Planes of Aeroflot and Rossiya Airlines are seen parked at Sheremetyevo International Airport, as the spread of the coronavirus disease (COVID-19) continues, outside Moscow, Russia April 8, 2020 REUTERS/Tatyana Makeyeva/File PhotoRegister now for FREE unlimited access to Reuters.comLONDON, May 30 (Reuters) – Insurance premiums are doubling or more for some aviation and marine business particularly exposed to the war in Ukraine, increasing costs for airline and shipping firms, industry sources say.Global commercial insurance premiums rose 11% on average in the first quarter, according to insurance broker Marsh, which said the war was putting upward pressure on rates.But the overall figure masks sharper moves in some sectors, and only covers the first five weeks following the invasion.Register now for FREE unlimited access to Reuters.comWar is typically excluded from mainstream insurance policies. Customers buy extra war cover on top.Garrett Hanrahan, global head of aviation at Marsh, said aviation war insurance was no longer available for Ukraine, Russia and Belarus as a result of the conflict.For the rest of the world, aviation war cover has doubled, as insurers try to recoup some of their losses, he said.”The hull war market is beginning to reflate itself through rate rises.”The conflict, which Russia calls a “special military operation”, could lead to insurance losses of $16 billion-$35 billion in so-called “specialty” insurance classes such as aviation, marine, trade credit, political risk and cyber, S&P Global said in a report. read more Aviation insurance claims alone could total $15 billion, S&P Global said, with hundreds of leased planes stranded in Russia as a result of western sanctions and Russian countermeasures.One aircraft lessor described recent rate increases on its insurance as “not a pretty sight”. read more Some aircraft lessors – a particularly exposed sector of the market because their planes are stuck in Russia – were now having to pay 10 times their original premium, one underwriter said, while another said insurers could “name their price” to lessors.In ship insurance, policyholders pay an additional “breach” premium when a ship enters particularly dangerous waters, locations which are updated by the Lloyd’s market.For the area around Russian and Ukrainian waters in the Black Sea and Sea of Avov, this has increased multiple times, three insurance sources said, to around 5% of the value of the ship, from 0.025% before the invasion, amounting to millions of dollars for a seven-day policy.Each time a ship goes into those waters, it has to pay that extra premium.Rates for ships going into other Russian waters have also risen by at least 50% after the Lloyd’s market classified all Russian ports as high risk, two of the sources said.Because of the dangers, some marine insurers have also stopped providing cover for the region. read more Register now for FREE unlimited access to Reuters.comReporting by Carolyn Cohn, Jonathan Saul and Noor Zainab Hussain, Editing by Angus MacSwanOur Standards: The Thomson Reuters Trust Principles. .

Column: Market turbulence won’t slow aluminium’s green drive

LONDON, May 26 (Reuters) – These are turbulent times for the global aluminium market.Aluminium has for years been characterised by chronic oversupply thanks to China’s relentless build-out of primary smelting capacity.Now, however, buyers in Europe and the United States are paying up record high premiums to get hold of physical metal.Register now for FREE unlimited access to Reuters.comThe Chinese aluminium juggernaut has run out of momentum and smelters in Europe are powering down as a rolling energy crunch takes a rising toll on the region’s producers. read more London Metal Exchange (LME) stocks are disappearing to fill gaps in the supply chain. Even after its recent tumble LME three-month metal at a current $2,860 per tonne is trading at levels last seen in the great bull market of 2008.None of which, it seems, is going to slow down the drive towards green low-carbon aluminium with some of the world’s largest buyers this week committing to purchase a minimum 10% of near-zero carbon metal by 2030.GREEN ALLIANCEThe newly-formed aluminium branch of the First Movers Coalition comprises automotive companies Ford (F.N) and Volvo Group (VOLVb.ST), packaging company Ball Corp , aluminium products manufacturer Novelis (NVLXC.UL) and trade house Trafigura.The Coalition, led by the World Economic Forum and the U.S. government, is aimed at tackling carbon emissions in heavily emitting sectors such as steel, shipping and aviation. And now aluminium.The light metal is a key enabler of the green energy transition. It is a material of choice for electric vehicle (EV) battery casings and solar panels as well as offering light-weighting across multiple transport applications.However, producing aluminium is an energy-intensive process, the global sector accounting for around 2% of greenhouse gas emissions, including over one billion tonnes per year of carbon dioxide.The paradox is encapsulated in an EV battery. Aluminium accounts for only 1-2% of the cost but 17% of the carbon impact, according to Torbjörn Sternsjö, senior advisor at Swedish products group Granges, speaking at CRU’s London aluminium conference.This is a problem given ever more automakers are themselves committing to carbon-neutrality – as early as 2035 in the case of Porsche.Global aluminium production by power source 2020FROM LOW CARBON…Coal is still the globally dominant source of power for smelting aluminium, reflecting the market dominance of China, which last year accounted for around 58% of world primary output.Within China there has been a rush to swap coal-fired capacity for new plants in hydro-rich Yunnan province but spaces are fast running out and most of the country’s smelters continue to run on captive coal plants or draw energy from coal-based grids.Changing the source of power from fossil fuel to renewables is the fastest way of lowering primary aluminium’s carbon footprint.Outside of China, the rush to go green has been led by those producers with large captive hydro generation capacity.The LMEpassport for ESG accreditation now lists several aluminium producers, including Russia’s Rusal, U.S. operator Century Aluminum (CENX.O), Indonesian producer Asahan Aluminium and smelters in France (Dunkerque) and the United Kingdom (Lochaber).All have disclosed carbon equivalent footprints of 0-4 tonnes per tonne of aluminium, referencing research house CRU’s Emissions Analysis Tool.No-one yet can make it to zero on a commercial basis.The new green aluminium coalition accepts that its 10% purchase commitments for near-zero metal will be dependent on “advanced technologies not yet commercially available”….TO NO CARBONThe collective race to get to zero or near-zero aluminium is already underway, led by ELYSIS, a joint venture between Alcoa and Rio Tinto.It requires the replacement of the carbon anode in the electrolytic smelting process. The anode accounts for 1.9 tonnes of carbon per tonne of aluminium, the largest remaining carbon problem for a renewables-powered smelter, according to Tim Murray, chief executive of Cardinal Virtues Consulting, also presenting at the CRU conference.The anode being trialled in the ELYSIS process results in zero direct emissions, a much longer anode life and 15% lower costs, Alcoa chief operations officer John Slaven told delegates.If the smelter is fed with “green” alumina, the carbon impact falls below 1 tonne per tonne of metal, freight accounting for most of the residue.A processing path to near-zero primary aluminium is starting to take tangible shape.NO GREEN SANCTIONSThere has been concern that aluminium’s race to go green would be abruptly halted by Russia’s invasion of Ukraine and the possible sanctioning of Rusal metal.Rusal is already a major supplier of low-carbon aluminium from its hydro-powered smelters in Siberia and is itself working on inert anode technology.Fortunately for carbon-conscious buyers, the company was already put through the U.S. sanctions process in 2018, resulting in owner Oleg Deripaska (still sanctioned) giving up control of the company.That shields Rusal this time around. So too do memories of the sanctions supply-chain disruption which stretched from Guinean bauxite mines to European automakers.Rusal’s significance as a supplier, particularly to Europe, will only increase as buyers look for low-carbon metal.NO GREEN PREMIUM…YETThe First Movers Coalition is intended to create a decarbonisation tipping-point for individual sectors centred on future purchase commitments.The incentive for suppliers will be a premium for their low-carbon aluminium, according to Trafigura chief executive Jeremy Weir.Such a green premium remains conspicuous by its absence at the primary metal stage of aluminium’s process chain.And it might not appear for long at all, Colin Hamilton, commodities analyst at BMO Capital Markets, told the CRU conference.Rather, a green premium would simply be a “stepping-stone to low-carbon becoming the prime market and anything else sub-prime.”We may not have to wait much longer to find out because the drive to zero-carbon aluminium has just accelerated.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

In it for the long haul: Qantas bets on non-stop Sydney-London flights with Airbus order

- Orders 12 Airbus ultra-long haul A350-1000 planes

- Commercial direct Sydney-London flight to start late in 2025

- 20-hour trip to be world’s longest non-stop flight

- Orders 20 A321XLRs and 20 A220s to renew domestic fleet

- Overall Airbus deal could be worth more than $4 bln – Barrenjoey

SYDNEY, May 2 (Reuters) – Qantas Airways (QAN.AX) will fly non-stop from Sydney to London after ordering a dozen special Airbus (AIR.PA) jets, charging higher fares in a multi-billion dollar bet that fliers will pay a premium to save four hours on the popular route.To be launched late in 2025, the flights will use A350-1000 planes, specially configured with extra premium seating and reduced overall capacity, to ferry up to 238 passengers in a 20-hour trip – the world’s longest direct commercial flight.Announcing plans for the service on Monday, the loss-making carrier said a strong recovery in the domestic market and signs of an improvement in international flying after the worst of the COVID-19 pandemic had given it the confidence to make a major investment on its future. Qantas forecasts a return to profit in the financial year starting this July.Register now for FREE unlimited access to Reuters.comThe order from the European aircraft maker also includes 40 narrowbody A321XLR and A220 jets to start the replacement of Qantas’ ageing domestic fleet, with deliveries spread over a decade. The airline did not disclose the value of the Airbus deal, but analysts at Barrenjoey estimated in a client note it would cost at least A$6 billion ($4.23 billion).”Since the start of the calendar year, we have seen huge increases in demand,” Qantas Chief Executive Alan Joyce told reporters at Sydney Airport, where an Airbus A350-1000 test plane flown from France emblazoned with the Qantas logo and “Our Spirit flies further” was parked in a hangar as a backdrop for the announcement.Qantas shares surged as much as 5.5% on Monday to the highest level since November after it also said debt levels had fallen to pre-COVID levels faster than the market’s expectations.The A350-1000 order was the culmination of a challenge called “Project Sunrise” set for Airbus and its rival Boeing Co (BA.N) in 2017 to create aircraft capable of the record-breaking flights.Airbus was selected as the preferred supplier in late 2019, but Qantas delayed placing an order for two years due to financial challenges during the COVID pandemic.Airbus Chief Commercial Officer Christian Scherer said the aircraft to be used on the Sydney-London flights would offer more fuel storage than A350-1000s currently in operation with other airlines.The Qantas planes will carry passengers across four classes and will have around 100 fewer seats than rivals British Airways (ICAG.L) and Cathay Pacific Airways Ltd (0293.HK) use on their A350-1000s. The Australian carrier will dedicate more than 40% of the jets’ cabins to premium seating.CEO Joyce said demand for non-stop flights had grown since the pandemic, when complex travel rules were put in place. Rising fuel costs could be recovered through higher fares, he said, as the airline had done previously on its non-stop Perth-London flights.In a market update, Qantas said while it expects an underlying operating loss for the financial year ending June 30, 2022, the second half would benefit from improved domestic and international demand, with free cash flow seen rising further in the current quarter.Barrenjoey analysts forecast Qantas could achieve a 20% revenue premium on the ultra-long haul flights, which Joyce said will also go to New York from late 2025 and possible future destinations like Paris, Chicago and Rio de Janeiro.Qantas estimated Project Sunrise would have an internal rate of return of around 15%.($1 = 1.4180 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Jamie Freed; Additional reporting by Sameer Manekar in Bengaluru; Editing by Diane Craft, Sam Holmes and Kenneth MaxwellOur Standards: The Thomson Reuters Trust Principles. .

Japan buyers agree to Q2 aluminium premium of $172/T, sources say

Containers are seen at an industrial port in the Keihin Industrial Zone in Kawasaki, Japan September 12, 2018. REUTERS/Kim Kyung-HoonRegister now for FREE unlimited access to Reuters.com

- Initial offers made by producers were $195-$250/T

- Second straight quarterly price fall

- Contrast to soaring premiums in Europe and the U.S.

TOKYO, April 7 (Reuters) – The premium for aluminium shipments to Japanese buyers for April to June was set at $172 a tonne, down 2.8% from the previous quarter, as weak demand in Japan and China outweighed concerns of supply disruptions from Russia, five sources said.The figure is lower than the $177 per tonne paid in the January-March quarter and marks a second consecutive quarterly drop. It is also lower than initial offers of $195-$250 made by producers. read more Japan is Asia’s biggest aluminium importer and the premiums for primary metal shipments it agrees to pay each quarter over the benchmark London Metal Exchange (LME) cash price set the benchmark for the region.Register now for FREE unlimited access to Reuters.comThe sources, who were directly involved in pricing talks, declined to be identified because of the sensitivity of the discussions.One of them, who works at a Japanese trading house, said the decline in premiums reflected weak demand from the automobile sector as it deals with a chip shortage, as well as amply supply in Asia as China has increased exports of semi-manufactured metals.A tight container market and high freight rates also made it difficult for the metal to be shipped from Asia to Europe or North America where premiums are much higher, the source said.China is increasing exports of aluminium to fill a widening supply gap in Western markets. read more Global suppliers such as Rio Tinto (RIO.AX) and South32 (S32.AX) and Japanese manufacturers of rolled products and trading houses began price negotiations in early March. The talks took longer than usual because of uncertainty about exports from Russia as a result of sanctions following its invasion of Ukraine.Russia accounted for 17% of Japan’s total imports of primary aluminium ingots in 2021 and 6% of global aluminium supply.Concerns about the impact of disrupted Russian shipments as well as reduced output because of high power prices drove aluminium prices to a record high of $4,073.50 a tonne in early March.The duty-paid physical premiums in Europe and the United States have soared to $595 a tonne and $880 a tonne, respectively, while Asia’s spot premiums have remained around $110-170 a tonne this year, the sources said.Another of the sources said so far Russia’s Rusal had maintained shipments to Japan, which made global suppliers retreat from high initial offers.However, another of the sources said Asian supplies might get tighter as “global traders have been collecting primary aluminium from several locations in Asia and sending them to Europe or North America by chartering bulk ships to take an advantage of higher premiums”.Register now for FREE unlimited access to Reuters.comReporting by Yuka Obayashi; Editing by Himani Sarkar and Barbara LewisOur Standards: The Thomson Reuters Trust Principles. .

Column: European smelter squeeze keeps zinc close to record highs

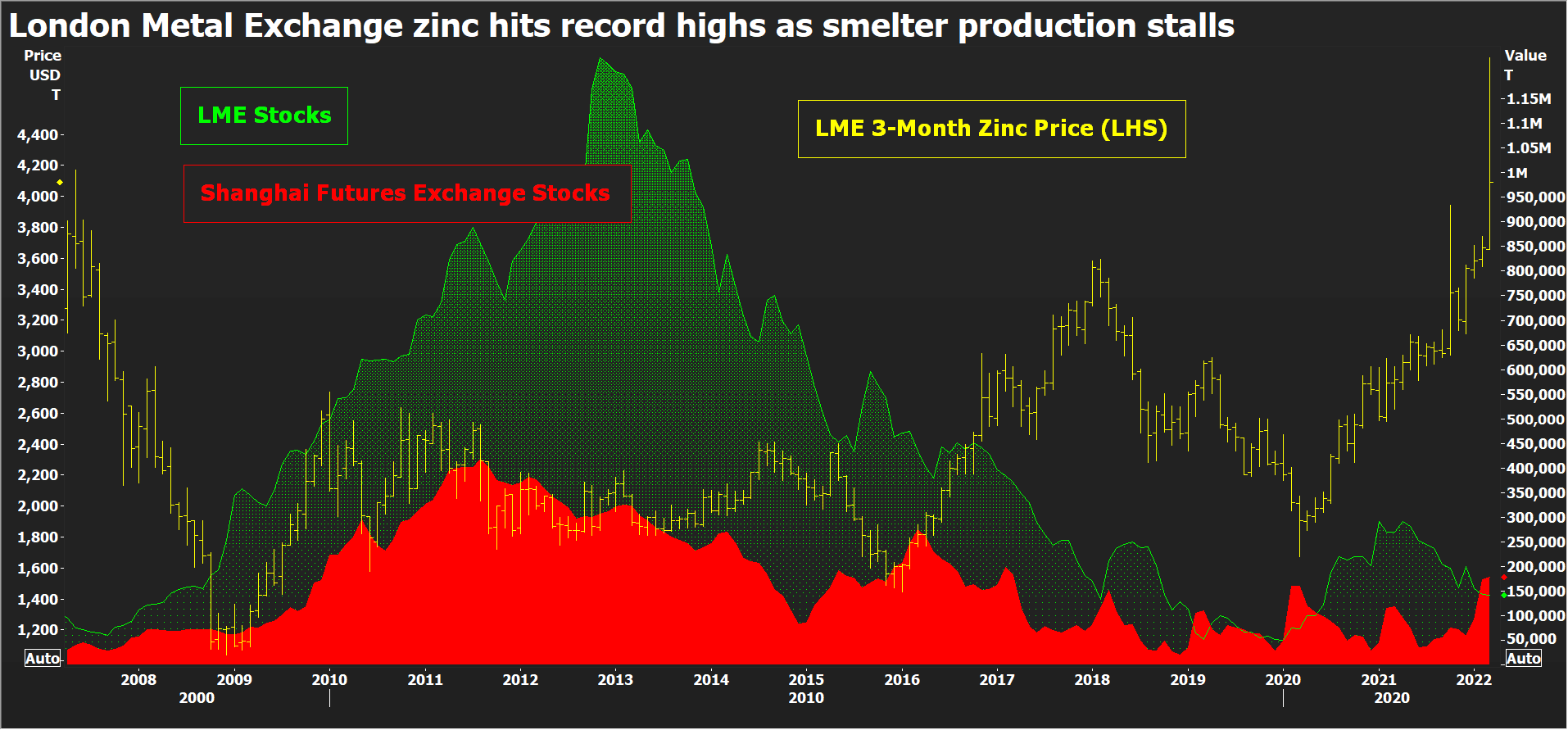

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

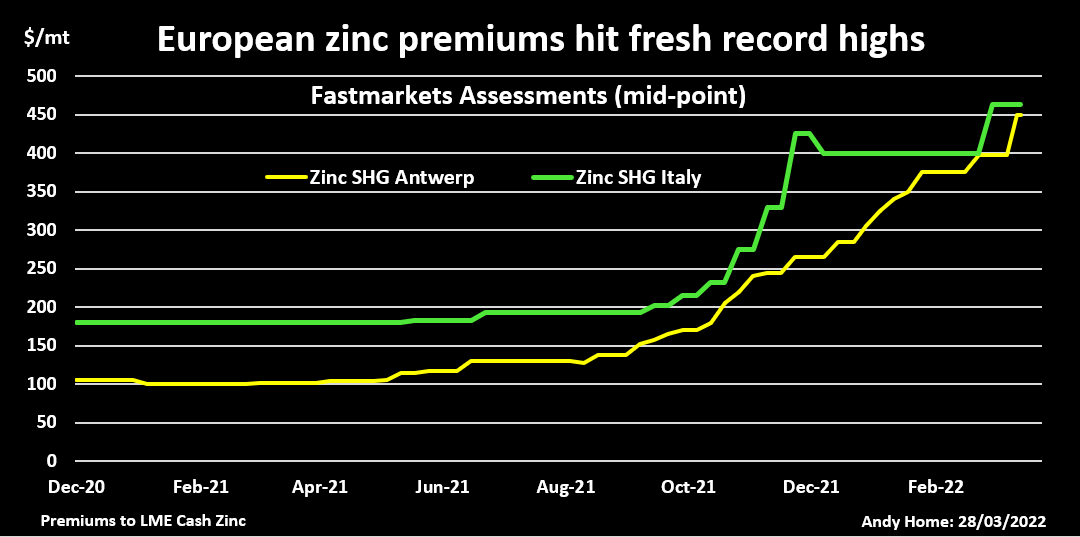

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .