Register now for FREE unlimited access to Reuters.comBEIJING, Sept 13 (Reuters) – Zhou Changchang likes to spend his spare time cruising along the streets of China’s capital with his cycling club friends, on his Tiffany Blue bicycle made by the British company Brompton.The 42-year-old teacher is part of a growing army of cycling enthusiasts in China, who are splashing out on premium bicycles made by the likes of Brompton, Giant and Specialized, fuelling a market that consultancy Research & Markets estimates could be worth $16.5 billion by 2026.Social media and e-commerce platforms say there has been a surge of interest in cycling over the past year and sales of bicycles and gear are booming.Register now for FREE unlimited access to Reuters.comTypically, Chinese cyclists will pay more than 13,000 yuan ($1,870) for an inner-city, high-end foldable bike made by the likes of Brompton. High-performance road bikes, made for longer journeys, start at around 10,000 yuan ($1,450) and can go many times higher.Last month, media reported that a bicycle made by luxury brand Hermes sold for 165,000 yuan ($24,500).”The majority of riding hobbyists are willing to splurge,” e-commerce platform JD.com said last month.It said road bike sales on its platform had more than doubled from June to August compared with the same time last year, while riding apparel sales had jumped 160%.China has had a long love affair with bicycles and was once known as the “kingdom of bicycles”.For decades, bikes made by the likes of the Flying Pigeon company filled the streets.Cycling fell out of fashion when a growing middle class turned to cars but bike manufacturers saw a revival in 2014 as bike-sharing companies like Mobike and Ofo sprang up to flood cities with their fleets, offering rides as cheap as 1 yuan.Zhou, like many cyclists, said he got into biking to get fit. COVID-19 and its lockdowns also created a urge for the open road.”I really longed for the outdoors and fresh air,” said Shanghai office worker Lily Lu who went out and ordered a Brompton bike for 13,600 yuan ($1,965) the day after she was released from a three-month lockdown.As the craze gathers pace, manufacturers are struggling to meet demand. Lu said she had to wait two months to get her bicycle. Brompton did not respond to a request for comment.China’s Pardus, which makes racing bikes that can cost more than 30,000 yuan ($4,335), said sales doubled from last year and its factory was operating around the clock.”Everything is out of stock,” said Pardus branding director Li Weihai.

($1=6.96 yuan)Register now for FREE unlimited access to Reuters.comReporting by Sophie Yu, Brenda Goh; Editing by Robert BirselOur Standards: The Thomson Reuters Trust Principles. .

Juicy Couture owner scoops up UK’s Ted Baker for about $254 mln

The Ted Baker logo is seen at their store at the Woodbury Common Premium Outlets in Central Valley, New York, U.S., February 15, 2022. REUTERS/Andrew Kelly/File PhotoRegister now for FREE unlimited access to Reuters.com

- Offer price of 110 pence per Ted Baker share

- Offer backed by Ted Baker board

Aug 16 (Reuters) – Juicy Couture and Forever 21 owner Authentic Brands (ABG) (AUTH.N) has agreed to buy Ted Baker (TED.L) in a deal worth roughly 211 million pounds ($254 million), ending months of speculation over the fate of the British fashion group.Pandemic-related losses forced Ted Baker to put itself up for sale in April and the company picked a preferred suitor the following month. However, the bidder – reported to have been ABG – in June decided not to make an offer, forcing Ted Baker to consider other options. read more Ted Baker has now reached an agreement with U.S.-based ABG, whose brands also include Reebok, consisting of 110 pence cash for each Ted Baker share, and which represents a premium of about 18.2% to Monday’s closing price.Register now for FREE unlimited access to Reuters.comThe companies said the deal would not be revised unless a rival suitor emerges.”ABG believes there are significant growth opportunities for the Ted Baker brand in North America given (its) … strong consumer recognition in this market,” the New York-listed company said in a statement on Tuesday.Known for its suits, shirts and dresses with quirky details, Ted Baker is in the midst of a turnaround plan and is looking to benefit from a rebound in demand for office and leisure wear.In May it posted a smaller annual loss of 38.4 million pounds and said sales in the first quarter of the current year had risen 20% year-on-year. read more Ted Baker had also rejected several bids from private-equity group Sycamore before launching its sale process, and Tuesday’s move is the latest in a flurry of deals for British companies, made more affordable to overseas buyers by the weakness of the pound.Ted Baker’s shares were up about 17% at 108p in early trading, just shy of the offer price and still well short of their peak in 2015 when they were trading at 2,972p apiece.($1 = 0.8299 pounds)Register now for FREE unlimited access to Reuters.comReporting by Pushkala Aripaka in Bengaluru; Editing by Sherry Jacob-Phillips and David HolmesOur Standards: The Thomson Reuters Trust Principles. .

Snap reaches 1 mln premium subscribers in bid for new revenue

A woman stands in front of the logo of Snap Inc. on the floor of the New York Stock Exchange (NYSE) while waiting for Snap Inc. to post their IPO, in New York City, NY, U.S. March 2, 2017. REUTERS/Lucas Jackson/File PhotoRegister now for FREE unlimited access to Reuters.comAug 15 (Reuters) – Snap Inc (SNAP.N), parent company of social media app Snapchat, has reached 1 million subscribers for its Snapchat+ premium subscription, the company said on Monday, afterlaunching the service in June as a new source of revenue.Social media companies including Snap, Twitter Inc (TWTR.N) and Meta Platforms Inc (META.O), which all earn the majority of revenue from selling digital advertising, are facing a weakening ad market due to record-high inflation causing brands to reign in their marketing spending.Snap’s shares dropped 25% last month after disappointing second quarter earnings, as it suffered from weaker advertising demand than Wall Street had expected. Chief Executive Evan Spiegel said the company would work to speed up revenue growth, in part through new sources of revenue. read more Register now for FREE unlimited access to Reuters.comSnapchat+, which costs $3.99 per month in the United States, offers access to 11 exclusive features not yet available to general users. Four new features announced Monday include new Snapchat app icon designs and the ability for subscribers to have their messages be more visible to celebrities on Snapchat. Subscribers can also use Snapchat on desktops.The paid subscription feature is now expanding to more countries including Saudi Arabia, India and Egypt, for a total of 25 markets, Snap said.Twitter, which is in a legal battle with billionaire Elon Musk over his attempt to walk away from his $44-billion deal to buy the company, also previously launched a $4.99 per month subscription product called Twitter Blue. Facebook and Instagram do not offer paid subscriptions as of now.Register now for FREE unlimited access to Reuters.comReporting by Angelique Chen and Sheila Dang; Editing by Josie KaoOur Standards: The Thomson Reuters Trust Principles. .

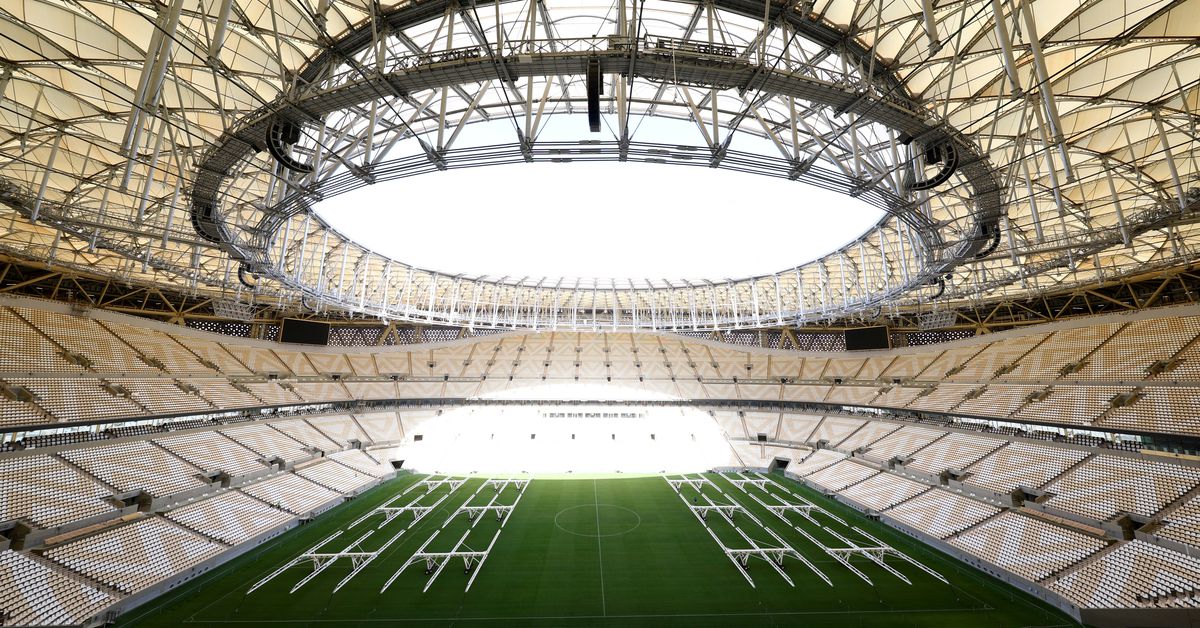

EXCLUSIVE World Cup stadium stands will be alcohol free under Qatari curbs – source

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Positive real yields may spell more trouble for U.S. stocks

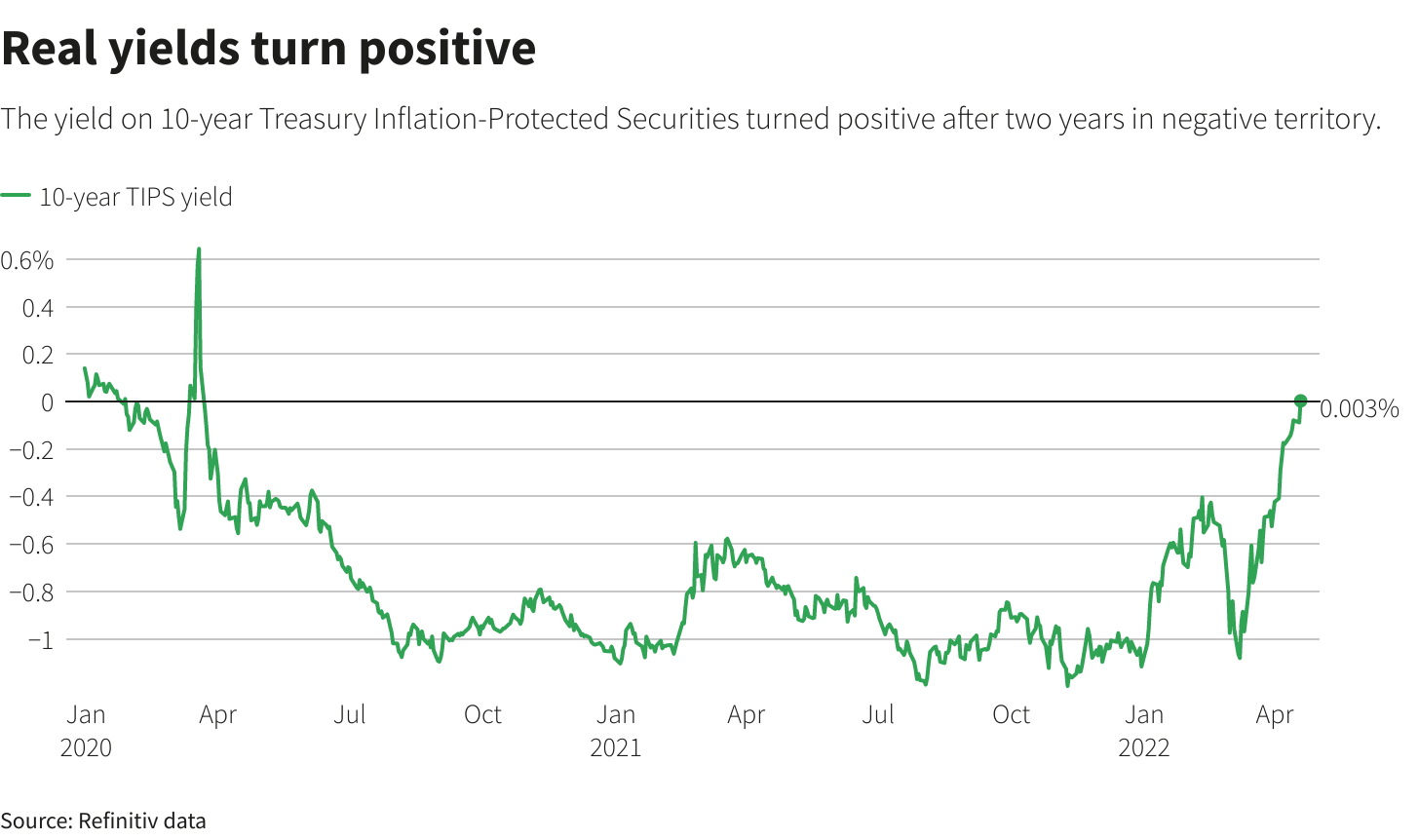

A street sign for Wall Street is seen in the financial district in New York, U.S., November 8, 2021. REUTERS/Brendan McDermid/File Photo/File PhotoRegister now for FREE unlimited access to Reuters.comNEW YORK, April 20 (Reuters) – A hawkish turn by the Federal Reserve is eroding a key support for U.S. stocks, as real yields climb into positive territory for the first time in two years.Yields on the 10-year Treasury Inflation-Protected Securities (TIPS) – also known as real yields because they subtract projected inflation from the nominal yield on Treasury securities – had been in negative territory since March 2020, when the Federal Reserve slashed interest rates to near zero. That changed on Tuesday, when real yields ticked above zero. Negative real yields have meant that an investor would have lost money on an annualized basis when buying a 10-year Treasury note, adjusted for inflation. That dynamic has helped divert money from U.S. government bonds and into a broad spectrum of comparatively riskier assets, including stocks, helping the S&P 500 (.SPX) more than double from its post-pandemic low.Register now for FREE unlimited access to Reuters.comAnticipation of tighter monetary policy, however, is pushing yields higher and may dent the luster of stocks in comparison to Treasuries, which are viewed as much less risky since they are backed by the U.S. government. Reuters GraphicsOn Tuesday, stocks shrugged off the rise in yields, with the S&P 500 ending up 1.6% on the day. Still, the S&P 500 is down 6.4% this year, while the yield on the 10-year TIPS has climbed more than 100 basis points.”Real 10-year yields are the risk-free alternative to owning stocks,” said Barry Bannister, chief equity strategist at Stifel. “As real yield rises, at the margin it makes stocks less attractive.”One key factor influenced by yields is the equity risk premium, which measures how much investors expect to be compensated for owning stocks over government bonds.Rising yields have helped result in the measure standing at its lowest level since 2010, Truist Advisory Services said in a note last week.

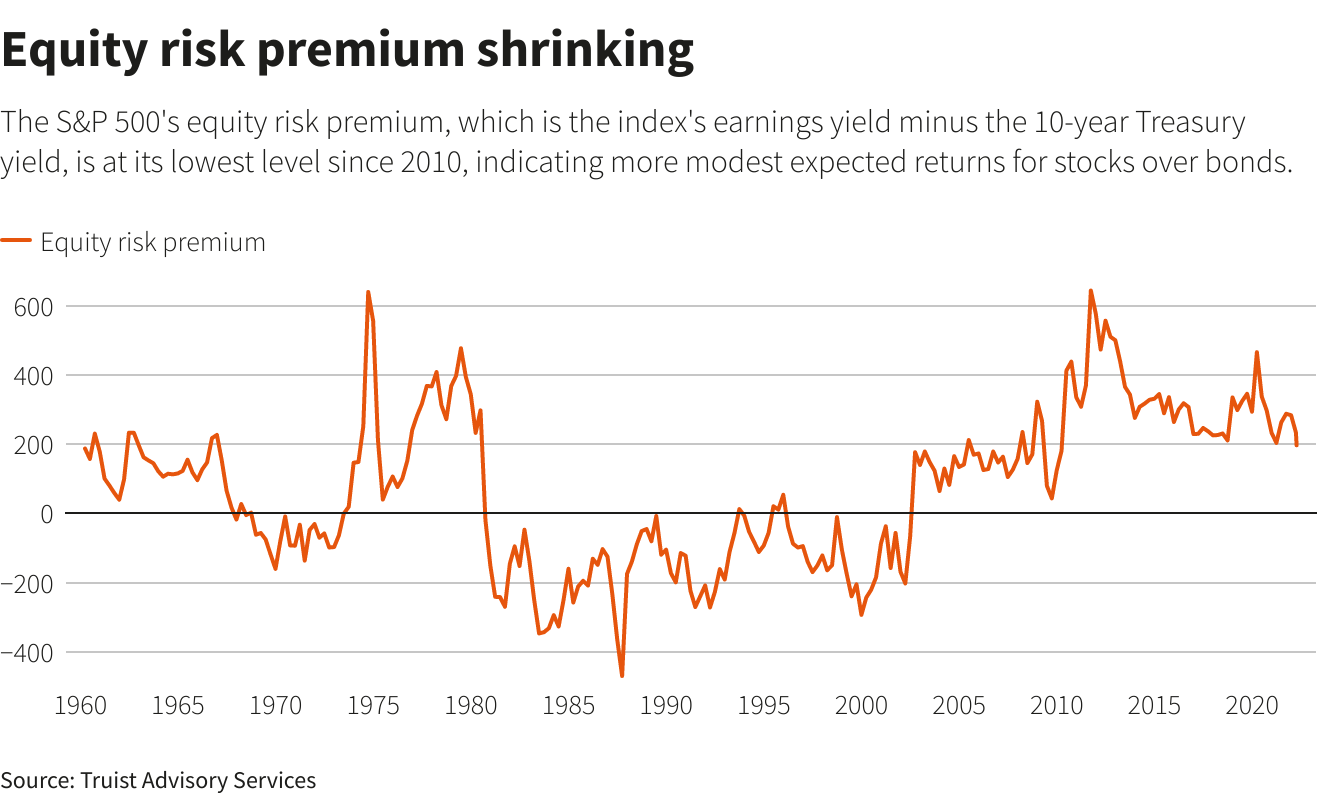

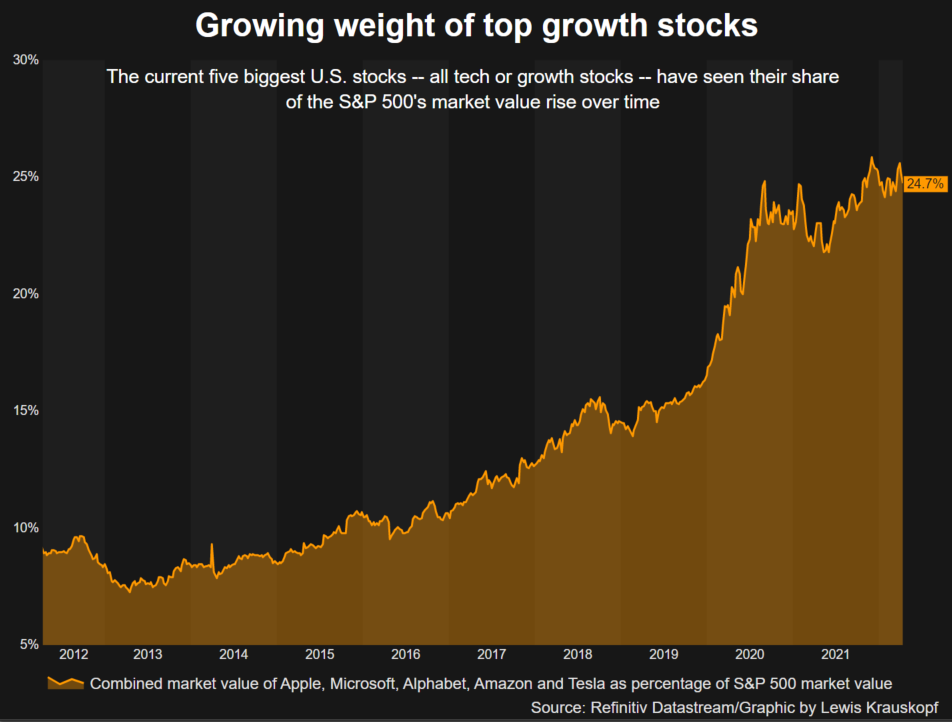

Reuters GraphicsOn Tuesday, stocks shrugged off the rise in yields, with the S&P 500 ending up 1.6% on the day. Still, the S&P 500 is down 6.4% this year, while the yield on the 10-year TIPS has climbed more than 100 basis points.”Real 10-year yields are the risk-free alternative to owning stocks,” said Barry Bannister, chief equity strategist at Stifel. “As real yield rises, at the margin it makes stocks less attractive.”One key factor influenced by yields is the equity risk premium, which measures how much investors expect to be compensated for owning stocks over government bonds.Rising yields have helped result in the measure standing at its lowest level since 2010, Truist Advisory Services said in a note last week. Reuters GraphicsHEADWIND TO GROWTH SHARESHigher yields in particular dull the allure of companies in technology and other high-growth sectors, with those companies’ cash flows often more weighted in the future and diminished when discounted at higher rates.That may be bad news for the broader market. The heavy presence of tech and other growth stocks in the S&P 500 means the index’s overall expected dividends are weighted in the future at close to their highest level ever, according to BofA Global Research. Five massive, high-growth stocks, for example, now make up 22% of the weight of the S&P 500.At the same time, growth shares in recent years have been highly linked to the movement of real yields.Since 2018, a ratio comparing the performance of the Russell 1000 growth index (.RLG) to its counterpart for value stocks (.RLV) – whose cash flows are more near-term – has had a negative 96% correlation with 10-year real rates, meaning they tend to move in opposite directions from growth stocks, according to Ohsung Kwon, a U.S. equity strategist at BofA Global Research.Rising yields are “a bigger headwind to equities than (they have) been in history,” he said.

Reuters GraphicsHEADWIND TO GROWTH SHARESHigher yields in particular dull the allure of companies in technology and other high-growth sectors, with those companies’ cash flows often more weighted in the future and diminished when discounted at higher rates.That may be bad news for the broader market. The heavy presence of tech and other growth stocks in the S&P 500 means the index’s overall expected dividends are weighted in the future at close to their highest level ever, according to BofA Global Research. Five massive, high-growth stocks, for example, now make up 22% of the weight of the S&P 500.At the same time, growth shares in recent years have been highly linked to the movement of real yields.Since 2018, a ratio comparing the performance of the Russell 1000 growth index (.RLG) to its counterpart for value stocks (.RLV) – whose cash flows are more near-term – has had a negative 96% correlation with 10-year real rates, meaning they tend to move in opposite directions from growth stocks, according to Ohsung Kwon, a U.S. equity strategist at BofA Global Research.Rising yields are “a bigger headwind to equities than (they have) been in history,” he said. Top five stocks market cap as percentage of S&P 500Bannister estimates the S&P 500 could retest its lows of the year, which included a drop in March of 13% from the index’s record high, should the yield on the 10-year TIPS rise to 0.75% and the earnings outlook – a key component of the risk premium – remain unchanged.Lofty valuations also make stocks vulnerable if yields continue rising. Though the tumble in stocks has moderated valuations this year, the S&P 500 still trades at about 19 times forward earnings estimates, compared with a long-term average of 15.5, according to Refinitiv Datastream.“Valuations aren’t great on stocks right now. That means that capital may look at other alternatives to stocks as they become more competitive,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.Still, some investors believe stocks can survive just fine with rising real yields, for now. Real yields were mostly in positive territory over the past decade and ranged as high as 1.17% while the S&P 500 has climbed over 200%.JPMorgan strategists earlier this month estimated that equities could cope with 200 basis points of real yield increases. They advised clients maintain a large equity versus bond overweight.”If bond yield rises continue, they could eventually become a problem for equities,” the bank’s strategists said. “But we believe current real bond yields at around zero are not high enough to materially challenge equities.”Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf in New York

Top five stocks market cap as percentage of S&P 500Bannister estimates the S&P 500 could retest its lows of the year, which included a drop in March of 13% from the index’s record high, should the yield on the 10-year TIPS rise to 0.75% and the earnings outlook – a key component of the risk premium – remain unchanged.Lofty valuations also make stocks vulnerable if yields continue rising. Though the tumble in stocks has moderated valuations this year, the S&P 500 still trades at about 19 times forward earnings estimates, compared with a long-term average of 15.5, according to Refinitiv Datastream.“Valuations aren’t great on stocks right now. That means that capital may look at other alternatives to stocks as they become more competitive,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.Still, some investors believe stocks can survive just fine with rising real yields, for now. Real yields were mostly in positive territory over the past decade and ranged as high as 1.17% while the S&P 500 has climbed over 200%.JPMorgan strategists earlier this month estimated that equities could cope with 200 basis points of real yield increases. They advised clients maintain a large equity versus bond overweight.”If bond yield rises continue, they could eventually become a problem for equities,” the bank’s strategists said. “But we believe current real bond yields at around zero are not high enough to materially challenge equities.”Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf in New York

Editing by Ira Iosebashvili and Matthew LewisOur Standards: The Thomson Reuters Trust Principles. .