BENGALURU, Sept 29 (Reuters) – Reliance Industries Ltd’s (RELI.NS) retail unit launched its first in-house premium fashion and lifestyle store on Thursday, as the billionaire Mukesh Ambani-led company continues to grab a bigger slice of India’s luxury market.The new store chain called Azorte, the first of which was launched in Bengaluru, will compete with the likes of Mango and Industria de Diseno Textil SA-owned Zara (ITX.MC), and cater to millenials and Gen Z.”The mid-premium fashion segment is one of fastest growing consumer segments as millennials and the Gen Z are increasingly demanding the latest of international and contemporary Indian fashion,” Akhilesh Prasad, chief executive of the fashion and lifestyle arm of Reliance Retail, said.Register now for FREE unlimited access to Reuters.comThe launch is a part of the Ambani company’s aggressive strides in the retail industry, forging partnerships with domestic and global brands. read more The company plans to build a portfolio of 50 to 60 grocery, household and personal care brands within the year and is in advanced talks to get the rights for LVMH-owned French beauty brand Sephora in India.Reliance’s luxury and lifestyle foray has been led by Ambani’s daughter Isha.Register now for FREE unlimited access to Reuters.comReporting by Nandan Mandayam and Nivedita Bhattacharjee in BengaluruOur Standards: The Thomson Reuters Trust Principles. .

Siemens Energy sees ‘need for action’ in $4.3 bln turbine unit takeover plan

MADRID, May 23 (Reuters) – Siemens Energy (ENR1n.DE) does not yet see signs of a recovery at wind turbine maker Siemens Gamesa (SGREN.MC), its chief executive said on Monday after launching a 4.05 billion euro ($4.29 billion) bid for minority holdings in the unit.Siemens Energy announced the bid on Saturday after pressure from shareholders to raise its stake in Siemens Gamesa from the 67% it inherited after a spin off from Siemens (SIEGn.DE). Siemens Gamesa said it would review the offer. read more Siemens Gamesa shares rose more than 6% at the Madrid market open to trade at about 17.7 euros by 0705 GMT, just below the 18.05 euro per share offer price. Siemens Energy shares rose 2.7% in Frankfurt.Register now for FREE unlimited access to Reuters.comSiemens Gamesa, whose shares had fallen 20% since the start of the year until the offer was made, had issued three profit warnings in less than a year, dogged by product delays and operational problems.”There are not yet clear signs of a near-term recovery in the current setup,” Siemens Energy Chief Executive Christian Bruch said, adding that Siemens Gamesa’s financial performance was “really creating the need for action.”The bid price represented a premium of 27.7% over the Spanish-listed stock’s last unaffected closing price on May 17, and a 7.8% premium to Friday’s closing price.Asked about the onshore turbine business which has caused particular headaches, Bruch told analysts on a conference call: “There is no reason why you cannot be successful in onshore business if you fix your operational issues.”European turbine makers have racked up losses in a fiercely competitive market as metals and logistics prices surged due to COVID-19, import duties and Russia’s invasion of Ukraine. read more “I don’t believe that the supply chain environment will get easier,” Bruch said, increasing the need to “push for operational excellence everywhere as fast as possible”.He said pooling suppliers would “leverage the double-digit billion procurement volume we have as a total group as best we can.”Working to produce hydrogen from wind power, a technology seen as a promising way to reduce planet-warming carbon emissions from industry, could also be more effective under the new setup, he said.($1 = 0.9431 euros)Register now for FREE unlimited access to Reuters.comReporting by Isla Binnie; Editing by Christian Schmollinger and Edmund BlairOur Standards: The Thomson Reuters Trust Principles. .

Siemens Energy launches $4.3 billion bid for remaining Siemens Gamesa stake

A model of a wind turbine with the Siemens Gamesa logo is displayed outside the annual general shareholders meeting in Zamudio, Spain, June 20, 2017. REUTERS/Vincent WestRegister now for FREE unlimited access to Reuters.com

- Siemens Energy bids 18.05 euros/share for 33% stake

- Bid comes after operational problems at Siemens Gamesa

- Deal could yield cost synergies of up to 300 mln eur

FRANKFURT, May 21 (Reuters) – Siemens Energy (ENR1n.DE) on Saturday launched a 4.05 billion euro ($4.28 billion) bid for the remaining shares in struggling wind turbine unit Siemens Gamesa (SGREN.MC), hoping to remove a complex ownership structure that has weighed on its shares.Siemens Energy said the 18.05 euros per share bid constitutes a premium of 27.7% over the last unaffected closing share price of Spanish-listed Siemens Gamesa of 14.13 euros on May 17. It is a 7.8% premium to Friday’s closing price.Siemens Energy has faced mounting shareholder pressure to seek control of Siemens Gamesa (SGRE), in which it owns 67%, a stake it inherited as part of a spin-off from former parent Siemens (SIEGn.DE).Register now for FREE unlimited access to Reuters.comThat stake has given Siemens Energy little influence to deal with product delays and operational problems at Siemens Gamesa. The group has issued three profit warnings in less than a year.”It is critical that the deteriorating situation at SGRE is being stopped as soon as possible, and the value-creating repositioning starts quickly,” said Joe Kaeser, Siemens Energy’s supervisory board chairman.This year, sources told Reuters that Siemens Energy was exploring options to acquire the remaining stake in Siemens Gamesa and a deal could materialise by summer. read more Siemens Energy said it plans to finance up to 2.5 billion euros of the transaction with equity or equity-like instruments, adding a first step could be a capital increase without subscription rights.The remainder would be financed with debt as well as cash on hand, Siemens Energy said, adding it aimed to delist Siemens Gamesa. Spanish stock market regulations allow that once ownership of 75% is reached.Full integration of Siemens Gamesa will simplify Siemens Energy’s structure and provide a more coherent business model that caters to legacy energy assets like coal, transition technologies such as gas, and renewable power sources.”This transaction comes at a time of major changes affecting global energy,” Siemens Energy Chief Executive Christian Bruch said. “Our conviction is that the current geopolitical developments will not lead to a setback to the energy transition.”Siemens Energy said the deal would lead to cost synergies of up to 300 million euros annually within three years of the full integration, mainly due to more favourable supply chain management, combined administration and joint R&D.The deal should close in the second half and is expected to achieve revenue synergies of a mid triple-digit million amount by 2030, the group said.($1 = 0.9470 euros)Register now for FREE unlimited access to Reuters.comReporting by Christoph Steitz and Ludwig Burger; Editing by Nick Zieminski, Daniel Wallis and David GregorioOur Standards: The Thomson Reuters Trust Principles. .

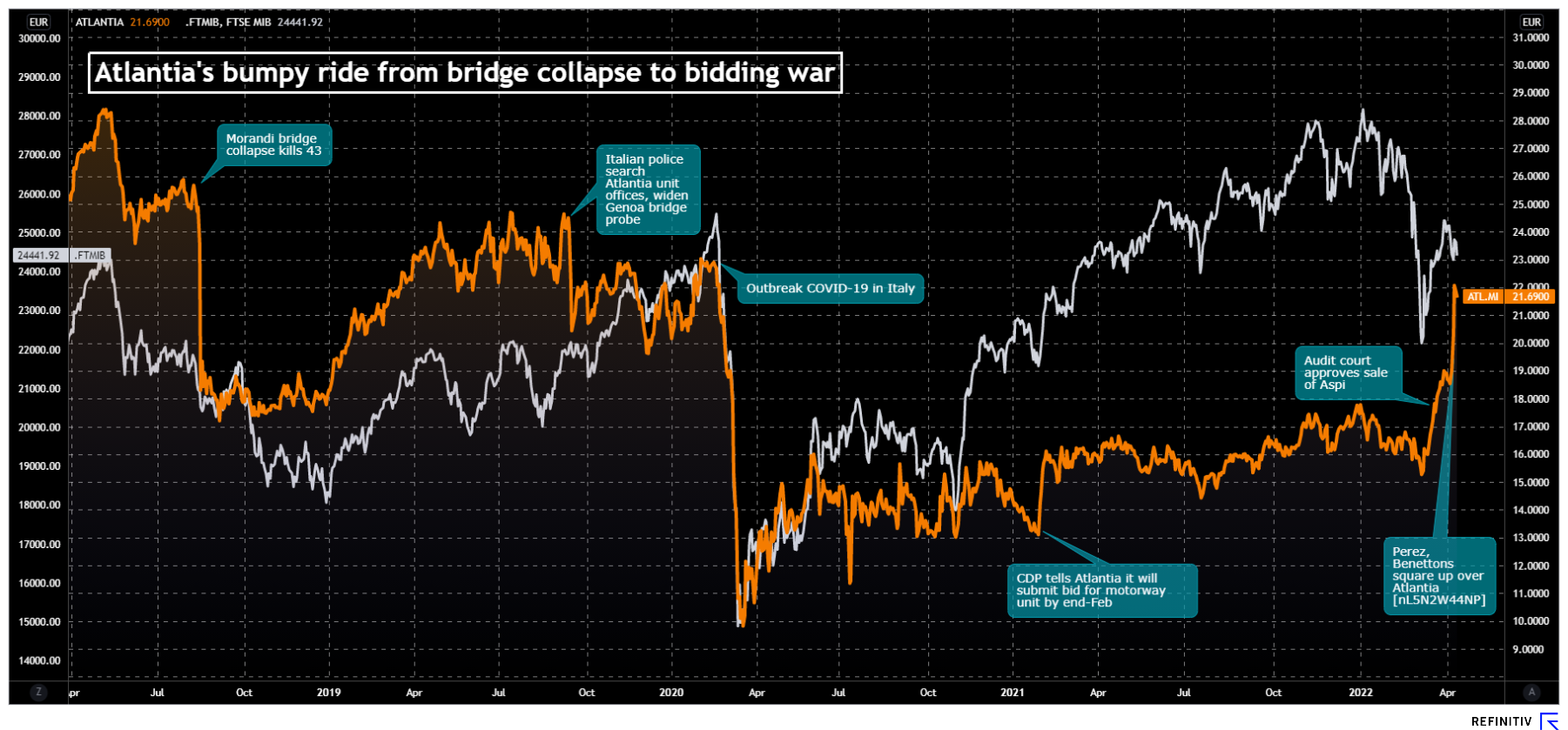

Benetton team working on premium of around 30% to buy out Atlantia – sources

The logo of infrastructure group Atlantia in Rome, Italy October 5, 2020. REUTERS/Guglielmo MangiapaneRegister now for FREE unlimited access to Reuters.comMILAN, April 12 (Reuters) – The Benetton family and U.S. investment fund Blackstone are working on a premium of around 30% over Atlantia’s (ATL.MI) average stock price in the last six months, as they ready a bid that could land as early as Wednesday, three sources said.The two partners are considering an offer between 22 and 23 euros per share, one of the sources said, but cautioned no final decision had been taken.While a significant premium on the six month average share price, that would be a more modest increase over the current price of about 21.7 euros, and would value the whole of Atlantia – in which the Benetton family already owns a 33% stake – at about 18.1-19.0 billion euros ($19.7-$20.7 billion).Register now for FREE unlimited access to Reuters.comShares in the Italian infrastructure group have gained nearly 20% since April 6 when speculation first emerged about an approach involving Global Infrastructure Partners (GIP), Brookfield and Florentino Perez, head of Spain’s ACS (ACS.MC).The stock hit a two-year high of 22.5 euros on Monday as investors waited for a move that could take the group private.”The offer could land very soon, even early Wednesday morning,” one of the sources said.Blackstone and Benetton holding company Edizione declined to comment. Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Editing by Mark Potter and Chizu NomiyamaOur Standards: The Thomson Reuters Trust Principles. .