The Covid-19 pandemic has taught Indians not just the significance of buying health insurance but also renewing this policy on time. A recent study by Policybazaar.com showed that in FY 2021-22, 85 per cent of their customers renewed their family floater policies, and 80 per cent renewed their individual health policies, on time. Furthermore, 60 per cent chose to bolster their coverage with riders. Lifelong renewability benefit Timely renewal allows policyholders to avail of the benefit of lifelong renewability. Kapil Mehta, co-founder, SecureNow Insurance Brokers says, “If you …

Key stories on business-standard.com are available to premium subscribers only.

Already a premium subscriber? LOGIN NOW

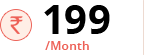

MONTHLY STAR

Business Standard Digital

![]()

Business Standard Digital Monthly Subscription

Complete access to the premium product

Convenient – Pay as you go

Pay using Amex/Master/VISA Credit Cards and VISA Debit Cards Only

Auto renewed (subject to your card issuer’s permission)

Cancel any time in the future

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

Requires personal information

What you get?

ON BUSINESS STANDARD DIGITAL

- Unlimited access to all the content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that industry.

- Stay on top of your investments. Track stock prices in your portfolio.

- 18 years of archival data.

NOTE :

- The product is a monthly auto renewal product.

- Cancellation Policy: You can cancel any time in the future without assigning any reasons, but 48 hours prior to your card being charged for renewal.

We do not offer any refunds. - To cancel, communicate from your registered email id and send the email with the cancellation request to [email protected]. Include your contact number for speedy action.

Requests mailed to any other ID will not be acknowledged or actioned upon.

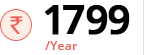

SMART ANNUAL

Business Standard Digital

Subscribe Now and get 12 months Free

![]()

Business Standard Premium Digital – 12 Months + 12 Months Free

Subscribe for 12 months and get 12 months free.

Single Seamless Sign-up to Business Standard Digital

Convenient – Once a year payment

Pay using an instrument of your choice -all Credit and Debit Cards, Net Banking, Payment Wallets, and UPI

Exclusive Invite to select Business Standard events

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

What you get

ON BUSINESS STANDARD DIGITAL

- Unlimited access to all content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that

industry. - Stay on top of your investments. Track stock prices in your portfolio.

NOTE :

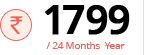

- The monthly duration product is an auto renewal based product. Once subscribed, subject to your card issuer’s permission we will charge your card/ payment instrument each month automatically and renew your subscription.

- In the Annual duration product we offer both an auto renewal based product and a non auto renewal based product.

- We do not Refund.

- No Questions asked Cancellation Policy.

- You can cancel future renewals anytime including immediately upon subscribing but 48 hours before your next renewal date.

- Subject to the above, self cancel by visiting the “Manage My Account“ section after signing in OR Send an email request to [email protected] from your registered email address and by quoting your mobile number.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

First Published: Mon, May 09 2022. 14:06 IST !function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=[];t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window,document,’script’,’https://connect.facebook.net/en_US/fbevents.js’);fbq(‘init’,’550264998751686′);fbq(‘track’,’PageView’); .

Dear Reader,

Dear Reader,