BRASILIA, July 22 (Reuters) – Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures. read more “The problem is the change in the spending cap,” said an Economy Ministry official, who requested anonymity to discuss the situation openly. “It weakens the reading that the fiscal situation will be under control in the coming years.”Register now for FREE unlimited access to Reuters.comEven with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil’s yield curve remains under pressure as investors brace for the worst. read more Both major presidential candidates on the ballot in October – leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro – have signaled they plan to extend this year’s boost in social spending into next year.”It’s a fiscal bomb,” said Sergio Goldenstein, chief strategist at Renascença DTVM. “Risk premiums look high, but there is little room for a relevant drop.”The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil’s five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.Concerns about Brazil’s credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.”All the credit spreads in the world are opening, our bonds are not immune to that,” said Ronaldo Patah, chief strategist at UBS Consenso.In fact, Brazil’s strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.Brazil’s central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.”I am struck by this process of (yield curve) flattening that we are seeing at a very high level”, said the chief economist at Ativa Investimentos Etore Sanchez.Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending.”The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected”, said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.Register now for FREE unlimited access to Reuters.comReporting by Marcela Ayres and Jose de Castro

Editing by Brad HaynesOur Standards: The Thomson Reuters Trust Principles. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

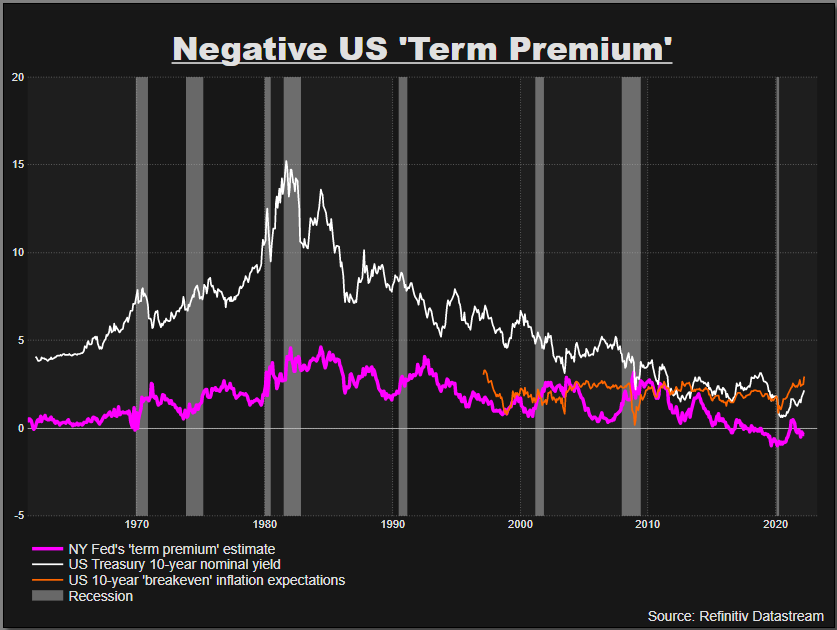

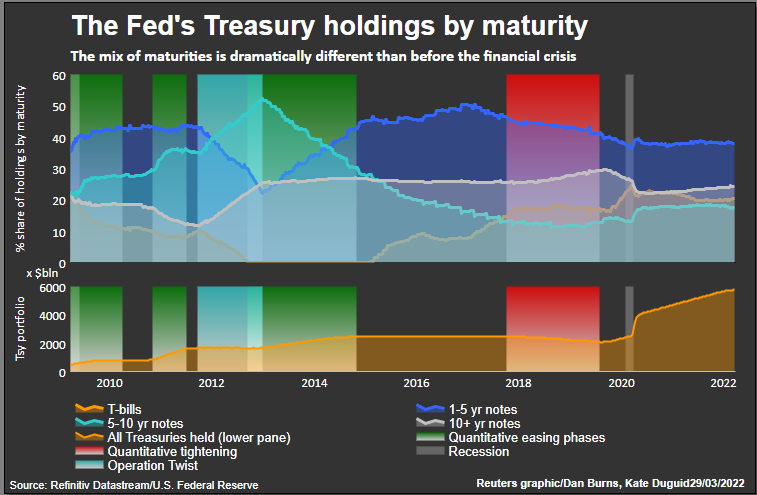

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

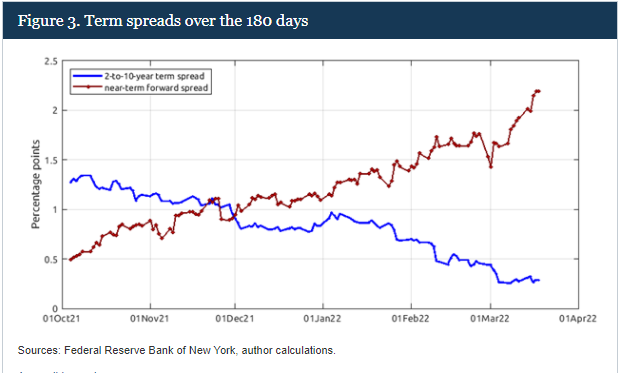

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Middle East Crude Benchmarks slip; Al-Shaheen premium hikes

BEIJING, March 11 (Reuters) – Middle East crude benchmarks Oman, Dubai and Murban shaded weaker on Friday as major oil producers strive to bring more supply to the market to offset the embargos on Russian cargos, while policymakers around the globe mull tapering inflation.Qatar Energy has sold four May-loading crude cargoes via tenders at record premiums after buyers avoided Russian oil amid fears of Western sanctions following Moscow’s invasion of Ukraine. Spot premiums for al-Shaheen crude nearly tripled from the previous month after the producer sold two al-Shaheen crude cargoes to Unipec and PetroChina at about $12 a barrel above Dubai quotes, they said. The cargoes will load on May 2-3 and 29-30.Register now for FREE unlimited access to Reuters.comExports of Malaysia’s flagship Kimanis crude oil are set to fall to six cargoes in May, down two from April, due to maintenance at oilfields offshore Sabah, a preliminary loading schedule showed on Friday. read more Sinopec’s (600028.SS) 250,000 barrels-per-day Yangzi refinery will shut down its whole plant for a 61-day planned maintenance, starting from March 15, according to a company statement. OSPKuwait raised the official selling prices (OSPs) for two crude grades it sells to Asia in April from the previous month, a price document reviewed by Reuters showed on Friday. read more The producer has set April Kuwait Export Crude (KEC) price at $4.80 a barrel above the average of Oman/Dubai quotes, up $2.25 from the previous month.It also raised the April Kuwait Super Light Crude (KSLC) OSP to $5.95 a barrel above Oman/Dubai quotes, up $2.60.The price hike for KEC was 10 cents more than that for Saudi’s Arab Medium crude in the same month.WINDOWCash Dubai’s premium to swaps fell 61 cents to $11.48 a barrel.PRICES ($/BBL)India’s ONGC Videsh failed to get bids in its tender to sell 700,000 barrels of Russian Sokol crude in a growing backlash against Moscow for its invasion of Ukraine, sources familiar with the matter said. read more This was the first tender by ONGC Videsh, since the war in Ukraine began on Feb. 24.NEWSNorwegian state oil company Equinor (EQNR.OL) has stopped trading Russian oil as it winds down operations there in the wake of Moscow’s invasion of Ukraine. read more Canada is studying ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its dependence on Russian oil. read more European Union leaders are set to agree on Thursday to cut their reliance on Russian fossil fuels, although they are divided over whether to cap gas prices and to sanction oil imports as Moscow wages war in Ukraine. read more The European Central Bank will stop pumping money into financial markets this summer, it said on Thursday, paving the way for an increase in interest rates as soaring inflation outweighs concerns about the fallout from Russia’s invasion of Ukraine. read more For crude prices, oil product cracks and refining margins, please click on the RICs below.Register now for FREE unlimited access to Reuters.comReporting by Muyu Xu and Florence Tan; Editing by Krishna Chandra EluriOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Where now after 2% yield? Bond investors take stock

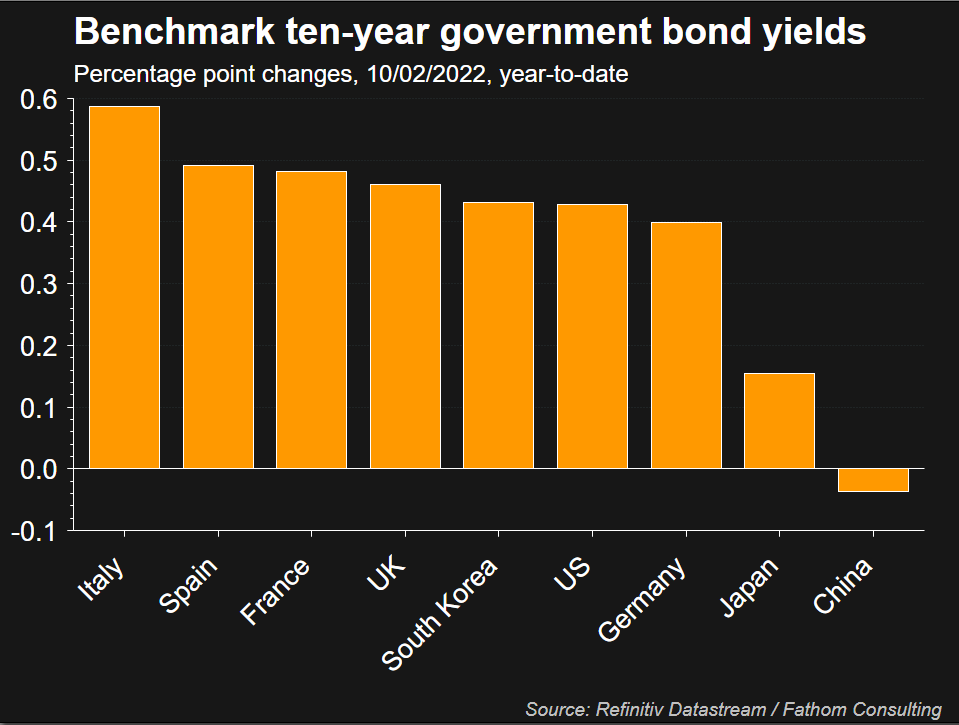

The Federal Reserve building is seen in Washington, U.S., January 26, 2022. REUTERS/Joshua Roberts/File PhotoRegister now for FREE unlimited access to Reuters.comRegisterNEW YORK, Feb 10 (Reuters) – U.S. Treasury yields have shot higher this year, rising faster than many forecast. Investors are now assessing if anticipation of a more hawkish Fed will continue to push levels up, with the potential to upset riskier assets.Expectations that the U.S. Federal Reserve may increase rates more aggressively than anticipated to counter rising inflation have pushed up yields while flattening the U.S. Treasury yield curve. That matters as bond yields impact global asset prices as well as consumer loans and mortgages. The shape of the U.S. Treasury yield curve can also help predict how the economy will fare.On Thursday, yields on 10-year notes hit 2% after higher-than-anticipated inflation data. Federal funds rate futures showed an increased chance of a half percentage-point tightening at next month’s meeting after the data, while strategists said the data increased the chances of swifter moves to reduce the Fed’s balance sheet. The central bank’s nearly $9 trillion portfolio doubled in size during the pandemic. read more Register now for FREE unlimited access to Reuters.comRegister“The market is starting to price in a much more aggressive path of rate hikes … clearly there is a sense of urgency again”, said Subadra Rajappa, head of U.S. rates strategy at Societe Generale.Yields, which move inversely to prices, are up from 1.79% at the beginning of February. The last time they breached 2% was August 2019.”I would say the chances of yields continuing to go higher are pretty high,” said Gargi Chaudhuri, Head of iShares Investment Strategy, Americas, at BlackRock, speaking ahead of the data.FOREIGN COMPETITIONCompetition in other markets for yield may be sapping demand for Treasuries and helping push yields higher, Chaudhuri said.A second rate hike by the Bank of England last week, and expectations of faster policy tightening by the European Central Bank (ECB), added to U.S. bonds’ weakness, with borrowing costs in Europe – as well as Japanese government bond yields – having jumped to multi-year highs in recent days. read more “Investors have these other markets to gravitate towards that they didn’t in the past, and that will require investors that are focusing on U.S. markets to seek a higher term premium and therefore will impact yields higher,” Chaudhuri said.Japan’s benchmark 10-year government bond yield is around its highest level since January 2016 at 0.220% while Germany’s 10-year government bond yield , at 0.255%, is at its highest since January 2019. read more  FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .