trading in mild contango.The market seems to be assuming that there is no shortage of aluminium despite the headline stocks figure ticking lower every day.But if metal is available, it is evidently sitting in the statistical darkness.One small clue as to its existence was a 92,000-tonne build in LME shadow aluminium stocks over the course of April and May.Such metal is primed for LME warranting if price and spreads move into the right alignment and the recent rise suggests that some metal at least is being enticed back to the paper market from the physical market.REGIONAL IMBALANCEJust about all of the shadow aluminium stocks build has occurred in Asia, which accounted for 87% of the 289,978 tonnes in this category at the end of May.LME warehouse locations in Europe held just 21,642 tonnes and U.S. ones 14,608 tonnes.The same regional skew is clear to see across all the LME base metals and is as equally true of registered stocks as it is of shadow inventory.It is a symptom of the supply and freight issues that have roiled the metals markets since the onset of COVID-19 two years ago.It is also a warning that metals supply chains are still far from functioning efficiently, even as prices bow to the weight of macro selling.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

‘Sell premium’ – Thailand discourages discounts, wants high value tourists

Tourists visit Maya bay after Thailand reopened its world-famous beach after closing it for more than three years to allow its ecosystem to recover from the impact of overtourism, at Krabi province, Thailand, January 3, 2022. Picture taken January 3, 2022. REUTERS/Athit Perawongmetha/File PhotoRegister now for FREE unlimited access to Reuters.comBANGKOK, July 4 (Reuters) – Thailand’s hotels, businesses and private hospitals should refrain from offering big discounts to lure tourists and focus instead on raising the country’s value as a premium travel destination, government ministers said on Monday.Thailand has received about 2 million foreign visitors in the first six months of this year, a steady revival after its tourism industry almost collapsed due to the pandemic and more than 18 months of complex and costly entry requirements.”We cannot let people come to Thailand and say because it’s cheap,” Deputy Prime Minister Anutin Charnvirakul said at an event at Bangkok’s main international airport to promote tourism.Register now for FREE unlimited access to Reuters.com“Instead they should say ‘because it works, it’s reasonable’, that’s where we can increase value,” he said, echoing remarks by the country’s tourism minister.Anutin likened the approach to that of luxury fashion brand Louis Vuitton.”Hold your ground. Sell premium. The more expensive, the more customers,” he said. “Otherwise Louis Vuitton wouldn’t have any sales.”One of Asia’s most popular travel destinations, Thailand welcomed a record of nearly 40 million visitors in pre-pandemic 2019, who spent 1.91 trillion baht ($53.53 billion), equivalent to 11% of gross domestic product.Arrivals slumped to 6.7 million the following year, and down to 428,000 in 2021, despite calibrated moves to end quarantine requirements.It is forecasting 10 million foreign arrivals in 2022.Earlier this year, Thailand launched a long-term visa programme for wealthy foreigners and skilled workers, sticking to its plan to lure high-spending visitors, despite major jobs and business losses in tourism during the pandemic.($1 = 35.6500 baht)Register now for FREE unlimited access to Reuters.comReporting by Chayut Setboonsarng and Panarat Thepgumpanat; Editing by Martin PettyOur Standards: The Thomson Reuters Trust Principles. .