Retail health, which led to the uptick in health insurance premia over the past two years during the pandemic, witnessed subdued growth in the April-June quarter (Q1) of FY23. Despite that, health insurance premia registered 22 per cent growth in Q1FY23 to over Rs 21,000 crore, primarily driven by group health insurance premia.

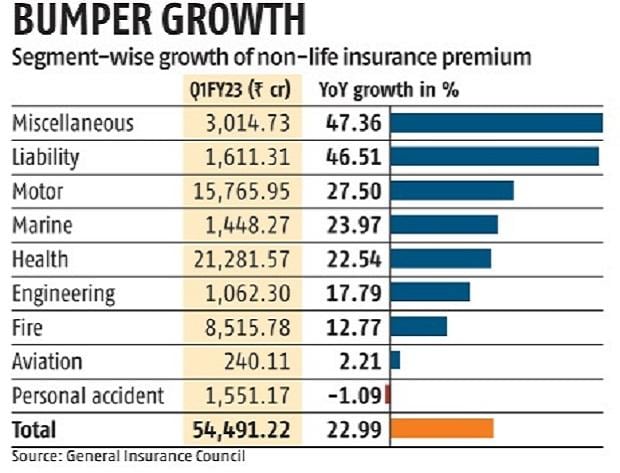

Motor insurance premia rose 27.5 per cent year-on-year (YoY) to Rs 15,765.95 crore, albeit on a low base, indicating a revival of growth in the segment buoyed by a pick-up in vehicle sales.

According to the data released by the general insurance council, retail health premia witnessed 11 per cent YoY growth in Q1FY23, while group health premia grew by 27 per cent. General insurers, which deal in multiple lines of business, witnessed only 2 per cent YoY growth in retail health insurance premia but managed to post 21 per cent YoY growth in overall health premia in Q1, owing to group health premia, which grew 25 per cent YoY.

Standalone health insurance companies reported 21 per cent rise in retail health premia and over 46 per cent growth in group health premia. Their overall health premia were up 28 per cent YoY.

The group health insurance segment has witnessed an increase in premium rates due to medical inflation and adverse claims ratio in the earlier periods.

“The health insurance segment is growing on a large base, hence growth is now normalising. In the June quarter, group health drove the growth in health insurance but the dampener was retail health insurance. Even standalone health insurers are growing group business despite their forte being retail health. The pandemic-induced growth that we were seeing is now normalising. Going forward, growth in the health segment will be driven by innovation, awareness, and further build-up in distribution channels,” said the CEO of a private sector general insurer.

The first quarter has typically been group health-heavy because in Q1, most corporates renew their group health insurance policies. “Also, group health insurance has been witnessing growth and this is reflected in premium growth. On the retail side, there has been some normalisation. It is too early to say but my sense is growth in the retail health segment will come back in the subsequent quarters,” said a senior executive at a private insurer.

Non-life insurers netted health premia to the tune of Rs 73,582.13 crore in FY22, compared to Rs 58,684.22 crore in FY21, an uptick of 25.39 per cent.

Experts view growth in the motor insurance segment as an encouraging sign for the industry, especially after muted growth in this segment following the Covid-19 pandemic.

“Growth in motor insurance was because of the low base of last year. The next two quarters are crucial for the motor segment. Overall, the motor industry is now bouncing back, so growth in motor insurance has to be seen from that perspective, too. Motor sales, except two-wheelers, have come to pre-Covid levels. So, motor insurance growth is in tandem with the pick-up in vehicle sales,” said the person quoted above. Motor insurance premia grew only 4 per cent YoY to Rs 70,432.59 crore in FY22.

The third-party premium hike has kicked in and vehicle sales have gone up, resulting in motor insurance premia witnessing growth, said the second person quoted above.

In Q1FY23, the non-life industry netted premia to the tune of Rs 54,492 crore, up 23 per cent YoY. While general insurers posted 22.73 per cent growth in their premia over the same period last year, the standalone health insurers reported 28.63 per cent growth.

.

Dear Reader,

Dear Reader,