TOKYO, Oct 13 (Reuters) – A joint venture set up by Japan’s Sony Group Corp (6758.T) and Honda Motor (7267.T) is aiming to deliver its first electric vehicles by 2026 and will sell them online, starting in the United States and Japan.The new EV will also be priced at a premium, offering a new software system developed by Sony that would open the way to recurring revenue from entertainment and other services that would be billed monthly, the companies said.The update from the joint venture, Sony Honda Mobility, is the first since the two companies launched the project in June.Register now for FREE unlimited access to Reuters.comKey details, including pricing, battery range and even the platform for the new vehicle have not been determined, but representatives of the new company detailed a vision for a vehicle that would function almost like a rolling smartphone.Sony will provide the software system for the new car, from the onboard controllers to cloud-based services that will connect with entertainment and payment systems.It will also provide sensors and other technology for a Level 3 autonomous drive system that will allow for drivers to pay more attention to the content and software services that will be offered.In Level 3 systems, also known as limited self-driving automation, drivers can ride without watching the road or handling the wheel on highway driving but need to be ready to take back control.Tesla (TSLA.O), General Motors(GM.N), Ford Motor Co (F.N) and Mercedes Benz(MBGn.DE) all offer some form of hands-free driving assist systems.“As safe driving technology will continue to evolve and the amount of concentration required to drive will be reduced, we should consider new ways to enjoy and spend time in the cabin space as a whole,” said Izumi Kawanishi, the joint venture’s president and executive at Sony.Honda will decide on the platform that the new vehicle will use and details like the battery supplier. The still-to-be named EV will likely be manufactured by Honda at one of its plants in Ohio.Honda, like its bigger rival Toyota Motor (7203.T), has been slow to shift its fleet to electric. It has also struggled over the years to make gains in the luxury vehicle market with its Acura brand.Yasuhide Mizuno, the joint venture’s chairman and chief executive, and a senior Honda executive, said the project was important for Honda to develop a “longer-term relationship” with its car buyers as the vehicle shifts to become more of a connected device.Mizuno said Honda believed that 2025 would be a crucial year in the shift toward EVs in the U.S. market and that the joint-venture believed it had to hit that opening even though it means a compressed development cycle for the new EV.The new EV will be delivered to the Japanese market in the second half of 2026. The two companies are considering a launch for Europe, but no plan has been set. Orders for the new EV should open in 2025, the companies said.($1 = 146.8300 yen)Register now for FREE unlimited access to Reuters.comReporting by Satoshi Sugiyama; Editing by Ana Nicolaci da CostaOur Standards: The Thomson Reuters Trust Principles. .

Mitsubishi pays record premium for Vietnam oil for power generation – sources

A man walks past in front of a sign board of Mitsubishi UFJ Trust and Banking Corporation, the asset management unit of Japan’s Mitsubishi UFJ Financial Group Inc. (MUFG), in Tokyo, Japan July 31, 2017. REUTERS/Issei KatoRegister now for FREE unlimited access to Reuters.comSINGAPORE, July 20 (Reuters) – Mitsubishi Corp bought a cargo of Vietnamese crude for loading in September on behalf of Japanese utilities at a record premium for the grade, traders said on Wednesday.The purchase comes after Nippon Steel bought a liquefied natural gas (LNG) cargo at the highest price ever paid in Japan. The world’s No. 2 LNG importer is scrambling for power fuels as a global heatwave drives electricity demand this summer. read more “Japan has a power shortage, so it has to pay up. Other countries also have the same problem now, especially in Europe,” one of the traders said.Register now for FREE unlimited access to Reuters.comMitsubishi paid a premium of $21 a barrel to dated Brent for the 300,000-barrel cargo of Vietnamese Chim Sao crude, said two of the traders who regularly track the grade.That puts the cost of the cargo at about $127 a barrel based on current Brent prices, or $38.1 million.Mitsubishi does not comment on individual deals, a spokesperson said.Japan last imported Chim Sao crude in February and April, according to Refinitiv data.Register now for FREE unlimited access to Reuters.comReporting by Florence Tan, Additional reporting by Nobuhiro Kubo in Tokyo; Editing by Louise HeavensOur Standards: The Thomson Reuters Trust Principles. .

Column: Collapsing metal inventories clash with plunging prices

LONDON, July 13 (Reuters) – London Metal Exchange (LME) stocks are rapidly dwindling.LME warehouses held just 696,109 tonnes of registered metal at the end of June, the lowest amount this century.Inventory halved over the first six months of the year and June’s tally was down by 1.67 million tonnes year-on-year.Register now for FREE unlimited access to Reuters.comThe downtrend has further to run.Nearly 306,000 tonnes of metal were awaiting physical load-out at the end of last month. Available tonnage of all metals was just 390,280.LME shadow stocks, metal stored off-market with the option of exchange delivery, rebuilt modestly in April and May but the year-to-date increase has been a negligible 4,600 tonnes.Shrinking exchange stocks should be a bullish price signal. Right now, however, macro is trumping micro as Western recession fears pummel the industrial metals complex. The LME Index (.LMEX), which tracks the performance of the exchange’s six main base metals, has slumped by 31% from its April peak.The scale of the disconnect between price and stocks is striking. The resulting mismatch of current scarcity and expected future surplus is likely to be resolved by sporadic flare-ups in LME time-spreads.LME registered and “shadow” stocksSTOCKED OUTThis is currently happening in the LME zinc market. The cash premium over three-month metalAvailable live stocks shrunk to a depleted 14,975 tonnes at one stage in June and are still a meagre 22,475 tonnes.The rest of the headline zinc inventory of 82,200 tonnes is scheduled to depart.It also happened to sister metal lead last year, when the cash premium spiked to over $200 per tonne in August as LME on-warrant stocks fell to less than 40,000 tonnes.Time-spread tightness has been a recurring feature of the LME lead contract ever since and the cash premium is once again edging wider, ending Tuesday valued at $33 per tonne.That’s because lead stocks haven’t rebuilt in any meaningful way, currently totalling 39,250 tonnes with available tonnage at 34,850.The LME tin market has been living with depleted stocks since the start of 2021 and backwardation appears to be now hard-wired into short-dated spreads.PHYSICAL TIGHTNESSLow LME stocks of all three metals reflect extreme physical supply-chain tightness.All three have seen significant supply disruption over the last year with tin smelters hit by coronarivus lockdowns, zinc smelters in Europe powering down due to high energy prices and the Stolberg lead plant in Germany out of action since July 2021 due to flooding. read more Physical premiums for all three metals have hit record highs in Europe and the United States and remain close to those levels even as outright prices have dropped like a stone.The LME has acted as market of last resort for physical buyers and stocks will only rebuild once the supply-chain pressures pass.Chinese exports are helping rebalance both lead and zinc markets but the process is a slow one as freight and logistics bottlenecks brake arbitrage flows.

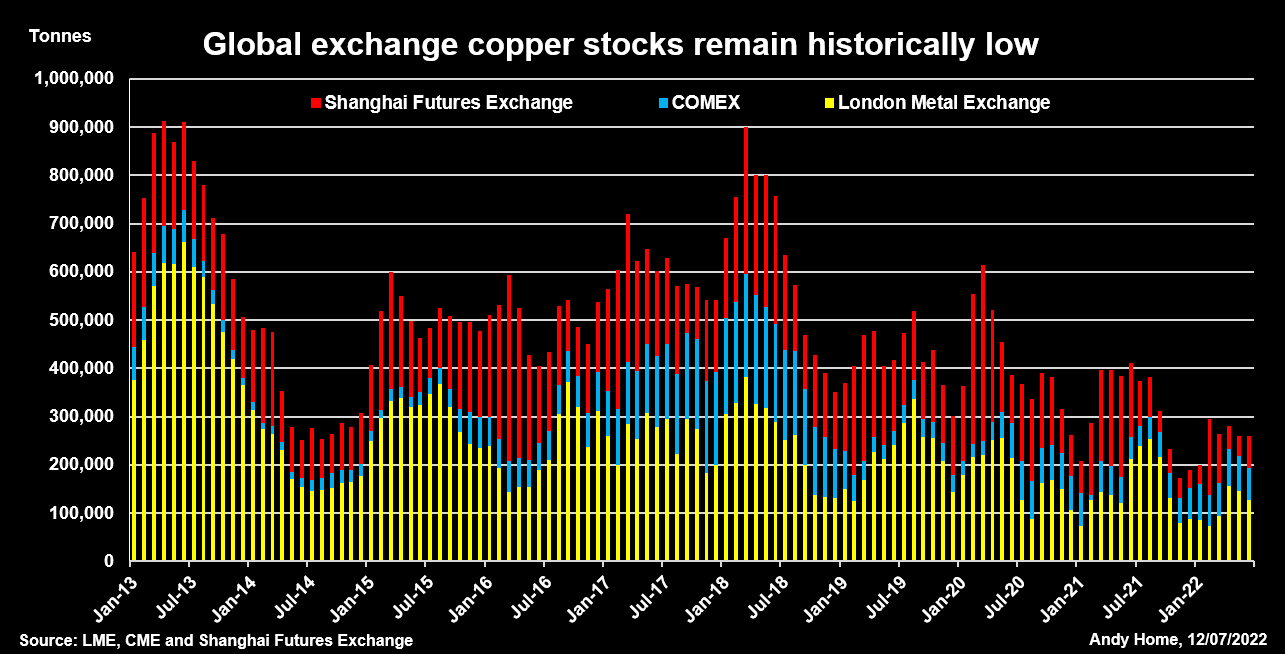

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.LME registered and shadow aluminium stocksOFF-MARKET BUILD?Weaker Chinese demand doesn’t appear to have made any impact on ShFE copper inventory, which remains low at 69,000 tonnes, down from 129,500 tonnes a year ago.However, the headline stocks may be deceiving.The Chinese market has been rocked by another multi-pledging stocks scandal reminiscent of the Qingdao fraud of 2014.That seems to have triggered movement of both aluminium and zinc into safe-haven storage and may be deterring copper exchange deliveries.It’s quite possible that such rotation between visible and non-visible storage is accentuating the LME stocks downtrend as well.Registered aluminium stocks, for example, collapsed by 64% over the first half of the year. Live tonnage stands at just 156,300 tonnes.Yet there is no sign of tension in aluminium time-spreads, the cash-to-three-months period trading in mild contango.The market seems to be assuming that there is no shortage of aluminium despite the headline stocks figure ticking lower every day.But if metal is available, it is evidently sitting in the statistical darkness.One small clue as to its existence was a 92,000-tonne build in LME shadow aluminium stocks over the course of April and May.Such metal is primed for LME warranting if price and spreads move into the right alignment and the recent rise suggests that some metal at least is being enticed back to the paper market from the physical market.REGIONAL IMBALANCEJust about all of the shadow aluminium stocks build has occurred in Asia, which accounted for 87% of the 289,978 tonnes in this category at the end of May.LME warehouse locations in Europe held just 21,642 tonnes and U.S. ones 14,608 tonnes.The same regional skew is clear to see across all the LME base metals and is as equally true of registered stocks as it is of shadow inventory.It is a symptom of the supply and freight issues that have roiled the metals markets since the onset of COVID-19 two years ago.It is also a warning that metals supply chains are still far from functioning efficiently, even as prices bow to the weight of macro selling.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Insurance rates jump for Ukraine war-exposed business, sources say

Planes of Aeroflot and Rossiya Airlines are seen parked at Sheremetyevo International Airport, as the spread of the coronavirus disease (COVID-19) continues, outside Moscow, Russia April 8, 2020 REUTERS/Tatyana Makeyeva/File PhotoRegister now for FREE unlimited access to Reuters.comLONDON, May 30 (Reuters) – Insurance premiums are doubling or more for some aviation and marine business particularly exposed to the war in Ukraine, increasing costs for airline and shipping firms, industry sources say.Global commercial insurance premiums rose 11% on average in the first quarter, according to insurance broker Marsh, which said the war was putting upward pressure on rates.But the overall figure masks sharper moves in some sectors, and only covers the first five weeks following the invasion.Register now for FREE unlimited access to Reuters.comWar is typically excluded from mainstream insurance policies. Customers buy extra war cover on top.Garrett Hanrahan, global head of aviation at Marsh, said aviation war insurance was no longer available for Ukraine, Russia and Belarus as a result of the conflict.For the rest of the world, aviation war cover has doubled, as insurers try to recoup some of their losses, he said.”The hull war market is beginning to reflate itself through rate rises.”The conflict, which Russia calls a “special military operation”, could lead to insurance losses of $16 billion-$35 billion in so-called “specialty” insurance classes such as aviation, marine, trade credit, political risk and cyber, S&P Global said in a report. read more Aviation insurance claims alone could total $15 billion, S&P Global said, with hundreds of leased planes stranded in Russia as a result of western sanctions and Russian countermeasures.One aircraft lessor described recent rate increases on its insurance as “not a pretty sight”. read more Some aircraft lessors – a particularly exposed sector of the market because their planes are stuck in Russia – were now having to pay 10 times their original premium, one underwriter said, while another said insurers could “name their price” to lessors.In ship insurance, policyholders pay an additional “breach” premium when a ship enters particularly dangerous waters, locations which are updated by the Lloyd’s market.For the area around Russian and Ukrainian waters in the Black Sea and Sea of Avov, this has increased multiple times, three insurance sources said, to around 5% of the value of the ship, from 0.025% before the invasion, amounting to millions of dollars for a seven-day policy.Each time a ship goes into those waters, it has to pay that extra premium.Rates for ships going into other Russian waters have also risen by at least 50% after the Lloyd’s market classified all Russian ports as high risk, two of the sources said.Because of the dangers, some marine insurers have also stopped providing cover for the region. read more Register now for FREE unlimited access to Reuters.comReporting by Carolyn Cohn, Jonathan Saul and Noor Zainab Hussain, Editing by Angus MacSwanOur Standards: The Thomson Reuters Trust Principles. .