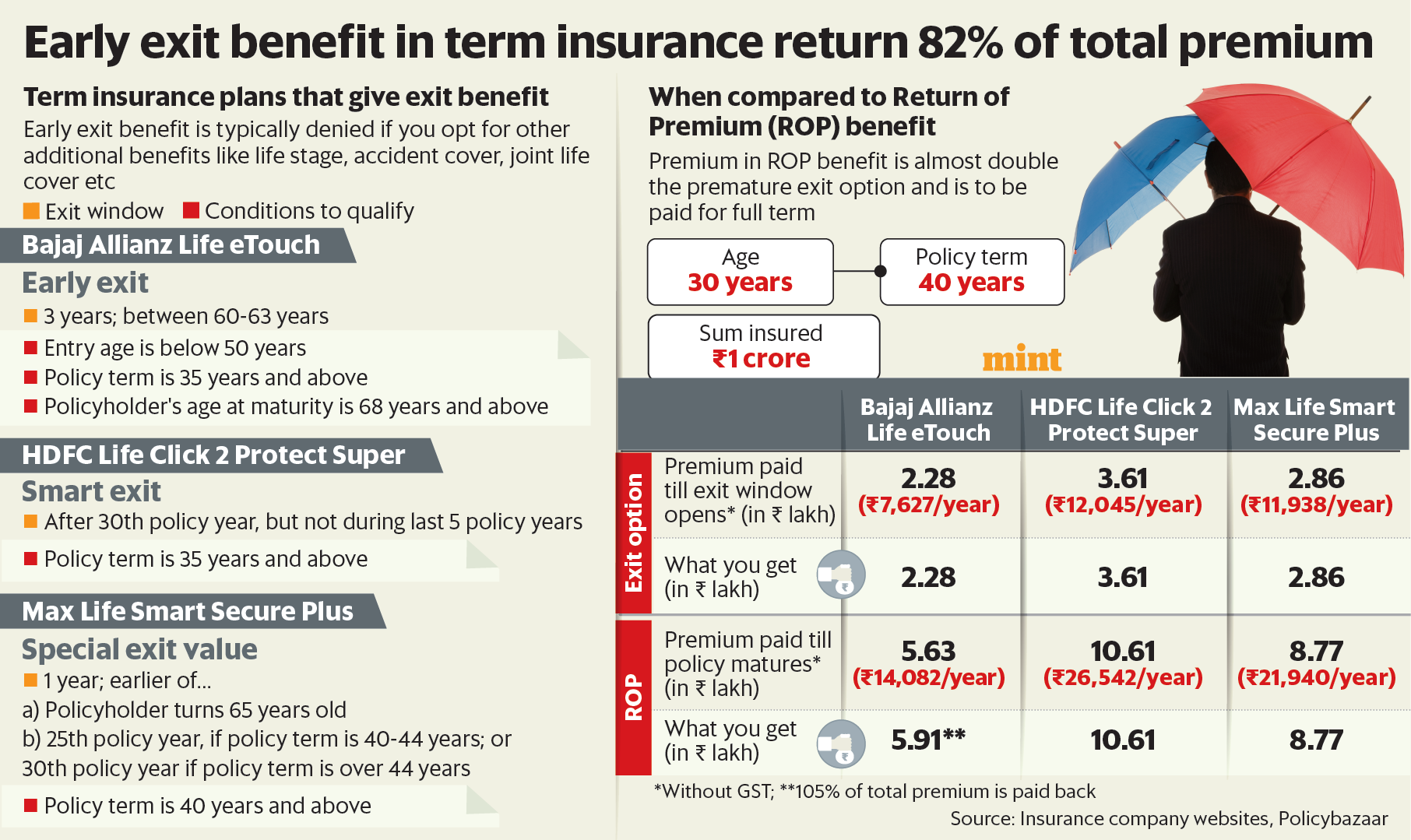

But, remember there are no free lunches, and the early exit benefit, too, comes with stringent conditions. Early exit is a benefit that is similar to the terminal illness rider, premium break, etc., available on a term insurance policy. It is different from a term plan with a return of premium (TROP), in that it allows policyholders to discontinue their term policy within a specified window and get the full premium back, net of GST, paid till that point. Currently, three insurance companies offer this benefit on their term insurance policies (see table). Different from TROP In TROP, the full premium (excluding GST) is paid as survival benefit at the end of the policy term if the policyholder lives through the entire term of the policy. If the policy is surrendered mid-term, policyholders are paid the surrender value (assigned after the first two years). TROP is an expensive feature as the premium on the former works out to almost double the premium on a regular term plan (see table). This is because the insurer guarantees a payout to the policyholder/beneficiary in TROP, unlike a pure risk term cover that only pays death benefit. Premature exit benefit, on the other hand, comes at no premium difference.  View Full ImageMint Exit benefit gives policyholders an option to terminate their term plan prematurely within a limited, predetermined window. But here is the catch: The duration within which you can discontinue the policy to get the premium back is 1-5 years and opens up when you turn 55-60 years, typically the age when you are closer to fulfilling your financial liabilities and may not need life insurance any longer. So, instead of paying the premium for a longer duration as with TROP, you can terminate the policy a little before maturity and get back the premium. Do note that the worth of the premium amount erodes each year on account of inflation. For instance, if the total pemium for a 40-year TROP of ₹1 crore paid over the policy term works out to ₹8 lakh, you will be paid back this premium in lump sum after the policy matures. However, if you were to consider inflation of 6%, the value of ₹8 lakh would be just ₹80,000 after 40 years. The same concept applies to the early withdrawal benefit too, but you would pay a much lower premium and for a shorter duration. Take note that if the policy is discontinued outside of the exit window, you will not get your premium back. Is it really zero-cost? It is not accurate to advertise this benefit as ‘zero-cost term plan’ because only the base premium amount after deducting 18% GST is paid back. The extra premium that is paid on add-on features is also deducted by some insurers.

View Full ImageMint Exit benefit gives policyholders an option to terminate their term plan prematurely within a limited, predetermined window. But here is the catch: The duration within which you can discontinue the policy to get the premium back is 1-5 years and opens up when you turn 55-60 years, typically the age when you are closer to fulfilling your financial liabilities and may not need life insurance any longer. So, instead of paying the premium for a longer duration as with TROP, you can terminate the policy a little before maturity and get back the premium. Do note that the worth of the premium amount erodes each year on account of inflation. For instance, if the total pemium for a 40-year TROP of ₹1 crore paid over the policy term works out to ₹8 lakh, you will be paid back this premium in lump sum after the policy matures. However, if you were to consider inflation of 6%, the value of ₹8 lakh would be just ₹80,000 after 40 years. The same concept applies to the early withdrawal benefit too, but you would pay a much lower premium and for a shorter duration. Take note that if the policy is discontinued outside of the exit window, you will not get your premium back. Is it really zero-cost? It is not accurate to advertise this benefit as ‘zero-cost term plan’ because only the base premium amount after deducting 18% GST is paid back. The extra premium that is paid on add-on features is also deducted by some insurers.

“The big upside is that the policyholder does not have to pay an extra fee or a higher premium to avail it, unlike in the case of TROP. The additional benefit comes at zero cost,” said Sajja Praveen Chowdary, business head, term life insurance, Policybazaar.com. Devil is in the details Policyholders should take note of the stringent terms around the withdrawal window. For instance, in the case of HDFC Life’s plan, the exit window opens in the 30th year, but the benefit is not available during the last five years. So, if you were to buy the policy for 35 years, you will qualify for the benefit after 30 years but won’t be able to avail it because of this clause. However, if the policy term is 36 years, you will get a one-year window between the 30th and 31st policy year to avail the benefit. Similarly, with Bajaj Allianz Life policy, the policyholder has to fulfil two conditions to qualify for the benefit—the policy term is at least 35 years and policyholder’s age should be 68 years or more at the time of policy maturity. Should you buy it This benefit will work well for those who want to terminate their life insurance policy once they no longer need it. The exit benefit will prompt more people to buy pure risk term insurance. “India as a market is used to getting money-back from insurance. It would take a massive campaign of the size of polio eradication to change this mindset. Given this mindset, the zero cost or early exit proposition will hopefully get many sceptics who earlier shied away from buying a pure risk term insurance to sign up for one,” said Mahavir Chopra, founder, Beshak.org. Read the terms around early exit carefully before signing up. Also, since the window is a short one and will open 25-30 years later, mark it now so that you don’t forget to avail it.

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

More

Less

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Post your comment

.

Dear Reader,

Dear Reader,

Dear Reader,

Dear Reader,