The passengers refused to wear the facemasks despite repeated reminders from the crew.

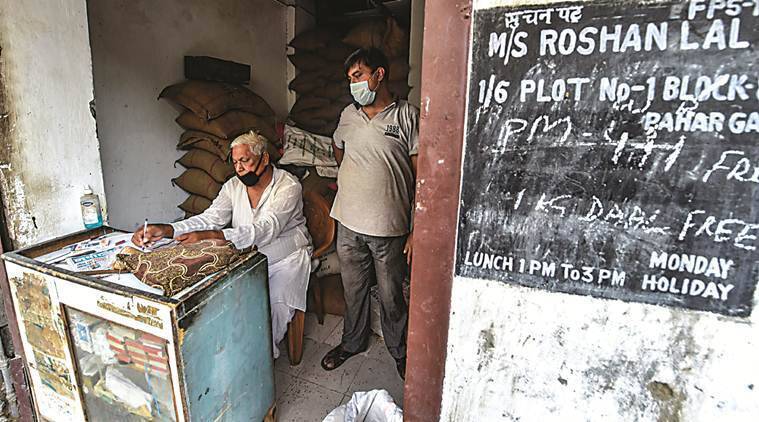

According to the Delhi Police, 16 challans were issued in respect of Covid-19 violations at the IGI Airport in June (Express photo by Nirmal Harindran)Following the Delhi High Court’s order to the Directorate General of Civil Aviation (DGCA) for strict action against passengers found not wearing masks inside the flights, a total of 15 passengers travelling from Srinagar to Delhi on June 29 were taken to the police station on their arrival in the national capital for refusing to wear masks despite repeated announcements by the crew.

According to the Delhi Police, 16 challans were issued in respect of Covid-19 violations at the IGI Airport in June (Express photo by Nirmal Harindran)Following the Delhi High Court’s order to the Directorate General of Civil Aviation (DGCA) for strict action against passengers found not wearing masks inside the flights, a total of 15 passengers travelling from Srinagar to Delhi on June 29 were taken to the police station on their arrival in the national capital for refusing to wear masks despite repeated announcements by the crew.

You have exhausted your

monthly limit.

To continue reading,

simply register or sign in

You need a subscription to read on.

Now available at Rs 2/day.

This premium article is free for now.

Register to continue reading this story.

This content is exclusive for our subscribers.

Subscribe to get unlimited access to The Indian Express exclusive and premium stories.

This content is exclusive for our subscribers.

Subscribe now to get unlimited access to The Indian Express exclusive and premium stories.

The submission was made by the DGCA in a reply before the division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad. Besides the 15 travellers, similar action was also taken against a passenger travelling from Muscat International Airport to Mumbai on June 16. In two other cases related to violation of guidelines, FIRs were also filed. A passenger travelling from Mumbai to Ranchi was offloaded on June 7.

The passengers refused to wear the facemasks despite repeated reminders from the crew. “Airline crew followed all the protocols in this respect and when all other means of getting the passengers to comply were exhausted, they were handed over to the security staff on arrival, with requisite documentation,” said the DGCA.

According to the Delhi Police, 16 challans were issued in respect of Covid-19 violations at the IGI Airport in June and a total of Rs 8,000 was imposed as penalty.

DGCA on June 8 had asked the airlines and airports to ensure strict compliance of Covid-19 protocols, following an order from the court.

A division bench of the court on June 3 had said that, “we are of the view that the DGCA should issue separate binding directions to all staff persons deployed at the airports and in the aircrafts, including flight attendants, air hostesses, captains/pilots and others, to take strict action against passengers and others who violate the masking and hygiene norms. All such persons who are found to violate the said norms should be appropriately fined and persistent defaulters should be placed on the no- fly list.”

The court on Monday heard an application seeking easing of restrictions at the airports and inside flights on account of the change in Covid-19 situation. Observing that there are very few coronavirus cases now, the division bench headed by Chief Justice Satish Chandra Sharma said that the DGCA shall carry out periodical review of the guidelines and also adhere to instructions issued by the Centre from time to time.

The High Court last year had initiated a suo motu case regarding non-compliance of guidelines by passengers during domestic travel. One of the High Court judges had taken note of the fact that many passengers in an Air India flight from Kolkata to New Delhi on March 5 wore masks below their chin and showed a “stubborn reluctance” to wear them properly.

Special offer

For your UPSC prep, a special sale on our ePaper. Do not miss out!

- The Indian Express website has been rated GREEN for its credibility and trustworthiness by Newsguard, a global service that rates news sources for their journalistic standards.

.