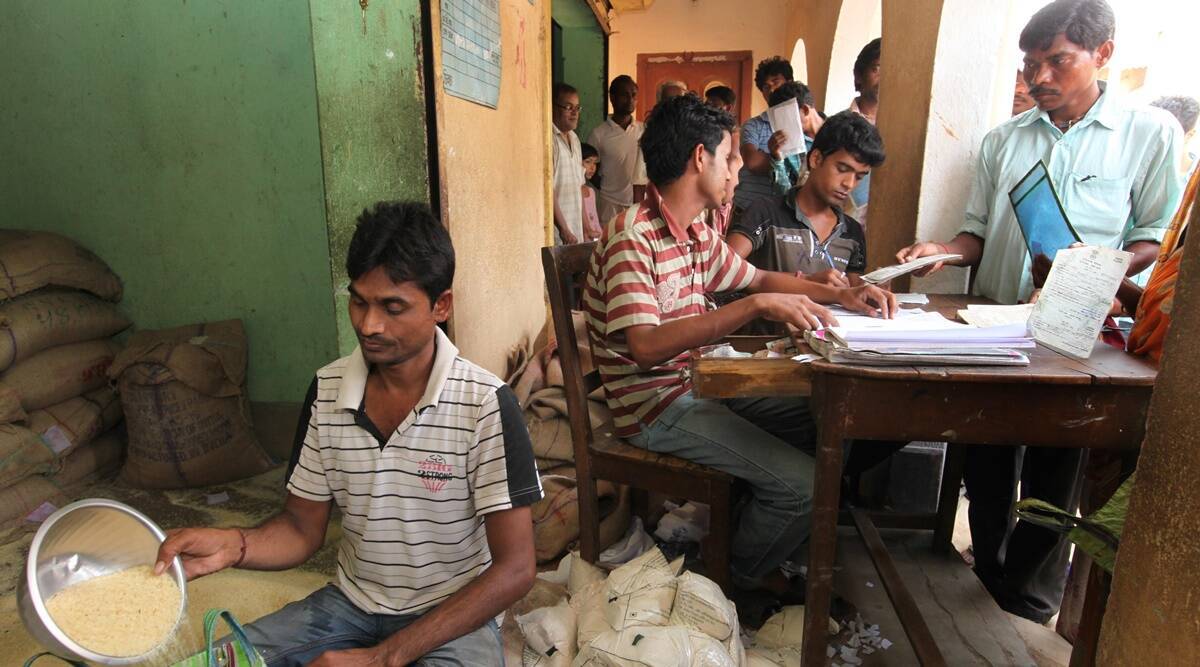

The Centre has extended the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) for another six months till September 2022, Union Ministry of Consumer Affairs, Food and Public Distribution said on Saturday.

In a statement, the Ministry said that the Union Cabinet, chaired by Prime Minister Narendra Modi, has decided to extend PMGKAY till September 2022 in “keeping with the concern and sensitivity towards the poor and vulnerable sections of society”.

🗞️ Subscribe Now: Get Express Premium to access the best Election reporting and analysis 🗞️

This will be the sixth phase of PMGKAY. The Phase-V of the scheme was to end in March 2022. The Centre had launched the scheme in April 2020 during the first wave of Covid-19.

Describing PMGKAY as the world’s “largest food security program”, the Ministry said, “The Government has spent approximately Rs 2.60 lakh crore so far and another Rs 80,000 crore will be spent over the next six months till September 2022, taking the total expenditure under PMGKAY to nearly Rs 3.40 lakh crore.”

“This will cover nearly 80 crore beneficiaries across India and like before, would be fully funded by the Government of India,” it added.

Giving reasons for extending the scheme, the Ministry said, “Even though the Covid-19 pandemic has significantly abated and economic activities are gathering momentum, this PMGKAY extension would ensure that no poor household goes to bed without food during this time of recovery.”

“Under the extended PMGKAY, each beneficiary will get additional 5 kg free ration per person per month in addition to his normal quota of foodgrains under the NFSA. This means that every poor household would get nearly double the normal quantity of ration,” the Ministry said.

According to the Ministry, the government had allocated about 759 LMT of free foodgrains under PMGKAY till Phase V. “With another 244 LMT of free foodgrains under this extension, the aggregate allocation of free foodgrains under the scheme now stands at 1,003 LMT,” it said.

“The benefit of free ration can be availed through portability by any migrant labour or beneficiary under One Nation One Ration Card (ONORC) plan from nearly 5 lakh ration shops across the country. So far, over 61 crore portability transactions have benefitted the beneficiaries away from their homes,” it said.

“This has been made possible due to the highest ever procurement despite the century’s worst pandemic with highest ever payment to farmers by the government. For this record, production in agricultural fields by the farmers deserves to be complimented,” it added.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘444470064056909’);

fbq(‘track’, ‘PageView’);

.

Dear Reader,

Dear Reader,