Such incidents are not uncommon. Many people prefer buying insurance online if it is available at lower rates. Data from insurance regulator Insurance Regulatory and Development Authority of India (IRDAI) shows that the contribution of individual insurance agents to individual new business premium is decreasing. It fell to 58.14% in 2020- 21 compared to 60.09% in 2019-20 in the life insurance business. In the case of health insurance, it slipped to 73.90% in 2020-21 from 75.21% in 2019-20.

Instead, online direct selling and web aggregators saw an uptick in sales— from 1.72% in 2019-20 to 1.92% in 2020-21 in life insurance new business premium and from 4.56% in 2019-20 to 5.95% in 2020-21 in health insurance. Interestingly, the share of banks in new business premium in life insurance increased from 26.7% in 2019-20 to 29% in 2020-21. However, it decreased from 8.06% to 7.84% in case of health insurance. The data trend aside, what you must care about is the distribution channel through which you are buying the policy.

![Mint Mint]() View Full ImageMint

View Full ImageMint

Focus on source more than the premium: There is a casual approach to buying insurance. People lay emphasis on the premium amount or a specific insurance company. However, the first step should be to search for a favourable distribution channel, be it individual, corporate agents or web-aggregators. Take into account factors such as expertise in the industry, the agent’s commission structure, and the pre and post sales services.

Skin in the game: Not all distribution channels earn the same amount on selling a policy. You must understand to what extent you matter to a specific distribution channel. Ask the agent how much upfront or renewable commission they earn from the premium you pay.

“Agents’ remuneration includes first year as well as renewal commission whereas alternate channels get only first year commission which is higher than the commission given to agents. Hence an agent would be service-oriented because their future commissions are linked,” said Shailesh Kumar, co-founder and insurance head at Insurance Samadhan, a grievance redressal platform.

Mahavir Chopra, founder, Beshak.org agrees with this. “Customer executives on toll-free numbers have goals that may not be aligned to customer’s long-term interest. For instance, if a claim gets rejected due to something amiss in the proposal form or even information that is incorrectly understood, there is hardly any impact on the reputation or earnings of the advisor,” says Chopra.

So far as banks are concerned, they have the least skin in the game. The online web-aggregator platforms do have a separate team that looks into claims resolution, but banks do not have any such mechanism.

Advice jaroori hai: Insurance is not a one-size-fits-all product. Experts can guide you about the product that better suits your needs. The distributor involved should be incisive enough to ask the right questions. “Just as there are family doctors who stay involved with your family for generations, you need a similar connection when buying insurance,” said Kumar.

Most importantly, when the time comes to file a claim or make changes in the policy, dealing with customer care executives or bank officials is the last thing you want.

“In an imperfect world of insurance where post-sales services are still not seamless, you need a human by your side. Accept it or not, insurers have a certain conflict of interest in settling claims. We have seen cases where they would rather err on the side of not paying it over settling a claim. If you have a reputable agent by your side, they will fight for you to get your rightful claims settled,” said Chopra.

Choose the advisor wisely: It is not that all individual agents are equally good. “95% agents leave the business in two-three years. You should buy policies online than going to such agents. At least you will have some support in the former,” said Avdesh Mishra, founder and CEO of Caterpillar Insurance.

Do your research well. Some websites like Beshak.org are building an alternative business model. “We have curated a list of professional financial advisors on our platform. Customers can explore the list and get a video consultation with anyone whom they prefer, without paying any fees or charges,” said Chopra.

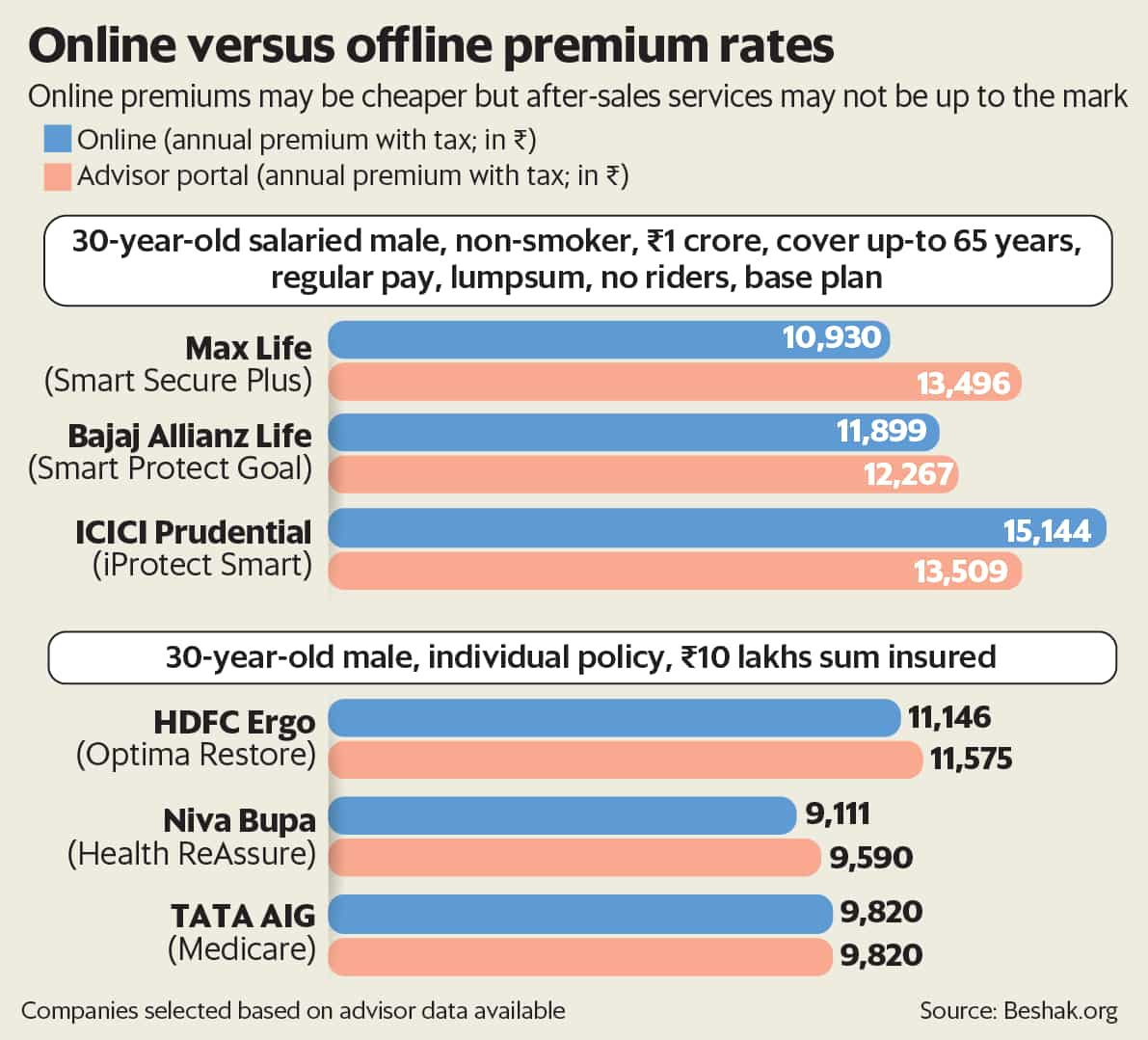

Price parity: Meanwhile, individual agents have started questioning the price disparity.

“The industry has been working aggressively over the last few years to minimize the difference between what an agent charges and direct sales. In our case, the difference has been coming down year-on-year and is now about 5-7%,” said Prashant Tripathy, MD & CEO, Max Life Insurance Co.

Mishra of Caterpillar Insurance confirms that he can now match the online prices against the physical services he offers for a couple of life insurance policies. A welcome trend, indeed.

Mint Take: Insurance misselling occurs across the board, whether the agent is a bank, aggregator, or individual. However, individual agents with whom you have a direct relationship may provide you with better after-sales service even if they quote a higher premium. Take this into account, while buying an insurance policy.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Never miss a story! Stay connected and informed with Mint.

Download

our App Now!!

.