BRASILIA, July 22 (Reuters) – Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures. read more “The problem is the change in the spending cap,” said an Economy Ministry official, who requested anonymity to discuss the situation openly. “It weakens the reading that the fiscal situation will be under control in the coming years.”Register now for FREE unlimited access to Reuters.comEven with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil’s yield curve remains under pressure as investors brace for the worst. read more Both major presidential candidates on the ballot in October – leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro – have signaled they plan to extend this year’s boost in social spending into next year.”It’s a fiscal bomb,” said Sergio Goldenstein, chief strategist at Renascença DTVM. “Risk premiums look high, but there is little room for a relevant drop.”The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil’s five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.Concerns about Brazil’s credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.”All the credit spreads in the world are opening, our bonds are not immune to that,” said Ronaldo Patah, chief strategist at UBS Consenso.In fact, Brazil’s strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.Brazil’s central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.”I am struck by this process of (yield curve) flattening that we are seeing at a very high level”, said the chief economist at Ativa Investimentos Etore Sanchez.Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending.”The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected”, said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.Register now for FREE unlimited access to Reuters.comReporting by Marcela Ayres and Jose de Castro

Editing by Brad HaynesOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

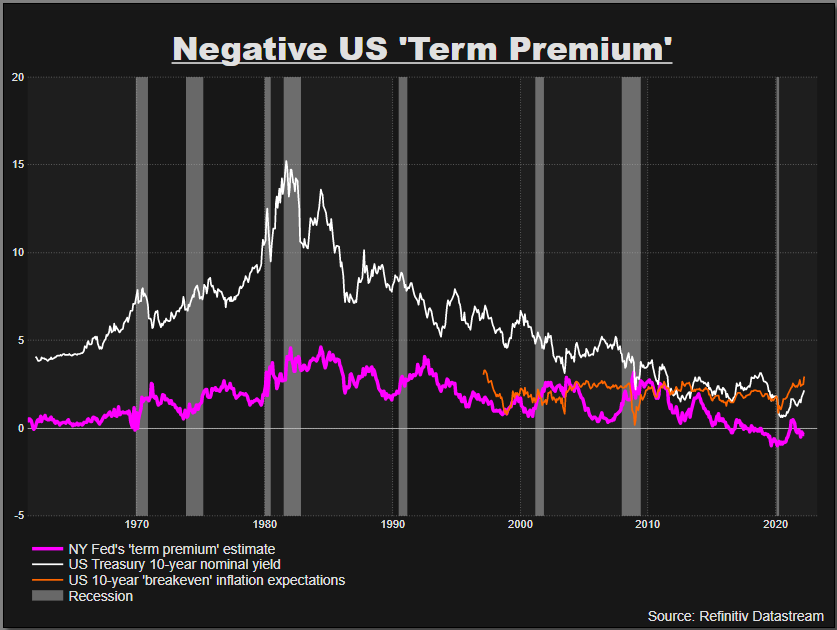

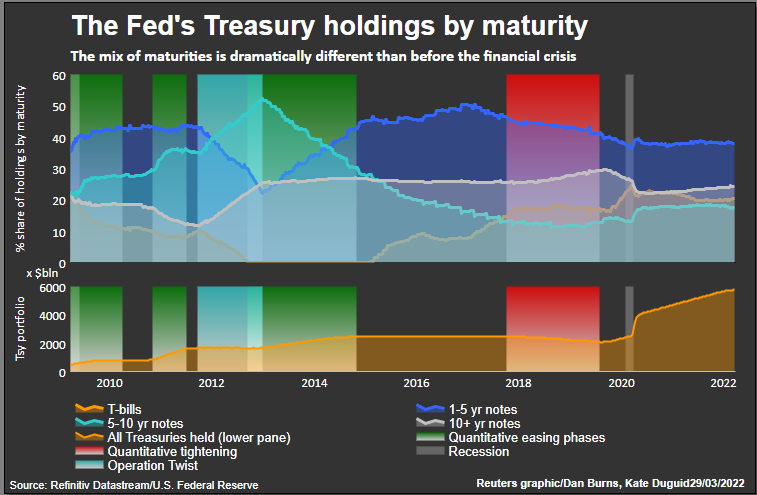

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

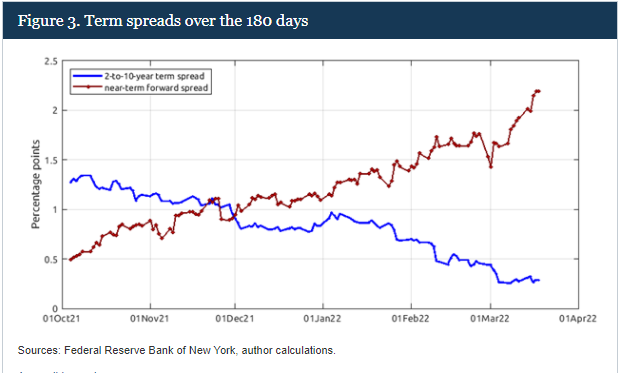

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Nigeria offers premium to raise $1.25 billion Eurobond

Nigerian Finance Minister Zainab Ahmed attends the IMF and World Bank’s 2019 Annual Spring Meetings, in Washington, File. REUTERS/James Lawler DugganRegister now for FREE unlimited access to Reuters.comLAGOS/ABUJA, March 17 (Reuters) – Nigeria has priced a $1.25 billion Eurobond issue at 8.375%, its debt office said on Thursday, a premium compared to existing tenors as the country sought to raise cash to fund a costly petrol subsidy scheme in the face of limited oil revenue.The latest debt issue marks Nigeria’s eight outing on the Eurobond market after it sold a $4 billion debt in September and had been considering more issues before fears around the Omicron coronavirus variant led it to shelve plans. read more “The choice to go ahead with the Eurobond issue in the current adverse market conditions is likely connected to continued force majeure reducing oil revenue, while retained fuel subsidies are spiralling in tandem with the higher oil price,” said Mark Bohlund, senior analyst at Redd Intelligence.Register now for FREE unlimited access to Reuters.comFinance Minister Zainab Ahmed told Reuters on Monday that Nigeria planned to tap 2 billion euros ($2.2 billion) this month or next of the money it raised in a eurobond sale last year and target more local borrowing in 2022 to help fund its costly petrol subsidies as oil prices rise. read more The government in January reversed a pledge to end its subsidies then, and instead extended them by 18 months amid heightened inflation to avert any protests in the run-up to presidential elections next year.At the same time, the price of oil has soared, so also has its cost as the country depends almost entirely on imports to meet its domestic gasoline needs. It also faces crude theft and vandalism in the Niger Delta, disrupting oil production.With Thursday’s bond sale, Nigeria offered more than existing eurobonds of 7.143%, creating extra debt service headache for the government struggling to boost growth with limited buffers.President Muhammadu Buhari has said the country’s deficit would rise by 1.01 trillion naira to 7.40 trillion or 4% of GDP as the government eyes new borrowing for fuel subsidy. The deficit was originally set at 3.42% of GDP.Analysts say deficit could rise above 10 trillion naira ($24 billion) in 2022 on higher fuel subsidy cost amid rising oil prices.($1 = 415.42 naira)Register now for FREE unlimited access to Reuters.comAdditional reporting by Rachel Savage in London;

Writing by Chijioke Ohuocha;

Editing by Chris Reese, Lisa Shumaker and Aurora EllisOur Standards: The Thomson Reuters Trust Principles. .

Ping An Insurance profit falls 29% amid premium income pressure

File Photo: A man walks past a branch of Ping An Bank, a subsidiary of Ping An Insurance, in Beijing, China. REUTERS/Thomas PeterRegister now for FREE unlimited access to Reuters.com

- Ping An annual net profit tanks 29% on year

- Life, property and casualty insurance premiums down

- Agent numbers slashed, bodes ill for future sales

SHANGHAI, March 17 (Reuters) – China’s Ping An (601318.SS), , the country’s largest insurer by market value, reported its biggest annual profit fall since 2008 on Thursday amid pressure on its premium income.Ping An posted a 29% fall in annual net profit to 101.6 billion yuan ($16 billion)in 2021 from 143.1 billion yuan, as premium income from life insurance fell 4.1% year-on-year to 490.3 billion yuan, while property and casualty insurance premium income fell 5.5% to 270 billion yuan.”Complex, severe economic situations across the world and resurgences of COVID-19 increased uncertainty in resident income expectations in 2021,” Ping An said in a filing, and this “tempered consumer spending on long-term protection products”.Register now for FREE unlimited access to Reuters.comAnother factor was a fall in the number of Ping An sales agents fell, which meant that its new business value of life and health insurance sank 23.6% to 37.9 billion yuan.Its army of insurance agents, once the jewel in Ping An’s crown, is set to shrink further, putting more pressure on sales.”In 2022, the number of agents may still fall quite a lot compared to the year before,” Huatai Securities said in a note published this month, adding that this “can only have an impact on the growth of new insurance policies”.PROPERTY EXPOSUREPing An has been shaken by growing concerns about its investments in a highly indebted property sector which faces a liquidity crunch amid a crackdown by Beijing on borrowing.While there are suggestions of an easing — from exempting M&A financing from the tighter restrictions to loosening mortgage lending — many developers are still feeling liquidity pressure, two people with knowledge said.Ping An said it had a total exposure of 54 billion yuan ($8.4 billion) to China Fortune Land Development Co last year as the developer faced mounting default pressure.Some analysts cautioned that the total property exposure of Ping An is much higher and still underestimated by the market, which will poses further credit risks.However, its Ping An Bank Co Ltd reported a 25.6% increase in annual profit for last year, compared to 2020, with the bank’s non-performing loan ratio down to 1.02% at end of December, from 1.05% three months ago.Ping An’s Shanghai-listed shares are down 9.72% in the year to date, compared with a 11.62% drop in the benchmark Shanghai Composite Index and a 8.11% fall in Hang Seng index.Register now for FREE unlimited access to Reuters.comReporting by Engen Tham, Zhang Yan; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .