BRASILIA, July 22 (Reuters) – Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures. read more “The problem is the change in the spending cap,” said an Economy Ministry official, who requested anonymity to discuss the situation openly. “It weakens the reading that the fiscal situation will be under control in the coming years.”Register now for FREE unlimited access to Reuters.comEven with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil’s yield curve remains under pressure as investors brace for the worst. read more Both major presidential candidates on the ballot in October – leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro – have signaled they plan to extend this year’s boost in social spending into next year.”It’s a fiscal bomb,” said Sergio Goldenstein, chief strategist at Renascença DTVM. “Risk premiums look high, but there is little room for a relevant drop.”The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil’s five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.Concerns about Brazil’s credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.”All the credit spreads in the world are opening, our bonds are not immune to that,” said Ronaldo Patah, chief strategist at UBS Consenso.In fact, Brazil’s strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.Brazil’s central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.”I am struck by this process of (yield curve) flattening that we are seeing at a very high level”, said the chief economist at Ativa Investimentos Etore Sanchez.Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending.”The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected”, said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.Register now for FREE unlimited access to Reuters.comReporting by Marcela Ayres and Jose de Castro

Editing by Brad HaynesOur Standards: The Thomson Reuters Trust Principles. .

EXCLUSIVE French nationalisation of EDF set to cost more than 8 bln euros

PARIS, July 11 (Reuters) – The French government is poised to pay more than 8 billion euros ($8.05 billion) to bring power giant EDF (EDF.PA) back under full state control, two sources with knowledge of the matter said, adding the aim is to complete the deal in the fourth quarter.One of the sources said the cost of buying the 16% stake the state does not already own could be as high as almost 10 billion euros, when accounting for outstanding convertible bonds and a premium to current market prices. EDF and the economy ministry declined to comment.The French government, which already has 84% of EDF, announced last week it would nationalise the company, which would give it more control over a revamp of the debt-laden group while contending with a European energy crisis.Register now for FREE unlimited access to Reuters.comThe sources said the state would likely launch a public offer on the market at a premium to the stock price because the other option – a nationalisation law to be pushed through parliament – would take too long.When Prime Minister Elisabeth Borne announced the nationalisation plan on July 6, the stake held by minority shareholders was worth around 5 billion euros.In addition, the French government would also have to buy 2.4 billion euros of convertible bonds and offer a premium to current stock market prices to entice minority shareholders, with the cost of the transaction going well beyond 8 billion euros, the sources said.They did not give details of the size of the premium, with one of them saying no final decision had been taken.TIMELINEFrance wants the buyout to take place in October or November, and for that to happen it would have to move quickly, the sources said, asking not to be named because the matter is confidential.The next step will be for the government to announce the offer price and make an official filing, the sources said. Then EDF will need to give its opinion while an independent expert will be drafted in to review the offer price.All this will take some time, given the holiday season lull.France may have to announce the terms of the offer over the coming weeks, before the holiday period in August, to ensure it can have a deal in the fourth quarter, one of the sources said.French Economy Minister Bruno Le Maire said at the weekend: “It won’t be an operation that will be fulfilled in days and weeks, it will take months. I will provide all the necessary precisions in the coming weeks, but not now.”The government last week increased the amount of money available for financial operations related to its state shareholding portfolio by 12.7 billion euros in the second half of the year, with officials saying this would cover the EDF deal and other, unspecified transactions.Goldman Sachs (GS.N) and Societe Generale (SOGN.PA) are working with the government to secure a deal, sources had previously said, while EDF is being advised by Lazard (LAZ.N) and BNP Paribas (BNPP.PA). read more ($1 = 0.9921 euros)Register now for FREE unlimited access to Reuters.comReporting by Mathieu Rosemain and Pamela Barbaglia, additional reporting by Leigh Thomas and Michel Rose, writing by Silvia Aloisi, editing by Barbara LewisOur Standards: The Thomson Reuters Trust Principles. .

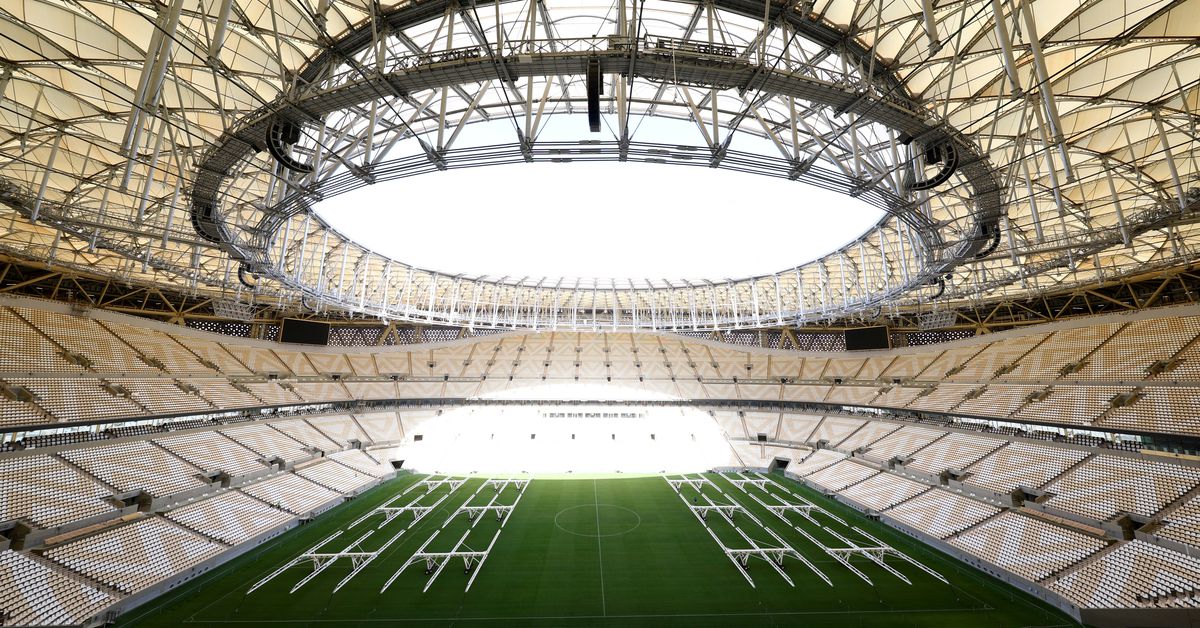

EXCLUSIVE World Cup stadium stands will be alcohol free under Qatari curbs – source

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Twitter set to accept Musk’s $43 billion offer

Elon Musk’s twitter account is seen through the Twitter logo in this illustration taken, April 25, 2022. REUTERS/Dado Ruvic/Illustration Register now for FREE unlimited access to Reuters.comNEW YORK, April 25 (Reuters) – Twitter Inc (TWTR.N) is poised to agree a sale to Elon Musk for around $43 billion in cash, the price the CEO of Tesla has called his “best and final” offer for the social media company, people familiar with the matter said.Twitter may announce the $54.20-per-share deal later on Monday once its board has met to recommend the transaction to Twitter shareholders, the sources said, adding it was still possible the deal could collapse at the last minute.Musk, the world’s richest person according to Forbes, is negotiating to buy Twitter in a personal capacity and Tesla (TSLA.O) is not involved in the deal.Register now for FREE unlimited access to Reuters.comTwitter has not been able to secure so far a ‘go-shop’ provision under its agreement with Musk that would allow it to solicit other bids once the deal is signed, the sources said. Still, Twitter would be allowed to accept an offer from another party by paying Musk a break-up fee, the sources added.The sources requested anonymity because the matter is confidential. Twitter and Musk did not immediately respond to requests for comment.Twitter shares were up 4.5% in pre-market trading in New York at $51.15.Musk, a prolific Twitter user, has said it needs to be taken private to grow and become a genuine platform for free speech.The 50-year-old entrepreneur, who is also CEO of rocket developer SpaceX, has said he wants to combat trolls on Twitter and proposed changes to the Twitter Blue premium subscription service, including slashing its price and banning advertising.The billionaire, a vocal advocate of cryptocurrencies, has also suggested adding dogecoin as a payment option on Twitter.He has said Twitter’s current leadership team is incapable of getting the company’s stock to his offer price on its own, but stopped short of saying it needs to be replaced.”The company will neither thrive nor serve this societal imperative in its current form,” Musk said in his offer letter last week.Up to the point Musk disclosed a stake in Twitter in April, the company’s shares had fallen about 10% since Parag Agrawal took over as CEO from founder Jack Dorsey in late November.The deal, if it happens, would come just four days after Musk unveiled a financing package to back the acquisition.This led Twitter’s board to take his offer more seriously and many shareholders to ask the company not to let the opportunity for a deal slip away, Reuters reported on Sunday. Before Musk revealed the financing package, Twitter’s board was expected to reject the bid, sources had said. read more The sale would represent an admission by Twitter that Agrawal is not making enough traction in making the company more profitable, despite being on track to meet ambitious financial goals the company set for 2023. Twitter’s shares were trading higher than Musk’s offer price as recently as November.Musk unveiled his intention to buy Twitter on April 14 and take it private via a financing package comprised of equity and debt. Wall Street’s biggest lenders, except those advising Twitter, have all committed to provide debt financing.Musk’s negotiating tactics – making one offer and sticking with it – resembles how another billionaire, Warren Buffett, negotiates acquisitions. Musk did not provide any financing details when he first disclosed his offer for Twitter, making the market skeptical about its prospects.Register now for FREE unlimited access to Reuters.comReporting by Greg Roumeliotis in New York, additional reporting by Krystal Hu;

Editing by Mark PotterOur Standards: The Thomson Reuters Trust Principles. .