An internal committee of the Insurance Regulatory and Development Authority of India (Irdai) has been discussing the proposal over the past few weeks, and the regulator is likely to issue draft guidelines allowing life insurers to sell indemnity health insurance products (commonly known as mediclaim policies), said the two people, both of whom spoke on the condition of anonymity since the rules are yet to be formalized.

View Full ImageCover to cover

View Full ImageCover to cover

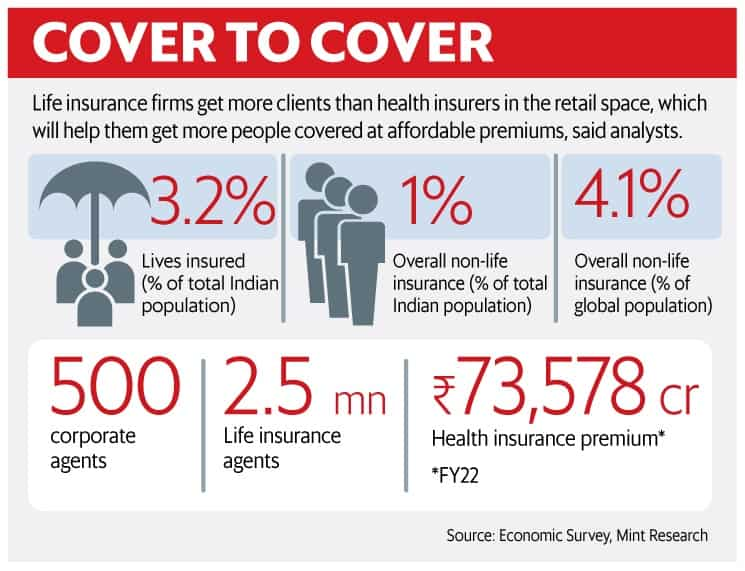

“Life insurance companies inherently get more customers than health insurers in the retail space, which will help them get more people covered under medical insurance at more affordable premiums,” one of the two people cited above said.

According to India’s Economic Survey 2021-22, life insurance penetration in the country stood at 3.2% in 2020, rising from 2.82% in 2019. However, the penetration of overall non-life insurance (which includes health insurance, motor insurance, fire and industrial insurance) is abysmally low at 1%, way behind the global average of 4.1%.

“With captive customers, larger distribution networks and higher disposable cash, life insurers are well-positioned to offer health insurance products to a larger population at better rates,” said the second person.

Life insurers in India have at least 2.5 million individual agents, tie-ups with over 500 corporate agents, a huge bancassurance channel, a large network of brokers, and thousands of their own physical branches where they sell insurance policies. Therefore, Irdai’s move may not only help enhance the penetration of health insurance in the country, but also raise competition among health insurers .

“Initially, to be able to encourage more customers, life insurers may offer health insurance policies whose premium could be 5-10% lower than the average price of basic health insurance policies offered by non-life insurers at present,” said the first person.

Initially, Irdai may allow life insurers either to sell existing mediclaim products of other companies, or allow them to both design and distribute mediclaim policies.

Once life insurers are allowed to design, price and sell mediclaim products, the primary competition will be between life and health insurers, which may lead to a friendlier premium regime for retail customers.

An email sent Irdai remained unanswered

Currently, basic mediclaim products for a sum insured of ₹2 lakh cost an annual premium of ₹5,000-7,000 for an adult individual without any pre-existing ailment and aged 18-50. This premium range may get lowered by 5-10% once Irdai allows life insurers to design and sell mediclaim products.

Health insurance accounts for 33% of total non-life industry premium. In FY22, health insurance premium totalled ₹73,578 crore.

Tarun Chugh, managing director and CEO of Bajaj Allianz Life Insurance Co. Ltd. said, “The confirmation on this (Irdai’s) proposal is awaited. As an industry, we (life insurers) have all the tenets in place to commence selling health insurance as soon as the signal comes in.”

“Considering our distribution network, underwriting skills, agile processes and technology, the (life insurance) industry can leverage these pillars to take the advantages of health insurance to different customer segments. It will be a win-win for all,” said Chugh.

According to Amit Palta, chief distribution officer at ICICI Prudential Life Insurance Co., India’s largest private life insurer in terms of assets, once life insurers are allowed to sell health insurance, getting into health business won’t be tough. Life insurance business too is about pricing ‘risks’ to provide protection, and more importantly, the end customer for both life and health insurance is essentially the same policyholder.

“However, there will be a requirement to build the requisite infrastructure to support indemnity claims to support customers so that the experience stays seamless. As an opportunity, this still is huge since India is under-penetrated on protection, and almost 70% of health-related expenses are still happening largely from out-of-pocket, depleting people’s savings. There is no doubt that adoption of health as a product is definitely required in the country.”

“Life insurers will be able to add one more product to their portfolio and reach out to the customer with a more well-rounded protection proposition. Including health within life insurance will improve the industry’s overall ability to take health protection to a larger set of the population. Apart from mortality, we can look at morbidity also, as a liability that can easily add to our assessment for medical products. It adds value, if we were to be allowed to take health indemnity products to the end customers,” said Palta.

In 2016, the insurance regulator had barred life insurance firms from offering indemnity-based health products either to individuals or as a group policy. However, after receiving representations from the industry, Irdai formed a committee to look into the feasibility of offering such policies again.

Even though the move may usher in a new business opportunity for life insurers, the key challenge for life players will be pricing health insurance products, creating a large enough hospital network for smoother settlements, and matching the claim processing capabilities that standalone health insurers have.

“Actuarial task will be crucial as under-pricing may lead to steep losses and over-pricing may fend off customers,” said the second person. This will be critical because by nature, life insurance policies have long gestation periods, lower claim frequency and better earnings prospects.

On the other hand, health insurance, by nature, causes cash-burn for insurers in the initial years due to high claim frequency and short duration of their validity to enable insurers gain from the premium paid by the customer.

Only if a policy remains claim-free during a given year, the health insurer is able to make money. But, even if 20- 30% of a health product’s customers raise claims in a year, the policy creates losses for the insurer as claim settlement amount is significantly higher than the premium paid.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

.

Dear Reader,

Dear Reader,