Salvadoran President, Nayib Bukele speaks during an event in May 2021. El Salvador become the first country to adopt bitcoin as legal tender in June.Camilo Freedman | SOPA Images | LightRocket | Getty ImagesIt has been more than a year since El Salvador made history by becoming the first country to make bitcoin legal tender, and so far, 37-year-old resident Edgardo Acevedo has found the nationwide crypto experiment to be relatively anticlimactic.”I don’t think anything has changed, except that the country is more recognized than before, but the economic life of Salvadorans remains the same or worse than a few years ago,” said Acevedo, a development engineer working in the capital city of San Salvador.Acevedo, who is also known by the pseudonym Ishi Kawa, tells CNBC that while bitcoin has become a topic of conversation, adoption remains low, and he has personally found that there are very few businesses that accept the world’s biggest cryptocurrency — and even fewer Salvadorans who wish to pay in the digital token.”What has improved is the issue of violence and crime, but economically, I can say that nothing has changed,” he said.It has been a rocky time, with the project not living up to the grand promises made by the country’s popular and outspoken president Nayib Bukele.The use of bitcoin in El Salvador appears to be low, as the currency has lost about 60% of its value since the experiment started and the country still faces plummeting economic growth and a high deficit. El Salvador’s debt-to-GDP ratio — a key metric used to compare what a country owes with what it generates — is set to hit nearly 87% this year, stoking fears that the nation isn’t equipped to settle its loan obligations.Data from Bloomberg Economics shows that El Salvador tops its ranking of emerging market countries that are vulnerable to a debt default. Even as it retires some of its outstanding debts, the country’s domestic and multilateral loan obligations pose a real threat, in part because the world’s biggest lenders aren’t too keen to give cash to a country betting its future on one of the most volatile assets on the planet.Pair these economic woes with a renewed war on gang violence and the country is barreling toward uncertainty.”The government claims the developments as a success, but most local commentators and international watchers are underwhelmed,” Rachel Ziemba, founder of Ziemba Insights, told CNBC. Bitcoin uptake appears lowWhen El Salvador’s Bitcoin Law came into effect Sept. 7, 2021, Jaime Garcia was hopeful that it would fix a few big problems with the way that Salvadorans send, receive and spend money.As part of the law, prices are now sometimes listed in bitcoin, tax contributions can be paid with the digital currency, and exchanges in bitcoin will not be subject to capital gains tax. But crucially, Bukele promoted the law as a way to expand financial inclusion — which is no small thing for a country where approximately 70% of the population does not have access to traditional financial services, according to the Bitcoin Law.To help facilitate national adoption, El Salvador launched a virtual wallet called “chivo” (Salvadoran slang for “cool”) that offers no-fee transactions, allows for quick cross-border payments, and requires only a mobile phone plus an internet connection. It aimed to bring users onboard quickly, both to scale bitcoin adoption and to offer a convenient onramp for those who had never been a part of the banking system.Bukele tweeted in January that about 60% of the population, or 4 million people, used the chivo app, and more Salvadorans have chivo wallets than traditional bank accounts, according to a Sept. 20 research note from Deutsche Bank. Still, only 64.6% of the country has access to a mobile phone with internet, that note says.But a report published in April by the U.S. National Bureau of Economic Research showed that only 20% of those who downloaded the wallet continued to use it after spending the $30 bonus. The research was based upon a “nationally representative survey” involving 1,800 households.Garcia, who lives in the Canadian province of Saskatchewan, fled El Salvador when he was 11 after rebels bombed his house, but he keeps in close touch with family and friends who stayed behind — and he sometimes sends money back home, too.”There are pockets where bitcoin is popular, like in El Zonte, but it’s clear that adoption is not massive,” said Garcia.”Big chains like McDonald’s, Starbucks, and most merchants at a mall will accept bitcoin — but are people using it? Not too much locally,” he said. “It’s mostly tourists using bitcoin.”A survey by the El Salvador-based El Instituto de Opinion Publica, a public opinion think tank, found that 7 in 10 Salvadorans do not think the Bitcoin Law has benefited their family economy.Another survey by the institute found that 76 out of 100 small and medium-size enterprises in El Salvador do not accept bitcoin payments.”Bitcoin’s first year in effect has transcended from a commercial expectation to an irrelevant topic for traders,” said Laura Andrade, director of El Salvador’s Universidad Centroamericana, according to a CNBC translation of her Spanish-language comments.Andrade said many large corporations are still advertising that they’re taking payments in bitcoin but are making excuses to not accept the cryptocurrency including saying their system does not work or the bitcoin wallet is out of service.”The foregoing is evidence that this cryptocurrency, in reality, never had penetration in national commerce,” Andrade said.”There seems to be evidence that most people used it primarily to get the free money from the government but have not used it on an ongoing basis given volatility and fees,” Ziemba said.Meanwhile, those who did use the government’s crypto wallet reportedly had technical problems with the app. Other Salvadorans fell prey to schemes involving identity theft, in which hackers used their national ID number to open a chivo e-wallet, in order to claim the free $30 worth of bitcoin offered by the government as an incentive to join.A survey published in March by the Chamber of Commerce and Industry of El Salvador found that 86% of businesses have never made a sale in bitcoin, and only 20% of businesses take bitcoin, despite the Law’s mandate that all merchants accept the cryptocurrency.”They gave people the wallets, they forced businesses to accept them, but essentially, in my opinion, it’s a big nothing burger,” said Frank Muci, a policy fellow at the London School of Economics, who has experience advising governments in Latin America. “Nobody really uses the app to pay in bitcoin. People that do use it, mostly use it for dollars.”The experiment also involved building a nationwide infrastructure of bitcoin ATMs, but they’re too far away for many people to use.Another hope for the chivo wallet was that it would help save hundreds of millions of dollars in remittance fees. Remittances, or money sent home by migrants, account for more than 20% of El Salvador’s gross domestic product, and some households receive over 60% of their income from this source alone. Incumbent services can charge 10% or more in fees for those international transfers, which can sometimes take days to arrive and require a physical pickup.But in 2022, recent data shows that only 1.6% of remittances were sent to El Salvador via digital wallets. According to the Deutsche Bank report from September, part of the reason bitcoin transfers haven’t caught on has to do with the complications of buying and selling bitcoin for dollars. The report notes that “people who send and receive remittances frequently use informal brokers to convert local currency to and from bitcoin” and extremely volatile prices make buying and selling the cryptocurrency a complex task requiring technical know-how.”This is a new money, a new way of doing things for a population that is very comfortable with dollars. This is a population that is largely unbanked and would rather deal with hard cash that they can see and feel,” Garcia said.Miles Suter, the crypto product lead at Cash App, told CNBC on a panel at the Messari Mainnet conference in New York that the government’s 90-day rollout of the chivo wallet and nationwide adoption of bitcoin was “rushed” and that there are still a lot of problems.”You shouldn’t mandate the acceptance of a specific currency,” said Suter, who spent six months in El Salvador in the runup to the passing of the Bitcoin Law. However, Suter added that the media perception is worse than how things are actually going on the ground.”I saw and experienced lives being changed by having access to a new emerging monetary standard,” he said.

Bitcoin uptake appears lowWhen El Salvador’s Bitcoin Law came into effect Sept. 7, 2021, Jaime Garcia was hopeful that it would fix a few big problems with the way that Salvadorans send, receive and spend money.As part of the law, prices are now sometimes listed in bitcoin, tax contributions can be paid with the digital currency, and exchanges in bitcoin will not be subject to capital gains tax. But crucially, Bukele promoted the law as a way to expand financial inclusion — which is no small thing for a country where approximately 70% of the population does not have access to traditional financial services, according to the Bitcoin Law.To help facilitate national adoption, El Salvador launched a virtual wallet called “chivo” (Salvadoran slang for “cool”) that offers no-fee transactions, allows for quick cross-border payments, and requires only a mobile phone plus an internet connection. It aimed to bring users onboard quickly, both to scale bitcoin adoption and to offer a convenient onramp for those who had never been a part of the banking system.Bukele tweeted in January that about 60% of the population, or 4 million people, used the chivo app, and more Salvadorans have chivo wallets than traditional bank accounts, according to a Sept. 20 research note from Deutsche Bank. Still, only 64.6% of the country has access to a mobile phone with internet, that note says.But a report published in April by the U.S. National Bureau of Economic Research showed that only 20% of those who downloaded the wallet continued to use it after spending the $30 bonus. The research was based upon a “nationally representative survey” involving 1,800 households.Garcia, who lives in the Canadian province of Saskatchewan, fled El Salvador when he was 11 after rebels bombed his house, but he keeps in close touch with family and friends who stayed behind — and he sometimes sends money back home, too.”There are pockets where bitcoin is popular, like in El Zonte, but it’s clear that adoption is not massive,” said Garcia.”Big chains like McDonald’s, Starbucks, and most merchants at a mall will accept bitcoin — but are people using it? Not too much locally,” he said. “It’s mostly tourists using bitcoin.”A survey by the El Salvador-based El Instituto de Opinion Publica, a public opinion think tank, found that 7 in 10 Salvadorans do not think the Bitcoin Law has benefited their family economy.Another survey by the institute found that 76 out of 100 small and medium-size enterprises in El Salvador do not accept bitcoin payments.”Bitcoin’s first year in effect has transcended from a commercial expectation to an irrelevant topic for traders,” said Laura Andrade, director of El Salvador’s Universidad Centroamericana, according to a CNBC translation of her Spanish-language comments.Andrade said many large corporations are still advertising that they’re taking payments in bitcoin but are making excuses to not accept the cryptocurrency including saying their system does not work or the bitcoin wallet is out of service.”The foregoing is evidence that this cryptocurrency, in reality, never had penetration in national commerce,” Andrade said.”There seems to be evidence that most people used it primarily to get the free money from the government but have not used it on an ongoing basis given volatility and fees,” Ziemba said.Meanwhile, those who did use the government’s crypto wallet reportedly had technical problems with the app. Other Salvadorans fell prey to schemes involving identity theft, in which hackers used their national ID number to open a chivo e-wallet, in order to claim the free $30 worth of bitcoin offered by the government as an incentive to join.A survey published in March by the Chamber of Commerce and Industry of El Salvador found that 86% of businesses have never made a sale in bitcoin, and only 20% of businesses take bitcoin, despite the Law’s mandate that all merchants accept the cryptocurrency.”They gave people the wallets, they forced businesses to accept them, but essentially, in my opinion, it’s a big nothing burger,” said Frank Muci, a policy fellow at the London School of Economics, who has experience advising governments in Latin America. “Nobody really uses the app to pay in bitcoin. People that do use it, mostly use it for dollars.”The experiment also involved building a nationwide infrastructure of bitcoin ATMs, but they’re too far away for many people to use.Another hope for the chivo wallet was that it would help save hundreds of millions of dollars in remittance fees. Remittances, or money sent home by migrants, account for more than 20% of El Salvador’s gross domestic product, and some households receive over 60% of their income from this source alone. Incumbent services can charge 10% or more in fees for those international transfers, which can sometimes take days to arrive and require a physical pickup.But in 2022, recent data shows that only 1.6% of remittances were sent to El Salvador via digital wallets. According to the Deutsche Bank report from September, part of the reason bitcoin transfers haven’t caught on has to do with the complications of buying and selling bitcoin for dollars. The report notes that “people who send and receive remittances frequently use informal brokers to convert local currency to and from bitcoin” and extremely volatile prices make buying and selling the cryptocurrency a complex task requiring technical know-how.”This is a new money, a new way of doing things for a population that is very comfortable with dollars. This is a population that is largely unbanked and would rather deal with hard cash that they can see and feel,” Garcia said.Miles Suter, the crypto product lead at Cash App, told CNBC on a panel at the Messari Mainnet conference in New York that the government’s 90-day rollout of the chivo wallet and nationwide adoption of bitcoin was “rushed” and that there are still a lot of problems.”You shouldn’t mandate the acceptance of a specific currency,” said Suter, who spent six months in El Salvador in the runup to the passing of the Bitcoin Law. However, Suter added that the media perception is worse than how things are actually going on the ground.”I saw and experienced lives being changed by having access to a new emerging monetary standard,” he said. ‘Sleepwalking into a debt default’Well before Bukele wagered that bitcoin would bandage over longstanding economic vulnerabilities, the country was in a lot of trouble.The World Bank projects that the Salvadoran economy will grow by 2.9% this year and 1.9% in 2023, down from 10.7% in 2021. But that growth itself was a bounce-back from an 8.6% contraction in 2020.Its debt-to-GDP ratio is almost 90%, and its debt is expensive at around 5% per year versus 1.5% in the U.S. The country also has a massive deficit — with no plans to reduce it, whether through tax hikes or by substantially cutting spending.In a research note from JPMorgan, analysts warn that El Salvador’s eurobonds have entered “distressed territory” in the last year, and S&P Global data reportedly shows that the cost to insure against a sovereign debt default is hitting multiyear highs.Both JPMorgan and the International Monetary Fund warn the country is on an unsustainable path, with gross financing needs set to surpass 15% of GDP from 2022 forward — and public debt on track to hit 96% of GDP by 2026 under current policies.El Salvador faces a heavy mix of multilateral and domestic debts, including imminent debt repayment deadlines in the billions of dollars, such as an $800 million eurobond that matures in January.”The domestic debt is very large, relatively short duration and needs to be rolled over frequently,” said Muci, who previously worked at the Growth Lab at the Harvard Kennedy School of Government.El Salvador has been trying since early 2021 to secure a $1.3 billion loan from the IMF — an effort that appears to have soured over Bukele’s refusal to heed the organization’s advice to ditch bitcoin as legal tender.Rating agencies, including Fitch, have knocked down El Salvador’s credit score, citing the uncertainty of the country’s financial future given the adoption of bitcoin as legal tender. That means that it’s now even more expensive for Bukele to borrow much-needed cash.Beyond the fact that global lenders don’t want to throw money at a country that is spending millions in tax dollars on a cryptocurrency whose price is prone to extreme volatility, the IMF’s largest shareholder, the U.S., is targeting Salvadoran officials as part of wider international sanctions against “corrupt actors.”The president’s efforts to consolidate power have also driven up this risk premium for global lenders.Bukele’s New Ideas party has control over the country’s Legislative Assembly. In 2021, the new assembly came under fire after it ousted the attorney general and top judges. The move prompted the U.S. Agency for International Development to pull aid from El Salvador’s national police and a public information institute and reroute the funds to civil society groups.Additionally, El Salvador can’t print cash to shore up its finances. El Salvador ditched its local currency, the colon, in favor of the U.S. dollar. Only the Federal Reserve can print more dollars. Meanwhile, its other national currency, bitcoin, is revered for the fact that it, too, is impossible to mint out of thin air.”One of the big issues has been the fact that the bitcoin gimmick has distracted from the fiscal and economic challenges of the country and made it more difficult for the country to access IFI lending and preferential terms,” Ziemba said.Ziemba added that there have been some swaps with major crypto firms that allowed the country to raise cash to pay off the debt due this year, and perhaps early next year, but the long-term debt sustainability remains a challenge.”They’ve spooked the bejesus out of financial markets and the IMF,” said Muci, who tells CNBC that nobody wants to lend money to Bukele unless it’s at “eye-gouging rates” of 20% to 25%.”The country is sleepwalking into a debt default,” Muci said.

‘Sleepwalking into a debt default’Well before Bukele wagered that bitcoin would bandage over longstanding economic vulnerabilities, the country was in a lot of trouble.The World Bank projects that the Salvadoran economy will grow by 2.9% this year and 1.9% in 2023, down from 10.7% in 2021. But that growth itself was a bounce-back from an 8.6% contraction in 2020.Its debt-to-GDP ratio is almost 90%, and its debt is expensive at around 5% per year versus 1.5% in the U.S. The country also has a massive deficit — with no plans to reduce it, whether through tax hikes or by substantially cutting spending.In a research note from JPMorgan, analysts warn that El Salvador’s eurobonds have entered “distressed territory” in the last year, and S&P Global data reportedly shows that the cost to insure against a sovereign debt default is hitting multiyear highs.Both JPMorgan and the International Monetary Fund warn the country is on an unsustainable path, with gross financing needs set to surpass 15% of GDP from 2022 forward — and public debt on track to hit 96% of GDP by 2026 under current policies.El Salvador faces a heavy mix of multilateral and domestic debts, including imminent debt repayment deadlines in the billions of dollars, such as an $800 million eurobond that matures in January.”The domestic debt is very large, relatively short duration and needs to be rolled over frequently,” said Muci, who previously worked at the Growth Lab at the Harvard Kennedy School of Government.El Salvador has been trying since early 2021 to secure a $1.3 billion loan from the IMF — an effort that appears to have soured over Bukele’s refusal to heed the organization’s advice to ditch bitcoin as legal tender.Rating agencies, including Fitch, have knocked down El Salvador’s credit score, citing the uncertainty of the country’s financial future given the adoption of bitcoin as legal tender. That means that it’s now even more expensive for Bukele to borrow much-needed cash.Beyond the fact that global lenders don’t want to throw money at a country that is spending millions in tax dollars on a cryptocurrency whose price is prone to extreme volatility, the IMF’s largest shareholder, the U.S., is targeting Salvadoran officials as part of wider international sanctions against “corrupt actors.”The president’s efforts to consolidate power have also driven up this risk premium for global lenders.Bukele’s New Ideas party has control over the country’s Legislative Assembly. In 2021, the new assembly came under fire after it ousted the attorney general and top judges. The move prompted the U.S. Agency for International Development to pull aid from El Salvador’s national police and a public information institute and reroute the funds to civil society groups.Additionally, El Salvador can’t print cash to shore up its finances. El Salvador ditched its local currency, the colon, in favor of the U.S. dollar. Only the Federal Reserve can print more dollars. Meanwhile, its other national currency, bitcoin, is revered for the fact that it, too, is impossible to mint out of thin air.”One of the big issues has been the fact that the bitcoin gimmick has distracted from the fiscal and economic challenges of the country and made it more difficult for the country to access IFI lending and preferential terms,” Ziemba said.Ziemba added that there have been some swaps with major crypto firms that allowed the country to raise cash to pay off the debt due this year, and perhaps early next year, but the long-term debt sustainability remains a challenge.”They’ve spooked the bejesus out of financial markets and the IMF,” said Muci, who tells CNBC that nobody wants to lend money to Bukele unless it’s at “eye-gouging rates” of 20% to 25%.”The country is sleepwalking into a debt default,” Muci said. Tourism and presidential popularity solidOn the day the Bitcoin Law took effect, Bukele revealed that the country had begun to add bitcoin to government coffers. Since then, the price of the cryptocurrency has plunged more than 60%, stoked by rising interest rates and failed projects and bankruptcies in the industry.The government has an unrealized paper loss on bitcoin of around $60 million. None of these losses are locked in until the country exits its bitcoin position.In aggregate, the entire experiment and all its associated costs have only set the government back around $375 million, according to estimates. That’s not nothing — especially considering the fact that El Salvador has $7.7 billion of bonds outstanding — but to an economy of $29 billion, it is comparatively small.El Salvador’s millennial, tech-savvy president — who once touted himself as the “world’s coolest dictator” on his Twitter bio — has tethered his political fate to the country’s crypto gamble, so he has a very big incentive to make it work in the long run and to pay off the country’s debt in the interim. Bukele faces reelection for another five-year presidential term in 2024.At least El Salvador’s big bitcoin gamble has been a win in terms of attracting bitcoin tourists.The tourism industry is up 30% since the Bitcoin Law took effect, according to official government estimates. The country’s tourism minister also notes that 60% of tourists now come from the U.S.The bitcoin experiment hasn’t hurt the president’s popularity either. Bukele’s approval ratings are north of 85% — thanks in large part to his tough-on-crime approach to leading. That’s no small thing to a country that was more dangerous per capita than Afghanistan five years ago.Suter said the project has also introduced many locals to the concept of savings, noting that before the Bitcoin Law, much of the population didn’t have a way to digitally hold their money and transact among one another.”It was all cash — and the cash that you earned that week, you typically spent it, because there wasn’t much ability to dream of growing it through investment.”

Tourism and presidential popularity solidOn the day the Bitcoin Law took effect, Bukele revealed that the country had begun to add bitcoin to government coffers. Since then, the price of the cryptocurrency has plunged more than 60%, stoked by rising interest rates and failed projects and bankruptcies in the industry.The government has an unrealized paper loss on bitcoin of around $60 million. None of these losses are locked in until the country exits its bitcoin position.In aggregate, the entire experiment and all its associated costs have only set the government back around $375 million, according to estimates. That’s not nothing — especially considering the fact that El Salvador has $7.7 billion of bonds outstanding — but to an economy of $29 billion, it is comparatively small.El Salvador’s millennial, tech-savvy president — who once touted himself as the “world’s coolest dictator” on his Twitter bio — has tethered his political fate to the country’s crypto gamble, so he has a very big incentive to make it work in the long run and to pay off the country’s debt in the interim. Bukele faces reelection for another five-year presidential term in 2024.At least El Salvador’s big bitcoin gamble has been a win in terms of attracting bitcoin tourists.The tourism industry is up 30% since the Bitcoin Law took effect, according to official government estimates. The country’s tourism minister also notes that 60% of tourists now come from the U.S.The bitcoin experiment hasn’t hurt the president’s popularity either. Bukele’s approval ratings are north of 85% — thanks in large part to his tough-on-crime approach to leading. That’s no small thing to a country that was more dangerous per capita than Afghanistan five years ago.Suter said the project has also introduced many locals to the concept of savings, noting that before the Bitcoin Law, much of the population didn’t have a way to digitally hold their money and transact among one another.”It was all cash — and the cash that you earned that week, you typically spent it, because there wasn’t much ability to dream of growing it through investment.” The president upped the ante in November when he announced plans to build a “Bitcoin City” next door to the Conchagua volcano in southeastern El Salvador. The bitcoin-funded city would offer significant tax relief, and geothermal energy rolling off the adjacent volcano would power bitcoin miners.But now, Bitcoin City is on hold, as is the $1 billion bitcoin bond sale, which was initially put on ice in March because of unfavorable market conditions.”Ultimately, El Salvador’s problems are just tangential to currency,” Muci said.”The plane is gonna crash eventually, if they don’t change things,” he said — “if they don’t raise taxes, cut spending, start being much more disciplined, convincing markets that they’re sustainable.””Bitcoin doesn’t solve any of El Salvador’s important economic problems,” he added.

The president upped the ante in November when he announced plans to build a “Bitcoin City” next door to the Conchagua volcano in southeastern El Salvador. The bitcoin-funded city would offer significant tax relief, and geothermal energy rolling off the adjacent volcano would power bitcoin miners.But now, Bitcoin City is on hold, as is the $1 billion bitcoin bond sale, which was initially put on ice in March because of unfavorable market conditions.”Ultimately, El Salvador’s problems are just tangential to currency,” Muci said.”The plane is gonna crash eventually, if they don’t change things,” he said — “if they don’t raise taxes, cut spending, start being much more disciplined, convincing markets that they’re sustainable.””Bitcoin doesn’t solve any of El Salvador’s important economic problems,” he added. .

.

Hdfc Bank Vs Bajaj Finance: Which Stock Is Better?

These financial companies include non-banking financial companies (NBFC), microfinance institutions (MFI), small finance banks (SFB), regional rural banks (RRBs), etc.

These companies along with scheduled commercial banks (SCBs) make up the Indian financial ecosystem.

When it comes to credit creation, banks are indisputable leaders. However, NBFCs have been recording higher credit growth in the last few years.

NBFCs are the largest borrowers for banks. In the last decade, NBFCs went from being 12% of banks’ balance sheets in 2010 to over 25% today. That’s phenomenal growth, isn’t it?

So, if you had limited capital to invest in just one financial company, which one you should choose: A bank or an NBFC.

This article aims to answer this question through a detailed comparison of India’s largest SCB and NBFC, that is HDFC Bank and Bajaj Finance.

Overview

Bajaj Finance is a deposit taking NBFC registered with the Reserve Bank of India (RBI). The company is in the business of lending and accepting deposits.

Bajaj Finance has a diversified portfolio comprising retail, SME, and commercial customers across urban and rural areas. The company offers products and services across six broad categories:

● Consumer lending

● SME lending

● Commercial lending

● Rural lending

● Deposits

● Partnerships and services

The company has two wholly owned subsidiaries, Bajaj Housing Finance (BHFL) and Bajaj Financial Securities (BFinSec).

The products and services offered via these two subsidiaries are an extension of its core products and services such as mortgages, margin facilities, etc.

The company has its operational presence in 3,329 locations in India. It had a customer base of 52.8 m as of 30th September 2021.

HDFC Bank is India’s largest bank by market cap and the largest private sector bank by assets. The company offers a range of products and services to individuals, businesses, and institutions under three heads:

● Wholesale Banking

● Retail Banking

● Treasury Operations

HDFC Bank is one of the most valuable brands in India with a brand value of US$ 20.2 bn. Also, it’s among the few companies listed on international stock exchanges.

Deposits

HDFC Bank and Bajaj Finance are engaged in the business of taking deposits and offering loans.

Therefore, cash is at the core of everything they do, it’s the lifeline of their business. The more cash they have, the more credit they can give.

These companies tap into various sources of funding to ensure they never run out of funds. These sources include their own equity, debt market, and deposits.

From a cost perspective, deposits are the cheapest source of funds. Therefore, amplifying their deposit buffers is one of the top priorities for these companies.

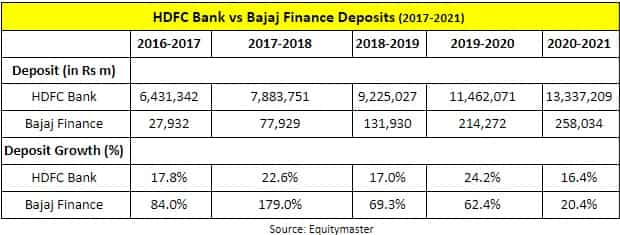

Let’s look at the deposit base of HDFC Bank and Bajaj Finance and its growth over the years.

View Full ImageEquitymaster

View Full ImageEquitymaster

With just a glimpse you will notice that HDFC Bank’s deposit base is higher than Bajaj Finance.

This enormous difference in deposit base exists because of the very nature of their business models.

HDFC Bank is a full-fledged bank. It accepts all types of deposits out of the box.

By all types of deposits, I mean demand deposits (saving account, current account), time deposits (FDs). The same is not true for Bajaj Finance.

Bajaj Finance is an NBFC. Generally, an NBFC is not allowed to accept any sort of deposit.

However, Bajaj Finance is an exception. The company has approval from RBI to accept deposits.

Now, even though the company accepts deposits, it’s only limited to time deposits such as FDs. The company can’t accept demand deposits.

This is one of the biggest differences between HDFC Bank and Bajaj Finance. It’s perhaps the biggest reason which explains such a substantial difference in their deposit base.

The other reason is the time for which they have been accepting deposits. HDFC Bank has been accepting deposits since 1994 when it was established. Bajaj Finance, on the other hand, started accepting deposits much later.

Talking of growth, Bajaj Finance appears to be doing better than HDFC Bank. Bajaj Finance’s deposit base grew at a CAGR of 56% over the last five years. During the same period, HDFC Bank’s deposit base grew at a CAGR of 15.7%.

However, one must note that HDFC Bank’s double-digit growth comes off on a higher base, which is commendable.

Advances

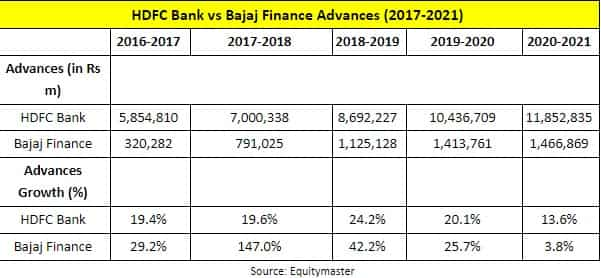

Bajaj Finance and HDFC Banks provide credit to individuals as well as businesses.

While Bajaj Finance is a leading financier for consumer durables, HDFC Bank is a leading player in the auto finance segment.

Also, HDFC Bank is the market leader in credit cards with a total market share of around 23%.

Let’s have a look at the loan book of these players.

View Full ImageEquitymaster

View Full ImageEquitymaster

In absolute terms, HDFC Bank’s loan book is 10 times that of Bajaj Finance. However, the latter’s loan book is growing at a phenomenal speed.

Thanks to its interest-free EMI scheme, which provides consumers with a convenient way to pay for their purchases, Bajaj Finance’s loan book has grown at a CAGR of 35.6% over the last five years.

HDFC Bank, on the other hand, has added loans at a CAGR of 15.1% during the same period.

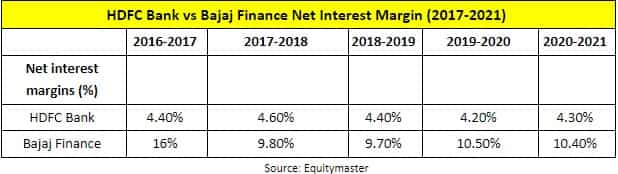

Net Interest Margins

When you park your money with banks, they offer you interest. Banks do the same on the lending side too. The only thing is the interest rate charged to borrowers is higher than what is offered to depositors.

The difference between interest earned and interest paid, known as “spread” in technical parlance, is the core income of a finance company. This difference appears as Net Interest Income or NII on the P&L statement.

Rising NII is a sign of a healthy financial institution. Now, if NII is divided by the total value of loans disbursed then that gives us Net Interest Margins (NIM).

NIM is an important metric as it reflects the core operational efficiency of a finance company. Thus, higher the NIM, the better it is for investors.

So, let’s see how HDFC Bank and Bajaj Finance did on this metric over the last five years.

View Full ImageEquitymaster

View Full ImageEquitymaster

HDFC Bank’s average NIM for the last five years turns out to be 4.4%. This is compared to Bajaj Finance’s average NIM of 11.2% during the same period.

The difference in NIM is due to different statutory requirements for both companies.

To avert any liquidity issues, these companies are required to invest a percentage of their total capital in liquid assets such as cash, gold, and g-secs. This is called the statutory liquidity ratio (SLR).

SLR for Bajaj Finance is 15% whereas it is 24% for HDFC Bank. This implies that Bajaj Finance has more money to lend compared to HDFC Bank.

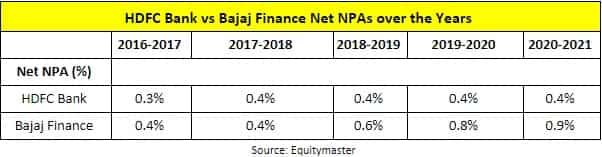

Non-Performing Assets (NPAs)

The loans disbursed by a financial company can be classified into two: secured loans and non-secured loans.

Secured loans are provided against collateral. If the borrower fails to pay, the creditor (a financial company) could sell the collateral to recover the loan amount. A home loan is a classic example of a secured loan.

In the case of unsecured loans, there is no collateral to rely on. If the borrower fails to pay, then the company could either restructure the loan or write off from its book. An example of unsecured lending is a loan for purchasing consumer durables as Bajaj Finance does.

Bajaj Finance and HDFC Bank, being large financial institutions, have a substantial portfolio of unsecured loans. They run the risk of losing that money if the borrower fails to pay them back.

If a borrower is overdue on his payments for more than 90 days, then that loan becomes a non-performing asset for a financial company.

NPAs beyond a certain limit could cripple a financial company.

Let’s look at the NPA numbers of Bajaj Finance and HDFC Bank.

View Full ImageEquitymaster

View Full ImageEquitymaster

HDFC Bank’s NPA for the last five years averages at 0.4%. It means that if HDFC Bank disburses a total loan of ₹100 then ₹0.4 doesn’t come back to the bank.

During the same period, Bajaj Finance’s NPA averaged0.6%.

NPAs of these companies are among the lowest in the industry. This tells us how good these companies are at assessing risk.

These companies have a strong risk assessment framework that helps them to screen high-quality borrowers. This remains one of the biggest competitive advantages for these companies and gives them an edge over their competitors.

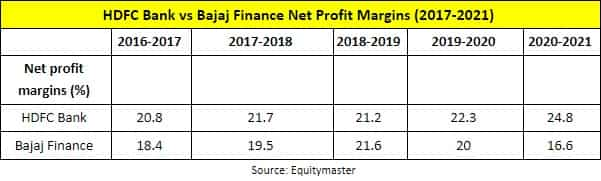

Net Profit Margins

Now let’s talk about the profits each company has been generating over the last five years.

The following table shows the net margins of HDFC Bank and Bajaj Finance over the last five years.

View Full ImageEquitymaster

View Full ImageEquitymaster

HDFC Bank scores a point here. HDFC Bank has clocked an average margin of 22.2% over the last five years. During the same period, Bajaj Finance has clocked an average margin of 19.2%.

What’s more interesting is that HDFC Bank has been reporting higher margins every passing year. This is due to the lean operating costs of the bank.

On top of that, HDFC Bank’s brand value allows it to raise capital at lower rates thereby reducing its overall costs.

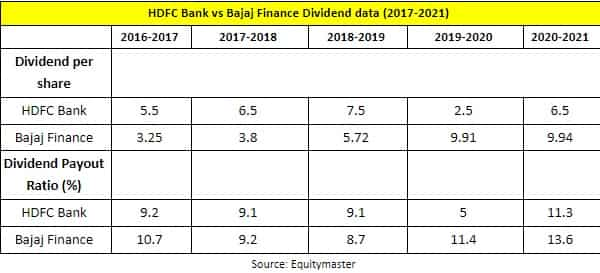

Dividend Payout

HDFC Bank and Bajaj Finance are leading lenders in their respective segments.

The scale at which they operate allows them to generate enough cash to share it with their shareholders.

These companies have rewarded their shareholders with dividends consistently over the last five years.

The following table shows the dividend profile of HDFC Bank and Bajaj Finance for the last five years.

View Full ImageEquitymaster

View Full ImageEquitymaster

HDFC Bank has paid an average dividend of ₹5.7 per share in the last five years. This along with an average dividend payout ratio of 8.7%.

Bajaj Finance, on the other hand, has paid an average dividend of ₹6.5 over the last five years along with an average dividend payout ratio of 10.7%.

Clearly, Bajaj Finance has been paying higher dividends.

Operational Presence

Bajaj Finance has an operational presence in 3,329 locations across the country. The company sells its products and services via physical points of sale present. It serves52.8 m customers via 119.900 physical points of sale across the country.

In addition to its physical network, the company has been strengthening its digital channels for the tech savvy. The company has been developing a super app to serve all the financial needs of its customers.

As of March 2021, HDFC Bank had a total of 21,364 banking outlets across the world. Besides banking outlets, the company operates an all-in-one payments app called “Payzapp”.

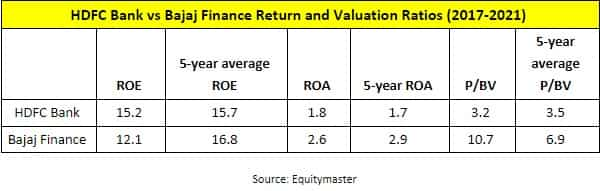

Return and Valuation Ratios

When comparing two financial companies, analysts usually use three ratios to find out which is undervalued. These three ratios are return on equity (ROE), return on assets (ROA), and price to book value (P/BV).

Return on equity (ROE) tells an investor how much profit a company generates on shareholders’ capital. It is expressed in terms of percentage.

Return on assets (ROA) tells an investor how much profit a company generates on total assets the company owns.

A crucial point to note is loans are assets for banks and ROA is calculated as a ratio of net income to its total performing (generating interest income) assets. For banks, ROA of 1% is a benchmark and anything beyond that is considered excellent.

Price to book value (P/BV) indicates the price an investor is willing to pay for each rupee of a company’s book value.

View Full ImageEquitymaster

View Full ImageEquitymaster

Bajaj Finance has performed better than HDFC Bank on return ratios. This is the reason why Bajaj Finance trades at a higher price to book (P/BV) multiple as compared to HDFC Bank.

Impact of Covid-19

The Covid-19 pandemic was a minor blip in the growth journey of HDFC Bank and Bajaj Finance.

These companies experienced a slowdown in the first two quarters as they exercised extreme caution.

Bajaj Finance in specific had to tread cautiously as NBFCs were required to offer moratorium services to their borrowers while not getting the same service for themselves. NBFCs are the largest borrowers of banks.

If looked at the brighter side of things, the pandemic accelerated the digitisation efforts of these companies. HDFC Bank and Bajaj Finance strengthened their digital infrastructure to strengthen its customer engagement, collection process, and product distribution.

These companies saw signs of recovery from third quarter onwards. On the retail front, home loans lead from the front. In the wholesale segment, these companies financed the working capital requirement of businesses.

Future Prospects

A large part of India is still credit averse. India’s total outstanding loans to gross domestic product (GDP) is just 15% compared to 80-100% in its western counterparts.

So, India has got a lot to cover and there is a lot of headroom for growth for HDFC Bank and Bajaj Finance.

Which channel would drive growth for these companies?

Both companies unequivocally agree that the future is digital.

Therefore, they have been investing in building digital channels either through in house development or through partnerships with fintechs.

Bajaj Finance has been in the process of developing a super app to serve all the financial needs of a customer. The company aims to streamline all its processes right from origination to collection, thereby reducing the costs.

HDFC Bank entered into a strategic partnership with Paytm to leverage Paytm’s digital platform and expand its reach in rural markets where Paytm enjoys good rapport with small merchants.

As far new areas of growth are concerned, Bajaj Finance is eyeing the healthcare industry. It has brought the concept of no cost EMI to the healthcare industry and aims to taste the same success it had with consumer durables.

HDFC Bank, on the other hand, has announced its merger with its parent company, HDFC Ltd. This merger would result in a financial behemoth worth US$ 160 bn.

HDFC Bank would benefit from this merger in two ways.

First, the bank would inherit all the customers associated with HDFC Ltd at no extra cost. This means more business for the bank as it can cross-sell various products to these customers.

Second, the bank would be able to raise fresh capital at a lower rate which can be then passed to its potential customers. This would give the bank an edge over its competitors.

Which is Better?

From the above discussion, Bajaj Finance leads the way on almost all metrics except for NPA and net profit margins.

However, the company’s phenomenal growth has been accounted for in its share price. That is why it trades at a premium valuation than HDFC Bank on P/BV multiple.

HDFC Bank’s performance is commendable, given its large book size. HDFC Bank is trading at a lower P/BV multiple than Bajaj Finance.

So, HDFC Bank is relatively undervalued here.

Though this article might have made things easier for you, we strongly recommend you check the fundamentals and valuations of both these companies on your own.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

Note: Equitymaster.com is currently not accessible due to technical reasons. We regret the inconvenience caused. Meanwhile, please access our content on LiveMint.com. You can also track us on YouTube and Telegram. This article is syndicated from Equitymaster.com

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!

.