PARIS, July 11 (Reuters) – The French government is poised to pay more than 8 billion euros ($8.05 billion) to bring power giant EDF (EDF.PA) back under full state control, two sources with knowledge of the matter said, adding the aim is to complete the deal in the fourth quarter.One of the sources said the cost of buying the 16% stake the state does not already own could be as high as almost 10 billion euros, when accounting for outstanding convertible bonds and a premium to current market prices. EDF and the economy ministry declined to comment.The French government, which already has 84% of EDF, announced last week it would nationalise the company, which would give it more control over a revamp of the debt-laden group while contending with a European energy crisis.Register now for FREE unlimited access to Reuters.comThe sources said the state would likely launch a public offer on the market at a premium to the stock price because the other option – a nationalisation law to be pushed through parliament – would take too long.When Prime Minister Elisabeth Borne announced the nationalisation plan on July 6, the stake held by minority shareholders was worth around 5 billion euros.In addition, the French government would also have to buy 2.4 billion euros of convertible bonds and offer a premium to current stock market prices to entice minority shareholders, with the cost of the transaction going well beyond 8 billion euros, the sources said.They did not give details of the size of the premium, with one of them saying no final decision had been taken.TIMELINEFrance wants the buyout to take place in October or November, and for that to happen it would have to move quickly, the sources said, asking not to be named because the matter is confidential.The next step will be for the government to announce the offer price and make an official filing, the sources said. Then EDF will need to give its opinion while an independent expert will be drafted in to review the offer price.All this will take some time, given the holiday season lull.France may have to announce the terms of the offer over the coming weeks, before the holiday period in August, to ensure it can have a deal in the fourth quarter, one of the sources said.French Economy Minister Bruno Le Maire said at the weekend: “It won’t be an operation that will be fulfilled in days and weeks, it will take months. I will provide all the necessary precisions in the coming weeks, but not now.”The government last week increased the amount of money available for financial operations related to its state shareholding portfolio by 12.7 billion euros in the second half of the year, with officials saying this would cover the EDF deal and other, unspecified transactions.Goldman Sachs (GS.N) and Societe Generale (SOGN.PA) are working with the government to secure a deal, sources had previously said, while EDF is being advised by Lazard (LAZ.N) and BNP Paribas (BNPP.PA). read more ($1 = 0.9921 euros)Register now for FREE unlimited access to Reuters.comReporting by Mathieu Rosemain and Pamela Barbaglia, additional reporting by Leigh Thomas and Michel Rose, writing by Silvia Aloisi, editing by Barbara LewisOur Standards: The Thomson Reuters Trust Principles. .

EXCLUSIVE World Cup stadium stands will be alcohol free under Qatari curbs – source

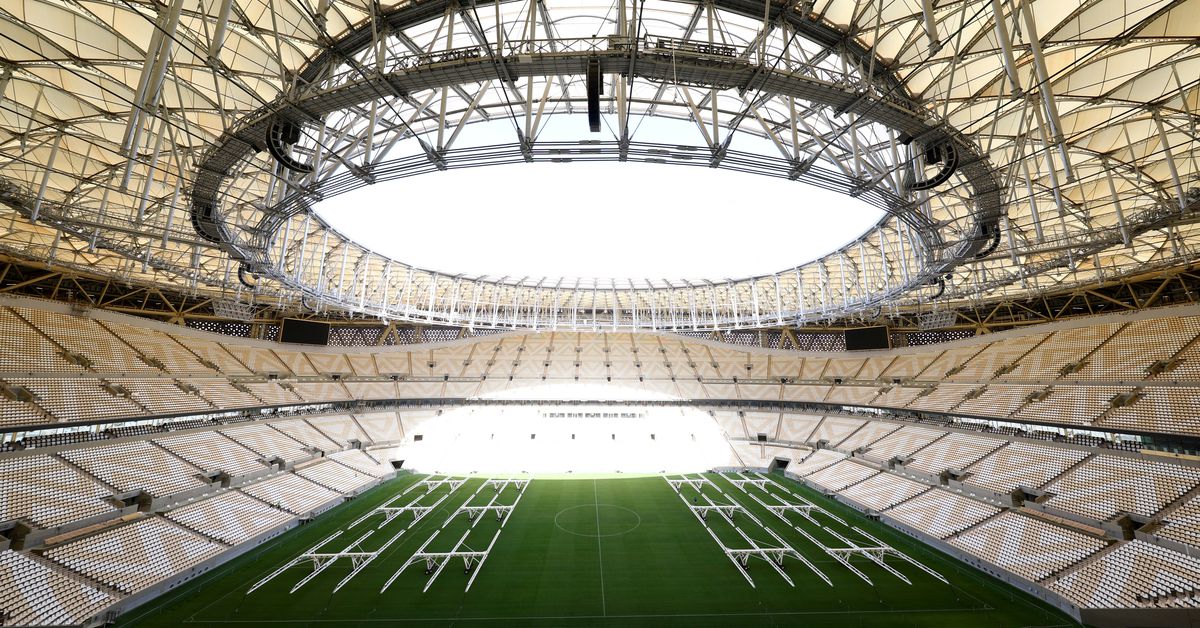

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Twitter set to accept Musk’s $43 billion offer

Elon Musk’s twitter account is seen through the Twitter logo in this illustration taken, April 25, 2022. REUTERS/Dado Ruvic/Illustration Register now for FREE unlimited access to Reuters.comNEW YORK, April 25 (Reuters) – Twitter Inc (TWTR.N) is poised to agree a sale to Elon Musk for around $43 billion in cash, the price the CEO of Tesla has called his “best and final” offer for the social media company, people familiar with the matter said.Twitter may announce the $54.20-per-share deal later on Monday once its board has met to recommend the transaction to Twitter shareholders, the sources said, adding it was still possible the deal could collapse at the last minute.Musk, the world’s richest person according to Forbes, is negotiating to buy Twitter in a personal capacity and Tesla (TSLA.O) is not involved in the deal.Register now for FREE unlimited access to Reuters.comTwitter has not been able to secure so far a ‘go-shop’ provision under its agreement with Musk that would allow it to solicit other bids once the deal is signed, the sources said. Still, Twitter would be allowed to accept an offer from another party by paying Musk a break-up fee, the sources added.The sources requested anonymity because the matter is confidential. Twitter and Musk did not immediately respond to requests for comment.Twitter shares were up 4.5% in pre-market trading in New York at $51.15.Musk, a prolific Twitter user, has said it needs to be taken private to grow and become a genuine platform for free speech.The 50-year-old entrepreneur, who is also CEO of rocket developer SpaceX, has said he wants to combat trolls on Twitter and proposed changes to the Twitter Blue premium subscription service, including slashing its price and banning advertising.The billionaire, a vocal advocate of cryptocurrencies, has also suggested adding dogecoin as a payment option on Twitter.He has said Twitter’s current leadership team is incapable of getting the company’s stock to his offer price on its own, but stopped short of saying it needs to be replaced.”The company will neither thrive nor serve this societal imperative in its current form,” Musk said in his offer letter last week.Up to the point Musk disclosed a stake in Twitter in April, the company’s shares had fallen about 10% since Parag Agrawal took over as CEO from founder Jack Dorsey in late November.The deal, if it happens, would come just four days after Musk unveiled a financing package to back the acquisition.This led Twitter’s board to take his offer more seriously and many shareholders to ask the company not to let the opportunity for a deal slip away, Reuters reported on Sunday. Before Musk revealed the financing package, Twitter’s board was expected to reject the bid, sources had said. read more The sale would represent an admission by Twitter that Agrawal is not making enough traction in making the company more profitable, despite being on track to meet ambitious financial goals the company set for 2023. Twitter’s shares were trading higher than Musk’s offer price as recently as November.Musk unveiled his intention to buy Twitter on April 14 and take it private via a financing package comprised of equity and debt. Wall Street’s biggest lenders, except those advising Twitter, have all committed to provide debt financing.Musk’s negotiating tactics – making one offer and sticking with it – resembles how another billionaire, Warren Buffett, negotiates acquisitions. Musk did not provide any financing details when he first disclosed his offer for Twitter, making the market skeptical about its prospects.Register now for FREE unlimited access to Reuters.comReporting by Greg Roumeliotis in New York, additional reporting by Krystal Hu;

Editing by Mark PotterOur Standards: The Thomson Reuters Trust Principles. .