SVOD subscriptions may also be affected by the bring-forward effect of Covid-19 as the currently accelerated growth rate may taper with the pandemic subsiding.Jehil Thakkar, Partner, Media and Entertainment Leader, Deloitte India, told IANS that the wide adoption of smartphones combined with cheap data as well as the diverse content available to address all tastes is one of the key factors that led to the growing adoption of OTT platforms in India.”Pricing too has been an influencer as low prices and some free options have always encouraged sampling and adoption in the country,” Thakkar said.According to experts, the market for providing video streaming services in India is highly fragmented with more than 40 streaming players vying for the customer’s wallet.Global streaming service providers such as Amazon, Disney-owned Hotstar and Netflix compete with domestic service providers such as Zee5, Voot, SonyLiv and MX Player), as well as a host of regional players.In a latest move, most major streaming players have launched mobile-centric plans targeting price-sensitive millennials and Gen Z customers.These plans also capitalise on low data rates ($0.09 per GB) and widespread smartphone user base (more than 600 million) in the country.Industry experts say that the demand for OTT streaming content based on geo-demography is on the rise, both within India and internationally from the considerable Indian diaspora.According to Gaurav Gandhi, Director & Country Manager, Amazon Prime Video India, one out of every five viewers for Indian Amazon Originals is from outside the country.In a recent blog, Gandhi said that the local language titles on Prime Video are viewed in over 4,000 cities and towns in India besides being watched in 170 countries.”Our Indian Amazon Originals enjoy incredible popularity both in the country and outside India International viewers already account for between 15 and 20 per cent of total audiences of these local language films,” he informed. .

India likely to offer lower import tariffs on premium Australian wine

This will be part of an early harvest agreement; officials hope to finalise the interim trade pact by end of this month

Topics

India | Australia | Wine

Shreya Nandi |

New Delhi

Last Updated at March 23, 2022 06:10 IST

India is likely to offer lower import tariffs on premium Australian wine as part of the interim trade deal that officials hope to finalise by month-end, people aware of the matter said. The interim trade deal, which was being negotiated since September last year, was supposed to be finalised at the beginning of the month. Both nations had earlier set a December 25 deadline but the deal couldn’t be finalised as both countries were not able to iron out disagreements on market access issues. “We have readied almost everything, but some key differences have …

Key stories on business-standard.com are available to premium subscribers only.

Already a premium subscriber? LOGIN NOW

MONTHLY STAR

Business Standard Digital

![]()

Business Standard Digital Monthly Subscription

Complete access to the premium product

Convenient – Pay as you go

Pay using Amex/Master/VISA Credit Cards and VISA Debit Cards Only

Auto renewed (subject to your card issuer’s permission)

Cancel any time in the future

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

Requires personal information

What you get?

ON BUSINESS STANDARD DIGITAL

- Unlimited access to all the content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that industry.

- Stay on top of your investments. Track stock prices in your portfolio.

- 18 years of archival data.

NOTE :

- The product is a monthly auto renewal product.

- Cancellation Policy: You can cancel any time in the future without assigning any reasons, but 48 hours prior to your card being charged for renewal.

We do not offer any refunds. - To cancel, communicate from your registered email id and send the email with the cancellation request to [email protected]. Include your contact number for speedy action.

Requests mailed to any other ID will not be acknowledged or actioned upon.

SMART ANNUAL

Business Standard Digital

Subscribe Now and get 12 months Free

![]()

Business Standard Premium Digital – 12 Months + 12 Months Free

Subscribe for 12 months and get 12 months free.

Single Seamless Sign-up to Business Standard Digital

Convenient – Once a year payment

Pay using an instrument of your choice -all Credit and Debit Cards, Net Banking, Payment Wallets, and UPI

Exclusive Invite to select Business Standard events

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

What you get

ON BUSINESS STANDARD DIGITAL

- Unlimited access to all content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that

industry. - Stay on top of your investments. Track stock prices in your portfolio.

NOTE :

- The monthly duration product is an auto renewal based product. Once subscribed, subject to your card issuer’s permission we will charge your card/ payment instrument each month automatically and renew your subscription.

- In the Annual duration product we offer both an auto renewal based product and a non auto renewal based product.

- We do not Refund.

- No Questions asked Cancellation Policy.

- You can cancel future renewals anytime including immediately upon subscribing but 48 hours before your next renewal date.

- Subject to the above, self cancel by visiting the “Manage My Account“ section after signing in OR Send an email request to [email protected] from your registered email address and by quoting your mobile number.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

First Published: Wed, March 23 2022. 06:10 IST !function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=[];t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window,document,’script’,’https://connect.facebook.net/en_US/fbevents.js’);fbq(‘init’,’550264998751686′);fbq(‘track’,’PageView’); .

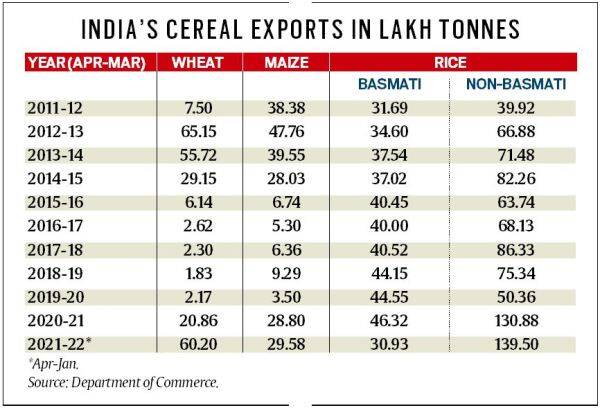

Explained: Export avenue for farmers

There are winners and losers in wars. And collateral beneficiaries too: The ongoing Russian invasion of Ukraine is happening when Indian farmers seem set to harvest a bumper rabi (winter-spring) crop. That includes not only wheat, but also mustard, maize (corn) and barley. Their prices have all firmed up, thanks to the war-induced disruption of grain trade via the Black Sea and Russian banks being blocked from the international payments system.

🗞️ Subscribe Now: Get Express Premium to access the best Election reporting and analysis 🗞️

India has already exported over 6 million tonnes (mt) of wheat during April-January 2021-22. Amit Takkar, managing director of Conifer Commodities Pvt. Ltd, a Gurgaon-based agricultural trade consultancy, expects total shipments for the fiscal to top 7.5 mt, an all-time-high.

The same goes for rice, where non-basmati exports have touched 14 mt in April-January and surpassed the 13.1 mt record for the whole of 2020-21. “We should end up doing close to 17 mt of non-basmati and another 4 mt of basmati,” says Nitin Gupta, vice president of Olam Agro India Ltd, a leading exporter of the cereal. Even corn shipments are on course to reach 3.5-4 mt, levels last seen in 2013-14 (see table).

Source: Department of Commerce

Source: Department of Commerce

The Ukraine factor

The surge in Indian rice exports since 2020-21 has been driven primarily by drought in Thailand – plus diversion of free/ultra-subsidised grain whose allocations, ostensibly for the public distribution system, were substantially increased post the Covid-19 pandemic.

But the escalating Russo-Ukrainian conflict’s impact is wider and probably far more beneficial for Indian farmers. According to the US Department of Agriculture, Russia and Ukraine together account for 28.3% of the world’s wheat exports, with the corresponding shares at 19.5%, 30.8% and 78.3% for corn, barley and sunflower oil, respectively. These are projections for 2021-22 made in early-February, before the war broke out.

The war has led to port closures in the Black Sea and Russian cargo movement being largely restricted through the Caspian Sea. As supplies from these two key agri powerhouses have dried up, it has created opportunities for India to fill the gap, even if partially. Further, it has driven up global prices and realisations for Indian farmers – just when they are about to bring their harvested rabi crop to the mandis!

The opportunity…

Mustard is selling now in Rajasthan’s major wholesale markets at Rs 6,500-6,700 per quintal, as against Rs 5,000-5,200 a year ago and the government’s minimum support price (MSP) of Rs 5,050. That’s good for growers of this oilseed also in Uttar Pradesh, Madhya Pradesh and Haryana.

Barley prices, too, are ruling at Rs 2,100-2,200 per quintal, higher than last year at this time (Rs 1,300-1,400) and its official MSP (Rs 1,635). This feed grain, which is also malted for use by breweries, is cultivated mainly in Rajasthan, UP, MP and Haryana. Maize is similarly trading at Rs 1,900-2,000 per quintal in most mandis, compared to Rs 1,200-1,300 a year back and the MSP of Rs 1,870.

The biggest beneficiary of higher maize prices would be Bihar. The state has a nearly 25% share in the country’s production of the feed grain, while even more, at roughly three-fourths, for the rabi crop marketed from late-April to May. There has been a huge jump in Indian maize exports to Vietnam and Malaysia, in addition to nearby markets such as Bangladesh, Nepal and Sri Lanka. These could further pick up with the Bihar crop’s arrival. New supplies from Brazil and Argentina won’t ready for dispatch before late-June/July, besides requiring longer voyage time to South-East Asian ports than from Visakhapatnam or Kakinada in Andhra Pradesh.

The opportunities are still higher in wheat, which is currently being shipped from Gujarat’s Kandla and Mundra ports at $340-350 per tonne free-on-board. That price (Rs 26,000-26,775/tonne) works out above the MSP of Rs 20,150, even after deducting port handling, storage and vessel loading charges (Rs 1,400), transport (Rs 1,500-3,000, depending upon the distance from inland to port) and costs of bagging, loading, etc at the mandi (Rs 1,600-2,000).

The opportunities are still higher in wheat, which is currently being shipped from Gujarat’s Kandla and Mundra ports at $340-350 per tonne free-on-board. That price (Rs 26,000-26,775/tonne) works out above the MSP of Rs 20,150, even after deducting port handling, storage and vessel loading charges (Rs 1,400), transport (Rs 1,500-3,000, depending upon the distance from inland to port) and costs of bagging, loading, etc at the mandi (Rs 1,600-2,000).

Simply put, soaring international prices have opened up export possibilities for Indian wheat, so much so that the government might not have to undertake significant MSP procurement this time. Farmers in Gujarat, Maharashtra, Karnataka or even MP and Rajasthan are likely to realise MSP-plus prices on the back of rising export demand. This will help whittle down public wheat stocks, which, at 23.4 mt on March 1, already stood below the 29.5 mt and 27.5 mt for the same date of 2021 and 2020, respectively. With lower procurement and the Pradhan Mantri Garib Kalyan Anna Yojana (free grain scheme) ending this month, there could be a corresponding reduction in the Centre’s food subsidy outgo as well.

The overall improved price sentiment may, moreover, induce farmers to plant more area under maize, cotton, soyabean, sesamum and sunflower in the upcoming kharif cropping season. That should go some way in promoting crop diversification – especially, weaning farmers away from paddy and sugarcane.

…Threats

On the downside, there is also the possibility of exporters competing among themselves to ship out the maximum quantity of grain. This is evident in Indian wheat being heavily discounted and offered at $340-350 per tonne, compared to $400-450 for grain from Argentina, Australia and European Union. The rush of cargoes is also resulting in congestion at ports and vessel wait periods (time spent after arrival and berthing) going up from 1-2 days to 5-7 days. “Logistical bottlenecks are going to be a real problem in the weeks ahead,” warns Takkar.

A second, perhaps greater, risk relates to availability of fertilisers. While the Food and Agriculture Organisation’s global food price index has hit an all-time-high in February, it has also been accompanied by skyrocketing prices of fertilisers and their raw materials/intermediates. Ensuring adequate availability of urea, di-ammonium phosphate (DAP), muriate of potash (MOP) and complex fertilisers, well before the start of kharif plantings from June, would have to receive priority.

“With question mark over the supply of MOP from Russia and Belarus, the government has to talk to other countries such as Canada, Israel and Jordan. Similar expeditious effort is needed to secure supply of DAP, phosphoric acid and rock phosphate from Saudi Arabia, Morocco, Jordan, Senegal, Tunisia and Togo,” a fertiliser industry source points out.

(The writer is National Rural Affairs & Agriculture Editor of The Indian Express and Senior Fellow at the Centre for Policy Research, New Delhi)

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘444470064056909’);

fbq(‘track’, ‘PageView’);

.

Singapore talks to India, seeks clarity

SINGAPORE/NEW DELHI :

Singapore has raised concerns with India about its ban of popular gaming app “Free Fire”, owned by technology group Sea Ltd, in the first sign of diplomatic intervention after the move spooked investors, four sources told Reuters.

After the ban, the market value of the New York-listed Southeast Asian firm dropped by $16 billion in a single day, and investors worry India could extend it to Sea’s e-commerce app, Shopee, which recently launched in the country.

The sources, who include two Indian government officials, said Singapore had asked Indian authorities why the app had been targeted in a widening crackdown on Chinese apps, even though Sea has its headquarters in the wealthy city state.

Singapore had queried if the app “was banned unintenationally,” said one of the Indian officials aware of the diplomatic initiative.

The concerns, raised with India’s external affairs ministry, were routed to the information technology (IT) department which ordered the ban, the two Indian sources said.

The sources, who declined to be identified because of the sensitivity of the discussions, said they did not know how, and if, the Indian government planned to reply to Singapore’s concerns.

Spokespersons for the Singapore government and Sea did not immediately respond to emailed requests for comment. India’s IT department, its external affairs ministry and the office of the main government spokesperson also did not respond.

India blocked “Free Fire” this month among a group of 54 apps it believes were sending user data to servers in China, government sources told Reuters.

China responded by expressing serious concern and saying it hoped India would treat all foreign investors in a non-discriminatory manner.

In its response to the ban, Sea told Reuters at the time, “We do not transfer to, or store any data of our Indian users in, China,” adding that it was a Singapore company that complied with Indian law.

India’s initial ban of 59 Chinese apps, including TikTok, came after a border clash with China in 2020, and was widened this month to a total of 321, with Free Fire among them.

KEY MARKET

India is the top market for both Free Fire and one of its more premium versions, Free Fire MAX, going by number of downloads, data from analytics firm SensorTower shows. But India made up just 2.6% of Sea’s mobile-game net sales in 2021.

Sea was caught off guard by India’s ban, sources have said.

Alphabet Inc’s Google told Sea and other companies about India’s ban, prompting the Singapore firm to ask the U.S. search giant why its app had been removed from the Play Store in India, said a source with direct knowledge of the matter.

In response, Google told Sea it was following the orders of the Indian government and could not disclose more, the person added. Google did not respond to a request for comment.

Sea has also sent a letter to India’s technology ministry seeking clarification. Two people briefed on the letter said it described the company as a “Singaporean” firm that did not park data in China.

Sea was founded in Singapore in 2009 as gaming publisher Garena and its founders are Chinese-born Singapore citizens.

The premium version of the game, Free Fire MAX, is now the most downloaded mobile game in India, and is still available on Google’s India Play Store.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Never miss a story! Stay connected and informed with Mint.

Download

our App Now!!

.

How students stand to benefit from India-Australia free trade agreement

India and Australia are discussing the possibility of allowing Indian students to extend their visas for an additional period of three-five years.

Want to check if you’re eligible for immigration?

Click here

Australian Trade Minister Dan Tehan is visiting India to advance negotiations for a proposed free trade agreement (FTA) aimed at promoting economic ties between the countries and promoting Australia as a premium destination for students and tourists.

Easier visa access for Indian students and professionals in Australia is a key demand of New Delhi, according to reports.

The two sides have agreed to conclude a long-pending FTA, officially dubbed as CECA, by the end of 2022.

“Goyal and I have been in regular contact over the Christmas/New Year period because we are both committed to concluding an interim free trade agreement,” Tehan was quoted in the statement.

The statement said that the trade pact is a “potential game-changer” in opening opportunities for both Australia and India and also an important piece of post-Covid economic recovery.

Tehan will also sign a memorandum of understanding on behalf of the Australian government with the Indian government to promote further travel and tourism between the countries.

The bilateral trade between the nations stood at USD 12.3 billion in 2020-21 as against USD 12.63 billion in 2019-20. Trade gap is in the favour of Australia.

India’s main exports to Australia are refined petroleum, medicaments, railway vehicles including hover-trains, pearls and gems, jewellery, made up textile articles, while major imports are coal, copper ores and concentrates, gold, vegetables, wool and other animal hair, fruits and nuts, lentils and education related services.

ET Online

ET Online

.