MELBOURNE, March 7 (Reuters Breakingviews) – The Canadian fund manager and its tech billionaire partner are abandoning a green takeover plan after their sweetened $6 bln bid was rejected. It leaves the Aussie power producer grappling with a weak demerger proposal and a pushy investor. Boss Graeme Hunt will feel the heat.Full view will be published shortly.Follow @AntonyMCurrie on TwitterRegister now for FREE unlimited access to Reuters.comCONTEXT NEWS- Brookfield Asset Management and Atlassian co-Chief Executive Mike Cannon-Brookes are walking away from an A$8.3 billion ($6.1 billion) takeover proposal for Australian power company AGL Energy, according to a March 6 tweet by Cannon-Brookes.- The consortium “looking to take private & transform AGL is putting our pens down – with great sadness,” he tweeted.- The decision follows AGL’s board rejection of a sweetened offer at A$8.25 a share, a 10% increase from the original offer.- The revised entreaty valued AGL’s equity at just under A$5.5 billion, a 15% premium to the price on Feb. 18, the day before the Brookfield group made its first offer, and a 31% premium to the three-month volume-weighted average price. Including debt, the offer valued the AGL enterprise at nearly A$8.3 billion.Register now for FREE unlimited access to Reuters.comEditing by Jeffrey Goldfarb and Thomas ShumOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

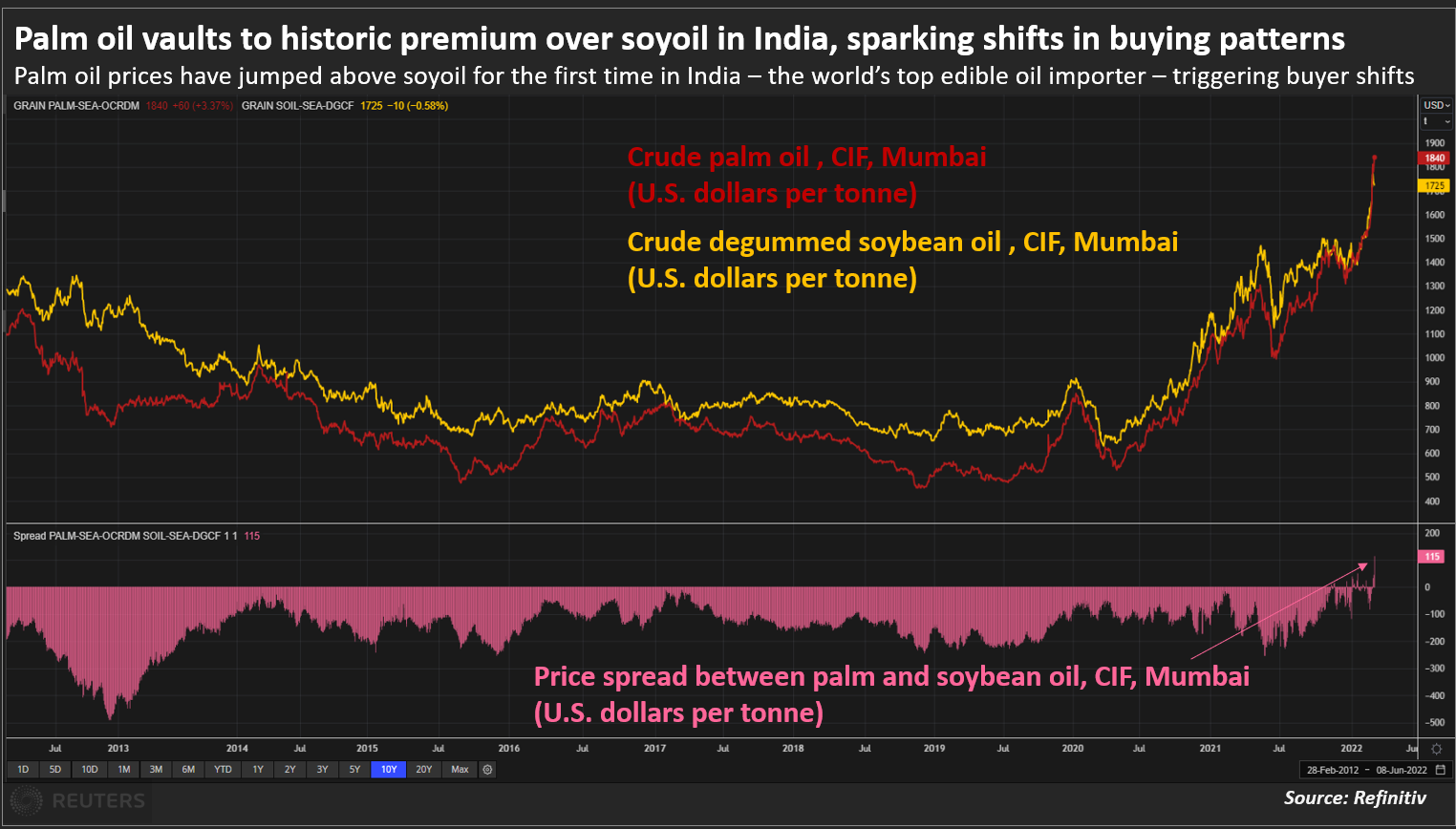

Palm oil becomes costliest vegoil as Ukraine war halts sunoil supply

- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .

Insurance costs of shipping through Black Sea soar

The Arkas Line’s Conti Basel container ship is docked in the Black sea port of Odessa, Ukraine, November 4, 2016. REUTERS/Valentyn OgirenkoRegister now for FREE unlimited access to Reuters.comRegisterLONDON, Feb 25 (Reuters) – Insurers have raised the cost of providing cover for merchant ships through the Black Sea, adding to soaring rates to transport goods through the region for vessels still willing to sail after Russia’s invasion of Ukraine.Ship owners pay annual war-risk insurance cover as well as an additional “breach” premium when entering high-risk areas. These separate premiums are calculated according to the value of the ship, or hull, for a seven-day period.Ship insurers have quoted the additional premium rate for seven days at anywhere between 1% to 2% and up to 5% of insurance costs, from an estimated 0.025% on Monday before Russia’s invasion began, according to indicative rates from marine insurance sources.Register now for FREE unlimited access to Reuters.comRegisterThis would mean additional costs of hundreds of thousands of dollars for a ship voyage depending on the destination.”Given the Russian offensive from land, sea and air, it would not be surprising if some insurers will be reluctant (to provide cover),” one insurance source said.A Moldovan-flagged chemical tanker was hit by a missile on Friday near Ukraine’s port of Odessa, seriously wounding two crew.On Thursday, a Turkish-owned ship was hit by a bomb off Odessa with no casualties and the ship sailed safely into Romanian waters.Ukraine has appealed to Turkey to block Russian warships from passing through the Dardanelles and Bosphorus straits which lead to the Black Sea, after Moscow on Thursday launched a full-blown assault on Ukraine. read more Russian forces landed at Ukraine’s Black and Azov Sea ports as part of the invasion.Ukraine’s military has suspended commercial shipping at its ports although some Russian Black Sea ports remain open, including Novorossiisk, traders said on Friday.”Due to the sea invasion potential and Crimea’s location in the Black Sea, freight destined for surrounding countries will likely see re-routings and longer transit to meet its final destination,” added Glenn Koepke with supply-chain tracking platform FourKites.Mark Nugent, with shipbroker Braemar ACM, citing satellite tracking data, said a number of dry bulk vessels in the Black Sea had reversed course and were sailing towards the Bosphorus to exit the region.Freight rates have jumped after shipping companies including the world’s top container lines MSC and Maersk and many oil tanker owners suspended sailings through the region.Average earnings for smaller aframax tankers trading in the Black Sea jumped to over $100,000 a day on Thursday from $8,000 a day on Monday, shipping sources said.Earlier this month, London’s marine insurance market added the Ukrainian and Russian waters around the Black Sea and Sea of Azov to its list of areas deemed high risk, which prompted some shipping companies to hold back on sending vessels into the area. read more Register now for FREE unlimited access to Reuters.comRegisterAdditional reporting by Michael Hogan in Hamburg and Carolyn Cohn in London; Editing by Nick MacfieOur Standards: The Thomson Reuters Trust Principles. .

Australia’s AGL Energy rejects $3.5 bln offer, backs decision to split

- Australia’s 2nd richest man, Canada’s Brookfield made joint bid

- Offer was at a 4.7% premium to AGL’s last close

- AGL says demerger plans on track

Feb 21 (Reuters) – Australian power producer AGL Energy Ltd on Monday rejected a $3.54 billion takeover offer from billionaire Mike Cannon-Brookes and Canada’s Brookfield Asset Management (BAMa.TO) in favour of its plan of splitting in two this year.AGL said the A$7.50 apiece proposal from Cannon-Brookes, Australia’s second-richest man and co-founder of software firm Atlassian, and the Canadian buyout group was a 4.7% premium to the stock’s Friday close and undervalued it.”The proposal does not offer an adequate premium for a change of control and is not in the best interests of AGL Energy shareholders,” AGL Chairman Peter Botten said.Register now for FREE unlimited access to Reuters.comRegisterThe unsolicited cash proposal with an option for AGL shareholders to elect a scrip alternative also provided limited other information about how the deal would be structured, Botten said.Cannon-Brookes’ investment vehicle, Grok Ventures, and Brookfield did not immediately respond to a request for comment.The profits and value of AGL, Australia’s biggest polluter, have shrunk on government pressure to cut retail rates, waning investor appetite for coal-fired power and an influx of solar and wind energy into the grid.The Australian Financial Review had reported on Sunday that the parties made a joint bid for AGL which included plans to halt its proposed split into a bulk power generator and a carbon-neutral energy retailer. AGL plans to re-brand as Accel Energy and hold the company’s coal-fired power plants and wind farm contracts. It would spin off AGL Australia Ltd, the country’s biggest retailer of electricity and gas, into a separately listed company. read more AGL said earlier this month it had made significant progress in its demerger plans and repeated on Monday that the split was on track to be completed by June. “The board is confident that the demerger will create a strong future for both parts of the business,” Botten said.($1 = 1.3961 Australian dollars)Register now for FREE unlimited access to Reuters.comRegisterReporting by Harish Sridharan and Shashwat Awasthi in Bengaluru; editing by Grant McCoolOur Standards: The Thomson Reuters Trust Principles. .

Tight supplies lift Mideast, Russian crude grades to multi-year highs

- Cash Dubai’s premium breaches $4/bbl for first time – Platts

- ESPO premiums jump to $7/bbl, highest since Dec 2019

- Sokol premiums rise to highest since Dec 2019

SINGAPORE, Feb 16 (Reuters) – Middle East benchmark Dubai crude soared to a record this week while spot premiums for April-loading Russian oil jumped to their highest in more than two years in Asia, trade sources said on Wednesday as prices returned to pre-pandemic levels.The global supply-demand balance has tightened as the Organization of the Petroleum Exporting Countries and its allies are lagging behind commitments to increase output by 400,000 barrels per day each month. read more Demand, meantime, is robust as refiners globally are cranking up operations to reap higher margins on gasoline and diesel.Register now for FREE unlimited access to Reuters.comRegisterThe Russia-Ukraine crisis has also boosted Brent prices, pushing the benchmark’s premium to Dubai to its highest since 2013 this week.There was no immediate sign of the price spread weakening after Russia pulled back some of its forces from the border on Tuesday.The wide spread between the benchmarks is boosting Asia’s demand for Middle East and Russian grades priced off Dubai, leading spot premiums to hit multi-year highs this month.Cash Dubai hit a record high at Tuesday’s market close, breaching $4 a barrel premium over futures for the first time, oil pricing agency S&P Global Platts reported.The April cash Dubai versus same-month Dubai futures was assessed at a premium of $4.08 a barrel, Platts data showed.For Russian grades, spot premiums for ESPO Blend crude exported from the Far East port of Kozmino soared to their highest in more than two years after producer Surgutneftegaz sold three cargoes via a tender, trade sources said.The cargoes for late March to early April loading were sold at premiums of $7-$7.10 a barrel above Dubai quotes, they said, about $2 higher than last month.ESPO crude premiums were last seen at these levels in December 2019, Refinitiv data showed.Trading houses Mitsui and Petraco bought the cargoes, the sources said.Similarly, spot premiums for Russian Sokol crude loading in April jumped to their highest since January 2020 after India’s ONGC Videsh sold a cargo via a tender, they added.The cargo for April 19-25 loading was sold to Glencore at a premium of $7.80-$7.90 a barrel to Dubai quotes, the sources said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Florence Tan in Singapore and Olga Yagova in Moscow; Editing by Tom Hogue, Shailesh Kuber & Simon Cameron-MooreOur Standards: The Thomson Reuters Trust Principles. .