BRASILIA, July 22 (Reuters) – Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures. read more “The problem is the change in the spending cap,” said an Economy Ministry official, who requested anonymity to discuss the situation openly. “It weakens the reading that the fiscal situation will be under control in the coming years.”Register now for FREE unlimited access to Reuters.comEven with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil’s yield curve remains under pressure as investors brace for the worst. read more Both major presidential candidates on the ballot in October – leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro – have signaled they plan to extend this year’s boost in social spending into next year.”It’s a fiscal bomb,” said Sergio Goldenstein, chief strategist at Renascença DTVM. “Risk premiums look high, but there is little room for a relevant drop.”The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil’s five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.Concerns about Brazil’s credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.”All the credit spreads in the world are opening, our bonds are not immune to that,” said Ronaldo Patah, chief strategist at UBS Consenso.In fact, Brazil’s strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.Brazil’s central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.”I am struck by this process of (yield curve) flattening that we are seeing at a very high level”, said the chief economist at Ativa Investimentos Etore Sanchez.Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending.”The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected”, said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.Register now for FREE unlimited access to Reuters.comReporting by Marcela Ayres and Jose de Castro

Editing by Brad HaynesOur Standards: The Thomson Reuters Trust Principles. .

Nigeria offers premium to raise $1.25 billion Eurobond

Nigerian Finance Minister Zainab Ahmed attends the IMF and World Bank’s 2019 Annual Spring Meetings, in Washington, File. REUTERS/James Lawler DugganRegister now for FREE unlimited access to Reuters.comLAGOS/ABUJA, March 17 (Reuters) – Nigeria has priced a $1.25 billion Eurobond issue at 8.375%, its debt office said on Thursday, a premium compared to existing tenors as the country sought to raise cash to fund a costly petrol subsidy scheme in the face of limited oil revenue.The latest debt issue marks Nigeria’s eight outing on the Eurobond market after it sold a $4 billion debt in September and had been considering more issues before fears around the Omicron coronavirus variant led it to shelve plans. read more “The choice to go ahead with the Eurobond issue in the current adverse market conditions is likely connected to continued force majeure reducing oil revenue, while retained fuel subsidies are spiralling in tandem with the higher oil price,” said Mark Bohlund, senior analyst at Redd Intelligence.Register now for FREE unlimited access to Reuters.comFinance Minister Zainab Ahmed told Reuters on Monday that Nigeria planned to tap 2 billion euros ($2.2 billion) this month or next of the money it raised in a eurobond sale last year and target more local borrowing in 2022 to help fund its costly petrol subsidies as oil prices rise. read more The government in January reversed a pledge to end its subsidies then, and instead extended them by 18 months amid heightened inflation to avert any protests in the run-up to presidential elections next year.At the same time, the price of oil has soared, so also has its cost as the country depends almost entirely on imports to meet its domestic gasoline needs. It also faces crude theft and vandalism in the Niger Delta, disrupting oil production.With Thursday’s bond sale, Nigeria offered more than existing eurobonds of 7.143%, creating extra debt service headache for the government struggling to boost growth with limited buffers.President Muhammadu Buhari has said the country’s deficit would rise by 1.01 trillion naira to 7.40 trillion or 4% of GDP as the government eyes new borrowing for fuel subsidy. The deficit was originally set at 3.42% of GDP.Analysts say deficit could rise above 10 trillion naira ($24 billion) in 2022 on higher fuel subsidy cost amid rising oil prices.($1 = 415.42 naira)Register now for FREE unlimited access to Reuters.comAdditional reporting by Rachel Savage in London;

Writing by Chijioke Ohuocha;

Editing by Chris Reese, Lisa Shumaker and Aurora EllisOur Standards: The Thomson Reuters Trust Principles. .

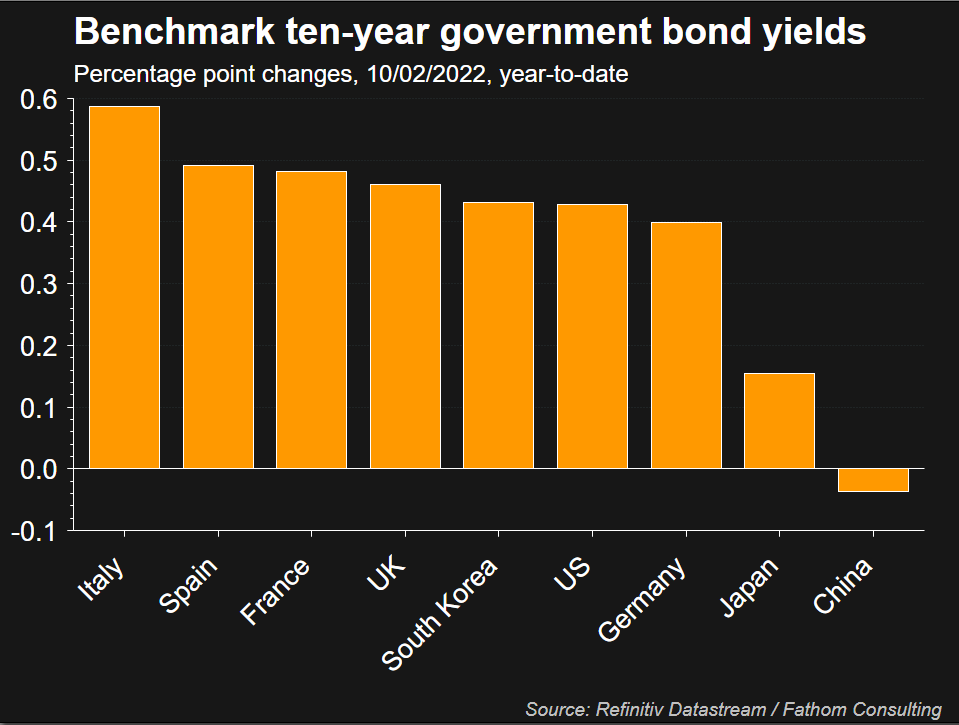

Analysis: Where now after 2% yield? Bond investors take stock

The Federal Reserve building is seen in Washington, U.S., January 26, 2022. REUTERS/Joshua Roberts/File PhotoRegister now for FREE unlimited access to Reuters.comRegisterNEW YORK, Feb 10 (Reuters) – U.S. Treasury yields have shot higher this year, rising faster than many forecast. Investors are now assessing if anticipation of a more hawkish Fed will continue to push levels up, with the potential to upset riskier assets.Expectations that the U.S. Federal Reserve may increase rates more aggressively than anticipated to counter rising inflation have pushed up yields while flattening the U.S. Treasury yield curve. That matters as bond yields impact global asset prices as well as consumer loans and mortgages. The shape of the U.S. Treasury yield curve can also help predict how the economy will fare.On Thursday, yields on 10-year notes hit 2% after higher-than-anticipated inflation data. Federal funds rate futures showed an increased chance of a half percentage-point tightening at next month’s meeting after the data, while strategists said the data increased the chances of swifter moves to reduce the Fed’s balance sheet. The central bank’s nearly $9 trillion portfolio doubled in size during the pandemic. read more Register now for FREE unlimited access to Reuters.comRegister“The market is starting to price in a much more aggressive path of rate hikes … clearly there is a sense of urgency again”, said Subadra Rajappa, head of U.S. rates strategy at Societe Generale.Yields, which move inversely to prices, are up from 1.79% at the beginning of February. The last time they breached 2% was August 2019.”I would say the chances of yields continuing to go higher are pretty high,” said Gargi Chaudhuri, Head of iShares Investment Strategy, Americas, at BlackRock, speaking ahead of the data.FOREIGN COMPETITIONCompetition in other markets for yield may be sapping demand for Treasuries and helping push yields higher, Chaudhuri said.A second rate hike by the Bank of England last week, and expectations of faster policy tightening by the European Central Bank (ECB), added to U.S. bonds’ weakness, with borrowing costs in Europe – as well as Japanese government bond yields – having jumped to multi-year highs in recent days. read more “Investors have these other markets to gravitate towards that they didn’t in the past, and that will require investors that are focusing on U.S. markets to seek a higher term premium and therefore will impact yields higher,” Chaudhuri said.Japan’s benchmark 10-year government bond yield is around its highest level since January 2016 at 0.220% while Germany’s 10-year government bond yield , at 0.255%, is at its highest since January 2019. read more  FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .