Debroop Roy, 26, was approached by a family friend, doubling up as an insurance agent, with a lucrative investment plan. Roy will have to invest ₹1.2 lakh every year for 12 years and from the 13th year onwards, he will get ₹1.3 lakh annually for the next 34 years. That’s not all. The ₹14.40 lakh paid in premiums over the first 12 years will be returned fully in the final year of the investment term.

“The plan caught my attention as it promises guaranteed annual income well into retirement years and also returns the total investment amount. But, I approached a financial expert before committing as I’m aware how traditional insurance policies are pushed during the tax-saving season,” said Roy.

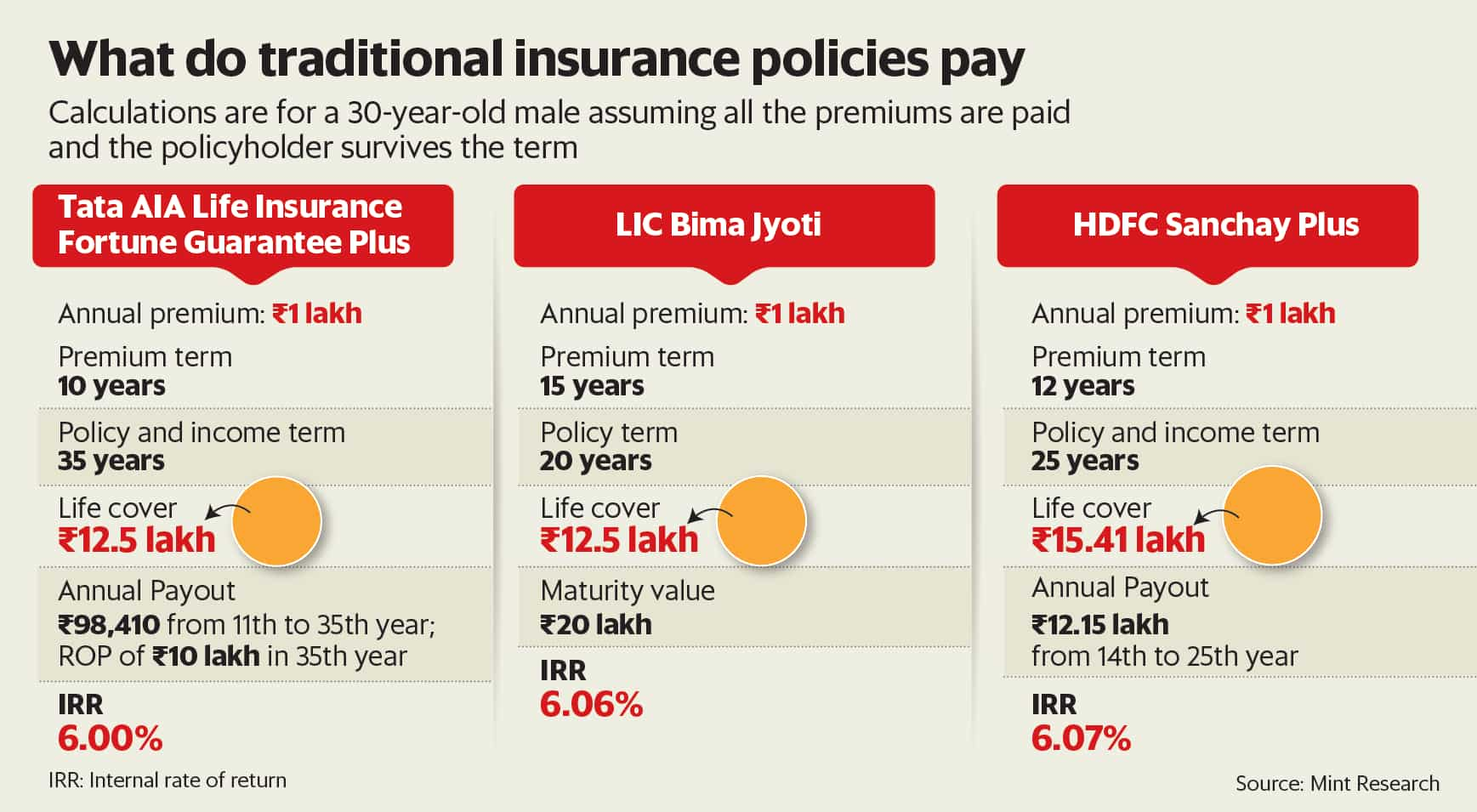

Roy was right in doing that. The internal rate of return (IRR) on this traditional insurance policy is 6%. In an insurance policy, IRR gives you the rate at which the invested money will grow to yield the guaranteed maturity amount in relation with inflation.

Mint calculated the IRR of three different traditional life insurance plans–one endowment plan and two money back plans with and without return of premium options–and found traditional insurance plans with policy terms of 20-35 years typically yield 6% (see graph). This is less than other comparable fixed-income investment options of the Public Provident Fund (PPF) and Sukanya Samriddhi scheme, which also enjoy triple taxation benefits like life insurance products, that are currently offering 8.1% and 7.6% annual interest rates, respectively.

![Mint Mint]() View Full ImageMint

View Full ImageMint

“Policies bought 20-25 years back are maturing to yield 6%-7%. It is worth noting that 20-22 years back, 10-year G-sec yield was 12%, 30-year G-sec yield was around 14% and AAA bond was 16-18%. During that time if somebody invested in AAA bonds and reinvested after 5-10 years in a 10-year G-sec bond, the return on investment would have compounded a minimum 9%. If you compare this, traditional insurance plans are a strict no,” said Vijai Mantri, co-founder and chief investment strategy, JRL Money.

The idea is not just to see what you earn on your investment but also to draw attention to the acute shortfall in insurance coverage that such plans offer. “The primary call of insurance is protection and endowment plans fail to achieve that,” said Mantri.

The shortfall

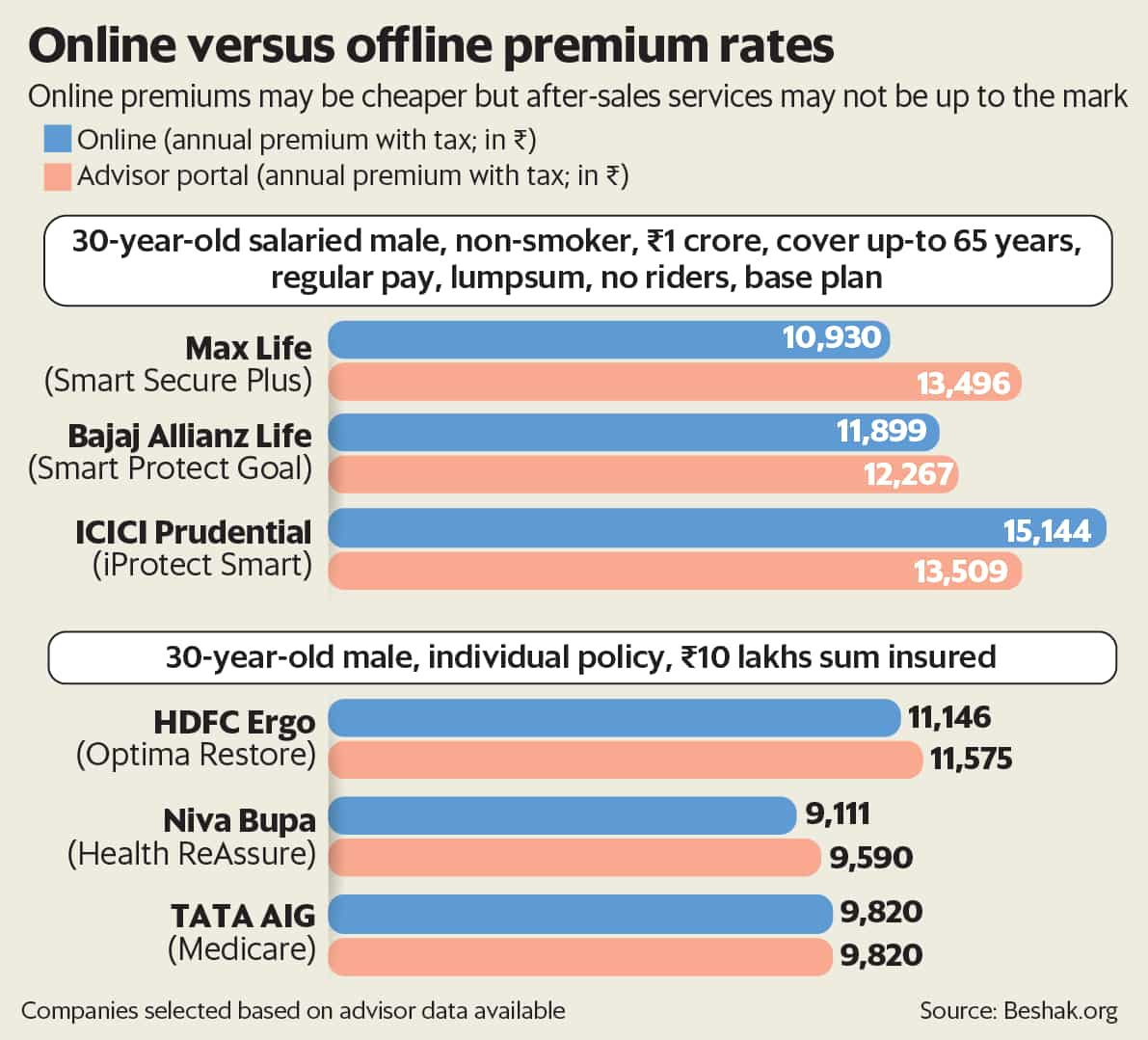

As a general rule, financial planners suggest buying a life insurance cover of 10-12 times one’s annual income. This is totally affordable if you buy a pure risk term plan. For example, a 30-year-old woman has to pay around ₹11,000 in premiums annually for a ₹1 crore life cover. In a traditional plan, on the other hand, affordable premiums offer an abysmally insufficient cover.

“In an endowment plan, you can either pay an affordable premium or get sufficient coverage. If you want to buy a life cover of ₹1 crore through an endowment plan, you’ll have to shell out ₹6 lakh – ₹7 lakh annually on the premium alone,” said Prableen Bajpai, founder, FinFix Research and Analytics.

The pull factor

It’s no secret that traditional insurance plans are aggressively sold in the last quarter of every financial year when taxpayers scramble to make last-minute tax-saving investments. The appeal is not just a tax break on the premium but also tax-free maturity proceeds.

“Maturity proceeds, including bonuses, received from life insurance policies are fully tax-exempt provided the ratio of premium paid to sum assured does not exceed 10% in any year. For policies issued before 1 April 2012 and after 1 April 2003, it is 20% of the sum assured,” said Sujit Bangar, founder, Taxbuddy.com.

Kartik Sankaran, founder, Fiscal Fitness, is of the opinion that tax breaks on life insurance policies prove to be more expensive than paying the tax. “Maturity proceeds are tax-free and you get a tax break today but you live with over 20 years of poor returns. One should rather allocate the premium in a mix of term plan and equity-linked savings scheme (ELSS) fund. Even after paying long-term capital gains (LTCG) on an ELSS fund 20 years later, you will have more net earning.”

Insurance policies lack liquidity and flexibility and, hence, are not the ideal tax-saving tool under section 80C. In comparison, ELSS, PPF, and National Savings Certificate score higher on flexibility as they have shorter lock-ins of 3 years, 15 years, and 5 years, respectively. Partial withdrawal on PPF is allowed after 5 years.

The idea of protection and saving in one plan along with guaranteed returns make traditional plans still very attractive to many investors. “As long as the customer knows what he’s buying, it’s alright but the problem is that selling practices are such that these plans are sold without properly explaining the commitments of long lock-in and that the premium has to be paid for a couple of years and not just the first year,” said an industry expert who did not wish to be named.

Policyholders, said experts, should ask questions on IRR, lock-in period and payment terms before buying a policy.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!

.