Trading information for KKR & Co is displayed on a screen on the floor of the New York Stock Exchange (NYSE) in New York, U.S., August 23, 2018. REUTERS/Brendan McDermidRegister now for FREE unlimited access to Reuters.com

- Ramsay receives A$88 cash per share proposal

- Proposal at a 37% premium to Ramsay’s last close

- Ramsay stock up 29.8% in early trade

April 20 (Reuters) – Ramsay Health Care Ltd (RHC.AX), Australia’s largest private hospital operator, said on Wednesday it received a A$20.05 billion ($14.80 billion) indicative takeover offer from a consortium led by private equity giant KKR & Co (KKR.N).The non-binding proposal of A$88 cash per share represents a premium of nearly 37% to Ramsay’s Tuesday closing price of A$64.39. The offer sent the hospital operator’s shares up as much as 29.8% to A$83.55 in early trade, their biggest-ever intraday jump.Ramsay said in a statement it would provide the KKR-led consortium with due diligence on a non-exclusive basis and talks were at a preliminary stage.Register now for FREE unlimited access to Reuters.comThe hospital operator said it had reviewed the proposal with its advisers and asked for further information from the consortium in relation to its funding and structure of the deal.KKR did not immediately respond to a Reuters request for comment.If successful, the takeover would be the biggest in Australia this year and nearly double deal activity, which at a total value of $17.4 billion, suffered a 41.2% decline in the first quarter compared with a year earlier, according to Refinitiv data.The proposal comes as record-low interest rates prompt private equity firms, superannuation and pension funds with ample liquidity to invest in healthcare and infrastructure assets.The deal would also rank as the second biggest private-equity backed in deal in Australia, following a consortium’s A$31.6 billion ($23.35 billion) enterprise value deal for Sydney airport last year. read more The pandemic hit healthcare operators including Ramsay, with the shutdown of non-urgent surgeries, staffing shortages due to isolation regulations, and upward wage pressure weighing on earnings and hurting stocks, making the sector relatively affordable for a buyout, compared to a few years ago.Last year, Australian biopharmaceutical giant CSL Ltd (CSL.AX) said it would buy Swiss drugmaker Vifor Pharma AG (VIFN.S) for $11.7 billion. read more Ramsay operates hospitals and clinics across 10 countries in three continents, with a network of more than 530 locations, according to its website.It has 72 private hospitals and day surgery units in Australia, while it operates clinics and primary care units in about 350 locations across six countries in Europe.KKR currently owns French healthcare group Elsan.Earlier this year, Ramsay and Malaysia’s Sime Darby Holdings received a $1.35 billion buyout offer from IHH Healthcare Bhd (IHHH.KL) for their Asia joint venture. Ramsay said it was still pursuing this transaction. The hospital operator has hired UBS AG’s Australia Branch and Herbert Smith Freehills as financial and legal advisers, respectively, for the KKR-led consortium’s proposal.($1 = 1.3535 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Harish Sridharan in Bengaluru; additional reporting by Byron Kaye in Sydney; Editing by Sriraj Kalluvila, Aditya Soni and Krishna Chandra Eluri and Rashmi AichOur Standards: The Thomson Reuters Trust Principles. .

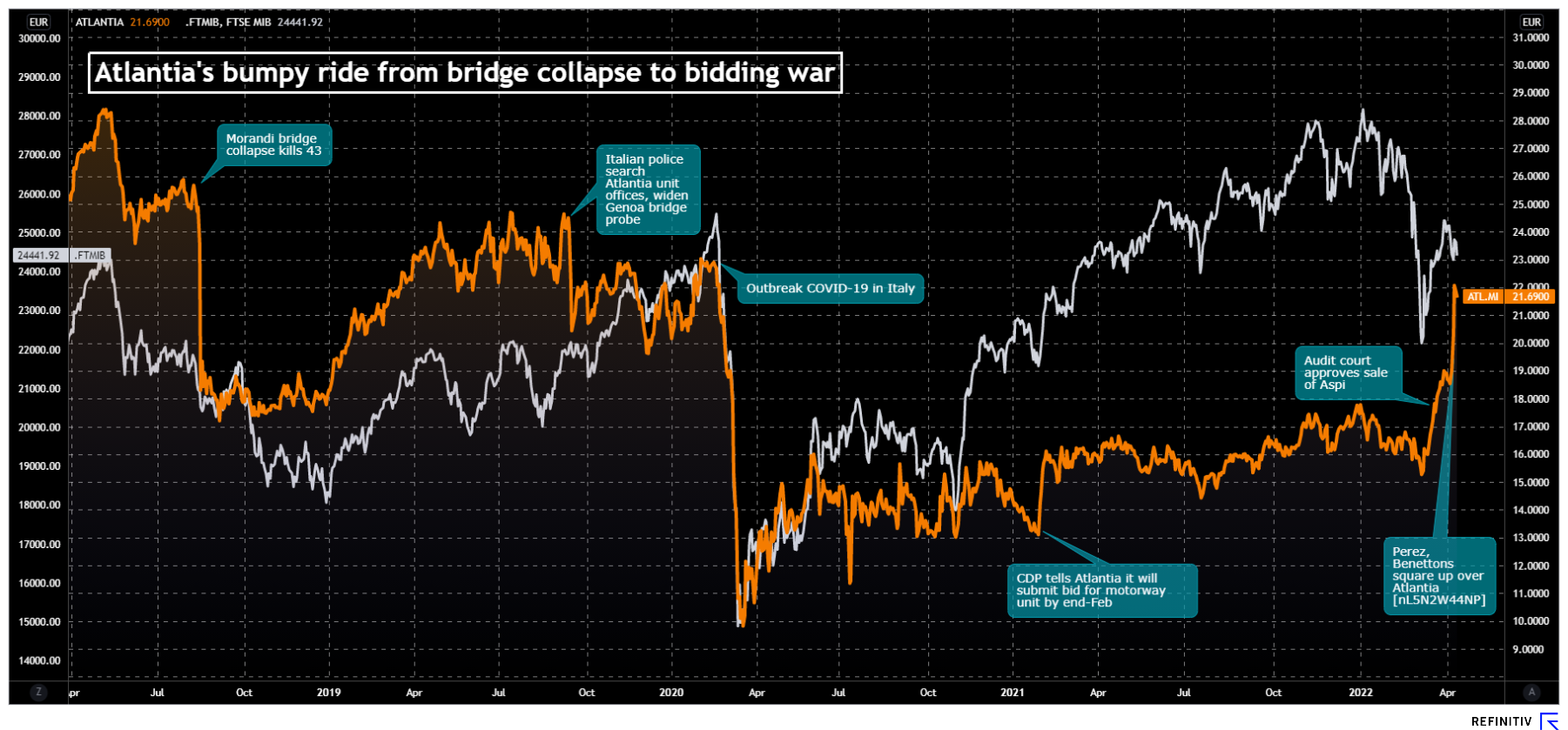

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.com

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.com