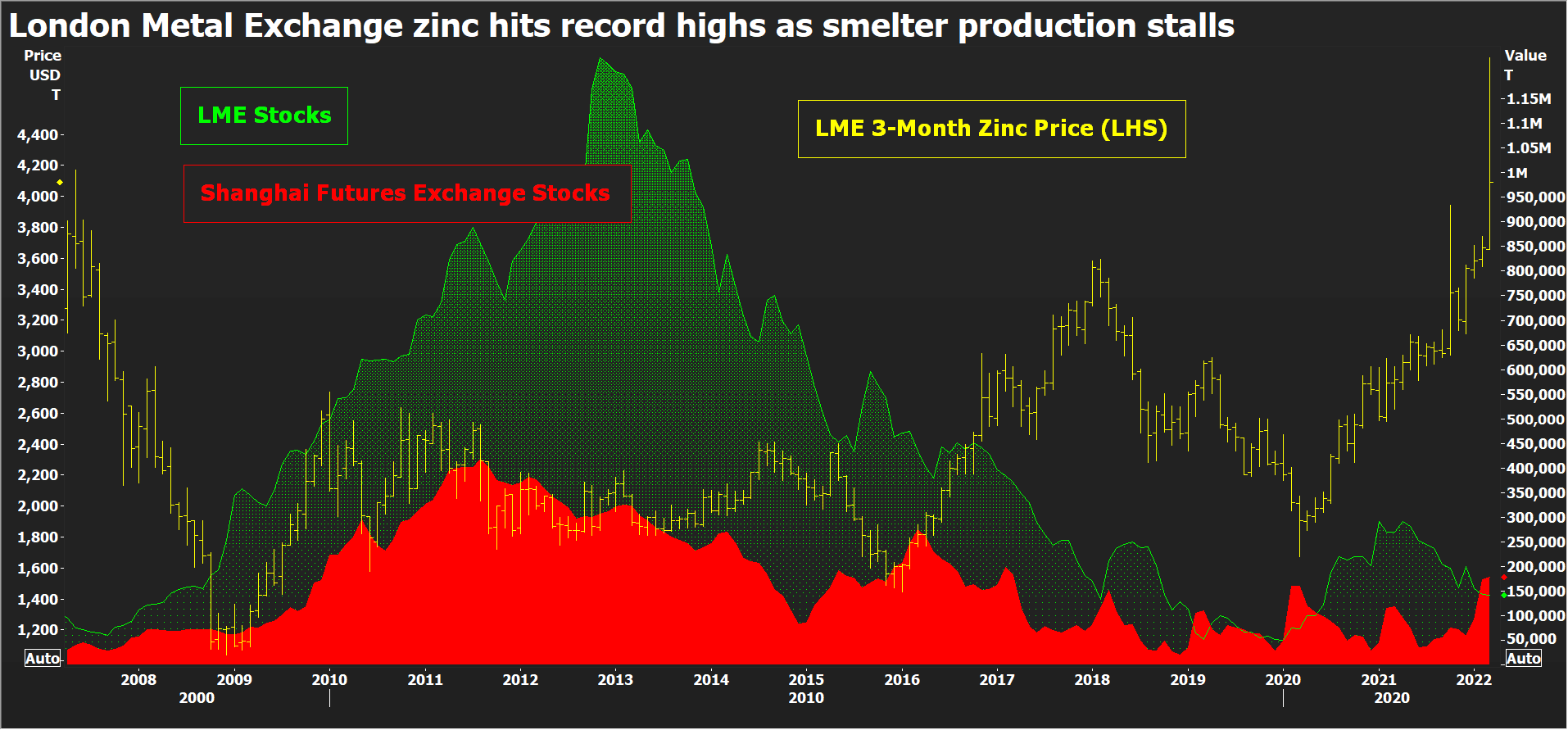

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

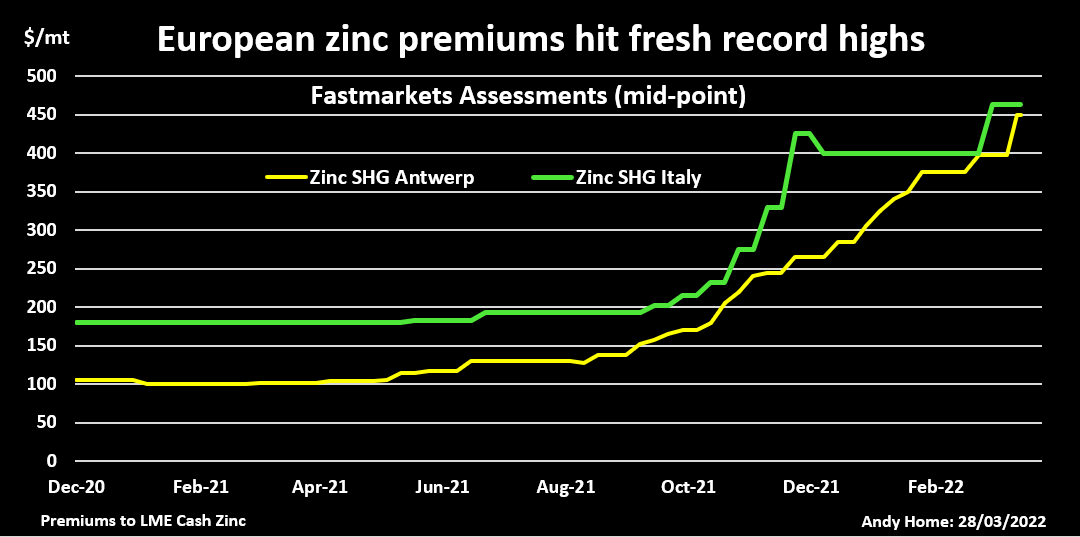

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Sycamore can relieve Ted Baker from its misery

The Ted Baker logo is seen in Central Valley, New York, U.S., February 15, 2022. REUTERS/Andrew KellyRegister now for FREE unlimited access to Reuters.comMILAN, March 18 (Reuters Breakingviews) – Sycamore Partners is digging in the fashion discount corner. The U.S. fund, which specialises in struggling retail assets, said on Friday that it could make a cash offer for hard-pressed British fashion firm Ted Baker (TED.L), triggering a 19% rally in its stock. For investors, the approach is a way of escaping the clutches of founder and former Chief Executive Ray Kelvin, whose overenthusiastic hugging habits led to his resignation in 2019 and a share price rout. Ted Baker shares are worth less than a tenth of their value before the scandal erupted.For Sycamore, it looks like an easy win. Assuming the U.S. fund pays 230 million pounds, a roughly 30% premium to Thursday’s market value, it could make a chunky 30% internal rate of return by simply growing revenue at 5% a year for five years and hiking the EBITDA margin to 12%, Breakingviews calculations show. That suggests the retailer may be worth more. Despite uncertainties in Europe because of the Ukrainian conflict, Ted Baker has worked hard to reduce its discounted sales to protect margins. Sycamore has ample wiggle room to pull investors from their misery. (By Lisa Jucca)Follow @Breakingviews on TwitterRegister now for FREE unlimited access to Reuters.comCapital Calls – More concise insights on global finance:Tencent WeChat Pay rejig would have 1 bln problems read more KKR property deal threads the needle in Japan read more Electric-car makers need to stay on their diet read more Online grocer woes imply fresh price wars read more China Swiss IPOs as predictable as a cuckoo clock read more Register now for FREE unlimited access to Reuters.comEditing by Ed Cropley and Oliver TaslicSign up for a free trial of our full service at https://www.breakingviews.com/trial and follow us on Twitter @Breakingviews and at www.breakingviews.com. All opinions expressed are those of the authors. .

Australia’s Virtus accepts $514 million sweetened CapVest bid, topping BGH offer

March 14 (Reuters) – Australia’s Virtus Health Ltd said on Monday it had accepted a sweetened A$704.8 million ($514 million) takeover offer from CapVest Partners LLP, which topped an improved offer from rival bidder BGH Capital.However, the months-long bidding war for the in vitro fertilization service provider was not necessarily over as the deal with London-based CapVest allows the Virtus board to consider a superior proposal from Melbourne-based BGH or another party.CapVest’s revised cash offer of A$8.25 per share is a 7% premium to Virtus’s Thursday close and a 58% premium to its close on Dec. 13, before the bidding war broke out.Register now for FREE unlimited access to Reuters.comThe deal, unanimously recommended by the company’s board, knocks out a A$8.10 per share offer from Melbourne-based BGH Capital made after the market close on March 10. That offer was conditional on Virtus not signing an implementation deed with London-based CapVest.The latest CapVest deal includes a potential simultaneous off-market takeover offer, if it does not reach the required minimum threshold of 50% shareholder acceptance.Virtus’ share price has jumped around 64% since the end of 2019. read more ($1 = 1.3723 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Savyata Mishra in Bengaluru; Editing by Richard Chang and Jane WardellOur Standards: The Thomson Reuters Trust Principles. .

BMW triples pre-tax earnings with high prices, top-end vehicle sales

The headquarters of German luxury carmaker BMW is seen in Munich, Germany, August 5, 2020. REUTERS/Michael DalderRegister now for FREE unlimited access to Reuters.comBERLIN, March 10 (Reuters) – BMW more than tripled its pre-tax earnings to 16 billion euros ($17.67 billion) in 2021, the company said on Thursday, as higher pricing and strong sales of top-end vehicles boosted revenues even as supply chain troubles limited production.Group revenues climbed 12.4% from last year to 111 billion euros, the company said, with net profit reaching a record high of 12.46 billion.The premium carmaker will propose a dividend of 5.8 euros per share, up from last year’s 1.9 euros, it said.Register now for FREE unlimited access to Reuters.comBMW, Mini and Rolls-Royce deliveries fell in the fourth quarter by 14.2% due to semiconductor bottlenecks, with rising raw material prices also weighing on earnings.Quarterly net profit for the group came in at 2.25 billion euros, a third higher than last year but slightly below third quarter’s profits of 2.58 billion.BMW saw higher unit sales than any other premium carmaker in 2021, delivering 2.5 million cars even as semiconductor shortages restricted output, a victory which has been attributed to its strong relations with suppliers.”We are in a good position and optimistic about the future,” Chief Financial Executive Nicolas Peter said.($1 = 0.9053 euros)Register now for FREE unlimited access to Reuters.comReporting by Victoria Waldersee, Tristan Chabba

Editing by Madeline ChambersOur Standards: The Thomson Reuters Trust Principles. .

Asia Fuel Oil VLSFO cash premiums gain, HSFO cash premiums hit multi-month highs

SINGAPORE, March 8 (Reuters) – Asia’s cash premiums for 0.5% very low-sulphur fuel oil (VLSFO) rose for a second consecutive session on Tuesday, while the prompt-month spread for the marine fuel grade remained in steep backwardation.Cash differentials for Asia’s 0.5% VLSFO , which have surged about 44% in the last month, were at a premium of $19.80 a tonne to Singapore quotes, compared with $19.67 per tonne a day earlier.The March/April VLSFO time spread traded at $32 a tonne on Tuesday, compared with $33.75 a tonne on Monday.Register now for FREE unlimited access to Reuters.comThe front-month VLSFO crack rose to $29.83 per barrel against Dubai crude during Asian trading hours, up from $29.61 per barrel in the previous session.Meanwhile, the 380-cst HSFO barge crack for April traded at a discount of $16.79 barrel to Brent on Tuesday, while cash premiums for 380-cst high sulphur fuel oil (HSFO) rose to a more than four-month high of $5.55 per tonne to Singapore quotes.Backed by firmer deals in the physical market, the cash differentials for 180-cst HSFO surged to a premium of $8.59 a tonne to Singapore quotes, a level not seen since October last year. They were at a premium of $6.39 per tonne a day earlier.ASIA REFINERS TO CRANK UP RUNS- Some Asian refineries plan to increase output in May to cash in on high prices for gasoil exports to Europe, even as the steepest crude prices in 14 years threaten profit margins, numerous trade sources said. read more – European diesel supplies have shrunk following the disruption of western sanctions imposed on Russia in response to its invasion of Ukraine, which it describes as a “special operation”.- Strong European demand has boosted Asian refiners’ profits for producing gasoil for exports to the West. However, the refiners are also paying record premiums for Middle East crude supplies after the disruption of sanctions left buyers with limited options.WINDOW TRADES- One 380-cst high-sulphur fuel oil (HSFO) deal, two 180-cst HSFO trades- One VLSFO trade was reportedOTHER NEWS- The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia’s invasion of Ukraine. read more – Oil prices rose on Tuesday, with Brent surging past $126 a barrel, as fears of formal sanctions against Russian oil and fuel exports spurred concerns about supply availability.ASSESSMENTSRegister now for FREE unlimited access to Reuters.comReporting by Koustav Samanta; Editing by Shinjini GanguliOur Standards: The Thomson Reuters Trust Principles. .