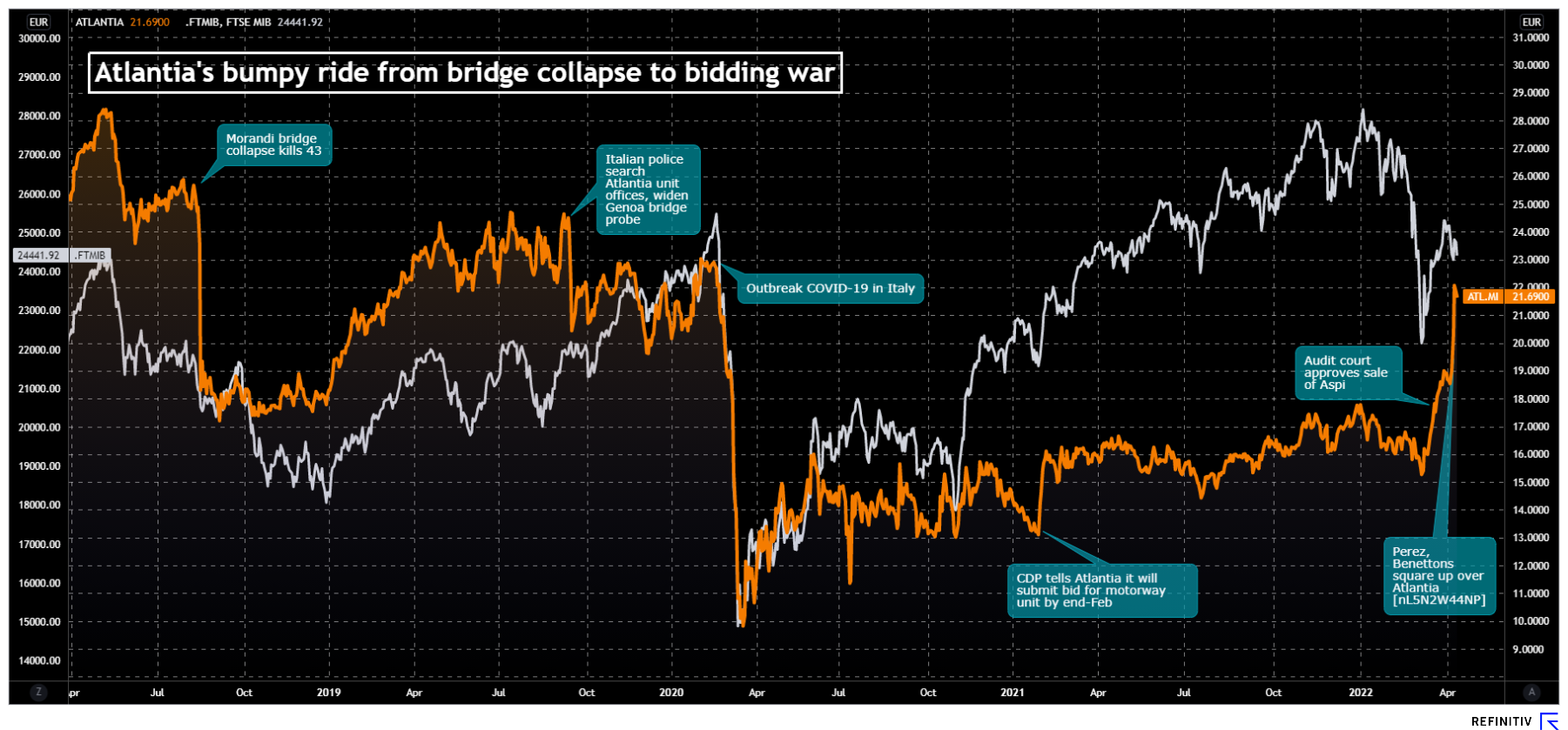

The logo of infrastructure group Atlantia in Rome, Italy October 5, 2020. REUTERS/Guglielmo MangiapaneRegister now for FREE unlimited access to Reuters.comMILAN, April 12 (Reuters) – The Benetton family and U.S. investment fund Blackstone are working on a premium of around 30% over Atlantia’s (ATL.MI) average stock price in the last six months, as they ready a bid that could land as early as Wednesday, three sources said.The two partners are considering an offer between 22 and 23 euros per share, one of the sources said, but cautioned no final decision had been taken.While a significant premium on the six month average share price, that would be a more modest increase over the current price of about 21.7 euros, and would value the whole of Atlantia – in which the Benetton family already owns a 33% stake – at about 18.1-19.0 billion euros ($19.7-$20.7 billion).Register now for FREE unlimited access to Reuters.comShares in the Italian infrastructure group have gained nearly 20% since April 6 when speculation first emerged about an approach involving Global Infrastructure Partners (GIP), Brookfield and Florentino Perez, head of Spain’s ACS (ACS.MC).The stock hit a two-year high of 22.5 euros on Monday as investors waited for a move that could take the group private.”The offer could land very soon, even early Wednesday morning,” one of the sources said.Blackstone and Benetton holding company Edizione declined to comment. Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Editing by Mark Potter and Chizu NomiyamaOur Standards: The Thomson Reuters Trust Principles. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

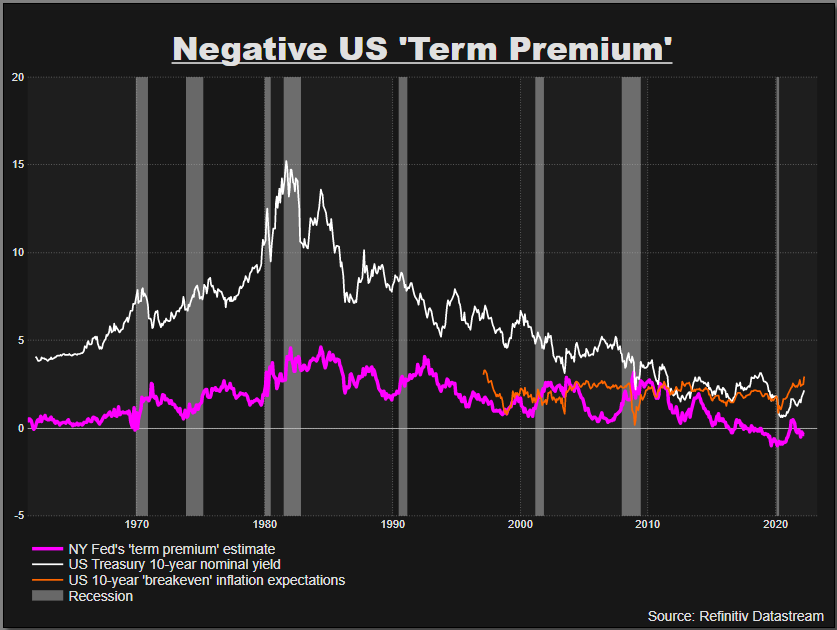

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

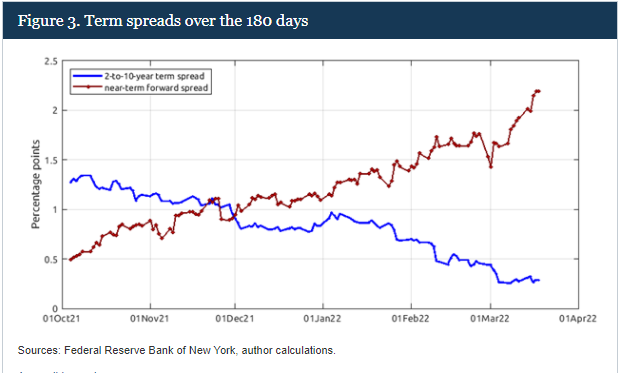

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

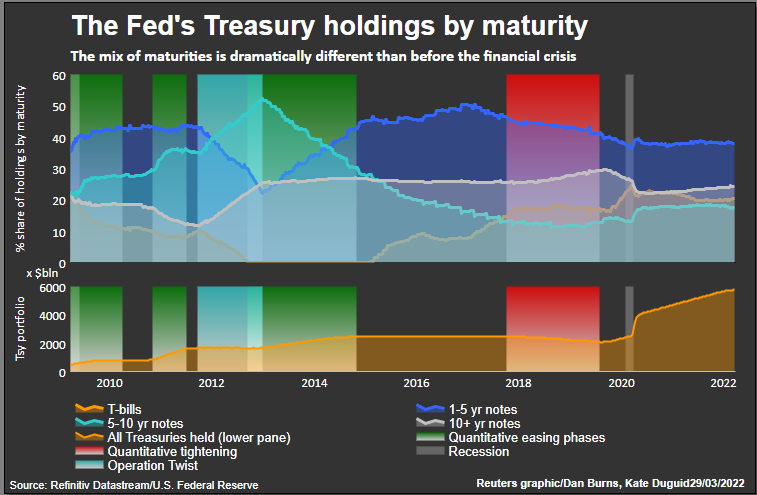

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Column: European smelter squeeze keeps zinc close to record highs

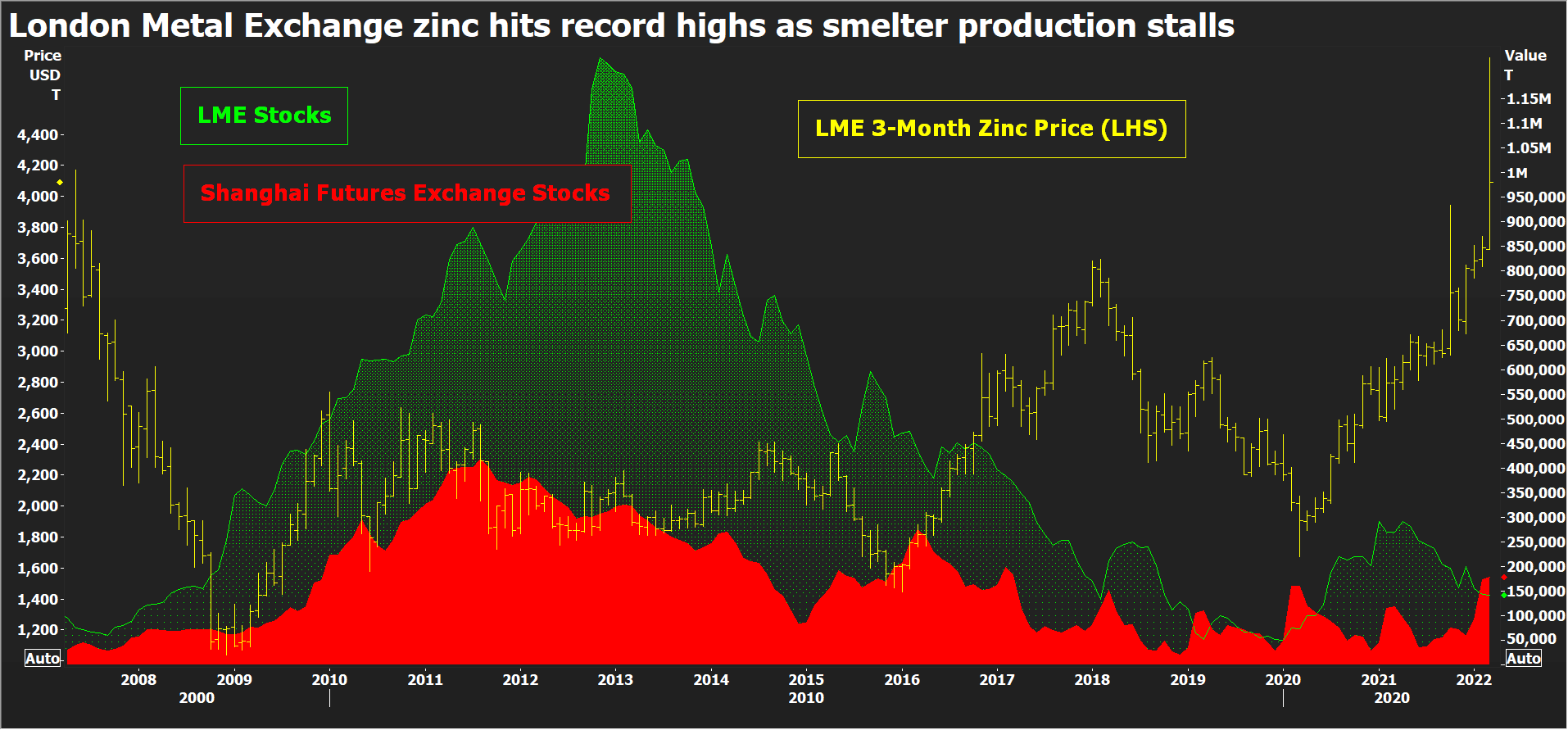

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

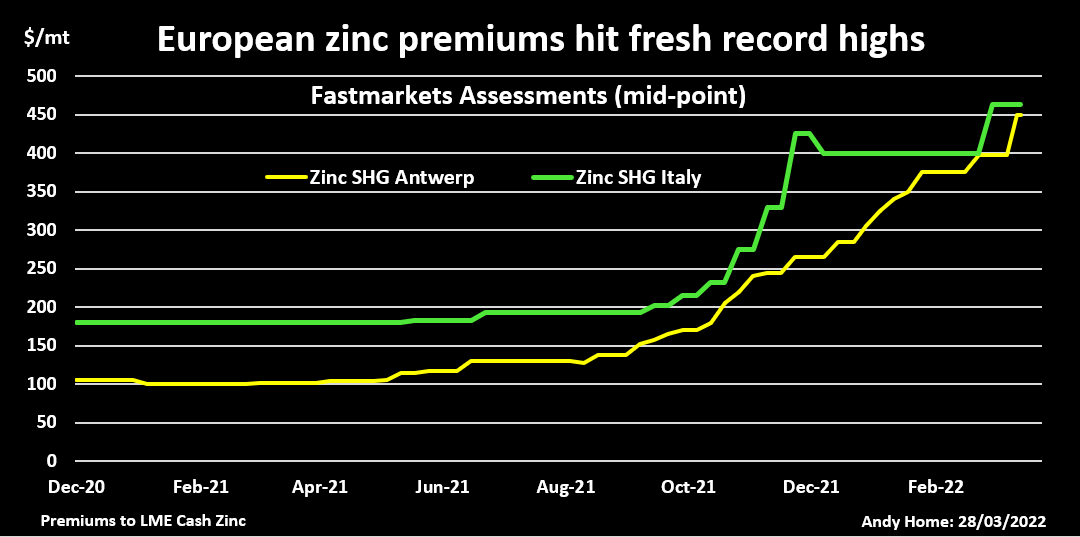

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Ping An Insurance profit falls 29% amid premium income pressure

File Photo: A man walks past a branch of Ping An Bank, a subsidiary of Ping An Insurance, in Beijing, China. REUTERS/Thomas PeterRegister now for FREE unlimited access to Reuters.com

- Ping An annual net profit tanks 29% on year

- Life, property and casualty insurance premiums down

- Agent numbers slashed, bodes ill for future sales

SHANGHAI, March 17 (Reuters) – China’s Ping An (601318.SS), , the country’s largest insurer by market value, reported its biggest annual profit fall since 2008 on Thursday amid pressure on its premium income.Ping An posted a 29% fall in annual net profit to 101.6 billion yuan ($16 billion)in 2021 from 143.1 billion yuan, as premium income from life insurance fell 4.1% year-on-year to 490.3 billion yuan, while property and casualty insurance premium income fell 5.5% to 270 billion yuan.”Complex, severe economic situations across the world and resurgences of COVID-19 increased uncertainty in resident income expectations in 2021,” Ping An said in a filing, and this “tempered consumer spending on long-term protection products”.Register now for FREE unlimited access to Reuters.comAnother factor was a fall in the number of Ping An sales agents fell, which meant that its new business value of life and health insurance sank 23.6% to 37.9 billion yuan.Its army of insurance agents, once the jewel in Ping An’s crown, is set to shrink further, putting more pressure on sales.”In 2022, the number of agents may still fall quite a lot compared to the year before,” Huatai Securities said in a note published this month, adding that this “can only have an impact on the growth of new insurance policies”.PROPERTY EXPOSUREPing An has been shaken by growing concerns about its investments in a highly indebted property sector which faces a liquidity crunch amid a crackdown by Beijing on borrowing.While there are suggestions of an easing — from exempting M&A financing from the tighter restrictions to loosening mortgage lending — many developers are still feeling liquidity pressure, two people with knowledge said.Ping An said it had a total exposure of 54 billion yuan ($8.4 billion) to China Fortune Land Development Co last year as the developer faced mounting default pressure.Some analysts cautioned that the total property exposure of Ping An is much higher and still underestimated by the market, which will poses further credit risks.However, its Ping An Bank Co Ltd reported a 25.6% increase in annual profit for last year, compared to 2020, with the bank’s non-performing loan ratio down to 1.02% at end of December, from 1.05% three months ago.Ping An’s Shanghai-listed shares are down 9.72% in the year to date, compared with a 11.62% drop in the benchmark Shanghai Composite Index and a 8.11% fall in Hang Seng index.Register now for FREE unlimited access to Reuters.comReporting by Engen Tham, Zhang Yan; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Australia’s Virtus accepts $514 million sweetened CapVest bid, topping BGH offer

March 14 (Reuters) – Australia’s Virtus Health Ltd said on Monday it had accepted a sweetened A$704.8 million ($514 million) takeover offer from CapVest Partners LLP, which topped an improved offer from rival bidder BGH Capital.However, the months-long bidding war for the in vitro fertilization service provider was not necessarily over as the deal with London-based CapVest allows the Virtus board to consider a superior proposal from Melbourne-based BGH or another party.CapVest’s revised cash offer of A$8.25 per share is a 7% premium to Virtus’s Thursday close and a 58% premium to its close on Dec. 13, before the bidding war broke out.Register now for FREE unlimited access to Reuters.comThe deal, unanimously recommended by the company’s board, knocks out a A$8.10 per share offer from Melbourne-based BGH Capital made after the market close on March 10. That offer was conditional on Virtus not signing an implementation deed with London-based CapVest.The latest CapVest deal includes a potential simultaneous off-market takeover offer, if it does not reach the required minimum threshold of 50% shareholder acceptance.Virtus’ share price has jumped around 64% since the end of 2019. read more ($1 = 1.3723 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Savyata Mishra in Bengaluru; Editing by Richard Chang and Jane WardellOur Standards: The Thomson Reuters Trust Principles. .