- Orders 12 Airbus ultra-long haul A350-1000 planes

- Commercial direct Sydney-London flight to start late in 2025

- 20-hour trip to be world’s longest non-stop flight

- Orders 20 A321XLRs and 20 A220s to renew domestic fleet

- Overall Airbus deal could be worth more than $4 bln – Barrenjoey

SYDNEY, May 2 (Reuters) – Qantas Airways (QAN.AX) will fly non-stop from Sydney to London after ordering a dozen special Airbus (AIR.PA) jets, charging higher fares in a multi-billion dollar bet that fliers will pay a premium to save four hours on the popular route.To be launched late in 2025, the flights will use A350-1000 planes, specially configured with extra premium seating and reduced overall capacity, to ferry up to 238 passengers in a 20-hour trip – the world’s longest direct commercial flight.Announcing plans for the service on Monday, the loss-making carrier said a strong recovery in the domestic market and signs of an improvement in international flying after the worst of the COVID-19 pandemic had given it the confidence to make a major investment on its future. Qantas forecasts a return to profit in the financial year starting this July.Register now for FREE unlimited access to Reuters.comThe order from the European aircraft maker also includes 40 narrowbody A321XLR and A220 jets to start the replacement of Qantas’ ageing domestic fleet, with deliveries spread over a decade. The airline did not disclose the value of the Airbus deal, but analysts at Barrenjoey estimated in a client note it would cost at least A$6 billion ($4.23 billion).”Since the start of the calendar year, we have seen huge increases in demand,” Qantas Chief Executive Alan Joyce told reporters at Sydney Airport, where an Airbus A350-1000 test plane flown from France emblazoned with the Qantas logo and “Our Spirit flies further” was parked in a hangar as a backdrop for the announcement.Qantas shares surged as much as 5.5% on Monday to the highest level since November after it also said debt levels had fallen to pre-COVID levels faster than the market’s expectations.The A350-1000 order was the culmination of a challenge called “Project Sunrise” set for Airbus and its rival Boeing Co (BA.N) in 2017 to create aircraft capable of the record-breaking flights.Airbus was selected as the preferred supplier in late 2019, but Qantas delayed placing an order for two years due to financial challenges during the COVID pandemic.Airbus Chief Commercial Officer Christian Scherer said the aircraft to be used on the Sydney-London flights would offer more fuel storage than A350-1000s currently in operation with other airlines.The Qantas planes will carry passengers across four classes and will have around 100 fewer seats than rivals British Airways (ICAG.L) and Cathay Pacific Airways Ltd (0293.HK) use on their A350-1000s. The Australian carrier will dedicate more than 40% of the jets’ cabins to premium seating.CEO Joyce said demand for non-stop flights had grown since the pandemic, when complex travel rules were put in place. Rising fuel costs could be recovered through higher fares, he said, as the airline had done previously on its non-stop Perth-London flights.In a market update, Qantas said while it expects an underlying operating loss for the financial year ending June 30, 2022, the second half would benefit from improved domestic and international demand, with free cash flow seen rising further in the current quarter.Barrenjoey analysts forecast Qantas could achieve a 20% revenue premium on the ultra-long haul flights, which Joyce said will also go to New York from late 2025 and possible future destinations like Paris, Chicago and Rio de Janeiro.Qantas estimated Project Sunrise would have an internal rate of return of around 15%.($1 = 1.4180 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Jamie Freed; Additional reporting by Sameer Manekar in Bengaluru; Editing by Diane Craft, Sam Holmes and Kenneth MaxwellOur Standards: The Thomson Reuters Trust Principles. .

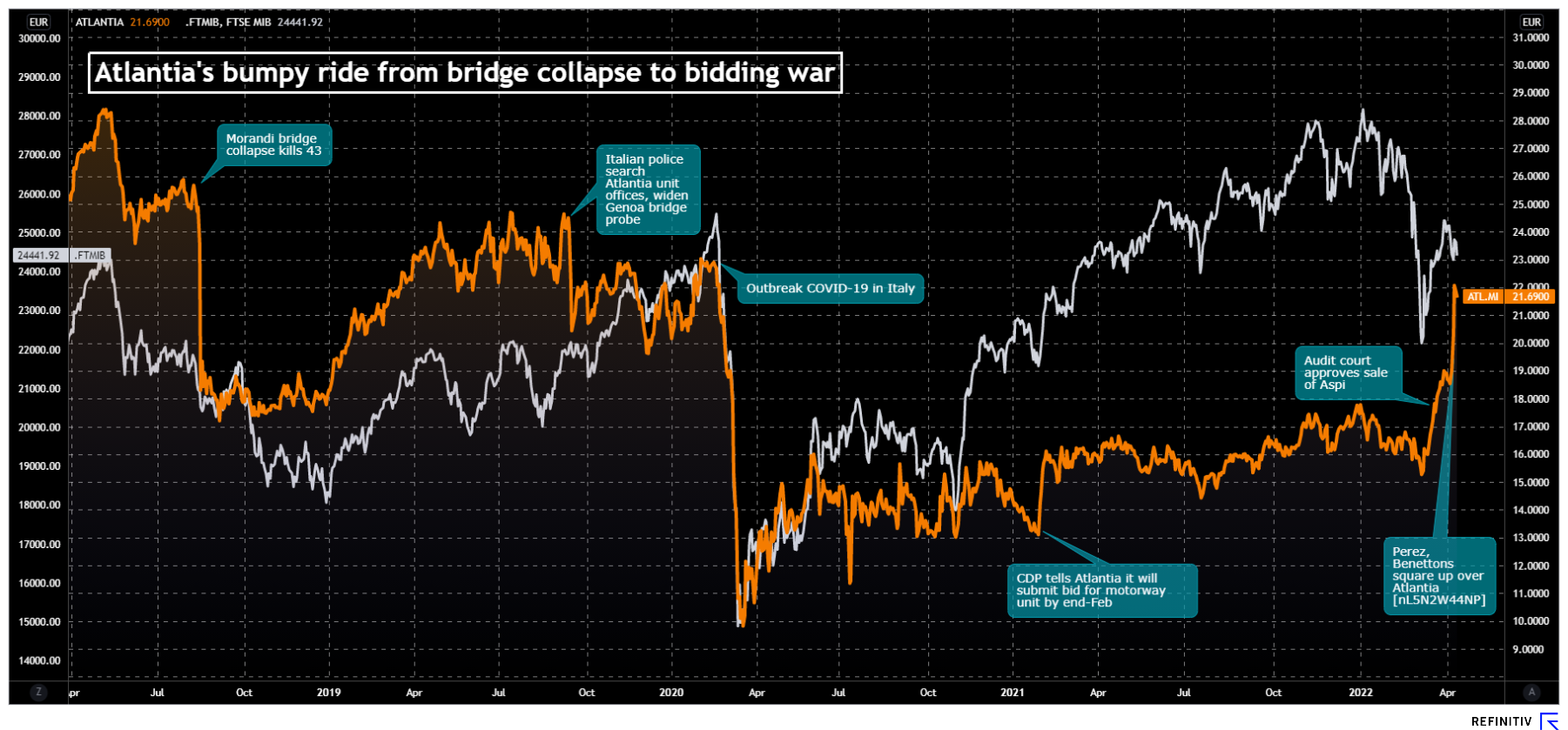

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.com

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.com