File – The Biogen Inc., headquarters, Wednesday, March 11, 2020, in Cambridge, Mass. Medicare says it’s considering a cut in enrollee premiums, after officials stuck with an earlier decision to sharply limit coverage for a pricey new Alzheimer’s drug projected to drive up program costs. (AP Photo/Steven Senne, File)

WASHINGTON (AP) — Medicare said Thursday it’s considering a cut in enrollee premiums, after officials stuck with an earlier decision to sharply limit coverage for a pricey new Alzheimer’s drug projected to drive up program costs.

The agency “is looking at that, and is still going through the process,” spokeswoman Beth Lynk said of a potential reduction in premiums, as Medicare announced its final coverage decision for Aduhelm, a drug whose benefits have been widely questioned in the medical community.

Officials said Medicare will keep coverage restrictions imposed earlier on the $28,000-a-year medication, paying for Aduhelm only when it’s used in clinical trials approved by the Food and Drug Administration or the National Institutes of Health.

The projected cost of Aduhelm was a major driver behind a $22 increase in Medicare’s Part B premium this year, boosting it to $170.10 a month. That price hike is already being paid by more than 56 million Medicare recipients signed up for the program’s outpatient coverage benefit. Lawmakers have called for a rollback and Health and Human Services Secretary Xavier Becerra already directed Medicare to reassess.

Thursday’s coverage decision illustrates the impact that a single medication can have on the budgets of individuals and taxpayers. It comes as legislation to authorize Medicare to negotiate prescription drug prices remains stuck in the Senate, part of President Joe Biden’s stalled social and climate agenda. That’s left Democrats with nothing to show on their promises to cut prescription drug costs, unless they can overcome internal disagreements.

Medicare’s determination on Aduhelm included an important caveat. Officials said that if it or any other similar drug in its class were to receive what’s called “traditional” FDA approval, then Medicare would open up broader coverage for patients. Such approval is granted when a medication shows a clear clinical benefit.

That was not the case with Aduhelm. It received what’s known as “accelerated” approval last year because of its potential promise. But manufacturer Biogen is required to conduct a follow-up study to definitively answer whether Aduhelm truly slows the progression of Alzheimer’s. If that study is successful, FDA would grant full approval.

That would also open up Medicare coverage.

Dr. Lee Fleisher, chief medical officer of the Centers for Medicare & Medicaid Services, said “there will be quick access for Medicare beneficiaries” for Alzheimer’s drugs that receive the traditional FDA approval, after demonstrating a clear benefit.

Aduhelm hit the market as the first new Alzheimer’s medication in nearly two decades. Initially priced at $56,000 a year, it was expected to quickly become a blockbuster drug, generating billions for Cambridge, Mass.-based Biogen.

But although the company slashed the price in half — to $28,000 a year — Aduhelm’s rollout has been disastrous.

Pushback from politicians, physicians and insurers left the company with just $3 million in sales from Aduhelm last year. Doctors have been hesitant to prescribe it, given weak evidence that the drug slows the progression of Alzheimer’s. Insurers have blocked or restricted coverage over the drug’s high price tag and uncertain benefit.

The CMS decision means that for Medicare to pay, patients taking Aduhelm will have to be part of clinical trials to assess the drug’s safety and effectiveness in slowing the progression of early-stage dementia.

Tamara Syrek Jensen, head of CMS’s coverage and analysis unit, said “it’s status quo” as far as limitations the agency initially imposed on Aduhelm in January.

The limits stayed on despite a massive lobbying push by the Alzheimer’s Association to change Medicare’s position, including outreach to members of Congress, online advertising and social media campaigns directed at the agency.

The association, the largest group of its kind, has received contributions from drugmakers, including Biogen.

The group’s CEO said he was “very disappointed” after reviewing Medicare’s decision.

Shelley Cook | Uplift

A weekly review of funny, uplifting news in Winnipeg and around the globe that is delivered to your inbox each Wednesday.

Sign up for Uplift

“Denying access to FDA-approved Alzheimer’s treatments is wrong,” Harry Johns said in a statement. “At no time in history has CMS imposed such drastic barriers to access FDA-approved treatments for people facing a fatal disease.”

Aduhelm has sparked controversy since the FDA approved it against the recommendation of outside advisers.

The medicine, administered intravenously in a doctor’s office, hasn’t been shown to reverse or significantly slow Alzheimer’s. But the FDA said its ability to reduce clumps of plaque in the brain is likely to slow dementia.

Many experts say there is little evidence to support that claim. And a federal watchdog and congressional investigators are conducting separate probes into how the FDA reviewed the medication.

Alzheimer’s is a progressive neurological disease with no known cure. The vast majority of U.S. patients are old enough to qualify for Medicare, which covers more than 60 million people, including those 65 and older, and disabled people under 65.

The reason Aduhelm falls under Medicare’s outpatient benefit, and not its pharmacy drug program, is that it’s given in a doctor’s office. Beneficiary premiums are set to cover about 25% of the cost of outpatient care.

.

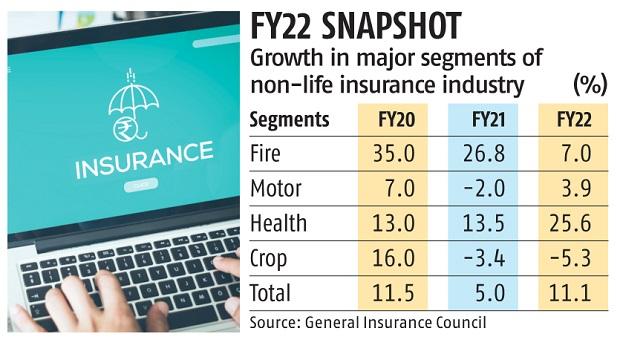

Group health premiums, on the other hand, reported a higher growth than retail health premiums at 31 per cent. This is because of a spike in demand with pick up in hiring across sectors and price correction. Group health growth is a function of the economy. On the other hand, retail health growth is organic and depends on the awareness and needs of individuals. “There is a huge demand for quotes on group health policies from corporates. Even smaller corporates have realised that they need to provide protection to their employees. And, the pandemic has certainly boosted the demand for such policies,” Bhaskar Nerurkar, head — health administration team — Bajaj Allianz General Insurance, had said.

Group health premiums, on the other hand, reported a higher growth than retail health premiums at 31 per cent. This is because of a spike in demand with pick up in hiring across sectors and price correction. Group health growth is a function of the economy. On the other hand, retail health growth is organic and depends on the awareness and needs of individuals. “There is a huge demand for quotes on group health policies from corporates. Even smaller corporates have realised that they need to provide protection to their employees. And, the pandemic has certainly boosted the demand for such policies,” Bhaskar Nerurkar, head — health administration team — Bajaj Allianz General Insurance, had said.