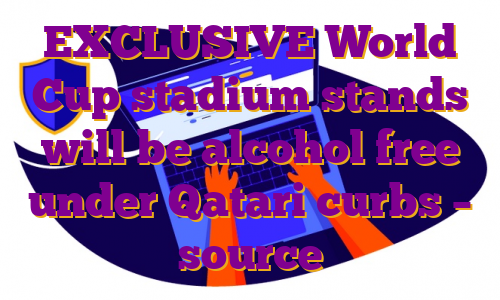

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Asia Gold High prices drag India discounts to 7-week low; China demand sluggish

A saleswoman displays a gold necklace inside a jewellery showroom on the occasion of Akshaya Tritiya, a major gold buying festival, in Kolkata, India, May 7, 2019. REUTERS/Rupak De ChowdhuriRegister now for FREE unlimited access to Reuters.com

- India sees discount of up to $10/oz vs $9 last week

- Indian buyers will wait for a hefty correction- dealer

- Buyers in China cautious, conserving their expenditure – analyst

June 10 (Reuters) – Gold discounts in India this week were stretched to their highest level in seven weeks as higher prices repelled demand, while fresh concerns over the spread of COVID in top-consumer China left buyers reluctant to make purchases.This week, dealers in India were offering a discount of up to $10 an ounce over official domestic prices — inclusive of the 10.75% import and 3% sales levies, up from the last week’s discount of $9.Retail buying in India will remain weak, especially from rural areas as farmers focus on planting of summer-sown crops, said a Mumbai-based dealer with a private bullion importing bank.Register now for FREE unlimited access to Reuters.com“In May, prices were attractive. Retail consumers were buying for weddings. Now buyers will wait for a hefty correction,” the dealer said.Weddings are one of the biggest drivers of gold purchases in India.In China, gold was being sold at a discount of $1.5 to a premium of $0.5 an ounce versus global benchmark spot rates .Physical gold demand in China is pretty sluggish, StoneX analyst Rhona O’Connell said, adding that people haven’t been coming back into the market yet after lockdowns were eased, as they are cautious about the outlook and are conserving their expenditure for now.China’s commercial hub of Shanghai faces an unexpected round of mass COVID-19 testing for most residents this weekend – just 10 days after a city-wide lockdown was lifted. read more COVID-related restrictions weighed on demand in China in May and “the average trading volumes of Au9999 – a proxy of Chinese wholesale gold demand – witnessed the weakest May since 2013,” the World Gold Council said in a monthly note.In Hong Kong, gold continued to be sold at a discount of about $1.8 an ounce to a $1 premium, while in Japan, gold was sold between a premium of 50 cents and at par with the benchmark.Register now for FREE unlimited access to Reuters.comReporting by Eileen Soreng, Bharat Govind Gautam in Bengaluru, Rajendra Jhadav in Mumbai; Editing by Shailesh KuberOur Standards: The Thomson Reuters Trust Principles. .

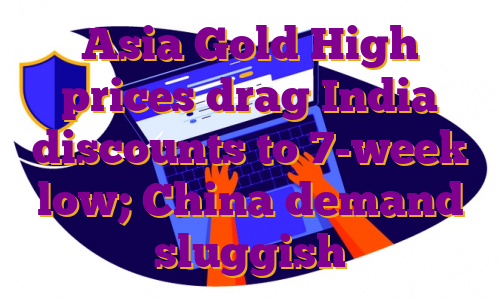

Shift to premium spirits helps Remy weather China lockdowns

- 2021/22 current operating profit up 39.9% vs forecast 38.6%

- Expects another year of strong growth in 2022/23

- Still eyes double-digit organic sales growth in Q1 – CEO

PARIS, June 2 (Reuters) – France’s Remy Cointreau (RCOP.PA) on Thursday predicted a strong start to its new financial year, as broad demand for its premium spirits helps to offset inflationary pressures and the impact of COVID lockdowns in China.The maker of Remy Martin cognac and Cointreau liquor made the upbeat comments after reporting higher-than-expected operating profit growth for its financial year ended March 31.”On the strength of our progress against our strategic goals, new consumption trends and our robust pricing power, we are starting the year 2022-23 with confidence,” Chief Executive Officer Eric Vallat said in a statement.Register now for FREE unlimited access to Reuters.comThe pandemic has helped Remy’s long-term drive towards higher-priced spirits to boost profit margins, accelerating a shift towards premium drinks, at-home consumption, cocktails and e-commerce.Vallat told journalists that for the new fiscal year, Remy expected “solid profitable growth” as price increases and cost control would help mitigate inflationary pressures.In the short term, Vallat said: “I can confirm we are expecting double-digit organic sales growth in the first quarter despite the lockdown in China and high comparables.”With China accounting for 15-20% of group sales, growth would be led by demand from other regions, notably the United States.Strong demand for its premium cognac in China and the United States, along with tight cost management, lifted the company’s 2021/22 organic operating profit by 39.9% to 334.4 million euros ($356.3 million), beating the 38.6% forecast by analysts.Reflecting its confidence, Remy said it would pay shareholders an ordinary dividend of 1.85 euros per share in cash and an exceptional dividend of 1 euro.”Remy guides to another year of strong growth and margin improvement, led by its strong pricing power, which suggests upside to consensus organic EBIT of +10%,” Credit Suisse analysts said in a note.Remy Cointreau shares jumped more than 3% in early trade, before handing back some gains.The company reiterated its 2030 goals for a gross margin of 72% and an operating margin of 33%. That compares with the 68.6% and 25.5% achieved respectively in 2021/22.($1 = 0.9385 euros)Register now for FREE unlimited access to Reuters.comReporting by Dominique Vidalon Editing by Sherry Jacob-Phillips and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

Insurance rates jump for Ukraine war-exposed business, sources say

Planes of Aeroflot and Rossiya Airlines are seen parked at Sheremetyevo International Airport, as the spread of the coronavirus disease (COVID-19) continues, outside Moscow, Russia April 8, 2020 REUTERS/Tatyana Makeyeva/File PhotoRegister now for FREE unlimited access to Reuters.comLONDON, May 30 (Reuters) – Insurance premiums are doubling or more for some aviation and marine business particularly exposed to the war in Ukraine, increasing costs for airline and shipping firms, industry sources say.Global commercial insurance premiums rose 11% on average in the first quarter, according to insurance broker Marsh, which said the war was putting upward pressure on rates.But the overall figure masks sharper moves in some sectors, and only covers the first five weeks following the invasion.Register now for FREE unlimited access to Reuters.comWar is typically excluded from mainstream insurance policies. Customers buy extra war cover on top.Garrett Hanrahan, global head of aviation at Marsh, said aviation war insurance was no longer available for Ukraine, Russia and Belarus as a result of the conflict.For the rest of the world, aviation war cover has doubled, as insurers try to recoup some of their losses, he said.”The hull war market is beginning to reflate itself through rate rises.”The conflict, which Russia calls a “special military operation”, could lead to insurance losses of $16 billion-$35 billion in so-called “specialty” insurance classes such as aviation, marine, trade credit, political risk and cyber, S&P Global said in a report. read more Aviation insurance claims alone could total $15 billion, S&P Global said, with hundreds of leased planes stranded in Russia as a result of western sanctions and Russian countermeasures.One aircraft lessor described recent rate increases on its insurance as “not a pretty sight”. read more Some aircraft lessors – a particularly exposed sector of the market because their planes are stuck in Russia – were now having to pay 10 times their original premium, one underwriter said, while another said insurers could “name their price” to lessors.In ship insurance, policyholders pay an additional “breach” premium when a ship enters particularly dangerous waters, locations which are updated by the Lloyd’s market.For the area around Russian and Ukrainian waters in the Black Sea and Sea of Avov, this has increased multiple times, three insurance sources said, to around 5% of the value of the ship, from 0.025% before the invasion, amounting to millions of dollars for a seven-day policy.Each time a ship goes into those waters, it has to pay that extra premium.Rates for ships going into other Russian waters have also risen by at least 50% after the Lloyd’s market classified all Russian ports as high risk, two of the sources said.Because of the dangers, some marine insurers have also stopped providing cover for the region. read more Register now for FREE unlimited access to Reuters.comReporting by Carolyn Cohn, Jonathan Saul and Noor Zainab Hussain, Editing by Angus MacSwanOur Standards: The Thomson Reuters Trust Principles. .

Column: Market turbulence won’t slow aluminium’s green drive

LONDON, May 26 (Reuters) – These are turbulent times for the global aluminium market.Aluminium has for years been characterised by chronic oversupply thanks to China’s relentless build-out of primary smelting capacity.Now, however, buyers in Europe and the United States are paying up record high premiums to get hold of physical metal.Register now for FREE unlimited access to Reuters.comThe Chinese aluminium juggernaut has run out of momentum and smelters in Europe are powering down as a rolling energy crunch takes a rising toll on the region’s producers. read more London Metal Exchange (LME) stocks are disappearing to fill gaps in the supply chain. Even after its recent tumble LME three-month metal at a current $2,860 per tonne is trading at levels last seen in the great bull market of 2008.None of which, it seems, is going to slow down the drive towards green low-carbon aluminium with some of the world’s largest buyers this week committing to purchase a minimum 10% of near-zero carbon metal by 2030.GREEN ALLIANCEThe newly-formed aluminium branch of the First Movers Coalition comprises automotive companies Ford (F.N) and Volvo Group (VOLVb.ST), packaging company Ball Corp , aluminium products manufacturer Novelis (NVLXC.UL) and trade house Trafigura.The Coalition, led by the World Economic Forum and the U.S. government, is aimed at tackling carbon emissions in heavily emitting sectors such as steel, shipping and aviation. And now aluminium.The light metal is a key enabler of the green energy transition. It is a material of choice for electric vehicle (EV) battery casings and solar panels as well as offering light-weighting across multiple transport applications.However, producing aluminium is an energy-intensive process, the global sector accounting for around 2% of greenhouse gas emissions, including over one billion tonnes per year of carbon dioxide.The paradox is encapsulated in an EV battery. Aluminium accounts for only 1-2% of the cost but 17% of the carbon impact, according to Torbjörn Sternsjö, senior advisor at Swedish products group Granges, speaking at CRU’s London aluminium conference.This is a problem given ever more automakers are themselves committing to carbon-neutrality – as early as 2035 in the case of Porsche.Global aluminium production by power source 2020FROM LOW CARBON…Coal is still the globally dominant source of power for smelting aluminium, reflecting the market dominance of China, which last year accounted for around 58% of world primary output.Within China there has been a rush to swap coal-fired capacity for new plants in hydro-rich Yunnan province but spaces are fast running out and most of the country’s smelters continue to run on captive coal plants or draw energy from coal-based grids.Changing the source of power from fossil fuel to renewables is the fastest way of lowering primary aluminium’s carbon footprint.Outside of China, the rush to go green has been led by those producers with large captive hydro generation capacity.The LMEpassport for ESG accreditation now lists several aluminium producers, including Russia’s Rusal, U.S. operator Century Aluminum (CENX.O), Indonesian producer Asahan Aluminium and smelters in France (Dunkerque) and the United Kingdom (Lochaber).All have disclosed carbon equivalent footprints of 0-4 tonnes per tonne of aluminium, referencing research house CRU’s Emissions Analysis Tool.No-one yet can make it to zero on a commercial basis.The new green aluminium coalition accepts that its 10% purchase commitments for near-zero metal will be dependent on “advanced technologies not yet commercially available”….TO NO CARBONThe collective race to get to zero or near-zero aluminium is already underway, led by ELYSIS, a joint venture between Alcoa and Rio Tinto.It requires the replacement of the carbon anode in the electrolytic smelting process. The anode accounts for 1.9 tonnes of carbon per tonne of aluminium, the largest remaining carbon problem for a renewables-powered smelter, according to Tim Murray, chief executive of Cardinal Virtues Consulting, also presenting at the CRU conference.The anode being trialled in the ELYSIS process results in zero direct emissions, a much longer anode life and 15% lower costs, Alcoa chief operations officer John Slaven told delegates.If the smelter is fed with “green” alumina, the carbon impact falls below 1 tonne per tonne of metal, freight accounting for most of the residue.A processing path to near-zero primary aluminium is starting to take tangible shape.NO GREEN SANCTIONSThere has been concern that aluminium’s race to go green would be abruptly halted by Russia’s invasion of Ukraine and the possible sanctioning of Rusal metal.Rusal is already a major supplier of low-carbon aluminium from its hydro-powered smelters in Siberia and is itself working on inert anode technology.Fortunately for carbon-conscious buyers, the company was already put through the U.S. sanctions process in 2018, resulting in owner Oleg Deripaska (still sanctioned) giving up control of the company.That shields Rusal this time around. So too do memories of the sanctions supply-chain disruption which stretched from Guinean bauxite mines to European automakers.Rusal’s significance as a supplier, particularly to Europe, will only increase as buyers look for low-carbon metal.NO GREEN PREMIUM…YETThe First Movers Coalition is intended to create a decarbonisation tipping-point for individual sectors centred on future purchase commitments.The incentive for suppliers will be a premium for their low-carbon aluminium, according to Trafigura chief executive Jeremy Weir.Such a green premium remains conspicuous by its absence at the primary metal stage of aluminium’s process chain.And it might not appear for long at all, Colin Hamilton, commodities analyst at BMO Capital Markets, told the CRU conference.Rather, a green premium would simply be a “stepping-stone to low-carbon becoming the prime market and anything else sub-prime.”We may not have to wait much longer to find out because the drive to zero-carbon aluminium has just accelerated.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .