Health insurance has become an essential part of life due to the rising cost of medical treatment, and medical inflation in the country. People are going beyond individual policies to buy policies that cover their family as well, to ensure they have a financial cushion in case of an emergency.However, budgeting for health insurance premium payments is also necessary. While approving your insurance application, the insurance company generally conducts a thorough assessment of your health profile to determine the cost of the policy and fix the premium charges.There are several factors that are considered in the premium calculation and every insurance company has specific guidelines.Here is all you need to know about the factors that influence your premium calculation:Age and genderThe insurance companies generally follow the rule of thumb — higher the age, higher the premium amount. This is because older people above the age of 40 are more at risk of suffering from an illness that may result in a claim. Therefore, it is advisable to buy a health insurance at a young age so that you can get comprehensive coverage and better benefits at an affordable premium. Also, women are charged a lesser premium by most insurance companies.Smoking habitsMost online health insurance premium calculators have this factor upfront that raises the premium amount. Since smoking raises the chances of fatal diseases the insurance companies charge a higher premium to cover those. Also, if a person smokes 10 or more cigarettes a day, some health insurance companies might deny the giving the policy, while others will charge extra.Also, if a person lies about their consumption habits and the insurance company finds about it later, then the policy might get cancelled.Pre-existing diseasesIndividuals with pre-existing illnesses are more likely to file a claim, hence, insurance companies charge a higher premium to cover that risk. However, most health insurance plans cover pre-existing illnesses after 2 to 4 years of the policy, the certainty of filing a claim is always more.Thus, for applicants with pre-existing illnesses such as blood pressure, thyroid, and diabetes the chances of rejection or costly premiums are higher.Personal and family medical historyThe insurer would ask for your and your family’s medical history to determine the premium cost as it reflects whether you are at risk of certain diseases that run in your family.Most insurers require the applicants of a certain age-group or all applicants to undergo a pre-medical screening to determine the premium costs.Nature of occupationYour nature of work and the amount of risk involved in your work is also an important factor for insurers to determine premium charges. If you’re exposed to dangerous machines or other elements that can harm or affect your health, then your premium charges will also be higher. Similarly, if you working conditions are risk free, your premium would be lesser.Type of plan you chooseThe premium payments will also vary depending on the type of health insurance cover you choose. There are group health insurance policies, family floater and individual policies. Generally, group health covers or corporate insurance premium cost less as they cover a bulk of people. On the other hand, a family floater costs more since there is a higher risk as it covers the entire family. Individual policies cost lesser compared to family floater policies.Also, add-on covers purchased in addition to the policy cost more resulting in higher premium charges. (Edited by : Sudarsanan Mani) .

How does a health insurance policy work

There is a lot of uncertainty around the health of a person because of the fragility of the human body. Hospital bills and medical care are expensive and can cost a large amount. This is when health insurances come into play. A health insurance not only prepares one for a rainy day, but also provides health security cover. A Health Insurance is a contract between an insurer (health insurance company) and an individual in which the insurer agrees to cover the cost of any medical expenses that may arise in the future in return for the premiums paid by the benefactor. This is how health insurance mechanism works in India: Choosing a plan- An individual can choose a health insurance plan according to his/her needs based on facilities provided, expenses covered, etc. from an insurance company of one’s choice. In case of pre-existing ailments, different companies have different policies for cover. Thus, it is very important to choose the right plan for oneself keeping in mind all the relevant factors. READ MORE: How to reduce the health insurance premium? Calculation of premium- After selecting an insurance plan, the premium is calculated for the buyer. It is calculated on the basis of age, income, health problems/ diseases if any. A comprehensive full body check-up is administered by the insurance company. Only after this, a premium payable every year is set by the company and the maximum amount that the insurance covers known as “sum assured” is authorised. How does the claim work – In case any medical expenses come up due to hospitalisation, the claim can be sought in two ways. The first alternative is cashless. In this method, if the insured goes to a hospital in the insurance company’s network list, all the expenses will be dealt with directly by the company. The second option is the reimbursement process. In this process, the bills are initially paid by the insured himself and the expenses are later reimbursed by the company to him after submitting the bills and receipts to the company. READ MORE: Looking to buy health insurance? 5 riders that you must be aware of What happens in case no claim is ever made by the insured- In case the need for medical coverage does not ever arise, then the individual, during that year, pays a premium for nothing in return. Some companies, however, provide a “no-claim bonus” under which the company refunds a certain percent of the premium for every year no claim is sought. At the same time, some companies tend to increase the sum assured of an individual as a reward for not making any claim. Health Insurance is quite a beneficial financial product for everyone. Health insurance plans have numerous additional benefits such as tax deduction, free health checkups among many others. One should very carefully choose an insurance cover considering his/her personal needs. Follow MintGenie for more such stories.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

.

Life insurers may get to sell health covers

An internal committee of the Insurance Regulatory and Development Authority of India (Irdai) has been discussing the proposal over the past few weeks, and the regulator is likely to issue draft guidelines allowing life insurers to sell indemnity health insurance products (commonly known as mediclaim policies), said the two people, both of whom spoke on the condition of anonymity since the rules are yet to be formalized.

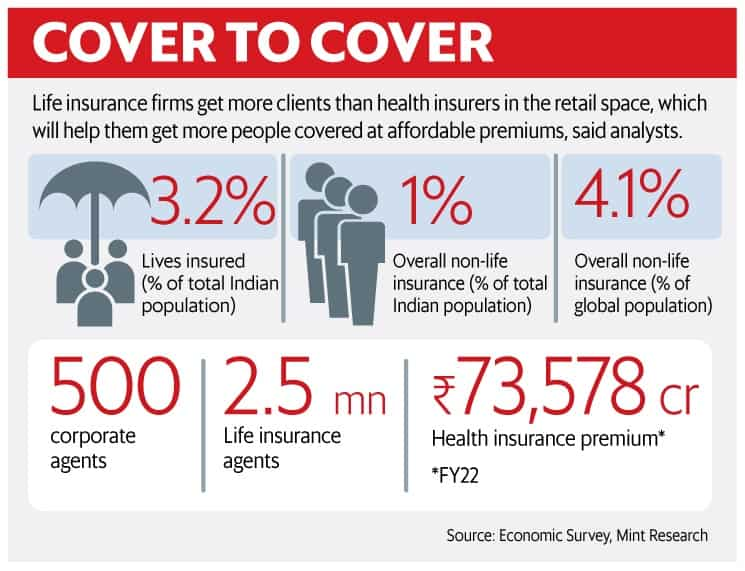

View Full ImageCover to cover

View Full ImageCover to cover

“Life insurance companies inherently get more customers than health insurers in the retail space, which will help them get more people covered under medical insurance at more affordable premiums,” one of the two people cited above said.

According to India’s Economic Survey 2021-22, life insurance penetration in the country stood at 3.2% in 2020, rising from 2.82% in 2019. However, the penetration of overall non-life insurance (which includes health insurance, motor insurance, fire and industrial insurance) is abysmally low at 1%, way behind the global average of 4.1%.

“With captive customers, larger distribution networks and higher disposable cash, life insurers are well-positioned to offer health insurance products to a larger population at better rates,” said the second person.

Life insurers in India have at least 2.5 million individual agents, tie-ups with over 500 corporate agents, a huge bancassurance channel, a large network of brokers, and thousands of their own physical branches where they sell insurance policies. Therefore, Irdai’s move may not only help enhance the penetration of health insurance in the country, but also raise competition among health insurers .

“Initially, to be able to encourage more customers, life insurers may offer health insurance policies whose premium could be 5-10% lower than the average price of basic health insurance policies offered by non-life insurers at present,” said the first person.

Initially, Irdai may allow life insurers either to sell existing mediclaim products of other companies, or allow them to both design and distribute mediclaim policies.

Once life insurers are allowed to design, price and sell mediclaim products, the primary competition will be between life and health insurers, which may lead to a friendlier premium regime for retail customers.

An email sent Irdai remained unanswered

Currently, basic mediclaim products for a sum insured of ₹2 lakh cost an annual premium of ₹5,000-7,000 for an adult individual without any pre-existing ailment and aged 18-50. This premium range may get lowered by 5-10% once Irdai allows life insurers to design and sell mediclaim products.

Health insurance accounts for 33% of total non-life industry premium. In FY22, health insurance premium totalled ₹73,578 crore.

Tarun Chugh, managing director and CEO of Bajaj Allianz Life Insurance Co. Ltd. said, “The confirmation on this (Irdai’s) proposal is awaited. As an industry, we (life insurers) have all the tenets in place to commence selling health insurance as soon as the signal comes in.”

“Considering our distribution network, underwriting skills, agile processes and technology, the (life insurance) industry can leverage these pillars to take the advantages of health insurance to different customer segments. It will be a win-win for all,” said Chugh.

According to Amit Palta, chief distribution officer at ICICI Prudential Life Insurance Co., India’s largest private life insurer in terms of assets, once life insurers are allowed to sell health insurance, getting into health business won’t be tough. Life insurance business too is about pricing ‘risks’ to provide protection, and more importantly, the end customer for both life and health insurance is essentially the same policyholder.

“However, there will be a requirement to build the requisite infrastructure to support indemnity claims to support customers so that the experience stays seamless. As an opportunity, this still is huge since India is under-penetrated on protection, and almost 70% of health-related expenses are still happening largely from out-of-pocket, depleting people’s savings. There is no doubt that adoption of health as a product is definitely required in the country.”

“Life insurers will be able to add one more product to their portfolio and reach out to the customer with a more well-rounded protection proposition. Including health within life insurance will improve the industry’s overall ability to take health protection to a larger set of the population. Apart from mortality, we can look at morbidity also, as a liability that can easily add to our assessment for medical products. It adds value, if we were to be allowed to take health indemnity products to the end customers,” said Palta.

In 2016, the insurance regulator had barred life insurance firms from offering indemnity-based health products either to individuals or as a group policy. However, after receiving representations from the industry, Irdai formed a committee to look into the feasibility of offering such policies again.

Even though the move may usher in a new business opportunity for life insurers, the key challenge for life players will be pricing health insurance products, creating a large enough hospital network for smoother settlements, and matching the claim processing capabilities that standalone health insurers have.

“Actuarial task will be crucial as under-pricing may lead to steep losses and over-pricing may fend off customers,” said the second person. This will be critical because by nature, life insurance policies have long gestation periods, lower claim frequency and better earnings prospects.

On the other hand, health insurance, by nature, causes cash-burn for insurers in the initial years due to high claim frequency and short duration of their validity to enable insurers gain from the premium paid by the customer.

Only if a policy remains claim-free during a given year, the health insurer is able to make money. But, even if 20- 30% of a health product’s customers raise claims in a year, the policy creates losses for the insurer as claim settlement amount is significantly higher than the premium paid.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

.

What are the factors I should look into to choose a health insurance policy

I am a 43-year-old with two kids, currently posted in Mumbai. The age of my spouse is 39. I want to buy a health insurance policy for my family with three dependents. Please suggest me suitable health insurance policy options, how much insurance cover would be enough in Mumbai, and what are the factors I should look into to choose the right health insurance policy.

-Ashish

One should have at least ₹10 -15 lakh of base plan in combination with a low-cost super top-up plan from the same insurance company. We recommend the below-mentioned options with premiums :

1. ₹10 lakh of Reassure Plan from Niva Bupa + ₹40 lakh of Recharge super top-up from Niva Bupa – Rs. 24,788(Base)+ ₹2,079(Super Top-up)= ₹26,867

2. ₹10 lakh of Prohealth Protect Plan from Manipal Cigna + ₹30 lakh of Super top-up plan – ₹28,524 (Base) + ₹2,490 (Super Top-up) = ₹31,014

3. ₹50 Lakh of Lifetime Health Plan – Domestic from Manipal Cigna Health insurance Co. – ₹32,214

Factors to consider before choosing the right health insurance:

1. Selecting the right insurance amount/Sum insured: At the time of selecting a health insurance plan, one should select the amount wisely as it covers the medical expenses for a year. One should also take a look at his or her income levels to analyze the premium affordable. One should have a sum insured which is 1.5 times of your annual income (Self + Spouse put together).

2. No Claim Bonus: NCB refers to the incentive offered by the insurance company for all the years that you have not filed a claim. Typically it varies from 5 to 50% p.a depending on the insurance company and plan. Your coverage amount is increased at the time of subsequent policy renewals for all claim-free years. This factor ensures that the policy is future-ready to get a sizable sum insured enhancement every year. It will ensure that ever so increasing medical inflation doesn’t eat into your sum insured over a period of time.

3. No disease wise capping: This refers to a capping put on various illnesses irrespective of the sum insured in the policy. There shouldn’t be any capping of diseases.

4. Cappings on room & ICU charges in a hospital: This refers to the limit on Room rent and ICU charges on a per-day basis. One must look at buying a policy that covers rooms on a single occupancy basis with actual charges covered for ICU admission.

5. Additional features: There are features like Refill/Annual Free health check-up every year/Wellness features /OPD etc which makes a health insurance policy a “New Age health insurance Plan.”

Query answered by Sanjiv Bajaj, joint chairman and MD of Bajaj Capital. Queries and views at [email protected]

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

.

What factors should I consider while choosing a health insurance policy?

I am 43 years old with two kids and currently posted in Mumbai. My spouse is 39 years old. I want to buy a health insurance policy for my family of three dependents. Please suggest suitable health insurance policy options. Also, suggest how much insurance cover would be enough in Mumbai and what factors I should look into while choosing the right health insurance policy?

-Ashish

One should have at least ₹10 -15 lakh of base plan in combination with a low-cost super top-up plan from the same insurance company. We recommend the below-mentioned options with premiums :

1. ₹10 Lakh of Reassure Plan from Niva Bupa + 40 lakh of Recharge super top-up from Niva Bupa – Rs. 24788(Base)+ ₹2079(Super Top-up)= ₹26867

2. ₹10 lakh of Prohealth Protect Plan from Manipal Cigna + 30 Lakh of Super top-up plan – ₹28524 (Base) + ₹2490 (Super Top-up) = ₹31014

3. ₹50 Lakh of Lifetime Health Plan – Domestic from Manipal Cigna Health insurance Co. – ₹32214

Factors to consider before choosing the right health insurance:

1. Selecting the right insurance amount/Sum insured: At the time of selecting a health insurance plan, one should select the amount wisely as it covers the medical expenses for a year. One should also take a look at his or her income levels to analyze the premium affordable. One should have a Sum insured which is 1.5 times of your annual income (Self + Spouse put together).

2. No Claim Bonus: NCB refers to the incentive offered by the insurance company for all the years that you have not filed a claim. Typically it varies from 5 to 50% p.a depending on the insurance company and plan. Your coverage amount is increased at the time of subsequent policy renewals for all claim-free years. This factor ensures that the policy is future-ready to get a sizable sum insured enhancement every year. It will ensure that ever so increasing medical inflation doesn’t eat into your sum insured over a period of time.

3. No disease-wise capping: This refers to a capping put on various illnesses irrespective of the sum insured in the policy. There shouldn’t be any capping of diseases.

4. Cappings on room & ICU charges in a hospital: This refers to the limit on Room rent and ICU charges on a per-day basis. One must look at buying a policy that covers rooms on a single occupancy basis with actual charges covered for ICU admission.

5. Additional features: There are features like Refill/Annual Free health check-up every year/Wellness features /OPD etc which makes a health insurance policy a “New Age health insurance Plan.”

Query answered by Sanjiv Bajaj, joint chairman and MD, Bajaj Capital.

(Send your queries and views to [email protected])

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

.