People play “Pokemon GO” on the Pokequan GoBoat Adventure Cruise in the Occoquan River in the small town of Occoquan, Virginia, U.S. August 14, 2016. REUTERS/Sait Serkan GurbuzRegister now for FREE unlimited access to Reuters.comAug 9 (Reuters) – Gaming software company AppLovin Corp (APP.O) made an offer on Tuesday to buy its peer Unity Software Inc (U.N) in a $17.54 billion all-stock deal, threatening to derail Unity’s announced plan to acquire AppLovin’s smaller competitor ironSource .AppLovin has offered $58.85 for each Unity share, which represents a premium of 18% to Unity’s Monday closing price. Unity will own 55% of the combined company’s outstanding shares, representing about 49% of the voting rights.AppLovin hired advisors to work out an offer after Unity last month said it would buy ironSource in a $4.4 billion all-stock transaction, sources familiar with the matter told Reuters. Unity’s board will have to terminate the ironSource deal if it wants to pursue a combination with AppLovin, according to the proposal.Register now for FREE unlimited access to Reuters.comUnder the proposed deal, Unity’s Chief Executive John Riccitiello will become CEO of the combined business, while AppLovin Chief Executive Adam Foroughi will take the role of chief operating officer.Unity said its board would evaluate the offer. The company is slated to report its earnings after the bell on Tuesday.Both companies make software used to design video games. Game-making software has also been expanding to new technologies such as the so-called metaverse, or immersive virtual worlds.Unity’s software has been used to build some of the most-played games such as “Call of Duty: Mobile,” and “Pokemon Go”, while AppLovin provides helps developers to grow and monetize their apps.AppLovin’s offer comes as game developers and console makers warn of a slowdown in the sector as decades-high inflation and easing of COVID-19 restrictions lead gamers to pick outdoor activities. The company lowered its sales guidance on Tuesday.”The deal comes as surprise to everybody in the business,” said Serkan Toto, founder of game industry consultancy Kantan Games. “It’s a $15 billion company going after a $15 billion company. It’s a desperate attempt to consolidate and the chances of this deal happening are very slim.”Shares of Palo Alto, California-based AppLovin, which went public last year, fell 9.9% while those of Unity rose 1% in the morning trading session. Shares of ironSource were down 9.7%.Foroughi said the combined company will have the potential to generate an adjusted operating profit of over $3 billion by the end of 2024.Register now for FREE unlimited access to Reuters.comReporting by Eva Mathews and Nivedita Balu in Bengaluru, Krystal Hu in New York; Editing by Saumyadeb Chakrabarty and Mike HarrisonOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Ramsay Health Care gets $14.8 bln bid from KKR-led consortium; shares soar

Trading information for KKR & Co is displayed on a screen on the floor of the New York Stock Exchange (NYSE) in New York, U.S., August 23, 2018. REUTERS/Brendan McDermidRegister now for FREE unlimited access to Reuters.com

- Ramsay receives A$88 cash per share proposal

- Proposal at a 37% premium to Ramsay’s last close

- Ramsay stock up 29.8% in early trade

April 20 (Reuters) – Ramsay Health Care Ltd (RHC.AX), Australia’s largest private hospital operator, said on Wednesday it received a A$20.05 billion ($14.80 billion) indicative takeover offer from a consortium led by private equity giant KKR & Co (KKR.N).The non-binding proposal of A$88 cash per share represents a premium of nearly 37% to Ramsay’s Tuesday closing price of A$64.39. The offer sent the hospital operator’s shares up as much as 29.8% to A$83.55 in early trade, their biggest-ever intraday jump.Ramsay said in a statement it would provide the KKR-led consortium with due diligence on a non-exclusive basis and talks were at a preliminary stage.Register now for FREE unlimited access to Reuters.comThe hospital operator said it had reviewed the proposal with its advisers and asked for further information from the consortium in relation to its funding and structure of the deal.KKR did not immediately respond to a Reuters request for comment.If successful, the takeover would be the biggest in Australia this year and nearly double deal activity, which at a total value of $17.4 billion, suffered a 41.2% decline in the first quarter compared with a year earlier, according to Refinitiv data.The proposal comes as record-low interest rates prompt private equity firms, superannuation and pension funds with ample liquidity to invest in healthcare and infrastructure assets.The deal would also rank as the second biggest private-equity backed in deal in Australia, following a consortium’s A$31.6 billion ($23.35 billion) enterprise value deal for Sydney airport last year. read more The pandemic hit healthcare operators including Ramsay, with the shutdown of non-urgent surgeries, staffing shortages due to isolation regulations, and upward wage pressure weighing on earnings and hurting stocks, making the sector relatively affordable for a buyout, compared to a few years ago.Last year, Australian biopharmaceutical giant CSL Ltd (CSL.AX) said it would buy Swiss drugmaker Vifor Pharma AG (VIFN.S) for $11.7 billion. read more Ramsay operates hospitals and clinics across 10 countries in three continents, with a network of more than 530 locations, according to its website.It has 72 private hospitals and day surgery units in Australia, while it operates clinics and primary care units in about 350 locations across six countries in Europe.KKR currently owns French healthcare group Elsan.Earlier this year, Ramsay and Malaysia’s Sime Darby Holdings received a $1.35 billion buyout offer from IHH Healthcare Bhd (IHHH.KL) for their Asia joint venture. Ramsay said it was still pursuing this transaction. The hospital operator has hired UBS AG’s Australia Branch and Herbert Smith Freehills as financial and legal advisers, respectively, for the KKR-led consortium’s proposal.($1 = 1.3535 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Harish Sridharan in Bengaluru; additional reporting by Byron Kaye in Sydney; Editing by Sriraj Kalluvila, Aditya Soni and Krishna Chandra Eluri and Rashmi AichOur Standards: The Thomson Reuters Trust Principles. .

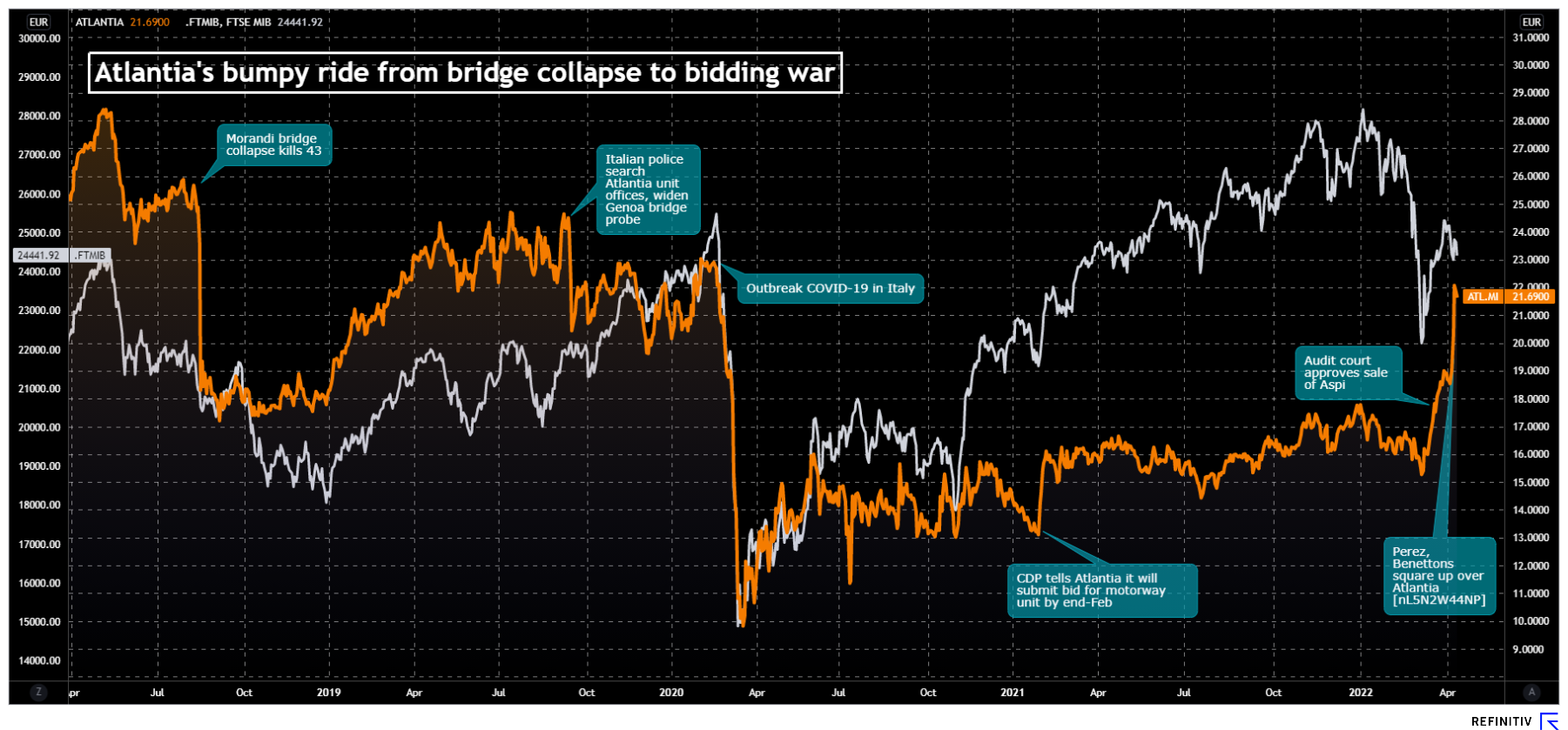

Benetton team working on premium of around 30% to buy out Atlantia – sources

The logo of infrastructure group Atlantia in Rome, Italy October 5, 2020. REUTERS/Guglielmo MangiapaneRegister now for FREE unlimited access to Reuters.comMILAN, April 12 (Reuters) – The Benetton family and U.S. investment fund Blackstone are working on a premium of around 30% over Atlantia’s (ATL.MI) average stock price in the last six months, as they ready a bid that could land as early as Wednesday, three sources said.The two partners are considering an offer between 22 and 23 euros per share, one of the sources said, but cautioned no final decision had been taken.While a significant premium on the six month average share price, that would be a more modest increase over the current price of about 21.7 euros, and would value the whole of Atlantia – in which the Benetton family already owns a 33% stake – at about 18.1-19.0 billion euros ($19.7-$20.7 billion).Register now for FREE unlimited access to Reuters.comShares in the Italian infrastructure group have gained nearly 20% since April 6 when speculation first emerged about an approach involving Global Infrastructure Partners (GIP), Brookfield and Florentino Perez, head of Spain’s ACS (ACS.MC).The stock hit a two-year high of 22.5 euros on Monday as investors waited for a move that could take the group private.”The offer could land very soon, even early Wednesday morning,” one of the sources said.Blackstone and Benetton holding company Edizione declined to comment. Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Editing by Mark Potter and Chizu NomiyamaOur Standards: The Thomson Reuters Trust Principles. .

KKR شرکت اسپارتا، سازنده دوچرخه رالی Accell را به قیمت 1.77 میلیارد دلار خریداری می کند

آمستردام، 24 ژانویه (رویترز) – کنسرسیومی به رهبری شرکت خریدار KKR (KKR.N) با تصاحب گروه Accell (ACCG.AS) موافقت کرده است که سازنده برندهای دوچرخه مانند اسپارتا، باتاووس و رالی را در سال 2018 ارزش گذاری می کند. آنها روز دوشنبه گفتند 1.56 میلیارد یورو (1.77 میلیارد دلار). این معامله آخرین نشانه افزایش علاقه سرمایه گذاران به صنعت دوچرخه های الکترونیکی است، پس از آن که شرکت دوچرخه سازی هلندی Van Moof سال گذشته 128 میلیون دلار از Hillhouse Capital برای تامین مالی توسعه ایالات متحده جمع آوری کرد. Cerberus Capital Management یک پیشنهاد ناموفق برای Dorel Industries کانادا ارائه کرد. پیشنهاد نقدی 58 یورویی به ازای هر سهم به صورت نقدی نشان دهنده حق بیمه 26 درصدی نسبت به قیمت پایانی Accell در 21 ژانویه و حق بیمه 42 درصدی نسبت به حجم وزنی سه ماهه آن است. در بیانیه آمده است که قیمت متوسط هم اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید ثبت نام "کنسرسیوم متعهد به توسعه بیشتر هلند به عنوان پایتخت جهانی دوچرخه سواری با ایجاد موقعیت پیشرو این شرکت در اروپا است. دوچرخه الکترونیکی mar شریک KKR Daan Knottenbelt در بیانیه ای گفت: این پیشنهاد قرار است در سه ماهه دوم پس از تایید عرضه شود و در سه ماهه سوم بسته شود.راب تر هار، رئیس Accell در بیانیه ای گفت. هیئت مدیره به اتفاق آرا از این معامله به عنوان ارائه "ارزش قانع کننده و فوری برای سهامداران" حمایت می کند و همچنین از نظر استراتژیک به شرکت کمک می کند. صنعت دوچرخه یکی از برندگان از همه گیری ویروس کرونا بود و Accell افزایش 17 درصدی در فروش را گزارش کرد. 2020 به 1.3 میلیارد یورو، و رشد قوی در فروش دوچرخه های الکترونیکی به عنوان جایگزینی برای حمل و نقل عمومی. در دسامبر Accell اعلام کرد که فروش سال 2021 تا نوامبر با وجود "باد مخالف کمبود قطعات جهانی" 4.4 درصد افزایش داشته است. او گفت که معتقد است KKR به احتمال زیاد به دنبال یک چرخش یا خروج سریع از Accell نخواهد بود. دوچرخه سواری "آینده است… و همچنین راه حل بسیاری از مشکلات اجتماعی و شهری". دو سهامدار بزرگ گروه، تسلین و هوگ بلریک، که به ترتیب 10.8 و 7.5 درصد سهام را در اختیار دارند، گفتند که از این معامله حمایت خواهند کرد. Accell پیشنهاد خرید 33 یورویی هر سهم در سال 2017 از Pon Holdings، که صاحب Gazelle، Santa Cruz است را رد کرد. و برندهای Urban Arrow. در نهایت پون در اکتبر سال 2021 شرکت Dorel Industries را به قیمت 810 میلیون دلار خریداری کرد، یعنی بیش از دو برابر آنچه سربروس ارائه کرده بود و برندهای Schwinn، Cannondale و Mongoose را در اختیار گرفت. بیشتر بخوانید، سرمایهگذاران خطرپذیر اروپایی در سالهای 2019 و 2020، 165 میلیون دلار برای دوچرخههای الکترونیکی ریختند، که بیشتر از مجموع چهار سال گذشته بود. ثبت نامگزارش توسط توبی استرلینگ. ویرایش توسط جیسون نیلی، کیث ویر و یان هاروی استانداردهای ما: اصول اعتماد تامسون رویترز. .