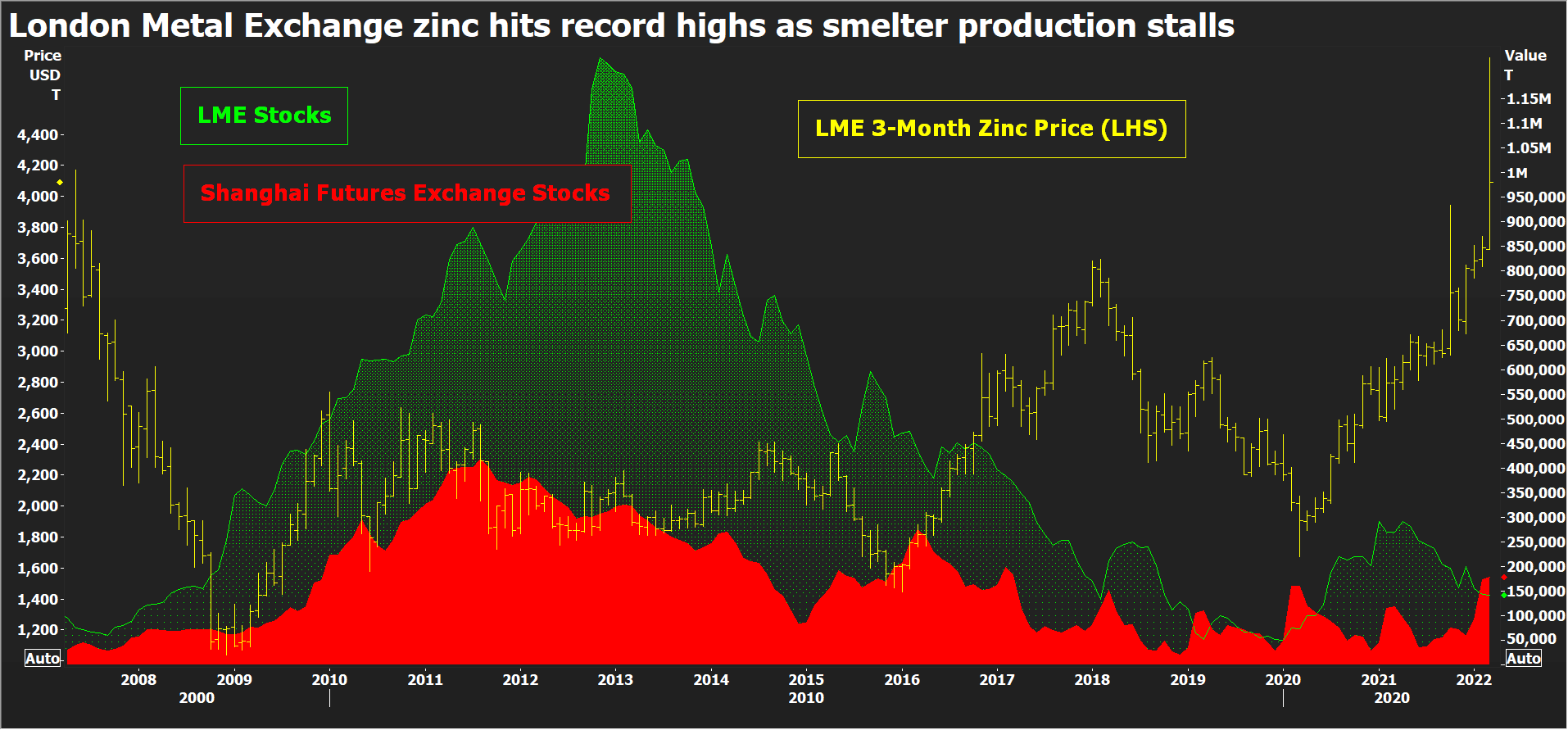

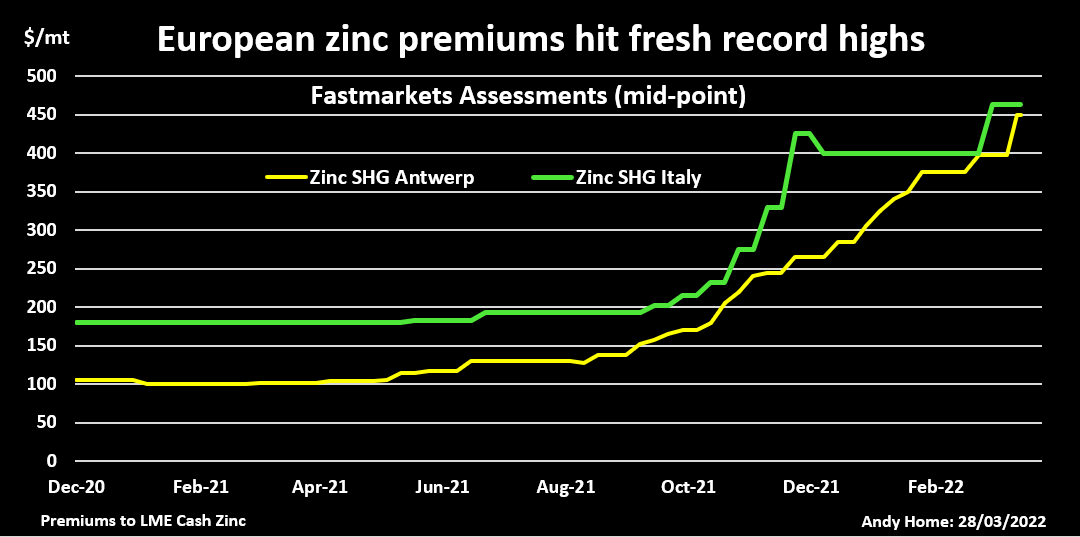

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

BMW triples pre-tax earnings with high prices, top-end vehicle sales

The headquarters of German luxury carmaker BMW is seen in Munich, Germany, August 5, 2020. REUTERS/Michael DalderRegister now for FREE unlimited access to Reuters.comBERLIN, March 10 (Reuters) – BMW more than tripled its pre-tax earnings to 16 billion euros ($17.67 billion) in 2021, the company said on Thursday, as higher pricing and strong sales of top-end vehicles boosted revenues even as supply chain troubles limited production.Group revenues climbed 12.4% from last year to 111 billion euros, the company said, with net profit reaching a record high of 12.46 billion.The premium carmaker will propose a dividend of 5.8 euros per share, up from last year’s 1.9 euros, it said.Register now for FREE unlimited access to Reuters.comBMW, Mini and Rolls-Royce deliveries fell in the fourth quarter by 14.2% due to semiconductor bottlenecks, with rising raw material prices also weighing on earnings.Quarterly net profit for the group came in at 2.25 billion euros, a third higher than last year but slightly below third quarter’s profits of 2.58 billion.BMW saw higher unit sales than any other premium carmaker in 2021, delivering 2.5 million cars even as semiconductor shortages restricted output, a victory which has been attributed to its strong relations with suppliers.”We are in a good position and optimistic about the future,” Chief Financial Executive Nicolas Peter said.($1 = 0.9053 euros)Register now for FREE unlimited access to Reuters.comReporting by Victoria Waldersee, Tristan Chabba

Editing by Madeline ChambersOur Standards: The Thomson Reuters Trust Principles. .

Palm oil becomes costliest vegoil as Ukraine war halts sunoil supply

- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

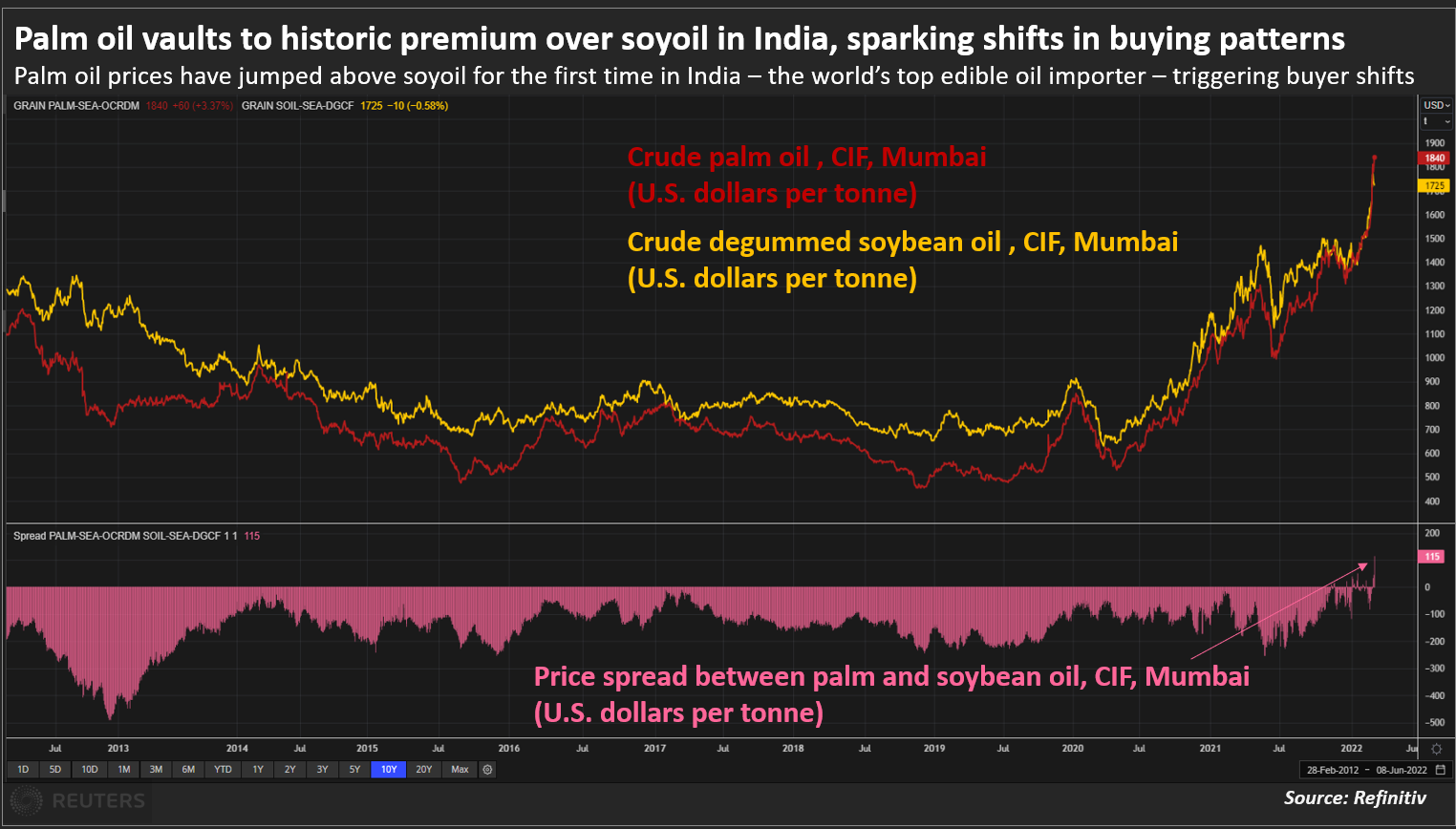

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .

Insurance costs of shipping through Black Sea soar

The Arkas Line’s Conti Basel container ship is docked in the Black sea port of Odessa, Ukraine, November 4, 2016. REUTERS/Valentyn OgirenkoRegister now for FREE unlimited access to Reuters.comRegisterLONDON, Feb 25 (Reuters) – Insurers have raised the cost of providing cover for merchant ships through the Black Sea, adding to soaring rates to transport goods through the region for vessels still willing to sail after Russia’s invasion of Ukraine.Ship owners pay annual war-risk insurance cover as well as an additional “breach” premium when entering high-risk areas. These separate premiums are calculated according to the value of the ship, or hull, for a seven-day period.Ship insurers have quoted the additional premium rate for seven days at anywhere between 1% to 2% and up to 5% of insurance costs, from an estimated 0.025% on Monday before Russia’s invasion began, according to indicative rates from marine insurance sources.Register now for FREE unlimited access to Reuters.comRegisterThis would mean additional costs of hundreds of thousands of dollars for a ship voyage depending on the destination.”Given the Russian offensive from land, sea and air, it would not be surprising if some insurers will be reluctant (to provide cover),” one insurance source said.A Moldovan-flagged chemical tanker was hit by a missile on Friday near Ukraine’s port of Odessa, seriously wounding two crew.On Thursday, a Turkish-owned ship was hit by a bomb off Odessa with no casualties and the ship sailed safely into Romanian waters.Ukraine has appealed to Turkey to block Russian warships from passing through the Dardanelles and Bosphorus straits which lead to the Black Sea, after Moscow on Thursday launched a full-blown assault on Ukraine. read more Russian forces landed at Ukraine’s Black and Azov Sea ports as part of the invasion.Ukraine’s military has suspended commercial shipping at its ports although some Russian Black Sea ports remain open, including Novorossiisk, traders said on Friday.”Due to the sea invasion potential and Crimea’s location in the Black Sea, freight destined for surrounding countries will likely see re-routings and longer transit to meet its final destination,” added Glenn Koepke with supply-chain tracking platform FourKites.Mark Nugent, with shipbroker Braemar ACM, citing satellite tracking data, said a number of dry bulk vessels in the Black Sea had reversed course and were sailing towards the Bosphorus to exit the region.Freight rates have jumped after shipping companies including the world’s top container lines MSC and Maersk and many oil tanker owners suspended sailings through the region.Average earnings for smaller aframax tankers trading in the Black Sea jumped to over $100,000 a day on Thursday from $8,000 a day on Monday, shipping sources said.Earlier this month, London’s marine insurance market added the Ukrainian and Russian waters around the Black Sea and Sea of Azov to its list of areas deemed high risk, which prompted some shipping companies to hold back on sending vessels into the area. read more Register now for FREE unlimited access to Reuters.comRegisterAdditional reporting by Michael Hogan in Hamburg and Carolyn Cohn in London; Editing by Nick MacfieOur Standards: The Thomson Reuters Trust Principles. .

Tight supplies lift Mideast, Russian crude grades to multi-year highs

- Cash Dubai’s premium breaches $4/bbl for first time – Platts

- ESPO premiums jump to $7/bbl, highest since Dec 2019

- Sokol premiums rise to highest since Dec 2019

SINGAPORE, Feb 16 (Reuters) – Middle East benchmark Dubai crude soared to a record this week while spot premiums for April-loading Russian oil jumped to their highest in more than two years in Asia, trade sources said on Wednesday as prices returned to pre-pandemic levels.The global supply-demand balance has tightened as the Organization of the Petroleum Exporting Countries and its allies are lagging behind commitments to increase output by 400,000 barrels per day each month. read more Demand, meantime, is robust as refiners globally are cranking up operations to reap higher margins on gasoline and diesel.Register now for FREE unlimited access to Reuters.comRegisterThe Russia-Ukraine crisis has also boosted Brent prices, pushing the benchmark’s premium to Dubai to its highest since 2013 this week.There was no immediate sign of the price spread weakening after Russia pulled back some of its forces from the border on Tuesday.The wide spread between the benchmarks is boosting Asia’s demand for Middle East and Russian grades priced off Dubai, leading spot premiums to hit multi-year highs this month.Cash Dubai hit a record high at Tuesday’s market close, breaching $4 a barrel premium over futures for the first time, oil pricing agency S&P Global Platts reported.The April cash Dubai versus same-month Dubai futures was assessed at a premium of $4.08 a barrel, Platts data showed.For Russian grades, spot premiums for ESPO Blend crude exported from the Far East port of Kozmino soared to their highest in more than two years after producer Surgutneftegaz sold three cargoes via a tender, trade sources said.The cargoes for late March to early April loading were sold at premiums of $7-$7.10 a barrel above Dubai quotes, they said, about $2 higher than last month.ESPO crude premiums were last seen at these levels in December 2019, Refinitiv data showed.Trading houses Mitsui and Petraco bought the cargoes, the sources said.Similarly, spot premiums for Russian Sokol crude loading in April jumped to their highest since January 2020 after India’s ONGC Videsh sold a cargo via a tender, they added.The cargo for April 19-25 loading was sold to Glencore at a premium of $7.80-$7.90 a barrel to Dubai quotes, the sources said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Florence Tan in Singapore and Olga Yagova in Moscow; Editing by Tom Hogue, Shailesh Kuber & Simon Cameron-MooreOur Standards: The Thomson Reuters Trust Principles. .