MUMBAI, Sept 30 (Reuters) – The Indian rupee is expected to open higher against the U.S. dollar on Friday, after the country reported a lower-than-expected current account deficit for the June quarter.The dollar index pulling back further from multi-year highs will likely be an additional boost for the rupee, traders said.The rupee is likely to open around 81.65-81.70 per dollar, up from 81.86 in the previous session.Register now for FREE unlimited access to Reuters.comIndia posted a CAD of $23.9 billion in the April-June period, wider than $13.4 billion in the preceding quarter but lower than $30.5 billion that economists were expecting.In terms of percentage of the GDP, the CAD widened to 2.8%, the highest in four years. A Reuters poll of 18 economists were expecting CAD of 3.6% of the GDP.”A slightly larger services surplus, and remittances, ensured the deficit did not widen dramatically,” said Rahul Bajoria, chief India economist at Barclays Bank.Bajoria expects the CAD to remain elevated in the coming quarters, thanks to the revival in domestic demand and the ongoing impact of elevated commodity prices.Traders await the Reserve Bank of India’s policy decision at 1000 IST (0430 GMT). The surging Treasury yields and the resultant pressure on the rupee is likely to prompt the RBI reason to deliver a 50-basis-point rate hike. read more “In the context how quickly the rupee has fallen over the last few days, we think it is almost certain the RBI will deliver a 50 basis point hike and a hawkish commentary,” a trader at a Mumbai-based bank said.FTSE Russel said India will be retained on its watch list for a potential upgrade to Market Accessibility Level ‘1’ and for consideration for inclusion in the FTSE Emerging Markets Government Bond Index (EMGBI).”FTSE Russell outcome reduces the likelihood that India would be added to GBI-EM, as it suggests that there have not been sufficient progress on overcoming operational hurdles,” DBS said in a note.The dollar index dropped about 1% on Thursday to near 112, pulling back away from the two-decade high of 114.78. A rally in the British pound to above 1.10 to the dollar pulled down the gauge.KEY INDICATORS: ** One-month non-deliverable rupee forward at 81.82; onshore one-month forward premium at 26 paise** USD/INR NSE October futures closed at 82.0175 on Thursday** USD/INR forward premium for end October is 24 paise** Dollar index at 112.12** Brent crude futures down 0.3% at $88.2 per barrel** Ten-year U.S. note yield at 3.79%** SGX Nifty nearest-month futures down 0.6% at 16,715** As per NSDL data, foreign investors sold a net $255.9 million worth of Indian shares on Sept. 28** NSDL data shows foreign investors sold a net $45.8 million worth of Indian bonds on Sept. 28Register now for FREE unlimited access to Reuters.comReporting by Nimesh Vora; Editing by Rashmi AichOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Brazil risk premium soars after Congress breaks spending cap

BRASILIA, July 22 (Reuters) – Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures. read more “The problem is the change in the spending cap,” said an Economy Ministry official, who requested anonymity to discuss the situation openly. “It weakens the reading that the fiscal situation will be under control in the coming years.”Register now for FREE unlimited access to Reuters.comEven with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil’s yield curve remains under pressure as investors brace for the worst. read more Both major presidential candidates on the ballot in October – leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro – have signaled they plan to extend this year’s boost in social spending into next year.”It’s a fiscal bomb,” said Sergio Goldenstein, chief strategist at Renascença DTVM. “Risk premiums look high, but there is little room for a relevant drop.”The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil’s five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.Concerns about Brazil’s credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.”All the credit spreads in the world are opening, our bonds are not immune to that,” said Ronaldo Patah, chief strategist at UBS Consenso.In fact, Brazil’s strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.Brazil’s central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.”I am struck by this process of (yield curve) flattening that we are seeing at a very high level”, said the chief economist at Ativa Investimentos Etore Sanchez.Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending.”The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected”, said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.Register now for FREE unlimited access to Reuters.comReporting by Marcela Ayres and Jose de Castro

Editing by Brad HaynesOur Standards: The Thomson Reuters Trust Principles. .

‘Sell premium’ – Thailand discourages discounts, wants high value tourists

Tourists visit Maya bay after Thailand reopened its world-famous beach after closing it for more than three years to allow its ecosystem to recover from the impact of overtourism, at Krabi province, Thailand, January 3, 2022. Picture taken January 3, 2022. REUTERS/Athit Perawongmetha/File PhotoRegister now for FREE unlimited access to Reuters.comBANGKOK, July 4 (Reuters) – Thailand’s hotels, businesses and private hospitals should refrain from offering big discounts to lure tourists and focus instead on raising the country’s value as a premium travel destination, government ministers said on Monday.Thailand has received about 2 million foreign visitors in the first six months of this year, a steady revival after its tourism industry almost collapsed due to the pandemic and more than 18 months of complex and costly entry requirements.”We cannot let people come to Thailand and say because it’s cheap,” Deputy Prime Minister Anutin Charnvirakul said at an event at Bangkok’s main international airport to promote tourism.Register now for FREE unlimited access to Reuters.com“Instead they should say ‘because it works, it’s reasonable’, that’s where we can increase value,” he said, echoing remarks by the country’s tourism minister.Anutin likened the approach to that of luxury fashion brand Louis Vuitton.”Hold your ground. Sell premium. The more expensive, the more customers,” he said. “Otherwise Louis Vuitton wouldn’t have any sales.”One of Asia’s most popular travel destinations, Thailand welcomed a record of nearly 40 million visitors in pre-pandemic 2019, who spent 1.91 trillion baht ($53.53 billion), equivalent to 11% of gross domestic product.Arrivals slumped to 6.7 million the following year, and down to 428,000 in 2021, despite calibrated moves to end quarantine requirements.It is forecasting 10 million foreign arrivals in 2022.Earlier this year, Thailand launched a long-term visa programme for wealthy foreigners and skilled workers, sticking to its plan to lure high-spending visitors, despite major jobs and business losses in tourism during the pandemic.($1 = 35.6500 baht)Register now for FREE unlimited access to Reuters.comReporting by Chayut Setboonsarng and Panarat Thepgumpanat; Editing by Martin PettyOur Standards: The Thomson Reuters Trust Principles. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

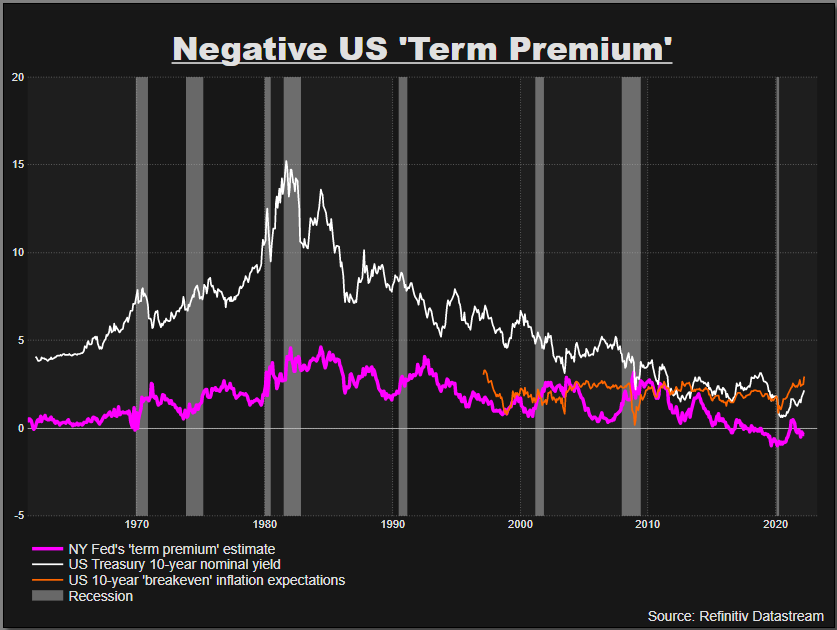

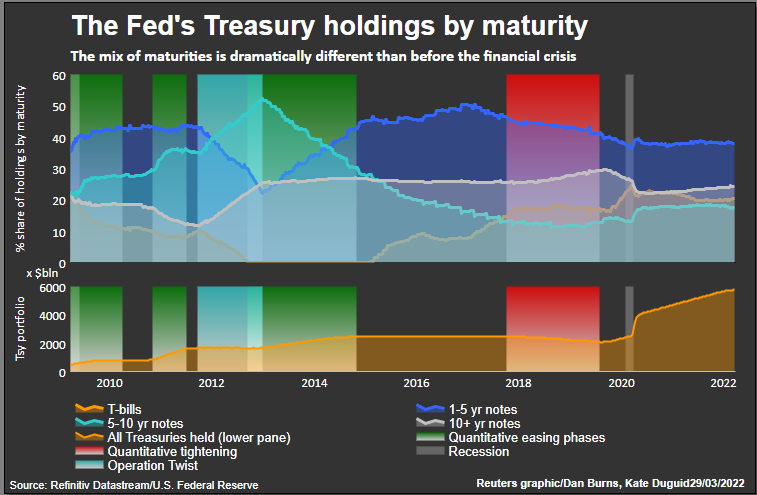

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

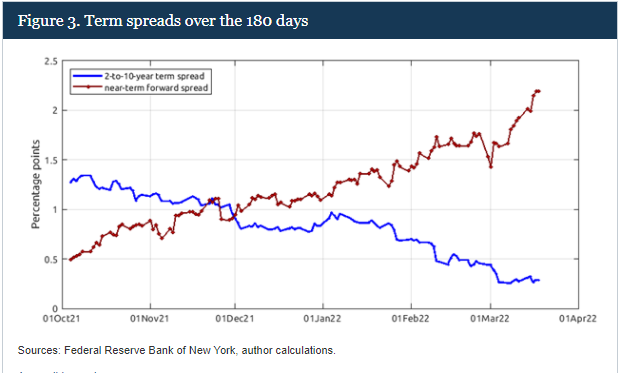

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Nigeria offers premium to raise $1.25 billion Eurobond

Nigerian Finance Minister Zainab Ahmed attends the IMF and World Bank’s 2019 Annual Spring Meetings, in Washington, File. REUTERS/James Lawler DugganRegister now for FREE unlimited access to Reuters.comLAGOS/ABUJA, March 17 (Reuters) – Nigeria has priced a $1.25 billion Eurobond issue at 8.375%, its debt office said on Thursday, a premium compared to existing tenors as the country sought to raise cash to fund a costly petrol subsidy scheme in the face of limited oil revenue.The latest debt issue marks Nigeria’s eight outing on the Eurobond market after it sold a $4 billion debt in September and had been considering more issues before fears around the Omicron coronavirus variant led it to shelve plans. read more “The choice to go ahead with the Eurobond issue in the current adverse market conditions is likely connected to continued force majeure reducing oil revenue, while retained fuel subsidies are spiralling in tandem with the higher oil price,” said Mark Bohlund, senior analyst at Redd Intelligence.Register now for FREE unlimited access to Reuters.comFinance Minister Zainab Ahmed told Reuters on Monday that Nigeria planned to tap 2 billion euros ($2.2 billion) this month or next of the money it raised in a eurobond sale last year and target more local borrowing in 2022 to help fund its costly petrol subsidies as oil prices rise. read more The government in January reversed a pledge to end its subsidies then, and instead extended them by 18 months amid heightened inflation to avert any protests in the run-up to presidential elections next year.At the same time, the price of oil has soared, so also has its cost as the country depends almost entirely on imports to meet its domestic gasoline needs. It also faces crude theft and vandalism in the Niger Delta, disrupting oil production.With Thursday’s bond sale, Nigeria offered more than existing eurobonds of 7.143%, creating extra debt service headache for the government struggling to boost growth with limited buffers.President Muhammadu Buhari has said the country’s deficit would rise by 1.01 trillion naira to 7.40 trillion or 4% of GDP as the government eyes new borrowing for fuel subsidy. The deficit was originally set at 3.42% of GDP.Analysts say deficit could rise above 10 trillion naira ($24 billion) in 2022 on higher fuel subsidy cost amid rising oil prices.($1 = 415.42 naira)Register now for FREE unlimited access to Reuters.comAdditional reporting by Rachel Savage in London;

Writing by Chijioke Ohuocha;

Editing by Chris Reese, Lisa Shumaker and Aurora EllisOur Standards: The Thomson Reuters Trust Principles. .