SINGAPORE, March 8 (Reuters) – Asia’s cash premiums for 0.5% very low-sulphur fuel oil (VLSFO) rose for a second consecutive session on Tuesday, while the prompt-month spread for the marine fuel grade remained in steep backwardation.Cash differentials for Asia’s 0.5% VLSFO , which have surged about 44% in the last month, were at a premium of $19.80 a tonne to Singapore quotes, compared with $19.67 per tonne a day earlier.The March/April VLSFO time spread traded at $32 a tonne on Tuesday, compared with $33.75 a tonne on Monday.Register now for FREE unlimited access to Reuters.comThe front-month VLSFO crack rose to $29.83 per barrel against Dubai crude during Asian trading hours, up from $29.61 per barrel in the previous session.Meanwhile, the 380-cst HSFO barge crack for April traded at a discount of $16.79 barrel to Brent on Tuesday, while cash premiums for 380-cst high sulphur fuel oil (HSFO) rose to a more than four-month high of $5.55 per tonne to Singapore quotes.Backed by firmer deals in the physical market, the cash differentials for 180-cst HSFO surged to a premium of $8.59 a tonne to Singapore quotes, a level not seen since October last year. They were at a premium of $6.39 per tonne a day earlier.ASIA REFINERS TO CRANK UP RUNS- Some Asian refineries plan to increase output in May to cash in on high prices for gasoil exports to Europe, even as the steepest crude prices in 14 years threaten profit margins, numerous trade sources said. read more – European diesel supplies have shrunk following the disruption of western sanctions imposed on Russia in response to its invasion of Ukraine, which it describes as a “special operation”.- Strong European demand has boosted Asian refiners’ profits for producing gasoil for exports to the West. However, the refiners are also paying record premiums for Middle East crude supplies after the disruption of sanctions left buyers with limited options.WINDOW TRADES- One 380-cst high-sulphur fuel oil (HSFO) deal, two 180-cst HSFO trades- One VLSFO trade was reportedOTHER NEWS- The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia’s invasion of Ukraine. read more – Oil prices rose on Tuesday, with Brent surging past $126 a barrel, as fears of formal sanctions against Russian oil and fuel exports spurred concerns about supply availability.ASSESSMENTSRegister now for FREE unlimited access to Reuters.comReporting by Koustav Samanta; Editing by Shinjini GanguliOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Where now after 2% yield? Bond investors take stock

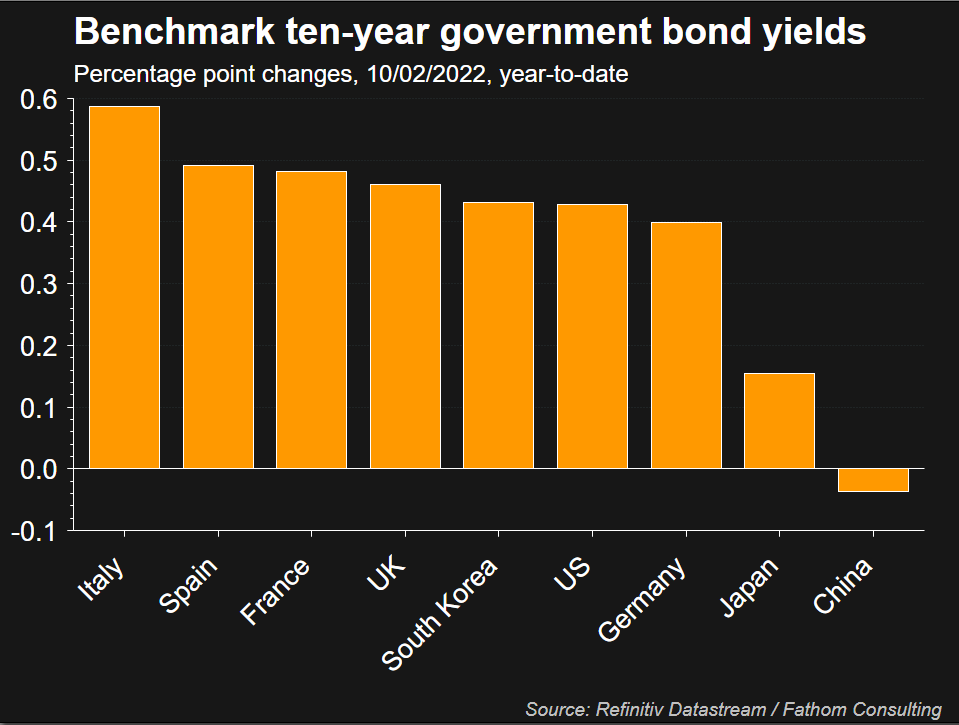

The Federal Reserve building is seen in Washington, U.S., January 26, 2022. REUTERS/Joshua Roberts/File PhotoRegister now for FREE unlimited access to Reuters.comRegisterNEW YORK, Feb 10 (Reuters) – U.S. Treasury yields have shot higher this year, rising faster than many forecast. Investors are now assessing if anticipation of a more hawkish Fed will continue to push levels up, with the potential to upset riskier assets.Expectations that the U.S. Federal Reserve may increase rates more aggressively than anticipated to counter rising inflation have pushed up yields while flattening the U.S. Treasury yield curve. That matters as bond yields impact global asset prices as well as consumer loans and mortgages. The shape of the U.S. Treasury yield curve can also help predict how the economy will fare.On Thursday, yields on 10-year notes hit 2% after higher-than-anticipated inflation data. Federal funds rate futures showed an increased chance of a half percentage-point tightening at next month’s meeting after the data, while strategists said the data increased the chances of swifter moves to reduce the Fed’s balance sheet. The central bank’s nearly $9 trillion portfolio doubled in size during the pandemic. read more Register now for FREE unlimited access to Reuters.comRegister“The market is starting to price in a much more aggressive path of rate hikes … clearly there is a sense of urgency again”, said Subadra Rajappa, head of U.S. rates strategy at Societe Generale.Yields, which move inversely to prices, are up from 1.79% at the beginning of February. The last time they breached 2% was August 2019.”I would say the chances of yields continuing to go higher are pretty high,” said Gargi Chaudhuri, Head of iShares Investment Strategy, Americas, at BlackRock, speaking ahead of the data.FOREIGN COMPETITIONCompetition in other markets for yield may be sapping demand for Treasuries and helping push yields higher, Chaudhuri said.A second rate hike by the Bank of England last week, and expectations of faster policy tightening by the European Central Bank (ECB), added to U.S. bonds’ weakness, with borrowing costs in Europe – as well as Japanese government bond yields – having jumped to multi-year highs in recent days. read more “Investors have these other markets to gravitate towards that they didn’t in the past, and that will require investors that are focusing on U.S. markets to seek a higher term premium and therefore will impact yields higher,” Chaudhuri said.Japan’s benchmark 10-year government bond yield is around its highest level since January 2016 at 0.220% while Germany’s 10-year government bond yield , at 0.255%, is at its highest since January 2019. read more  FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

FEDFor Kelsey Berro, fixed income portfolio manager at J.P. Morgan Asset Management, the level of yields in overseas markets such as Japan or Germany have made U.S. rates comparably more attractive, preventing a sustainable sell off, but that is expected to change.”Already you should start to see that some of these foreign investors take a second look at their home countries rather than reaching for yields in the U.S.,” she said.Still, there was strong demand seen for a recent 10-year Treasury auction, although it was unclear how much overseas bidders participated. SPEEDY ASCENTThe rise in US yields has come faster than many anticipated: In December, a Reuters poll forecast that 10-year note yields would rise to around 2% towards the end of 2022 – a level it has reached in the first couple of months. read more Some banks have been updating that view. Goldman Sachs analysts on Wednesday raised their forecast for the U.S. 10-year Treasury yield to 2.25% by end-2022, from a previous year-end target of 2%.The pace of gains has caused volatility in other assets. U.S. equities have been rocky this year, with shares of tech companies particularly volatile, as expectations of higher yields threaten to erode the value of their future earnings.Gene Podkaminer, Head of Research for Franklin Templeton Investment Solutions, called 2% on the benchmark 10-year a “psychological” level that could make U.S. government bonds more attractive versus other assets, such as volatile stocks.”When you start getting close to 2% … all of a sudden Treasuries are looking more appealing,” Podkaminer said earlier this week.One commonly cited metric still favors stocks, however.The equity risk premium – or the extra return investors receive for holding stocks over risk-free government bonds – favors equities over the next year, Keith Lerner, co-chief investment officer at Truist Advisory Services, said on Wednesday.The S&P 500 has historically beaten the one-year return for the 10-year Treasury note by an average of 11.8% when the premium stood at Wednesday’s level of 260 points, Lerner said.“I don’t think the U.S. 10-year yield hitting 2% would have a big impact on the stock markets per se,” said Manish Kabra, head of U.S. equity strategy at Societe Generale, citing the equity risk premium.However, “we could see some pressure if yields go to 2.5%,” she said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Davide Barbuscia; additional reporting by Saikat Chatterjee in London and Lewis Krauskopf in New York; editing by Ira Iosebashvili and Megan DaviesOur Standards: The Thomson Reuters Trust Principles. .

نفت خام خاورمیانه دبی در فعالیت تجاری محدود دچار افت شد

سنگاپور، 3 فوریه (رویترز) – شاخص نفت خام خاورمیانه دبی روز پنجشنبه در بحبوحه حجم معاملات محدود کاهش یافت زیرا شرکت کنندگان آسیایی برای تعطیلات سال نو قمری غایب بودند. قیمت نفت معیار جهانی در روز پنجشنبه به دنبال داده های ضعیف حقوق و دستمزد ایالات متحده و مقداری سود کاهش یافت. با توجه به اینکه تولیدکنندگان اوپک پلاس به افزایش تولید متوسط برنامهریزیشده پایبند بودند، تحت حمایت عرضه محدود باقی ماندند. WINDOW اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید ثبت نام کنید حق بیمه دبی برای مبادلات نقدی به بیش از دو سنت افزایش یافت و به بیش از 55 سنت رسید. بالاترین قیمت 3 دلار در هر بشکه. قیمت ها ($/BBL) QUALITY PREMIUM امتیاز کیفیت برای نفت خام موربان بارگیری در آوریل 0.8277 دلار در هر بشکه است و برای تجارت در محموله های بارگیری آوریل در طول فرآیند ارزیابی نزدیک بازار Platts تا فوریه، S&P موثر خواهد بود. پلاتس گفت که گلوبال پلاتس در یادداشتی به مشترکان در روز پنجشنبه اعلام کرد. پلاتس گفت، در ژانویه، قیمت برتر کیفیت برای نفت خام موربان بارگیری در ماه مارس 0.7470 دلار در هر بشکه بود. NEWSOPEC+ در روز چهارشنبه موافقت کرد که این نفت خام را حفظ کند. o افزایش متوسط در تولید نفت خود در حالی که این گروه از قبل برای دستیابی به اهداف موجود تلاش می کند و نگران پاسخ به درخواست ها برای کاهش ظرفیت خود برای نفت خام بیشتر از سوی مصرف کنندگان اصلی برای محدود کردن قیمت های افزایش یافته است. بیشتر بخوانید، اداره اطلاعات انرژی آمریکا روز چهارشنبه اعلام کرد، با افزایش تقاضای سوخت به بالاترین سطح خود از اوت 2019، ذخایر نفت خام و عرقیات آمریکا هفته گذشته کاهش یافت. بیشتر بخوانید برای قیمتهای نفت خام، ترکهای فرآوردههای نفتی و حاشیههای پالایشی، لطفاً روی RICهای زیر کلیک کنید. برای دسترسی نامحدود رایگان به رویترز.com هم اکنون ثبت نام کنید ثبت نام گزارش روسلان خساونه. ویرایش توسط Vinay Dwivedi استانداردهای ما: اصول اعتماد تامسون رویترز. .